The United States’ trade war has increased the risk of a financial crisis in New Zealand, according to the Reserve Bank’s latest Financial Stability Report.

Governor Christian Hawkesby said risks to the system had increased over the past six months but financial institutions were still in a strong position to support the economy.

Sweeping tariffs imposed on NZ and its major trading partners have increased geopolitical tensions and caused “heightened financial market volatility” which may result in a slowdown in global economic activity.

These new trade restrictions were the key risk to financial stability in the May report, as it could cause some debt carrying households and businesses to become distressed.

Businesses had already been delaying investment plans due to the weak domestic economy and may continue to do so due to tariff uncertainty. This would reduce demand for labour and household income.

The RBNZ said a slowdown in the domestic economy which caused an increase in unemployment could increase mortgage defaults.

“A particularly challenging scenario for indebted households and businesses would be if overall inflationary pressures increased alongside weaker economic growth and higher unemployment,” it said.

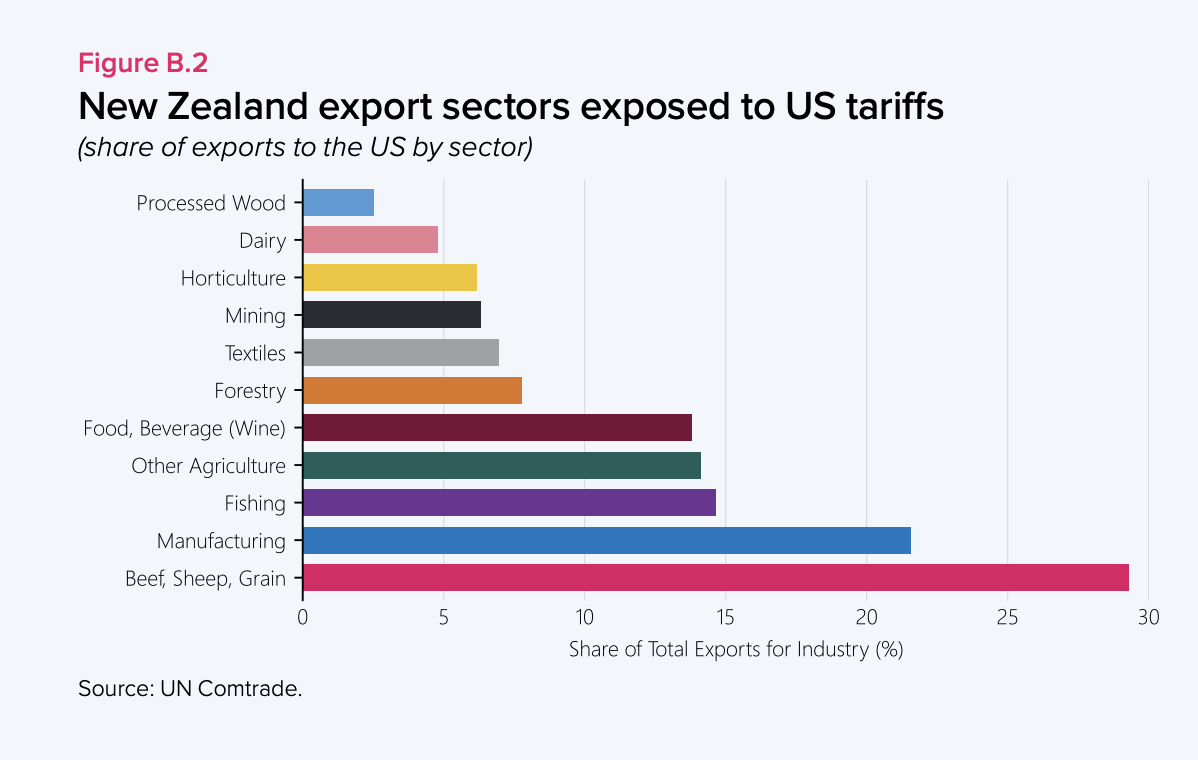

Agricultural businesses are among the most directly affected by the tariffs and could come under pressure. This comes not just from direct taxes in the US but also reduced demand from China and the rest of South East Asia.

However, RBNZ said farmers had benefitted from lower interest rates, higher commodity prices, and stricter lending standards which puts them in a better position to cope with any disruption.

Despite the risks, the economy was still expected to grow this year due to lower borrowing costs and high agricultural export prices.

Banks had strong capital and liquidity buffers to continue lending even if conditions deteriorate further, Hawkesby said. They also remain profitable, with non-performing loans expected to decline as mortgage rates reprice lower.

However, the central bank will proceed with a review of capital requirements in response to criticism that the current rules are onerous and overly-cautious.

A group of international experts will work with RBNZ to reassess key capital settings ahead of next year’s scheduled increase and the implementation of the Deposit Takers Act.

Banks are currently halfway through increasing their capital buffers to match new rules written in 2019 aimed at preventing collapses such as the 2008 Global Financial Crisis.

Politicians, bank lobbyists, and many economists feel the capital requirements are causing needlessly high interest rates and stifling competition in the banking sector. The RBNZ has agreed to review the rules, noting there have been a number of changes to the risk profile since 2019.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.