Trusts

Government rejoins the long and winding road towards a beneficial ownership register for companies and limited partnerships. But what about trusts?

27th Jan 26, 11:08am

1

Government rejoins the long and winding road towards a beneficial ownership register for companies and limited partnerships. But what about trusts?

The New Zealand Tax Podcast - How Australian capital gains tax can apply to the sale of a New Zealand property. More on effective marginal tax rates. And the meaning of payment for GST purposes

10th Aug 25, 10:58am

1

The New Zealand Tax Podcast - How Australian capital gains tax can apply to the sale of a New Zealand property. More on effective marginal tax rates. And the meaning of payment for GST purposes

PIEs more prominent as RBNZ issues Depositor Compensation Scheme product hierarchy policy following consultation

9th Jun 25, 7:30am

PIEs more prominent as RBNZ issues Depositor Compensation Scheme product hierarchy policy following consultation

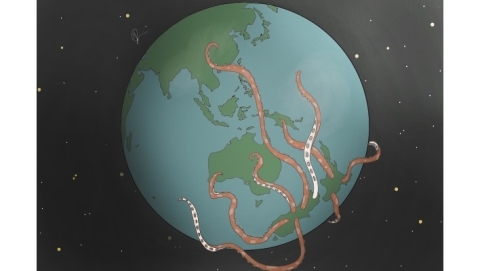

There's a much smaller number of NZ foreign trusts than there was a decade ago, but they're still quite popular in Argentina

19th Mar 25, 11:17am

1

There's a much smaller number of NZ foreign trusts than there was a decade ago, but they're still quite popular in Argentina

Home ownership rates are increasing while renting is declining, according to census data

6th Dec 24, 11:00am

83

Home ownership rates are increasing while renting is declining, according to census data

Associate Minister of Justice Nicole McKee sets sights on reforming anti-money laundering laws

16th May 24, 5:00am

12

Associate Minister of Justice Nicole McKee sets sights on reforming anti-money laundering laws

The New Zealand Tax Podcast: the IMF on capital gains tax, taxing wealth, and changing the ETS

25th Mar 24, 2:18pm

55

The New Zealand Tax Podcast: the IMF on capital gains tax, taxing wealth, and changing the ETS

The New Zealand Tax Podcast: Clarity about the the 39% trustee rate, and the timeline restoring interest deductibility for residential investment. But Inland Revenue doesn’t consider the removal of building depreciation “fair and efficient”

17th Mar 24, 4:51pm

62

The New Zealand Tax Podcast: Clarity about the the 39% trustee rate, and the timeline restoring interest deductibility for residential investment. But Inland Revenue doesn’t consider the removal of building depreciation “fair and efficient”

Coalition government not currently considering improving disclosure on the beneficial owners of NZ companies & limited partnerships

15th Mar 24, 7:44am

2

Coalition government not currently considering improving disclosure on the beneficial owners of NZ companies & limited partnerships

The New Zealand Tax Podcast: the UK budget drops a big change which will affect tens of thousands of Kiwis & British expats. And why there are so many trusts in New Zealand

13th Mar 24, 7:18am

23

The New Zealand Tax Podcast: the UK budget drops a big change which will affect tens of thousands of Kiwis & British expats. And why there are so many trusts in New Zealand

The New Zealand Tax Podcast; more from the Minister of Revenue on the future direction of Inland Revenue. And what connects the OECD’s international tax deal with the collapse of Newshub

5th Mar 24, 7:07am

12

The New Zealand Tax Podcast; more from the Minister of Revenue on the future direction of Inland Revenue. And what connects the OECD’s international tax deal with the collapse of Newshub

Terry Baucher details a busy start to 2024 in the world of tax, and asks when we will know the final shape of the Government’s tax package

9th Feb 24, 12:09pm

12

Terry Baucher details a busy start to 2024 in the world of tax, and asks when we will know the final shape of the Government’s tax package

The New Zealand Tax Podcast. Terry Baucher reviews the current state of trusts with legal specialist Tammy McLeod

27th Aug 23, 1:53pm

2

The New Zealand Tax Podcast. Terry Baucher reviews the current state of trusts with legal specialist Tammy McLeod

The New Zealand Tax Podcast – Terry Baucher rounds up a week of big election proposals to change the tax system, and dives into the fraught traps for trustees on how Australia and New Zealand differ in their rules and why they will be hard clean up

14th Aug 23, 2:50pm

25

The New Zealand Tax Podcast – Terry Baucher rounds up a week of big election proposals to change the tax system, and dives into the fraught traps for trustees on how Australia and New Zealand differ in their rules and why they will be hard clean up

Fund manager Nikko points out the raising of the top tax rate turbocharges the benefits of using PIEs

3rd Jul 23, 11:32am

8

Fund manager Nikko points out the raising of the top tax rate turbocharges the benefits of using PIEs