Every industry has a dirty secret which is known to its practitioners but is not generally known by a wider audience. In my view the New Zealand tax system’s dirty secret is how high effective marginal tax rates actually most impact our lowest earners.

The effective marginal tax rate (EMTR) is the highest rate of tax that is applied to the very last dollar that you earn. This also takes into consideration abatements or clawbacks which apply. Now for most persons, the natural assumption would be if the highest income tax rate is 39%, then the highest EMTR would be 39%. That's a fairly logical, quite understandable and mostly correct approach.

How your EMTR can be above the maximum income tax rate

But, “mostly” is doing a lot of lifting because in certain instances a person’s EMTR can be above the highest tax rate. This is usually where a tax relief is withdrawn, or abatements apply. One example of where tax reliefs will be withdrawn is the Independent Earner Tax Credit, which is available to taxpayers who are not receiving New Zealand superannuation or Working for Families and have annual income between $24,000 and $70,000.

However, between $66,000 and the upper $70,000 threshold, it starts to get clawed back at a rate of 13%. This means that although the personal income tax rate for income between $66,000 and $70,000 is 30%, the effect of the clawback means a person’s EMTR within that income range is actually 43%.

The most common example that impacts most people are the interlocking layers of abatements that apply when someone is claiming a tax credit or benefit. The most notable example, which we've discussed quite frequently, is Working for Families. These tax credits are abated at a rate of 27.5 cents on the dollar, where a family's income exceeds $42,700. (Respectively 28 cents and $44,900 from 1st April 2026).

Abatements also apply in relation to Accommodation Supplement and Jobseeker and the combination of all these results in people on modest incomes having extremely high EMTRs.

Working 40 hours a week for an additional $6.07 per hour

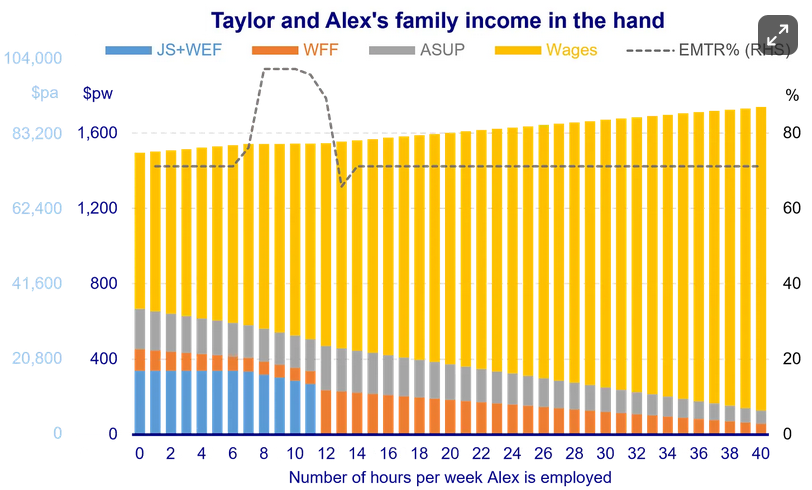

Ganesh Ahirao (Ganesh Nana), the last head of the recently disestablished Productivity Commission, has put together an illustration of how this Gordian Knot of abatements and benefits affects the family of Alex and Taylor and their two children.

The relevant facts are that Taylor is employed full-time at $25 per hour. So the family income is $1000 gross per week which, after deductions for income tax and ACC, is $829 per week net.

The family rent a two-bedroom house in Island Bay, paying the median rent for the suburb of $625 per week. This means that, after rent, the family has $204.30 per week to meet all other non-rent living costs and expenses. They're therefore claiming additional assistance. Alex can claim Jobseeker Support there's also Working for Families credits and Accommodation Supplement available.

However, as Ganesh illustrates, if Alex and Taylor do make a claim, they can find themselves trapped in nightmarish web of overlapping, interlocking benefits where the level of abatements can be dependent on what other assistance they're receiving. Complicating matters is the requirement for anyone like Alex claiming Jobseeker Support to accept employment.

How to lose 71.2% in tax and abatements on the minimum wage

If Alex takes five hours at the minimum wage of $23.50 per hour (i.e. $117.50 per week) this won’t affect his Jobseeker Support because he's allowed to earn up to $160 per week before abatement. His earnings will be subject to tax and ACC but crucially they also have an impact on the Working for Families and Accommodation Supplement because the family income is above the abatement thresholds.

The abatements and tax on $117.50 total $83.62 leaving net cash in hand of $33.88, or an EMTR of 71.2% - more than double the official income tax rate of 30% (31.67% once 1.67% ACC earner levy is added).

Remember this 71.2% EMTR is for a family earning a little bit under $60,000 a year, $1200 a week. As Ganesh’s analysis illustrates their EMTR can get even higher.

A well-known problem, at least amongst the experts

Earlier this year I discussed a paper prepared by Treasury which examined this issue of how the tax and transfer system affects financial incentives to work. In the paper Treasury noted that most New Zealanders have EMTRs below 50% with only 6% experiencing EMTRs over 50%.

The Treasury paper noted families with children are more likely to face higher EMTRs. Single parent families are particularly hard hit, with 30% of single parent families having EMTRs greater than 50%, and in some cases higher than 100%.

The lesson from the Treasury paper, and Ganesha's substack, is that over time we have built a complicated, interlocking and confused system of means tested benefits.

We also have a not unreasonable expectation that people receiving benefits should attempt to work. However, the EMTRs of 70% or even more resulting from the abatements applied by means testing may make the actual return for any additional hours minimal.

In such situations, and faced with such disincentives, why would people work extra hours? What Ganesh’s substack hammers home is the need to be step back and have a real think about what we are trying to do with our work and benefits system and the interaction between tax and benefits.

Inconsistent approach

This problem has also been recently highlighted by the changes to the FamilyBoost initiative where the Government is reducing the abatement rates and increasing the abatement thresholds with effect from 1st October because the initiative - a key election promise - wasn't reaching as many people as expected.

FamilyBoost is now available for families earning up to $229,100, well above the low threshold impacting families like Alex and Taylor. Understandably this has led to questions as to whether such families should be receiving assistance. Which is perhaps a bit rough, because raising children is not cheap.

A long-standing issue ignored for too long

In my view the Government is sending wildly opposite messages here. In many cases, the abatement thresholds have not been increased with inflation for some time. Therefore, with the rise in cost of living and rent in particular, people on lower incomes are struggling to keep up.

This is leading to more applications for supplementary assistance, which then feeds this spiral of higher EMTRs applying. It's time for someone to grasp the nettle and say, “Well, this is really not achieving very much. Let's go away and rethink it.”

Strange bedfellows?

Now, in the strange story basket this week is one where the Green Party and the Taxpayers Union have found common ground.

This curious tale is a byproduct of the local government election in Wellington. Two Green Party candidates running there are proposing a change to the taxation rating system. Instead of taxing properties on their total value, including improvements, the Green party candidates want to base rates solely on the value of the underlying land.

Jordan Williams, the executive director of the Taxpayers Union, came out and endorsed this approach on the basis that the current system effectively penalises developments by taxing improvements.

Meanwhile the Green Party candidates are looking to target what they see as land banking, where people are just simply sitting on land, not paying rates. The move is intended to encourage the land to be used for productive purposes, whether it's more housing or alternative commercial developments.

It's interesting to see very opposite political bedfellows come together on this point. It’s probably a once in a Blue (or Green) Moon but certainly it's an example where a principled tax approach can result in a common approach from what appear at first sight to be some unlikely bedfellows.

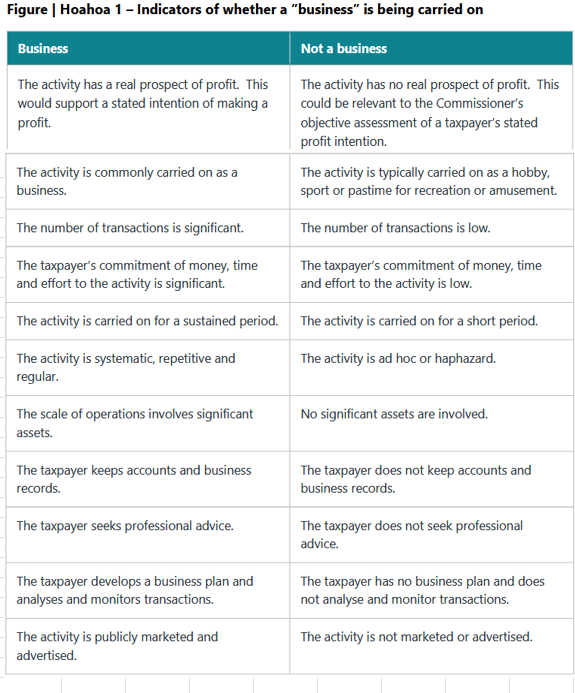

Is that a business you’re carrying on? New Inland Revenue guidance

Inland Revenue has released a draft interpretation statement for consultation on the important issue of when and whether a taxpayer is carrying on a “business” for income tax purposes.

As the draft interpretation statement notes:

“It is important to understand if you are carrying on a business, and when that business is being carried on, because carrying on a business is a requirement of many provisions in the Income Tax Act 2007. In particular, an amount that a person derives from a business is included in a person’s income for tax purposes and the person is allowed a deduction for expenditure incurred in carrying on that business.”

This draft statement is part of a project whereby Inland Revenue is modernising and updating its previous guidance, which in this particular case goes back to 1971. Unless otherwise stated these updates are not changing any previous interpretation.

The leading decision in this area is Grieve v CIR (1984) 6 NZTC 61,682 (CA). In Grieve the court ruled that deciding whether a taxpayer is in business involves a two-fold inquiry as to the nature of the activities carried on and the intention of the taxpayer in engaging in those activities.

The draft statement (which runs to 46 pages including references) discusses these relevant factors in depth but it also has a useful summary.

Overall, this is a useful guide to a commonly asked question.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

10 Comments

The Treasury paper noted families with children are more likely to face higher EMTRs. Single parent families are particularly hard hit, with 30% of single parent families having EMTRs greater than 50%, and in some cases higher than 100%.

Keep up the great work reporting in this space Terry. I agree we need a good reshuffle of how the taxation functions remove barriers for single parents and any lower income families with kids, so that they can work, grow their careers and succeed. What modern country should in effect, punish people for having children by allowing so many benefits to help, then making it financially not worth returning to work or getting a pay rise.

Predominantly local body rates masquerade as a wealth tax. That is because the higher the value of the property then pro rata, the higher percentage of the councils overall rate take, it will be charged. That compounds further with central government collecting 15% GST over the top of that. The thing is it is described as a goods and service charge but anomalies abound. A household of say six will use more of said services than a household of one or two but the latter will pay more rates if the property is of the greater value. Such distortions have been compounding for far too long and the whole system is long overdue for an overhaul and starting with the base land, that is unimproved, value is the obvious option.

The flash areas seem to get all the best amenities though.

Generalisation there but not entirely inaccurate either. But consider this. Two Christchurch houses side by side, same sized sections and structures, same street frontage, each occupancy of two people. One pays $10,400 rates annually, the other $5,800. The difference being the former is a new house, a EQC rebuild. That is the distortion I was referring to and to call rates as being an equitable charge for goods and services is obfuscation at its very worst.

Sometimes. Sometimes it's a confusion of cause and effect. If there an impressive geographic feature that resulted in say a wonderful park, lake or foreshore amenities then the wealthiest are willing to pay more to live near it.... then people incorrectly assume the rich got more stuff.

Be an interesting piece or research but probably a mix of causes.

They really should rename WFF, because a couple that both work are pretty much ineligible.

WFF should be abolished, it's a taxpayer funded business welfare wage & salary subsidy. Which is why National have never abolished it in a decade.

Ditto the accommodation supplement.

...and the now billion plus pa extra income tax in over a decade of bracket creep

"In the paper Treasury noted that most New Zealanders have EMTRs below 50% with only 6% experiencing EMTRs over 50%."

Those figures are terrible. 6% over 50% is 6% of the population in a blind hole. And as kknz notes the end result with wff and AS is not even advantaging them, infact the opposite.

And yet despite all the evidence all governments of the last 25 years have closed their ears and eyes and deliberately added another layer or two to the problem.

Exactly.

Abatements and EMTRs - I first became aware of them in 2011 on reading The Big Kahuna and I believe every tax working group since has also highlighted the inequities.

I see the only way of untangling ourselves from this mess is to scrap all targeted welfare; replace with a UBI/GMI; and add capital/wealth and/or land taxes. It's really very simple. Radical, but simple;

https://morganfoundation.org.nz/kahuna/

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.