Retail spending was officially flat in April when compared with the previous month. However, a closer look at the figures gives a little cause for optimism.

Retail spending as measured by Statistics NZ's electronic cards transactions data had stalled badly in March after looking to start the year on more of an upswing following a dire 2024.

Stats NZ reported that for April the figures were, on a seasonally adjusted basis, unchanged.

However, these figures can be skewed somewhat when there are sharp falls in fuel prices - as there were in April.

The 'core' retail figures, which don't include fuel and vehicles in fact rose 0.2% on a seasonally adjusted basis.

In addition, when compared with the same month in 2024, the core retail sales were up 0.8%. And while we wouldn't say that's a sensational rise (considering the figures are not inflation-adjusted), it is the largest annual increase in over a year.

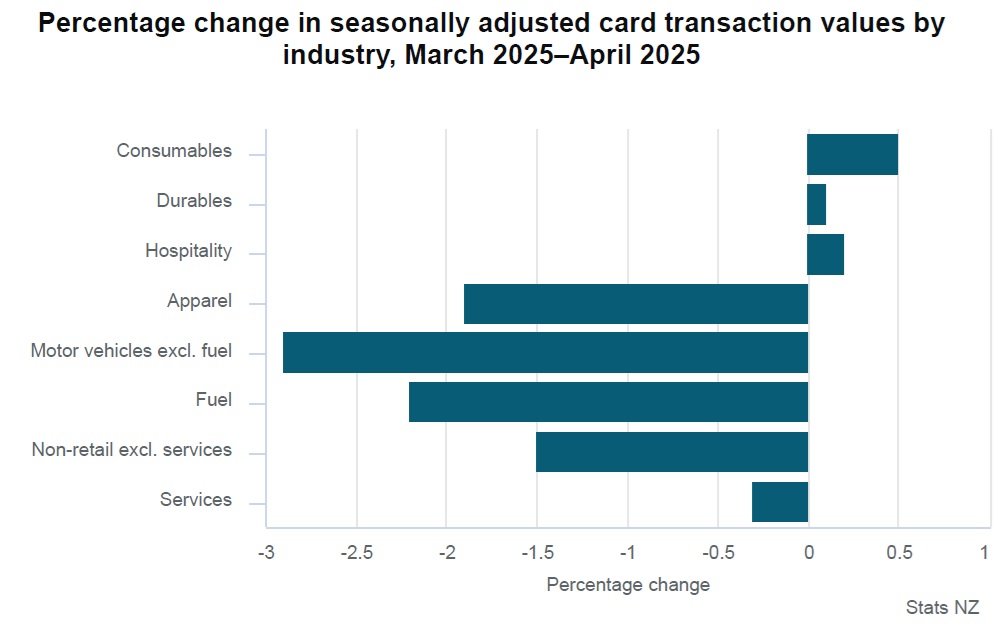

Looking at the detail of the seasonally adjusted figures for April 2025, showed that the apparel industry is continuing to find things real tough, recording a 1.9% drop in the month.

However, offsetting this were a gain of 0.1% for durables (its first rise this year), a 0.2% increase for hospitality (also first rise this year) and a 0.5% rise for consumables.

The non-retail (excluding services) category decreased by $33 million (1.5%) from March 2025. This category includes medical and other health care, travel and tour arrangement, postal and courier delivery, and other non-retail industries.

The services category was down $1.1 million (0.3%). This category includes repair and maintenance, and personal care, funeral, and other personal services.

The total value of electronic card spending, including the two non-retail categories (services and other non-retail), decreased from March 2025, down $18 million (0.2 percent).

In actual terms, cardholders made 158 million transactions across all industries in April 2025, which was down on the 160 million transactions in the same month a year ago. The average value of $55 per transaction was the same in April 2025 as it was in the same month a year ago.

In April 2025 the total amount spent using electronic cards was $8.7 billion.

Ann-Marie Johnson, advocacy manager for industry body Retail NZ said there is still a long way to go before retailers "see any light at the end of the tunnel".

"Retail NZ members are anticipating slow sales and uncertainty through this winter. Although there may be some relief from lower interest rates putting more money in consumers’ pockets, low consumer confidence will continue to rein in spending. We are hoping the upcoming Budget will help restore confidence to the marketplace."

Westpac senior economist Satish Ranchhod said the 0.2% seasonally adjusted rise in core retail spending in April 2025 was "a touch below" Westpac's forecast for a 0.3% rise and he said household spending appetites remained "subdued".

"We expect this picture will start to turn around over the coming months," he said.

He noted the "sharp falls" in borrowing costs in recent months.

"However, most New Zealand mortgages are fixed for a term, and many borrowers have rolled on to relatively expensive shorter-term rates while they’ve waited for interest rates to drop. As a result, the full impact of recent interest rate reduction is yet to flow though to households’ wallets," Ranchhod said.

"But that picture will change over the latter part of this year. Around half of all mortgages will come up for repricing over the next six months, and many borrowers will be able to refix at much lower rates. The related increases in disposable incomes levels is set to boost spending from mid-year."

Ranchhod said though that even with the fall in interest rates, there are still "some powerful headwinds" that are weighing on household spending. In addition to the large cost-of-living increases in recent years, the labour market has remained soft. Putting that all together means retail spending is likely to remain slow in the near term.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.