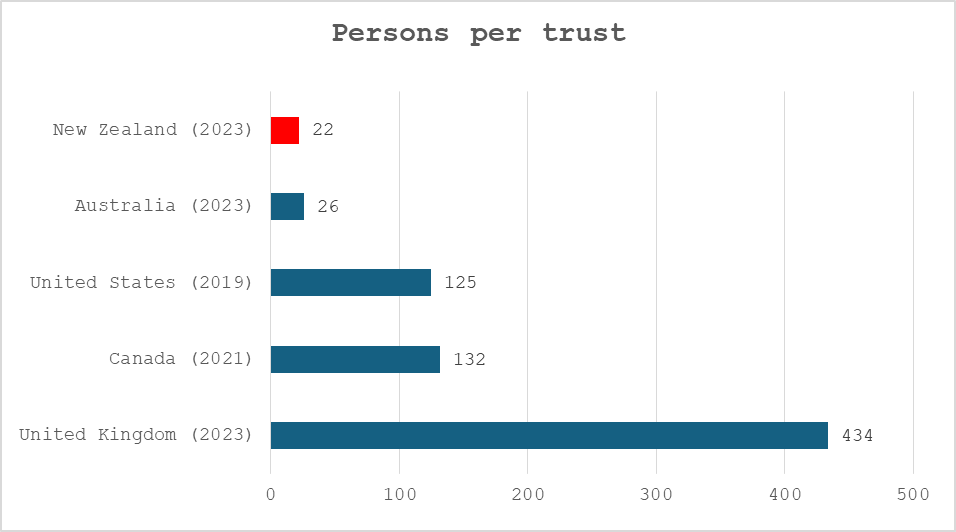

New Zealand has an extraordinarily high number of trusts relative to its population. We don't actually have official numbers on the number of trusts in the country but estimates range as high as 600,000. Inland Revenue’s recent trust disclosures data notes that as of 31st March 2023 it had 412,000 trusts with IRD numbers. Not all of them have to file tax returns but to put it in context that number of 412,000 represents one trust for every 12 people in the country. By comparison, based on UK tax return filing statistics filed for the same period, there is one trust in the UK for every 434 people.

(Prepared by author using latest available official tax return statistics)

So, there are a significant number of trusts in New Zealand. And that means unintended consequences are lurking for the settlors, trustees and beneficiaries of these trusts. One I would consider is a well-known issue is that for Australian tax purposes, a trust is deemed resident if any trustee is tax resident in Australia. A common pre-migration planning tactic for people moving from here to Australia is to ensure that they resign any trusteeships.

Watch out for Australian resident executors

By the way, this trust residency rule also applies to executors. I've frequently advised clients that they need to update their wills and if they have an Australian executor, they need to remove that person or consider alternatives.

Got an Australian resident trustee? Get ready to pay Australian capital gains tax even if it is your main home.

The implications of having an Australian resident trustee are frankly messy, to put it mildly. For Australian tax purposes a trust is deemed tax resident in Australia if ANY trustee is tax resident in Australia. This potentially makes the trust subject to Australian capital gains tax with the Australian resident trustee responsible for collecting the tax on any capital gain derived by the trust.

As an Australian resident trust any capital gain will be calculated under Australian tax law. This applies regardless of the fact that we don't have a general capital gains tax. The issue that's emerged in several cases that I'm dealing with relates to property has been sold by a trust and the disposal was not taxable for New Zealand because either the bright-line test didn’t apply or in some cases the property was actually the main home of one of the trust beneficiaries.

Australia has an exemption from capital gains tax for the main home, but and this is a huge but, this exemption does NOT apply to main homes held in trust.

The danger scenario

The danger scenario is a typical New Zealand complying trust with an Australian resident trustee. The trust sells a New Zealand situated property and then looks to distribute the gain. Even if that gain is distributed only to New Zealand resident beneficiaries, under Australian legislation, the Australian trustee is liable for the tax on that gain. Conceptually, it seems inconceivable that the sale of a New Zealand property distributed to New Zealand residents is taxable in Australia but it’s the interpretation the Australian Tax Office has adopted because at least one trustee is an Australian tax resident.

Well, what about the double tax agreement?

What can be done about this? Well in some cases, if there are only Australian resident trustees, then to use a technical term you are frankly stuffed. But more often than not, the majority of trustees are New Zealand tax residents. In this case you might be able to apply the clauses within the double tax agreement between Australia and New Zealand (the DTA) dealing with residency.

The problem is that the current DTA following the modifications made in 2017 to adopt the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS (the MLI), doesn't have an easy process for resolving this matter. Generally, you can apply the relevant double tax agreement to determine the place of effective management for non-individuals.

For example, a trust might have five trustees with only one in Australia and the remaining four trustees plus the settlor and this is the group which carries out the management of the trust. Accordingly, the place of effective management is in New Zealand. Australia therefore gets no taxing rights in relation to any disposals of non-Australian situated property. (Keep in mind that even if this scenario plays out, if a distribution is made to an Australian resident beneficiary who does not qualify for the Australian temporary resident exemption, the distribution is still taxable in Australia).

However, at present under the modified DTA, trustees wanting certainly will actually have to make an application to Inland Revenue through the mutual agreement process to ask them to consult with the Australian Tax Office and resolve the matter of residency.

A helpful United Kingdom court case?

Coincidentally, Howarth v HMRC [2025] EWCA Civ 822 an interesting UK Court of Appeal decision on the issue of place of effective management for a trust has just been released. The case involved a widely marketed tax avoidance scheme known as a “round the world” scheme, which was designed to avoid UK capital gains tax (CGT).

Under the scheme the trust’s Jersey based trustees held shares in a UK incorporated company. The Jersey trustees resigned in favour of a Mauritius resident trustee company who then sold the shares. Following the sale the Mauritian trustees resigned in favour of UK resident trustees. At the time the shares were sold, the trust would be deemed tax resident in Mauritius, a jurisdiction which, very conveniently, does not tax capital gains.

When the Court of Appeal considered the issue of the trust’s place of effective management it concluded the trustees in Mauritius were following a predetermined single plan set out by the UK settlors of the trust. The Mauritian trustees were “playing their parts in a script which had been written by others”. The Court of Appeal therefore upheld two lower court decisions (the equivalents of the Taxation Review Authority) that the place of effective management of the corporate trustee was in the UK.

It's quite useful to see courts talking about the residency of trusts because double tax agreements don't specifically refer to trusts but “non-individuals”. As a UK Court of Appeal decision, it represents a good precedent. Incidentally it's expected if the case goes up to the UK Supreme Court, it will probably still rule the same way.

I think Haworth v HMRC could be useful for any trustees who find themselves dealing with the complications of an Australian resident trustee and they wish to ensure any Australian tax is limited only to gains actually distributed to an Australian resident.

CPA Australia calls for a capital gains tax

Still in relation to capital gains tax, as previously discussed Inland Revenue has a long-term insights briefing currently out for consultation. (Submissions are open until 1st September). The briefing discusses how we need to look at ways we could expand the base tax base to meet coming financial demands mostly around superannuation, health and in my view, climate change.

This week CPA Australia, the accountancy body which represents over 3000 accountants here in New Zealand, has called for a rethink of the tax system, including consideration of an introduction of capital gains tax (CGT). The organisation agreed with Inland Revenue; there are many pressures on the New Zealand tax system particularly around ageing demographics. CPA Australia felt the absence of a capital gains tax puts pressure on other taxes. I agree with that analysis, and I also think that's tied to the question of productivity and diversion of our scarce capital into lower return assets, mainly residential property investment.

It's interesting to see the CPA Australia come out in favour of a CGT. It suggests that a CGT should only apply to assets acquired after a certain date. In other words, assets held prior to the introduction of that date would be exempt. This is what Australia did when it introduced CGT, coming up 40 years ago next month.

Follow Australia? “Yeah, nah.”

Interestingly, when the last Tax Working Group considered CGT, it got advice from Australia which recommended not to follow the Australian approach and instead go for what's sometimes known as the valuation day approach. This would base CGT on the valuation of assets on the date of introduction. CPA Australia rightly point out there are compliance problems with that approach but like so much of the stuff we encounter in the tax world, other countries have met and dealt with these issues, so they are not unique or insurmountable.

More on the abatement web

Last week I discussed a substack from Ganesh Ahirao, former head of the Productivity Commission analysing what I called The Dirty Secret of the New Zealand tax system - that very high effective marginal tax rates apply, sometimes over 70%, to people on very modest incomes.

Ganesh has written a follow up this week providing further examples illustrating how people trapped on low-income or benefits, who are trying to work their way out of the system, as they are encouraged to do so, are hit very quickly by very high marginal tax rates.

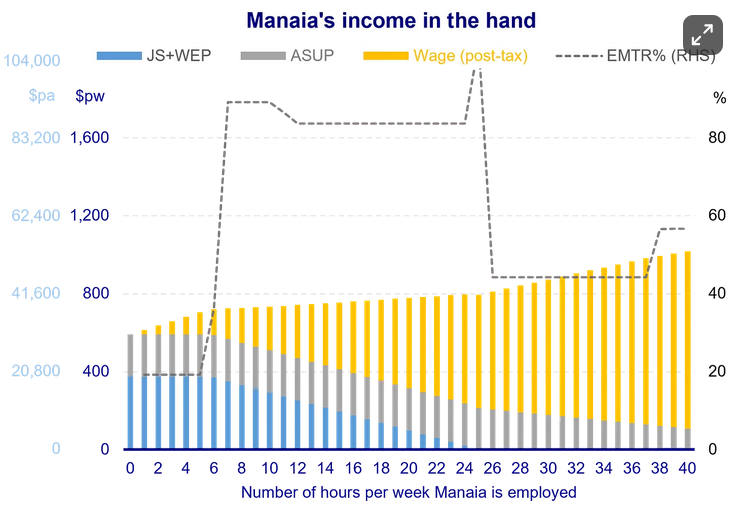

For example, Manaia is single with no children, no student loan, paying immediate rent of $415 a week for a one-bedroom flat. Manaia is eligible for Jobseeker Support alongside the Winter Energy Payment and Accommodation supplement for a total of $592 per week before tax. Six hours employment at the living wage will raise her weekly pre-tax income to $700 but above that threshold, she starts losing her Jobseeker Support at a rate of $0.70 on the dollar. Her effective marginal tax rate jumps above 80% plus.

As Ganesh details, many low-income earners seeking support even one as widespread as Working for Families face similar situations.

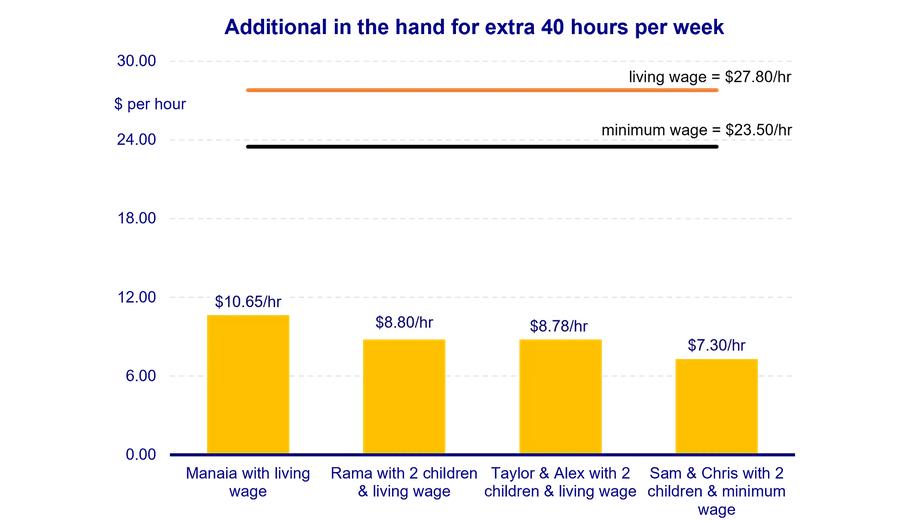

These graphs illustrate Ganesh’s argument which I fully endorse, is we have allowed a huge problem to develop over the last 30-40 years through constant tinkering with the benefits system and swapping universality for a more “targeted” approach. The result is a horrendously complex position which really needs cut through and reform.

I support that and make no apologies for bringing the story up. It is something we should be discussing more frequently and asking our politicians to fix. We can't be saying to people we need you to work if you're a beneficiary and then promptly hitting them with 80% marginal tax rates. That is unrealistic and unfair.

The meaning of ‘payment’ for GST purposes

And finally, this week, Inland Revenue has released a valuable draft interpretation statement for consultation on the meaning of payment for GST purposes. When a payment is made is crucial for determining the GST time of supply, the tax period for which you may return output tax. It’s also relevant when an input tax deduction can be claimed and particularly in relation to secondhand goods input tax deductions which are only available when a payment is made.

This draft interpretation statement (only 22 pages) will replace a couple of previous Inland Revenue guidance items, which are actually over 30 years old. The principles involved haven't changed, but it's still useful to see the advice consolidated in an updated interpretation statement.

The draft considers typical examples of what constitutes payment. Obviously, cash or bank transfers are payments, but what about if there is an offset or some vendor finance. For example, payment could be made by setting off against an existing debt owed by the supplier to the recipient. Accounting entries can count, but you have to have the evidence to support them, and obviously payment of a deposit represents a payment (and can trigger some GST time of supply issues in relation to the sale and purchase of a property), Overall a very useful guidance.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

1 Comments

For a CGT to be fair, it should commence with a Valuation Day (like Canada). The tax rate applied to gains should not be marginal tax rates. It could be say 20% (like Canada was - maybe now its 25%)). Only half the gain should be taxable (Canadian policy) - this recognises and adjusts for, in an "easy" way, the holding costs that may be associated with having held an asset for many years like interest, rates, insurance, maintenance, fees etc. Finally, NZs existing terrible superannuation savings system should move back to an EET system consistent with Canada, US, etc so super savings can fairly grow to a level that provides one with a comfortable retirement. Contributions should be compulsory and at least 10%. Family home should be exempt providing sale proceeds are applied to a replacement home within certain period.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.