New Zealand's primary sector is going gangbusters - and it's just driven our highest ever monthly goods trade surplus.

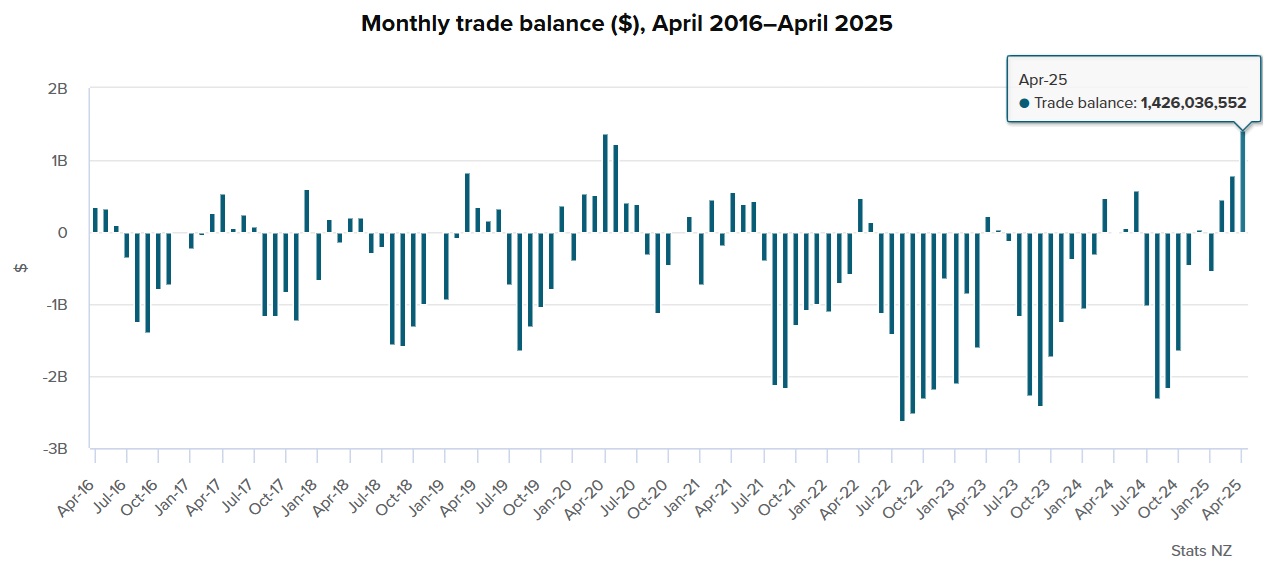

Statistics NZ's figures for April show that in the month the difference between what we exported and what we imported resulted in a surplus of $1.43 billion, which beat the previous record of $1.37 billion - also for an April month but during the pandemic affected times in 2020.

"New Zealand has had only four monthly surpluses over $1 billion. The last two were in 2020 and two out of the four were also in April months," Stats NZ international accounts spokesperson Viki Ward said.

"The overlap of the dairy and fruit industry seasons contributed to this high."

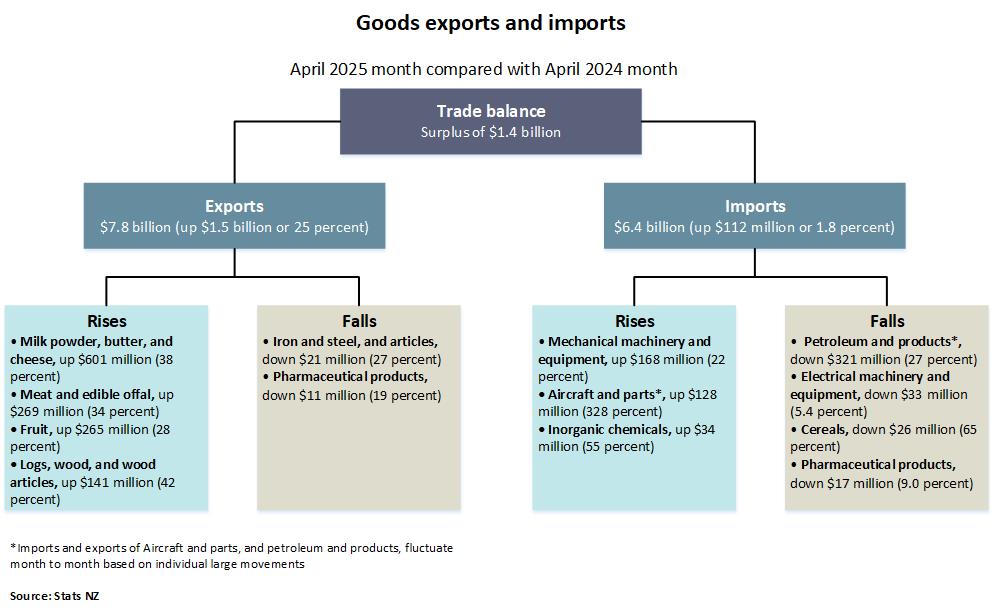

New Zealand imported $6.4 billion and exported $7.8 billion of goods (a record) in April 2025.

A year ago, in April 2024 the result for the month was actually a small trade deficit of $12 million.

Stats NZ said increases in our primary products exports in April 2025 compared with April 2024 contributed to this surplus, including:

- milk powder, butter, and cheese up $601 million, to $2.2 billion

- fruit up $265 million, to $1.2 billion

- meat and edible offal up $269 million, to $1.1 billion

- logs, wood, and wood articles up $141 million, to $481 million.

In the April 2025 month, these products made up 63% of New Zealand’s goods exports, compared with 58% of goods exports in the same month last year.

Milk powder was the largest contributor to exports in April 2025, reaching $1.0 billion, an increase of $247 million (32%) compared with April 2024.

In terms of the annual position, the trade deficit in the 12 months to April 2025 was $4.8 billion, but this was down from a deficit of $10.2 billion in the 12 months to April 2024.

Annual goods exports for the period ended April 2025 were valued at $75.4 billion, up $6.8 billion from the previous year, while annual goods imports were valued at $80.3 billion, up $1.4 billion from the previous year.

Back on the monthly figures, in terms of major destinations for export goods, the exports to our biggest destination, China, in April topped the $2 billion mark. This was not a record, but was up $476 million (30%) on the figure for the same month in 2024. The largest rises were for milk powder, butter, and cheese, up $165 million.

Exports to the United States were over $900 million, up $184 million (25%) on April 2024, exports to the European Union were just over $725 million, up $184 million (34%), exports to Australia were just under $725 million, up $34 million (4.9%) and exports to Japan were just over $490 million, up $54 million (12%) on the figures for April 2024 .

22 Comments

Excellent news! The policies of the National government are starting to bear fruit in a tough environment.

I agree it's good news. Not sure how much we can attribute to the current government though, looks like it's mostly commodity price related and maybe a good year for growing fruit?

Huh? Are National involved at setting the price of WMP at auctions? Can't see how this is their doing...

Of course National have no influence over the price of WMP or fruit crop, but they have been much more restrained in their spending, that's why they deserve credit. Labour would have continued they high spend mode and thus continued with the deficits.

Yes, those tax breaks for landlords have certainly driven massive innovation and resulted in a boom for our primary industries. I would never have seen it coming.

I don't quite follow that argument.

What interests me is there is no discussion of volumes that make up the value.

I reckon it's at or close to high tide in the ag commodity price cycle (I'd be in rapture if that read is wrong). Perhaps the US tariff circus may prolong the current values as NZ is tariff free.

At home land area producing meat and wool continues to reduce, inevitably leading to reduced production volumes going forward. If current commodity prices reduce 15%, what is the projected impact on BoP going forward?

You appear to be confusing the countries earning/ spending with the Governments earning/spending. They are not the same thing.

I don't think so. The earnings are derived from tangible goods and services, likewise the expenditure.

With such a high percentage of the export earnings derived from land base production I consider it relevant to consider volume as well as value.

The land area in production is finite and decreasing for animal based production. A figure of 95,000 hectares of animal production land sold to forestry comes to mind. That equates to a loss of around 1,000,000 stock units. And as carrying capacity is typically calculated on core mid winter capital breeding stock numbers (or capitalstock), rather than spring/summer/autumn trading stock numbers, that spells a reduction of around 1.5 million trading stock units available for sale and export from the coming breeding season.

So while commodity prices are high just now, when the cycle turns, coupled with lowered stock numbers, there may be a dramatic reversal in the BoP.

Let me know if there's a major flaw in this argument.

Cringe.

I'm going to call BS on your comment unless you can tell me which National policies dtopped our dollar by 10% aginst the US$, or caused global dairy prices to hit record highs.

Deficit/surplus is not only about the earning side, it's also about the spending side, and National have been much more restrained in spending than Labour were, when in government.

Maybe the current low cost of oil has helped. Certainly, all those recently redundant contractors and workers will be consuming less of everything.

Again, you fail to see the government spending side, which has been restrained under National, whereas it was out of control under Labour.

But national are borrowing more than labour so….

Not that I am against the current Govt Yvil, but I would have to say the current good trade terms are nothing to do with policy. It is quite simply demand. And long may it continue, hopefully.

Great news!

Good to hear but this doesn't drive the economy like the working couple with 1.5 kids living in a renovated villa, with polished floors, in Grey Lynn.

And at the moment they're not up to much.

How much of this is the rise in price of said exports? Looking at you WMP

There's some pages of export quantities rather than values in the excel sheet here

https://www.stats.govt.nz/information-releases/overseas-merchandise-tra…

You could have a dig around to answer your question. At first glance, looks like dairy export volumes are up a little on last year, meat is down a little, and fruit is way up. Aluminium down I guess because of the dry winter deal they made to slow down production.

Dairy volume will rise as the further processed product are discarded, meaning ratio of the bulk commodity product increases. However if it is a fact that NZ has scarcely much more of the requisite pasture to develop, then that increase will inevitably plateau.

Dairy herd has reduced in number from peak. Production per cow has increased incrementally with improved feeding and genetics.

I doubt that a quantum lift in productivity can be achieved from here though as use of nitrogen fertiliser has been significantly reduced under current regulatory regime.

Production is far more relaliant, now, on sunshine and clover than say 10 years ago.

I'm a city man but happily acknowledge that the country is almost entirely dependent on agriculture/horticulture/viticulture etc... for 80% of our income (10% is tourism and 10% everything else). NZ is a two trick pony. We desperately need a third string to our bow and that has to be natural resource exploitation (with mining and oil/gas at the top of the list). We have a 1st world welfare system but not 1st world incomes. We need way more fx dollars in the tin to increase our std of living. With a land mass greater than the entire UK, let's get to it! Fast!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.