By Diego Cerdeiro, Siddharth Kothari, and Dirk Muir

China’s importance in the global economy has increased dramatically in recent decades, and it has been a particularly crucial driver of trade integration in Asia.

China’s medium-term growth prospects, like that of other countries, will be determined in part by major forces such as convergence to advanced economies’ income levels and demographics. Yet key structural policy drivers, including domestic reform momentum, and external factors, including geoeconomic fragmentation, also significantly affect this path.

What would be the potential implications for Asia and beyond from these different growth paths? In our latest Regional Economic Outlook for Asia and the Pacific, we assess the potential effects of a downside scenario from ‘de-risking’ between China and Organisation for Economic Co-operation and Development economies.

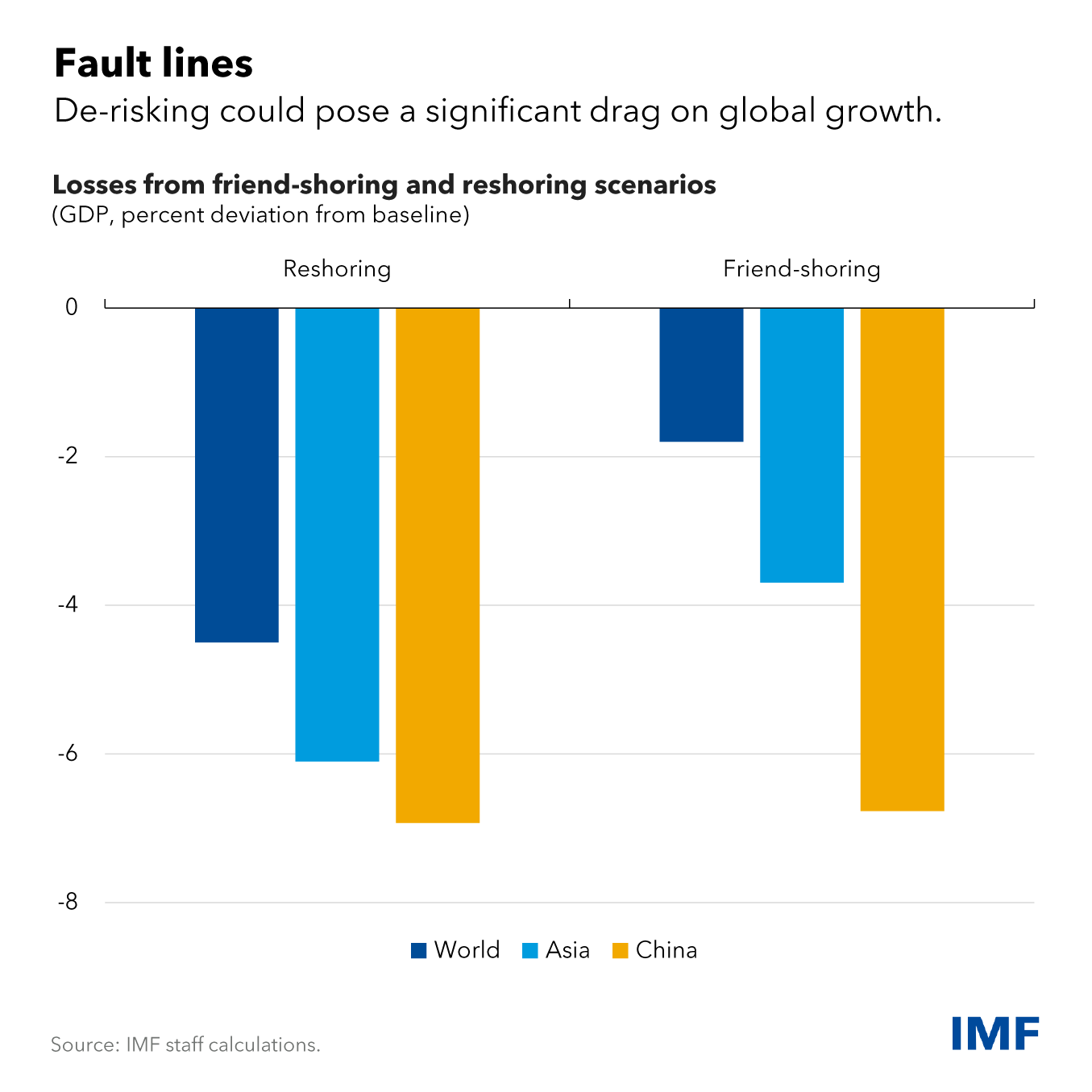

As the Chart of the Week shows, so-called de-risking strategies by China and the United States and other OECD countries that aim to reshore production domestically or friend-shore away from one another can result in a significant drag on growth around the world even assuming no new trade restrictions with third countries—especially in Asia.

While reshoring would be particularly painful to everyone, it is notable that friend-shoring does not generate net benefits for third countries in the long term. That’s because the benefits from trade diversion are offset by the effects of the contractions in both China and the OECD.

For the region, the results suggest that third countries should not expect to passively benefit from friend-shoring policies, but rather actively pursue reforms that can help them further integrate into global supply chains. For systemic economies around the world, there is an urgent need for constructive dialogue to resolve underlying sources of tensions and resist costly fragmentation outcomes.

In China, the risks that fragmentation poses on medium-term growth underscore the need for comprehensive structural reforms that would help income levels converge more rapidly with those in advanced economies—such as closing productivity gaps between state-owned and private firms and further opening up sectors to competition. Our research shows that achieving this would also have significant positive spillovers for other economies in Asia.

—See the Asia-Pacific Department’s recent blog outlining its latest economic outlook for the region: Asia Continues to Fuel Global Growth, but Economic Momentum is Slowing .

Diego Cerdeiro, Siddharth Kothari, and Dirk Muir are all economists at the IMF. This article was originally posted here.

4 Comments

Friends, this is total IMF swivel-eyed nonsense.

De-risking is about countries using public investment and strategic interventions to pursue specific goals - typically by lowering the risk associated with private investments, e.g. underwriting loans for a company that wants to strengthen domestic production / supply of critical goods and services, or providing grants to companies to maintain manufacturing capacity or specialist skills so that we can avoid becoming overly reliant on trading partners that could become exploitative. If you don't have a plan for your own country, you just become part of another country's plan.

It is worth noting that the most powerful countries on earth built their wealth and capacity by using industrial strategies like this - raising trade barriers, using capital controls, investing directly in the industries they wanted to develop.

The IMF are battling this 'back to the future' mood on de-risking hard because their mission is unbridled free trade - explicitly and shamefully placing the needs of capital above those of countries and their people.

Just out of interest Jfoe, what should NZ's strategy be? We seem to be reliant on buyers of our limited range of commodities.

Yes, we are currently part of China's plan. For example, China is indirectly subsidising their timber merchants to buy our crap timber to use (temporarily) for construction. The price our exporters receive basically secures China's supply and makes it uneconomical for us to process timber ourselves. So, like the mugs we are, we close down our sawmills and think we are doing great. Meanwhile, China process timber from other countries and sell it to us, and quietly get on with their aim of becoming self-sufficient in timber by the mid-2030s. At that point they will drop us like a stone and we will continue to import their processed timber. See also milk powder.

Imho, NZ strategy should focus on becoming energy self-sufficient / almost oil-free as soon as possible. This would involve large scale electrification to create a genuinely over-the-top abundant electricity supply, which would be stupidly cheap to consumers. We have huge natural advantages in clean energy and could position ourselves as the best place in the world for data centres and other energy intensive industries. I would also aim to create a highly competitive, top quality tertiary education sector while investing in communities to make us one of the safest, cleanest, greenest places to live, work, and study in the world.

Lots more to say - intensive eco-house building etc, but that's enough for now!

Thanks, I like your energy strategy. We are already off grid with an eco house.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.