The third week in September 2017 turned out to be of enduring importance.

All our local attention was on the General Election, one that produced an outcome only possible under MMP. It signaled a change of direction in how public policy was to be articulated in New Zealand. But because New Zealand political contests are for the centre ground, in fact money markets didn't expect anything material to really change in our economy.

And, in fact, not much has. General prosperity has continued with little threat to financial stability or fiscal discipline.

But another event happened that week that has turned the money markets upside down with a slow but relentless change. This event could in fact have substantial impact on the New Zealand economy.

That event involved just 25 words:

In October, the Committee will initiate the balance sheet normalization program described in the June 2017 Addendum to the Committee's Policy Normalization Principles and Plans.

Those words are contained in the press statement of the US Federal Reserve's Federal Open Market Committee's meeting of September 20, 2017 (September 21 NZT), and almost as an afterthought.

The impact over the past eight months has been substantial, and it will grow further over time.

Previously, the sovereign rate risk hierarchy was well understood. UST yields were 'risk free' and set the benchmark. Sure German Bunds may have already yielded less, and in some cases even negative interest rates were imposed by policy makers. But that was "Europe" which had special, endemic growth issues to contend with. The UST interest rates still set the benchmark. Other non-recession-bound economies operated at a premium the USTs, and Australia and New Zealand were counted among them. And China, being the dominant emerging market operated at a substantial premium over that (principally because of governance risk).

Since 2008 when the US central bank turned on the monetary tap, the money supply reservoir has filled to a stupendous US$4.3 tln - US$2.5 tln in treasuries and US$1.8 tln in mortgage-backed securities. The September 20, 2017 signal was that they shifted to a program to drain the reservoir in an attempt to get it back to normal levels.

All this affects supply & demand pressures. The Fed is now selling - each sale removes cash from the financial system. There was supposed to be more UST available for trading.

About the same time, bond markets started to understand that the US Federal fiscal situation was going to deteriorate rather quicker than expected. The claims of growth from corporate tax cuts were just not going to materialise, and the US Federal budget deficit would swell fast requiring it to be paid for by issuing vast new amounts of USTs.

But demand for all this extra debt is not expected to grow as fast as the supply. So investors expect higher yields.

What wasn't expected was that much of those higher yield expectation was for political risk, a premium that had been low in the past. A Trump-risk premium.

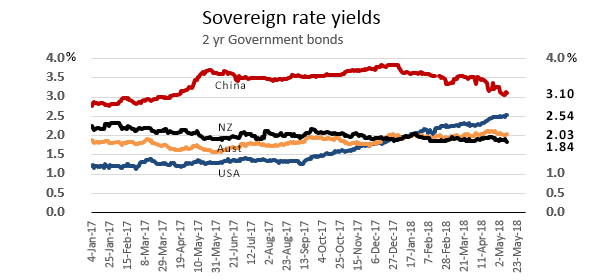

The change has been sharpest at the short end. The blue line in this next chart is the USA 2yr UST bond yield. Its rise since September 20, 2017 has been steady and consistent. The Aussie equivalent has risen marginally while the New Zealand equivalent has fallen marginally.

These moves have upended long relationships of premiums to the UST benchmarks.

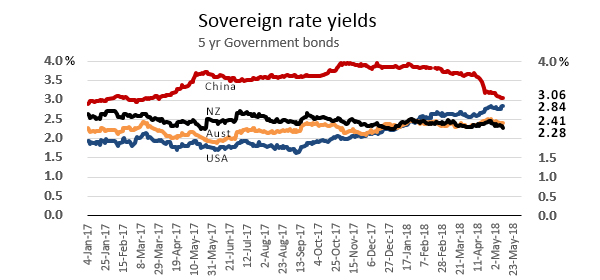

Similar shifts are apparent for the 5 year government paper ...

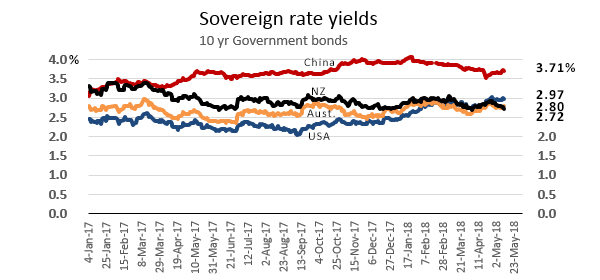

... and also the ten year bonds, although they are more muted at this longer duration.

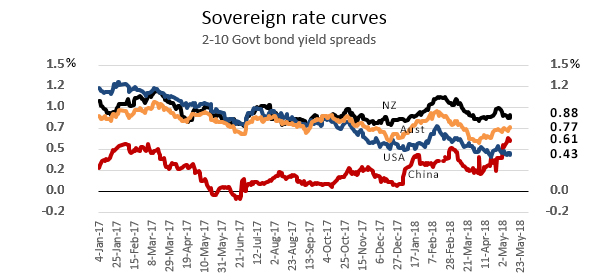

One way to look at these changes is to work out the rate curves. The principal one is the 2-10 curve, the simple difference between the bond yields of these two durations.

And here we can clearly see the American narrowing of the difference. In fact, that difference is its smallest since 2007. When longer-term interest rates fall below short-term rates, investors may be signaling a lack of confidence in future growth. The phenomenon often precedes a recession. We are not there yet, but in less than eighteen months the 2-10 difference has gone from about 120 bps to just over 40 bps; that is not only a big move, it has been a steady and relentless one. It is the bond market sending a powerful, consistent signal.

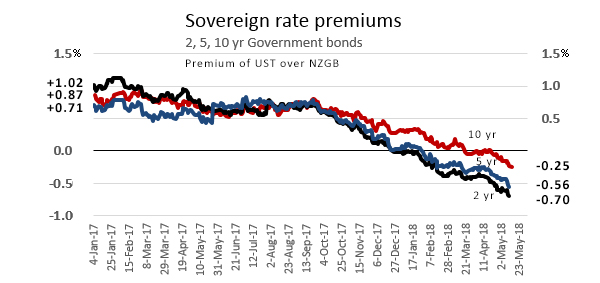

Another way to look at this data from a New Zealand perspective is to watch the US : NZ premium for each major duration. And the shift is quite striking, pivoting around the September 20, 2017 date.

Two years ago it would have been hard to imagine a bond world where New Zealand Government Bond yields would go from +60 to +100 bps premiums, to -25 to -70 bps discounts to the American equivalents. Not only has it happened, the discount seems to be picking up pace. Of course, not everyone thinks it will continue, or can even be sustained. But it has happened and is the present situation.

The local factors

We have talked about the US drivers, but there are also local drivers, two principal ones.

Firstly, the New Zealand government remains committed to running surpluses in their fiscal affairs. This is now bipartisan. These surpluses, which evaporated in the GFC, returned in 2015. They were consistent but small until early 2017, but since have swelled as rising prosperity has increased not only company tax collections, but more impressively personal taxes and GST as well. The track is for substantial surpluses. In 2018 they are running at the rate of +$6 bln/yr for the core OBEGAL definition and have been at a whopping +$10 bln/yr pace on a full Operating Balance basis.

Given the gross Government debt is 'only' just over $80 bln (and much less on a net debt basis), surpluses at this level are impressive. It allows a bipartisan commitment of keeping this debt at no more than 20% of GDP. Nominal GDP is growing quickly, up +6.5% in 2017, allowing plenty of room for nominal public debt growth and still meet the targets.

But surpluses don't require more borrowing. They work to depress debt levels. That in turn means that demand for risk-free NZGBs is likely to out-pace supply, keeping yields low. It is hard to see that dynamic changing anytime soon.

And it is not as though NZGB debt is popular for foreigners. It might be, but it is also irrelevant in the grand scheme of things. In a world bond market that now well exceeds US$100 tln, our NZGB $80 bln or so is just a rounding error and is treated as such by international bond investors.

In fact, the holdings of New Zealand government debt by foreigners is now down to just 54% and its lowest since 2012. Other Government agencies (like the NZ Super Fund, ACC, the RBNZ, etc) hold just under 20%. And the "financial sector" holds just over a quarter of this debt, and that is rising. This is where the additional demand will come from, due in large part to investment mandates that have a growing appetite as the economy grows.

And that is the second principal driver. At its heart is KiwiSaver. A fat 42% of all KiwiSaver investment is in Conservative, Default or Moderate funds. All these have high allocations for fixed income securities. While the world is open to them for these allocations, an important proportion will go into NZGBs. Some investment funds (usually not KiwiSaver) are required to hold only NZGBs. So if the inventory of them falls, yields are clearly going to be bid down as excess demand bids up the price.

It is important that Treasury keep a New Zealand debt market supplied with enough capacity to meet investors needs. Even now, there is a shortage of NZD debt traded, as anyone who wants to buy retail can tell you. These markets are captured by the big advisory distribution channels, often at the cost of very low yields for investors. As we have noted on this service before, its is usually better to get yield from bank term deposits, although they don't have the liquidity a bond market offers.

KiwiSaver is now a sector about to grow past $50 bln, $20+ bln or more in the conservative end. This sector is rising at about $10 bln per year and the pace will pick up. (The NZ Debt Market has proven to be of little help, stuck at about only $24 bln capitalisation.) This is a a good reason for the NZ Government to be adding to capacity; Another $4-5 bln per year will be needed just to ensure our bond markets function properly and don't get distorted in the way they did in the Clark/Cullen years when debt was paid down to very low levels. Memories are short.

So what does this all mean?

We are facing a long period of low NZGB yields, and that has little to do with international benchmark pricing:

- international bond traders ignore our markets because they are so small, with tiny capacity,

- the NZ Government is likely to be running large surpluses, require little extra debt funding,

- KiwiSaver demand for fixed income securities is rising and the pace is picking up.

In the long run, lower-than-international benchmark yields should get equalised in the currency markets, driving down the value of the Kiwi dollar. The main driver of the NZD are trade flows. That can easily be interrupted by major capital demands (like the insurance flows following the Christchurch earthquake), or heightened loan demand arising from property speculation. But those two examples are behind us now. Over the longer run however, the interest rate differentials will influence the currency.

We are in a period where interest rates will stay low, and our currency will slowly slip. Just a guess, however.

22 Comments

"It is important that Treasury keep a New Zealand debt market supplied with enough capacity to meet investors needs."

"Another $4-5 bln per year will be needed just to ensure our bond markets function properly and don't get distorted in the way they did in the Clark/Cullen years when debt was paid down to very low levels. Memories are short."

See what I mean?

Markets get all uppity when there isn't enough NZGB debt for their corporate welfare risk free investments. Yet in the next breath they get all hot in the collar about any government deficit spending - "inefficient" they say, "inflationary" they yell, "the debt will cripple the lives of our grandchildren" they moan. ("But, ah, could you please borrow a bit more cause we've go nowhere risk free to park our cash anymore.....")

NZGBs are net financial assets for the private sector. They are private savings.

Imagine if the Reserve Bank did some QE and just bought up all the NZGBs in existence so the public debt was owned by the government and effectively written off.

What would happen then? Would the sky over Aotearoa collapse? Would all the reserves which represent savings be spent in a massive hyper-inflationary spending binge??? No, they'd just have to be saved somewhere else.

Time to do away with bond issuance to match deficits. It's a relic of gold standard years.

I find that statement interesting as well. If true, what is the solution? Borrowing money and investing it in the NZ Superfund, exactly what National refused to do. I’d hate to see government spending more money or cutting taxes just because the financial sector needs more debt to trade. Also, isn’t there an argument that a shortage of debt is a good thing because it forces the financial sector to invest in productive endeavours? Why subsidise them with an easy safe play that adds no economic value when we could incentivise them to be creative and find investments we need.

Other than as required by a regulator, I would love to know who these 'corporates' are who invest in NZGBs. KiwiSaver or superannuation funds I understand, they have mandates to meet. I doubt bond traders would ever bother; the capacity is far too small; they work on variances of 1 or 2 bps.

I think you have been watching too many American movies.

You’ve replied to me but I’m interpreting this as being in response to the comment above mine.

Not sure what you mean by "corporate welfare risk free investments". As far as I know, the only "corporates" required to invest in NZGBs are banks to meet RBNZ requirements. Otherwise those who need this capacity are individuals or the same via their retirement savings schemes. The demand is not corporate (that bit is an imposition), it is by individuals.

If they are 'done away' with as you suggest, many mandates will need to be changed, and the change would be to allow them to invest in similar sovereign bonds overseas, and that 'somewhere else" would most likely be Australia. The result would be a substantial offshoring of funds.

With only money printing (QE) for all deficits and no market discipline (pricing), there would be no stopping politicians spending. You might as well also get rid of GAAP standards for public accounts. In fact, why have public accounts at all? Thinking about it, why even have taxes? Just spend with QE. Magic, there is no downside ... although most people would recognise the downsides would be massive.

http://bilbo.economicoutlook.net/blog/?p=31715

"There is no need to issue public debt"

Read above link with open mind.

No one is suggesting deficit spending without limit. Just functional deficits of the appropriate size. Pay interest on reserves if you want to maintain a target rate.

You may think I have been watching too many American movies.?????(more a follower of mmt)...but Adair Turner, former governor of bank of England is with me on the overt monetary finance http://www.imf.org/external/np/res/seminars/2015/arc/pdf/adair.pdf

http://bilbo.economicoutlook.net/blog/?p=31715

"There is no need to issue public debt"

Read above link with open mind.

been trying to get my head around this monetary finance.

https://www.imf.org/external/np/res/seminars/2015/arc/pdf/adair.pdf

Also Steve Keens notion that the deficit_ per_annum = change in GDP / velocity_of_money. Interesting stuff.

How can the main driver of the NZD be trade flows? NZD currency trading (non trade related) must be at least 10 times more than needed for trade flows, so I thought that wouldve had a greater influence?

I was thinking exactly the same. Trade is not the main driver of the NZD relative to other currencies such as USD and JPY.

I also agree - although I'd say trade is not the main driver in all currencies that have open capital accounts. BIS surveys show that currency turnover for investment purposes dwarfs that for trade purposes. Plus, US and NZ having been running trade deficits for decades; exchange rates do not adjust to restore balance

Interesting, thoughtful article. Thanks David.

Time for quasi-govt enterprises like Watercare, DHBs, Universities, Auckland Transport, Councils, etc to issue bonds to gather funds to spend on upgrading/new infrastructure ? Would give investment opportunities for local/overseas investors and go towards building NZ of the future.

Yes, it is certainly the case that we need more infrastructure investment. and you could add local councils to the list. But are these entities allowed to issue debt?

Thanks a lot for your article, David

I'd like to re-pose a question I asked 3 days ago and to which, I unfortunately never got a simple satisfactory answer.

In the MPS Orr said in response to the question: "what could lead to the OCR being cut",

“The key risks to a rate cut would be international growth faltering, or more importantly, international financial market conditions tightening,”

In other words, a rise in long-term interest rates, which could feed through into New Zealand lending rates.

Why would Orr consider cutting the OCR if long-term overseas interest rates rise? Is it simply to keep some NZ interest rates (the short end) low?

David, Gareth? Anyone else?

Is the theory that rising international interest rates increase interest rates here. If the RB doesn’t want interest rates to rise they might cut the OCR to attempt to counteract?

Well, to me, the RBNZ not wanting interest rates to rise in NZ would be the most important announcement of the MPS

I think you are being misled by the language. "Tightening financial conditions" is bank speak for stock market collapse brought on by high interest rates causing bankruptcies. The Financial Conditions Indexes are heavily weighted to stock market prices.

Have reread my 2017 forecasts.Only one way NZD is heading.

Wonderful stuff David.

From my point of view the RBNZ tried to stop the standard NZ house price madness by raising interest rates in 2014, but had to pull back as it was hitting the economy too hard. They then had a re-think and developed plans for capital controls on bank lending instead. These took some time to develop and implement (during which time Auckland house prices continued to inflate). Now that they are in place the RBNZ and RBA have bank lending firmly under control.

So now the RBNZ only needs to put interest rates up if the economy starts to get too hot (measured by wage inflation mainly). House price madness is contained by the capital controls on bank lending. Well done the RBA and RBNZ, that is a major achievement.

So we now have Sanity in monetary and fiscal policy. Who would have thought?

As you point out, the NZD/USD now becomes the major variable. If capital flows inwards to government and to house speculation are now sensible, that suggests the exchange rate will naturally float down to a level where export facing businesses start making good money and expanding their need for people. In short, a current account surplus at a lower exchange rate may be in our future. Gosh.

It may be an infrequent occurrence however it is absolutely warranted now given the respective macroeconomic fundamentals. In the US the Fed is no longer the UST bid and has embarked on unwinding its $2.5t portfolio just as the US moves to an expansionary fiscal package (tax cuts), also foreign UST holdings are falling. Meanwhile, NZ continues to follow a path of fiscal prudence with chronic inflation undershooting. Ultimately, absolute yields are largely irrelevant, it's all about real yields and the tend to be higher in NZ over the long term.

Keep this in context. Many countries would love to exchange even their officially put up debt figures for NZ's

numbers and proportion of debt to GNP.

NZGBs are priced to reflect holding a long term and very safe bet. Not for short term punts and people

looking for relatively higher yields (meaning high risks).

Yes, the other countries are awash in debt and this is a lifeline that cannot change quickly and must be

somehow managed so that the volume of liabilities can continue to be increased while keeping buyers satisfied and not run away. These are the financial and economic Sisyphus countries and it's hard to see how their plight

can end well.

So, comparing NZGBs to these other sovereign risk rated papers is not strictly comparing like with like.

Not many other AAA rated countries dare to have a publicly stated 20% national debt to GDP policy.

Ironically, market trends can make NZGBs be, comparatively speaking, very high quality but cheap.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.