Xero says Kiwi small businesses had strong job growth in the June quarter, despite "flatlining sales".

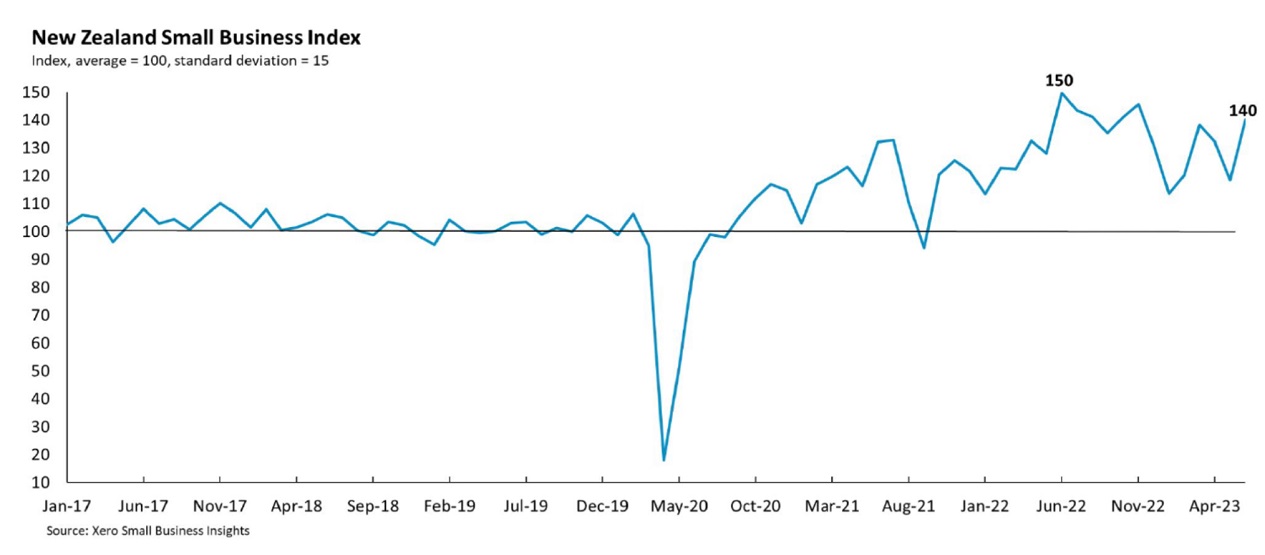

Xero has released its latest Xero Small Business Index for the June 2023 quarter, with the index rising 22 points in June to 140 points, its highest level since November 2022.

(Xero describes the index as "an unweighted composite index showing improvements or declines in the performance of the small business economy relative to the average month".) Xero provides a cloud-based accounting software service for small businesses and their advisors.

“This Index result is driven by the strong jobs growth figures, while the reduction in rising wage pressure is giving small business owners room to breathe,” Xero NZ Country Manager, Bridget Snelling said.

“Overall, the XSBI results reflect a level of resilience in Kiwi small businesses, despite the weaker sales data being consistent with New Zealand’s recession."

(The country has entered a 'technical recession' by virtue of recording two consecutive quarters of negative GDP growth in December 2022 and March 2023.)

Xero gave these as the small business highlights for the June quarter:

- Job growth averaged 6.9% y/y for the June quarter

- Sale growth averaged 3.9% y/y for the June quarter

- Wages growth averaged 3.5% y/y for the June quarter

- Small businesses waited 24.2 days to be paid in June

In the month of June itself, jobs rose 7.3% year-on-year (y/y) with the 6.9% average for the quarter running above the 2022 average of 6.1%.

Such strong jobs growth will be of more than passing interest for the Reserve Bank (RBNZ) ahead of the release next week (Wednesday, August 2) of official labour market data from Statistics NZ for the June quarter. The RBNZ - which wants to see some 'slack' forming in what has been an incredibly tight labour market - is forecasting that unemployment will rise to 3.5% from 3.4% previously. But a rise in unemployment doesn't also mean there hasn't been strong overall rises in the number of jobs being filled because there's been large numbers of migrant workers entering the country this year - meaning the potential work force has increased substantially.

The RBNZ has hiked the Official Cash Rate all the way up from just 0.25% as of the start of October 2021 to 5.5% as it seeks to rein in inflation. The RBNZ has for now at least paused the hikes, while inflation as measured by the Consumers Price Index fell to an annual rate of 6.0% in the June quarter from 6.7% previously. But that's still well outside the RBNZ's 1% to 3% target range.

Snelling said this strong small business jobs activity - coupled with cooling wages growth - "stands out as a mark of Kiwi small business strength and their ability to adapt to change".

Over the June 2023 quarter, the strongest average monthly jobs growth was in other services (+10.3% y/y) and hospitality (+9.6% y/y). The weakest industry over this period was real estate (+4.0% y/y).

By region, average jobs growth in the June 2023 quarter was led by Otago (+10.9% y/y) and Canterbury (+9.2% y/y). Hawke's Bay recorded 3.7% y/y average growth over the same period.

Alongside strong jobs growth, wage growth cooled to just 2.9% y/y in June 2023 and averaged 3.5% y/y for the June 2023 quarter.

"Many small business owners will be relieved to see wage growth begin to realign with the long term average (+3.9% y/y) after peaking at 6.5% y/y in November," Snelling said.

Sales rose 5.9% y/y in June 2023, with an average growth of just 3.9% y/y in the June 2023 quarter.

This was down from a 4.2% average for the March 2023 quarter, and well below the 12.9% y/y average over the whole of 2022.

"While 5.9% year-on-year growth may seem positive, this is still a step behind the latest inflation figures," Snelling said.

"...The road ahead is still challenging for our small business owners. They continue to walk the tightrope to balance books and maintain their bottom line while still providing for their staff and themselves.

“We can take solace in the fact the Official Cash Rate seems to have plateaued at least for the time being, which hopefully translates into a slowdown in mounting financial pressures for households and business alike."

4 Comments

Wait, are you telling me effectively devaluing every single NZ'ers pay by 15~20% is keeping the businesses open, keeping the profits up and creating more jobs? Let's have more of this thing called inflation and keep subsidising each other! What? There is a whiff of socialism you say? Nothing wrong with being more social :D

Job growth running behind sales growth - is NZ's productivity crisis still an unsolved mystery?

there's been large numbers of migrant workers entering the country this year

the strongest average monthly jobs growth was in other services (+10.3% y/y) and hospitality (+9.6% y/y)

We never learn, do we? Let's create a prosperous NZ by selling houses and lattes at soaring prices to one another.

Feel free to infect every article, no matter how positive sounding, with your pet hates.

Preemptive hiring to ensure you have workers available when you need them?

IMO this is driven by the logic of the Reserve pool of Labour. I am hiring fresh interns straight out of uni explicitly to train them up and have them available. Even at the cost of minimium wage, it makes sense vs not having the manpower.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.