Content supplied by EY

New Zealand is one of only a few countries with a dividend imputation regime. Introduced in 1988, New Zealand’s imputation regime removes double taxation on distributions by attributing to shareholders a credit for the tax borne on profits at the company level.

Benefits include a single layer of tax, a reduced cost of capital for local businesses and their investors, and a relatively high rate of domestic corporate tax for the government.

1. New Zealand tops the world in high dividend pay-outs

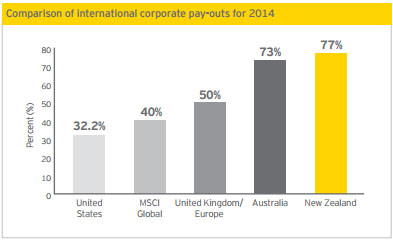

New Zealand companies pay out more profits as dividends than any other country in the world, with an average distribution in 2014 of 77% of post tax income. This is significantly higher than the US at 32% and the UK at close to 50%.

The MSCI World Index,2 which captures large and mid-cap representation across 23 developed markets, shows a global pay-out ratio of just 40%.

Closer to home, Australian corporates are second only to New Zealand, with a dividend pay-out ratio close to 73%.

What common factor between these two South Pacific economies might be exerting a strong influence on corporate dividend pay-out culture? Australia and New Zealand are two of only a handful of countries with a dividend imputation regime. By substantially removing the double taxation implicit within a classical system EY believes the regime replicates a near tax-free marketplace and, accordingly, imputation plays a significant role in fostering high dividend pay-outs.

2. What else is driving corporates’ high dividend pay-out culture?

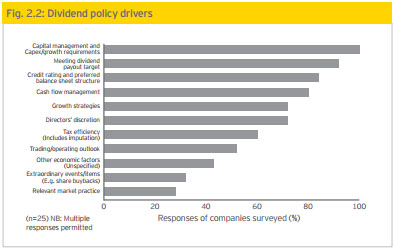

While tax efficiency and tax effectiveness play an important part in any firm’s decision about dividend pay-outs, it is only part of the story. While all corporates surveyed consider capital management to be the key driver of their dividend behaviour, meeting pay-out targets came a close second.

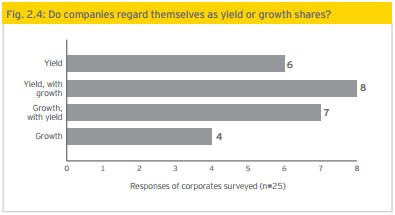

Corporates report increasing pressure from investors to deliver high cash returns, and stretching dividend pay-outs has been a factor in the post-Global Financial Crisis (GFC) reliable earnings base and stronger balance sheets. Most corporates see themselves as primarily yield driven, albeit harbouring some growth potential.

3. But investors want to have their cake and eat it, and some query directors on their approach

Interestingly, investor proxies do not believe that the prevalence of high dividend pay-outs is compromising corporates’ pursuit of investment opportunities and growth, where these exist. Many believe that post-GFC, balance sheets are stronger and de-geared, and access to capital is easier and historically less costly, meaning cash stockpiling is unnecessary.

However, investor proxies are keen to have it both ways. Some worry about the sustainability of pay-outs, noting that once set, dividend expectations are difficult to peg back.

Some also believe that corporates are too focused on maintaining dividends at the expense of longterm gain. Of the 12 investor proxies interviewed for this report, five rated directors’ approach to managing dividend policy as ‘fair to poor’. Concerns about performance relate to shortterm thinking, scant analysis of real dividend drivers, insufficient rigour in capital and financial management, and a lack of entrepreneurial spirit.

While somewhat at odds with investor preferences for yield over growth, such concerns suggest the need for debate on the extent to which corporates focus on cash-flow management and growth aspirations.

4. The imputation influence — feeding the dividend psyche

EY believes that imputation has fuelled the New Zealand corporate dividend psyche. Its effect is to deliver a pre-paid tax return, and given this significant tax influence (generating up to 39% more for investors), fully imputed dividends are seen as the ‘optimal dividend strategy’ by most directors. By comparison, the ‘classical system’, which is a common alternate system adopted by many countries, lacks an integrated tax approach, effectively leading to double taxation at the shareholder level, thus representing a barrier to company distributions.

This tax crediting effect of imputation closely replicates a tax-free outcome for dividends, particularly within New Zealand’s tax settings that closely align the top personal tax rate with the corporate rate (33% vs 28%). This has naturally encouraged corporates to value imputation crediting highly, to the extent that New Zealand directors have been described as being “wedded to imputation.”

5. Corporates have a ‘one-size fits all’ attitude to imputation

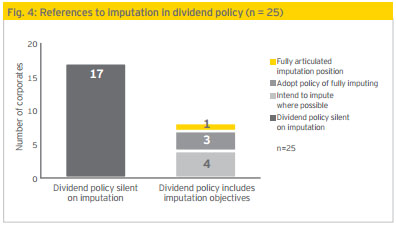

Given such a strong imputation mind-set, it is surprising that barely one third of corporates address imputation in their formal dividend policies. Even those that do, tend to declare a simple intention to impute rather than provide a more meaningful communication on the company’s ability to impute, who this will benefit, and why3.

This lack of detail on imputation within formal dividend policy reflects a general corporate view that imputation is good for all investors and everyone will benefit in some way; consequently, corporates typically adopt a blanket approach to imputation though most directors are aware that significant value disparities exist amongst differing investor profiles. For example, foreign shareholders cannot take advantage of imputation credits, along with those who are tax-exempt.

The regime prevents imputation credit streaming, which would otherwise allow corporates to disproportionately direct credits towards shareholders who are best able to use them. So corporates have little incentive to undertake a more detailed analysis of the system.

Up to 40% of imputation credits, if not more, cannot be fully redeemed by shareholders, illustrating the extent of foreign ownership in New Zealand companies (at 33%) and the number of shareholders who are tax-exempt, or low-rate taxpayers. Data for 2013 reveal a $38 billion pool of undistributed imputation credits (mainly within closely-held companies) reflecting the high-pay-out ratios across the widely-held NZX company sector.

6. Investors place less importance on imputation credits than corporates realise

Investor proxies take account of imputation credits when evaluating investment options and making recommendations. However, such tax considerations are typically subordinate to weightier factors such as commercial drivers, consistency and sustainability of pay-out ratios, and measures such as free cash flow.

The lack of weight given to imputation as a decision making factor may mean investors are taking imputation credits for granted — as an almost normative position for companies and dividend pay-outs in this country. And, few appear to appreciate the cash reducing interplay between imputation and resident withholding tax (RWT), where imputation shortfalls on dividends are replaced by RWT deductions. Given this lack of understanding, investors probably under-appreciate the value of imputation to New Zealand’s capital markets. They would certainly notice, and be very concerned, by its removal.

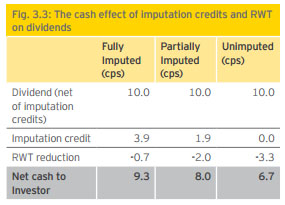

The table here shows the impact of imputation on a domestic shareholder, notably the impact of RWT. Running parallel to dividend imputation is the RWT regime which applies at a flat rate of 33% (being the top marginal rate for individuals), but this reduces by the offset of the actual imputation credits attached to a particular dividend.

RWT is a deduction from the dividend cash payout, thereby decreasing the cash receipt where the imputation credits allocated are less than the fully imputed amount (28%). This directly and negatively impacts the cash receipt to shareholders.4

7. Tax induced behaviours

Tax efficiency plays a major role in dividend pay-outs in New Zealand and was reported by well over half of corporate participants as a key dividend policy driver.

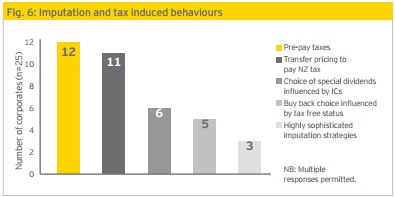

Because corporates place such a high value on imputation, they apply a number of strategies to increase the available pool of credits. These include pre-paying tax, transfer pricing to pay New Zealand tax, and the use of alternative distribution tools such as special dividends and share buy-backs. Some companies adopt a greater range of behaviours than others.

The most common practice is prepaying tax. Making smaller, short term pre-payments to manage the timing of imputation tax credits and dividend pay-outs is common, and sums tend to be in the $2m-$10m range.

At the extreme, a small number of companies (three out of 25) reported pre-paying significant amounts of tax in the tens of millions to feed their imputation pool, thus allowing consistency of imputed dividends. This behaviour demonstrates directors’ high value approach, and focus on delivering imputation credits. But, from an investor’s perspective, while small pre-payments are acceptable, the latter are seen as irrational, creating a value gap.

The second most common strategy reported was transfer-pricing foreign earnings to New Zealand on a pre-tax basis to maximise the proportion of domestic tax paid and consequent imputable credits generated.

8. Does imputation affect share price?

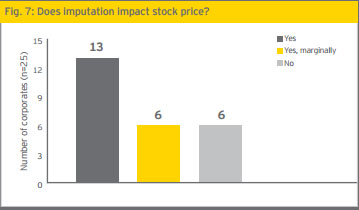

Many corporates believe that an imputing company would command a premium to its share price over a non-imputing company, but struggle to quantify that worth. They believe that investors value imputation credits and that their imputable status will underscore a share price premium. This follows closely from the corporate mind-set that regards imputing as highly important for maximising shareholder returns.

By contrast, investors generally thought that imputing would have only a marginal impact on share prices; tax imputed returns are factored in but do not drive investment decisions. This, of course, differs depending on the tax profile of each shareholder, with domestic investors more likely to be swayed by personal tax savings resulting from New Zealand’s imputation regime.

Research in Australia has concluded that the marketplace does, in fact, attribute a value to imputation credits of between 50% - 60% of the credit’s face value.5

Imputation has enabled the high pay-outs we see as a core feature of the New Zealand capital market. In EY’s view, the way in which imputation lubricates high dividend pay-out ratios has a positive impact on share prices.

9. Does imputation influence other corporate distributions?

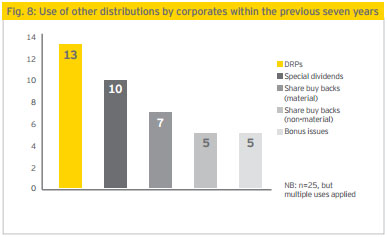

With a high level of ordinary dividend pay-outs, the case for additional one-off returns diminishes. Further, other distribution methods — Dividend Reinvestment Plans (DRPs), special dividends, buy-backs, and bonus issues — bring the spectre of negative signalling, a concern commonly mentioned by corporates and investors alike. Despite this, oneoff distributions were reported, with balance sheet re-structuring cited as a common rationale.

Imputation’s tax crediting effect closely replicates a tax free outcome for dividends, and this is significant in a market that does not have a capital gains tax. Thirteen of our 25 corporates reported adopting DRPs — a relatively high incidence.

Most identified it as a useful investor relations tool to cater for accumulating (growth) investors, but also in assisting corporate liquidity. Shareholders appeared less convinced, but the evidence showed increasing take-up ratios as the level of DRP discount increased.

For other forms of pay-outs, New Zealand corporates have closely favoured special dividends over both capital return buy-backs and bonus issues. Again, imputation and the tax neutrality outcomes underpinned this preference.

10. Imputation attracts widespread support, but the regime could be improved

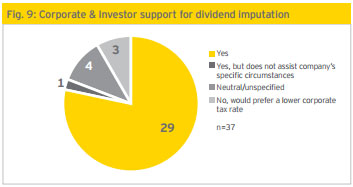

Both New Zealand corporates and investors overwhelmingly support a dividend imputation regime, but have serveral suggestions for improving the current system. The two most often cited were trans-Tasman mutual recognition of credits and domestic refunds of unusable credits (with others involving ability to stream credits, unrestricted carry forward of imputation balances, and over-imputing up to 33%).

Support for mutual recognition was universal and stems from a belief that it would encourage more Australian investment in New Zealand companies and provide overall benefits for business on both sides of the Tasman. Mutual recognition was raised frequently during the research, and much government resource has already been expended in pursuit of trans-Tasman co-operation. Yet fatigue with this long trodden path has left many feeling sceptical about any chances of success.

We believe that achieving mutual recognition would fit well with existing tax law and result in only a moderate fiscal cost to government. Recent modelling has revealed that the costs of mutual recognition are materially lower than was previously thought. However, to move this forward will require a concerted push from Australian business; this might be optimistic.

Cash refunds for unutilised imputation credits were suggested by one third of participants. Australia has allowed limited refundability for many years and in the New Zealand context this would have positive outcomes for investors with no and low tax rates. Enacting this adjustment to the imputation regime would require some significant work to align with existing tax policy and likely result in unwelcome costs to government.6

11. What might change to Australia’s imputation system mean for New Zealand?

Coming back to the threat of Australia returning to a classical, or other corporate tax system, a key question is the corresponding and likely level of any reduction in its corporate tax rate. While a fall in this rate to 20% has been mooted by some commentators, in reality it could be as little as 4% (from 30% to 26%). In New Zealand, any drop in the Australian corporate tax rate (for example, from a change to a classical system) would create pressure to follow suit because it would become increasingly difficult for New Zealand to attract investment if headline corporate tax rates were significantly lower elsewhere than New Zealand’s 28%.

A further consideration is the current practice of New Zealand companies preferring to pay tax domestically because of a favourable corporate tax rate and the consequent imputation credits generated. Were Australia’s tax rate to fall, it may well impact on where corporates choose to pay tax, reducing New Zealand’s overall tax revenue.

Ultimately, changes across the Tasman would see New Zealand faced with tough choices around the future of our own imputation system, the company tax rate, and the tax base for the government.

12. Is New Zealand’s imputation regime worth fighting for?

Imputation is at the heart of our tax settings. To a large extent, the regime works so well because of New Zealand’s individual tax rate setting, which is relatively low and closely aligned with the corporate rate (28% vs 33%). Within this tax policy structure, a fully imputed dividend only generates 5% of additional tax for a top rate investor, underpinning the success of the imputation system in terms of its influence on our high dividend pay-out psyche.

Removing New Zealand’s imputation regime would likely have significant impacts for our capital markets. Smaller firms depend on domestic equity, but without the availability of imputation credits, local investors may place their money elsewhere. Compounding this effect is the likely reduction in dividend pay-outs, further reducing returns to investors. With fewer local investors, New Zealand businesses would struggle to access capital and/or it would become more expensive.

Hand in hand with lower pay-out rates is greater retention of profits within companies; this runs the risk of poor investment decisions being made by corporates looking to grow outside domestic borders, particularly if less decision making rigour is applied.

Further, as Australian research shows, a share price premium is attached to imputation; a removal of New Zealand’s imputation regime is likely to depress the capital markets, at least in the short term.7

Some argue that the regime’s removal would result in a welcome corporate tax rate reduction, and this would in effect mute the impact of Australia dropping its own rate. However, IRD research from 2009 indicates that the flow-on changes in corporate behaviours from removal of our imputation regime would have a negative fiscal impact such that only a small rate reduction would be likely, perhaps just 2%.

If New Zealand were to abandon its imputation regime this would have significant and potentially negative consequences for our capital markets. Removal could

• Radically change entrenched corporate behaviour

• Reduce dividend pay-out levels

• Correspondingly herald higher corporate cash lock-up, and with it the potential for bad investments

• Cause to drop the NZX

• Result in only a small drop in corporate tax

• Create new tensions between corporate and investor expectations.

We would be loath to see New Zealand’s imputation system abandoned.

2. www.msci.com

3. That said, three companies demonstrated a thorough approach to describing their imputation policies for distributions to shareholders.

4. This is not the whole story since shareholders can utilise the RWT in their individual tax returns as a credit to reduce their tax liability, with any excess RWT credit being refundable. But this requires individual investors to lodge tax returns and reconcile all taxes and credits. On this we do question the degree to which imputation credits (and RWT) are just not claimed, and consequently “wasted”.

5. Over two decades there have been multiple studies of ASX listed companies measuring the share price drop off on an ex-dividend basis of imputing companies versus the drop off ex-dividend of non-imputing companies, and extrapolating the value differential.

6. In the government’s 2008 Discussion Document – Streaming and refundability of imputation credits, the fiscal cost of this measure was seen as a barrier to any change.

7. There is evidence of this implication from changes to the UK’s Advance Corporation Tax regime in 1999/2000.

The full Report by EY is here.

1 Comments

Dividend is something shareholders have in return on an investment. If you want to read more about it, here is a good article on Procedure for Declaring Dividend. There you will find out different types of dividends and its process of declaring.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.