Big numbers of the country’s publicly listed companies have just reported annual results - and overall they weren’t a great bunch.

However, analysts at financial services company Forsyth Barr see signs we may now have reached the low point.

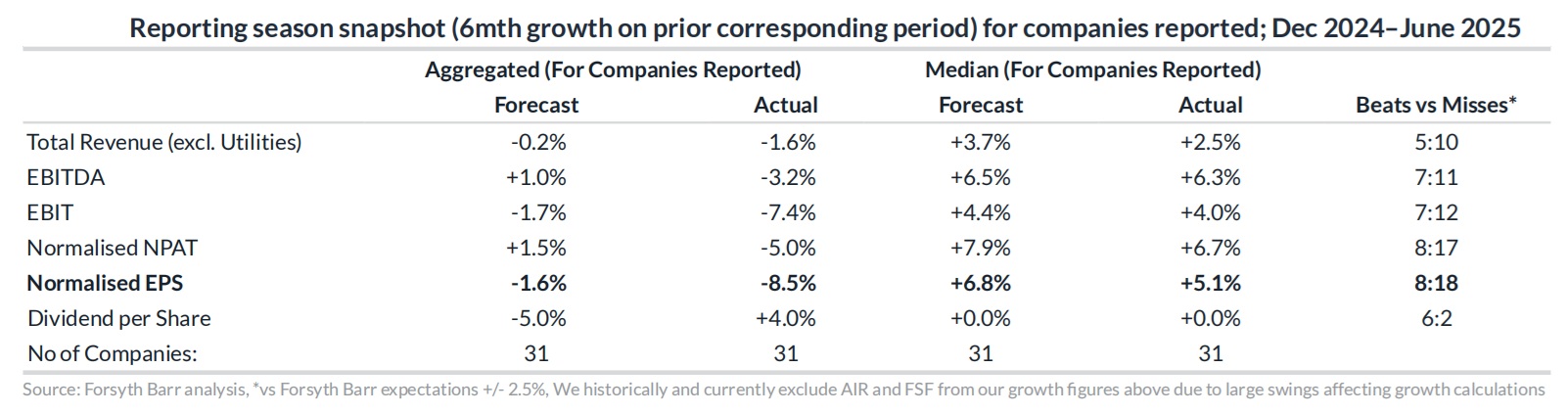

In a big crunch of the numbers of 31 NZX-listed companies that recently reported results for the June financial year, senior analysts Aaron Ibbotson and Matthew Leach say earnings ‘season’ again proved to be one of continued downgrades, “but it felt different this time”.

“Looking under the hood, we believe it was different: misses outpaced beats by more than 2x, and FY26 downgrades dwarfed upgrades by a near-record 6x.

“Yet the market reaction was, overall, net positive. Why? We see three factors at play":

- expectations were sufficiently low going into earnings—this may not have been reflected in forward forecasts, but it was evident in buy-side positioning;

- outlook statements had a slight positive bias—equity markets are forward-looking; and

- corporates are moving on from blaming the weak macro to addressing costs and corporate structures.

The two analysts believe that positive share price reactions to “broadly” negative news are “as good a signal as we will get for the start of a reversal in what has been an abysmal four years for the New Zealand market“.

“Add to that the RBNZ’s ‘better late than never’ shift to a more dovish stance, and the anatomy of a recovery is taking shape," they say.

“Now we just need those downgrades to slow. For that, the economy needs to recover.

”…The strong market reaction, positive outlook bias, and more dovish RBNZ suggest this time we may have seen the low.”

In analysing the numbers, Ibbotson and Leach say the latest reporting season, (excluding retail and agriculture, with companies in these sectors yet to report) resulted in earnings per share growth “closing below our expectations”, particularly at the aggregated level, where heavyweights Spark (SPK) and Genesis Energy (GNE) reported below expectations.

“Overall, the majority of earnings lines missed expectations, with only dividends surprising to the upside. That said, despite the number of misses, median growth finished in positive territory across the board, with EPS growth at +5%—a welcome sight following two years of negative growth.

“Of the 31 companies that reported, eight were ahead of our EPS expectations, five were in line, and 18 were below expectations (using a ±2.5% tolerance level),” the analysts said.

“Dividend announcements, however, surprised on the upside. On the face of it, the latest reporting season appears dire, with a large number of misses at the EPS line and downgrades to estimates across the board.

“However, the market, via share price reactions, appears to have taken the results and resultant earnings revisions in its stride, and looks to be moving forward with a more optimistic view. Overall, a majority of companies had share price movements outperforming the benchmark, with just a handful falling on the day. “

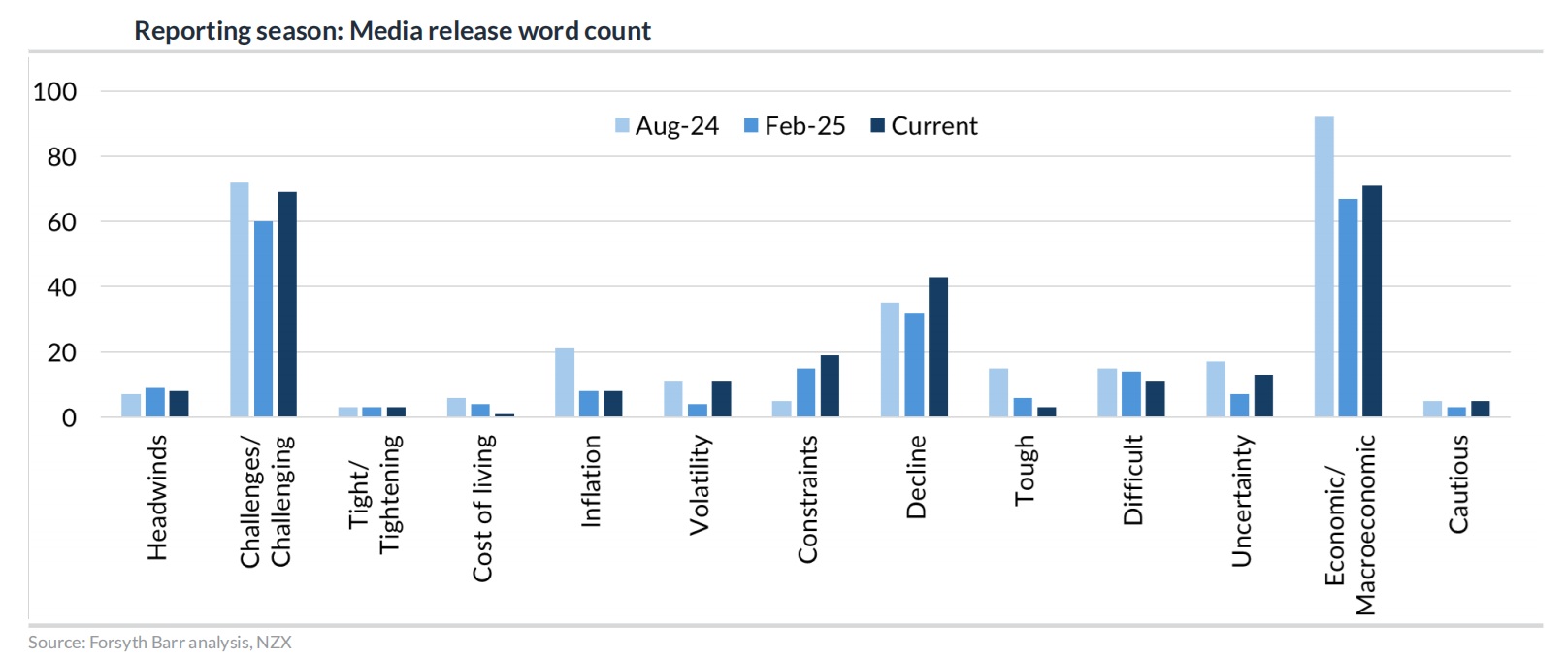

The analysts have even had a close look at what the companies say about their performances and economic conditions. Anyone guessing that things are “challenging” and that there’s “headwinds” out there is on the right track.

The analysts scanned the latest result announcements (media releases) for a selection of key words

and phrases and also repeated the exercise for the last two major reporting seasons (August 2024 and February 2025).

The results can be seen below.

1 Comments

Hmmm.

I cant buy that a positive share price movement despite poor reporting is as good a signal as any that we reached "reversal".

I think there is room for going a lower still and being there for a while. Reversal implies going "up".

But then they are paid analysts and I'm a " I thinker"....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.