Fletcher Building [FBU] has indicated that its chief executive Ross Taylor may be about to depart as the construction giant contemplates issuing earnings guidance likely to "materially vary" from current analysts' forecasts.

The Fletcher Building shares were put into a trading halt on Monday ahead of the release by the company of half year results on Wednesday morning (February 14).

Trading was halted on both the NZX and ASX after a request from Fletcher Building. However, the halt in Australia, which appeared to come later and after the Fletcher price had tanked by about 6% across the Tasman, included the release of much more information.

A letter from law firm Russell McVeagh, acting for Fletcher, said that the full Fletcher board was meeting on Tuesday to "consider a number of matters", including "potential provisions and impairments and the earnings forecast for the full year". There was also to be a board sub-committee meeting on Wednesday morning.

Fletcher will issue earnings guidance with its half year results "after all decisions are made at a board meeting and the board sub-committee meeting Wednesday morning".

"In addition it is possible that, given the matters to be considered at the board meeting, the CEO of [the company] will consider his position with [the company] with this to be announced when his decision is made," the letter says.

The letter also says that the Fletcher sub-committee will determine "the level of the interim dividend, or if no interim dividend will be paid".

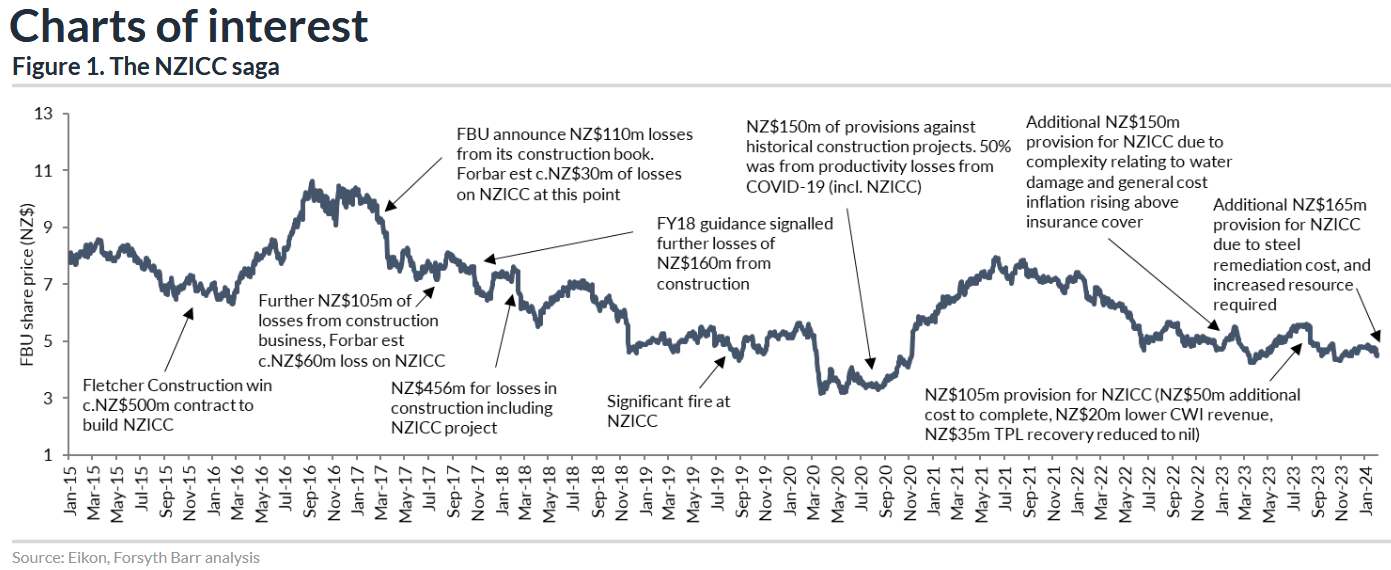

All this latest activity follows on from a further $165 million in provisions made by the company in respect of work on Auckland's NZ International Convention Centre, which Fletcher was contracted to build in 2015, originally slated for 2019 completion, but which was badly damaged by fire in late 2019 and is still yet to be completed.

Analysts from the Forsyth Barr investment services firm, who compiled the below chart, said Fletcher had now made about $420 million of provisions for NZICC in the past year.

And there's also ongoing speculation about Fletcher's involvement in a leaky pipe problem in West Australia, that Fletcher has to date strongly denied culpability for.

Taylor joined Fletcher in 2017, replacing Mark Adamson, who left amid hundreds-of-millions-of-dollars worth of writedowns by the company on big projects.

According to Fletcher Building annual reports, Taylor received $6.68 million in pay from the company in the financial year to June 2023 and $5.17 million the previous year. These figures include performance-related amounts that were earned in prior years.

Prior to joining Fletcher, Taylor, according to bio details published by Fletcher, had an "impressive career in construction, real estate, manufacturing and engineering sectors".

This included being CEO of UGL, an international engineering, services, construction and product manufacturing business, and prior to that Managing Director and CEO of Tenix, and before that various senior positions with Lend Lease.

According to the bio details he has "proven experience leading business turnarounds and improving performance and shareholder returns".

The Fletcher Building shares last traded at $4.16 and are down nearly 19% in the past 12 months. However, as stated higher up the article, there was a sudden slump in the price in Australia on Monday prior to trading being halted there and across the Tasman the Fletcher shares last traded at A$3.70, which at current rates of exchange converts to about NZ$3.94.

At time of writing, Taylor was still scheduled to present Fletcher's results on Wednesday morning.

38 Comments

Stand by for a very generous early exit package. Different rules at the top.

Golden parachute for the CEO, golden shower for everybody else?

Hmmm I thought a golden shower is something wished for 😂

Put a sock in it

6.68 million..does he really care the company has hit the rocks..probably not, but the workers probably do, the ones who will be the scapegoats for the elite management.

His leaving with have little effect. Until the plethora of fiefdoms at FBU are broken up, any CEO at FBU is going to get shafted by being fed inaccurate information and blindsided by 'surprises' that the fiefdoms are pretending aren't problems or are intentionally hiding.

Well Chris there is a pretty obvious fix, replace the entire management teams at every one of the "fiefdoms" and put your own people in there.

Nuclear option, get com-com to split up them up into separate companies

We can all dream.

What a dis-service this company does to New Zealand.

Ripping off everyone, screwing the market, and now failing again.

What a very average company.

It's much worse than that.

That's being rather too diplomatic.

And we keep getting told we need more 'executive' types with real world experience to run the country...

Fletchers is the perfect Textbook Examples of

1. why undercutting the market to create a monopoly situation can go spectacularly wrong

2. Vertical Integration Failures - when you have dodgy materials and you source or own those materials - there is nobody else to blame in that supply chain - except yourself.

Think its time that business does a series of Spin-Offs on the NZX/sell off privately and let the various businesses take ownership. They clearly have their hands in too many construction/material related pies under a conglomerate.

Have to be something like that as the market will not be kind to them and they will want some good news story or plan, otherwise the shares will be mud if they think carrying on as BAU will do.

He will of course be very well rewarded for failure. Pay close attention to where he goes next and if it's a quoted company and you have shares in it, sell immediately.

He is in his early 60's - I'd suggest he will consult in the industry for a couple of years- probably back in Australia and then quietly retire.

Looks like these guys are circling the plug hole as well. Honestly, why are avergae Kiwi's putting so much money into such risky investments. It can only be a combination of greed and ignorance.

https://newsroom.co.nz/2024/02/12/mum-and-dad-investors-threaten-to-tak…

Residential construction is going to get very ugly very quickly.

Heard today of a big-ish developer in Auckland going bust. Can’t say who as I don’t know how public it is.

And, I imagine the price of existing houses and apartments will rise speculatively/accordingly.

Not in the near term but probably in a couple of years, yes.

Totally. Bring the popcorn. I hope the regulators are watching very closely - or looks like they should be.

Yeah, I wouldn't be holding your breath waiting for the regulator to do anything meaningful.

That was the "or" bit :-)

They're supposed to be aiming for an IPO to pay off the stacks of debt. Can't imagine anyone wanting to invest in them.

Where is the shareholder activism in this company? If they are asleep at the wheel as owners its on them....

If its fund owners, its not really their money so they don't seem to care....

12% is owned by Allan Gray, an Australian fund manager.

No doubt FBU is scattered amongst a bunch of Kiwisaver funds acting as a handbrake on the aspirations and fortunes of your average Kiwi and Aussie.

Actually Allan Gray bought 40m shares at $6.30 and now own 95m. They must be down at least $200m, maybe $.25b??

I will never forget or forgive the creditors meeting for Hanover abusing the shareholders association guy as he tried to save them from themselves . Hotchin and Watson were their friends.

hahaha wolves in sheep's clothing...

Sam Stubbs from Simplicity was talking about this last week

https://www.thepost.co.nz/business/350169318/simplicity-calls-greater-s…

How much failure will it take to pry their febrile hands off the building industry?

My precious…..

Now the rest of the board please and thank you.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.