By Bernard Hickey

Business confidence is galloping along at 20 year highs and capacity constraints are building in a way that is pushing up inflationary pressures and reinforcing the need for higher interest rates, the New Zealand Institute of Economic Research (NZIER) has said.

The NZIER's March Quarter Survey of Business Opinion (QSBO) found businesses were the most confident about their own activity in the next quarter since the June quarter of 1999. A net 52% of businesses said general business conditions had improved, which was in line with the last quarter and still at its highest level since 1994.

NZIER Principal Economist Shamubeel Eaqub described the survey results as "stonking."

"The underlying strength in the economy continues to be very, very strong," Eaqub told a briefing to release the survey.

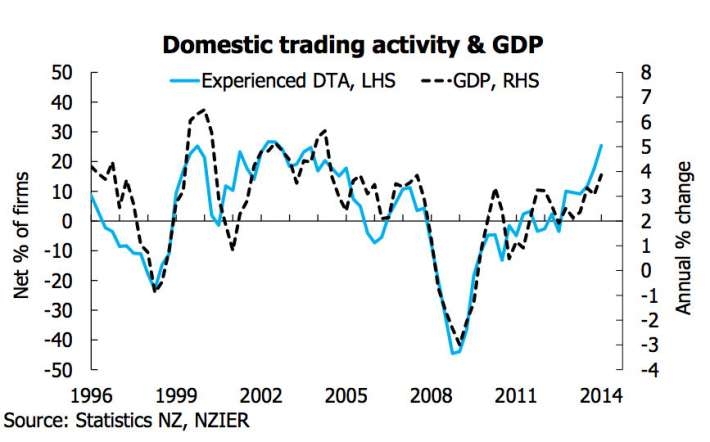

The March quarter survey of 661 non-farming businesses found a net 25% experienced an improvement in their own trading conditions in the quarter, up from 18% in the previous quarter and above the long run average of 11%. This was the highest reading since December 2003. A net 35% expected an improvement in the next quarter in their own trading, which was up from 31% in the previous quarter and the highest since June 1999.

Buiding investment intentions were at their highest level since the survey began in 1975.

The strength was broadening and becoming more persistent beyond Canterbury and Auckland, he said.

"That optimism is now translating into actual hiring and investment and those pricing intentions are now resulting in actual price increases," he said.

Capacity was seen as a constraint for a net 13.3% of businesses, up from 12.9% in the previous survey and the highest since March 2007.

"We're starting to see increases in capacity starting to become an issue," he said.

Eaqub said the strong business confidence, signs of capacity constraint and intentions to increase prices supported the Reserve Bank's move to normalise interest rates over the next two years.

"It strengthens the case for interest rate increases this year," Eaqub said, adding the NZIER expected mortgage rates to rise to 7.5% over the next year.

The New Zealand dollar rose around 20 basis points to 86.2 USc through the morning.

A net 16% of survey respondents said they had increased prices in the March quarter, up from 9% in the previous quarter and the highest since June 2011. A net 37% expected to increase prices in the June quarter, up from 23% the previous quarter and the highest since June 2010.

"Price increases are accelerating," NZIER said. "Fattening margins and growing sales are boosting profitability," it said.

NZIER said trading activity had accelerated to its fastest pace since December 2003 when annual GDP growth was near 4.5%.

"While we do not expect economic growth to hit such heady rates in the current business cycle, as credit conditions are very different now, our latest survey paints a clear picture: the recovery is strengthening."

Reaction

Westpac Senior Economist Michael Gordon said QSBO provided more evidence the economy had gathered considerable momentum.

"The lift in the pricing measures was the most substantial change since the previous survey, and provides further backing for the RBNZ's decision to start lifting interest rates now in order to head off inflation pressures over the next couple of years." Gordon said.

"Even so, we are wary of overstating their significance - reported price increases, while rising, are still well below boom-time levels," he said.

ANZ Chief Economist Cameron Bagrie said the RBNZ would be concerned with a lift in pricing intentions to near four year highs, which risked consumer price inflation rise over over 2% later in the year.

"This keeps the pressure on the RBNZ to return policy rates to more normal levels, and we expect 2-3 more OCR hikes in coming months. The clear risk profile is for 3 as opposed to 2 before a pause," Bagrie said.

(Updated with more detail, comments, economist reaction, NZ$ reaction)

NZIER quarterly survey of business opinion

Select chart tabs

11 Comments

This feel good story............ followed by the story about the budget defiict .

Its clear that Government spending is stimulating the the economy .

The budget next month is going to be interesting .

If the Goverment reduces "G" in the monetary equation , where G equals Government spending , then the whole boom could slow things.

BUT WHY WOULD WE WANT TO STOP THE PARTY SO SOON ?

It's a fine line on the QWERTY keyboard between the " o " and the " i " ....

... beware the " stonking " economy doesn't slam into the proverbial black swan and do a rather ugly swan dive ...

So long as Fonterrible don't bugger up ... again .... and so long as house prices keep rising , we're sweet .... no problems then .. whew !

Too much Stonking could lead to Stonkered.....all rather baffling sometimes but I'm looking close at those percentages.

Nice one Gummy.

I was very careful...

cheers

Bernard

not stonking, more stolle

http://www.youtube.com/watch?v=pSrL1BWWcvA

GBH is that you at 9:14+

before you say wash your mouth out see 12:36+

I guess business is looking up for most, since so many businesses have gone under the killed off the competition for those surviving. A look around any industrial area at all for lease signs tells an interesting story.

Luckily for us , Brazil ( which has a land area 32 times greater than NZ , much of it flat and fertile ) cannot get their dairying act together .... and are unlikely to do so for another decade or so ...

.... 'cos they could easily swamp our dairy products markets , undercut us easily , if they had a mind to ...

and the boys that went to Brasil (its all in the mind)

Germany is China’s largest fluid milk supplier due to price competiveness, accounting for 41 percent ofChina’s total imports. New Zealand and France are the second and third largest suppliers with 17percent and 16 percent export market shares, respectively. Germany’s export price (between January -September 2013) increased by 16 percent to $916.40 per ton. During that time, this price was 27 percent lower than the world’s average export price to China at $1,260 per ton, and 49 percent lower than New Zealand’s price to China

http://gain.fas.usda.gov/Recent%20GAIN%20Publications/Dairy%20and%20Pro…

Yo ho Gummy.

What's going on?

You are increasingly churning out gloomy observations about the future... sounding like almost everyone else around here.

You spending too much time here mate?

Zee more like he keeping it real

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.