Card spending in July rose by 0.5% from June and 2.6% compared to July 2024, but the bank's economists warned against assuming retail volumes were back on a growth trend.

Chief economist Sharon Zollner said generally, more positive trends were starting to emerge in spending.

But she noted spending on consumables (supermarkets) was a big driver, "so we do need to be cautious about assuming retail volumes are turning meaningfully higher just yet."

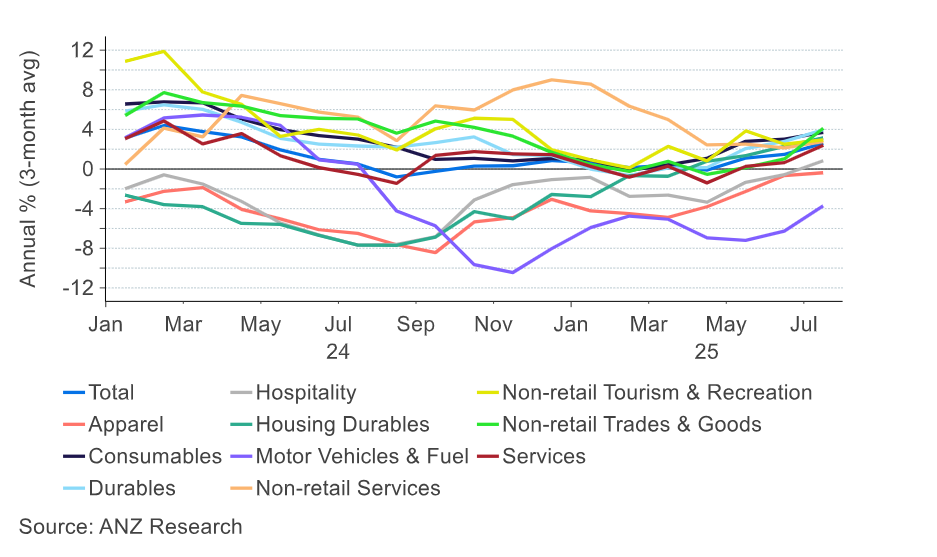

Nearly all store types had returned to the black on an annual basis.

However, there was a marked divergence between "must-haves" and "nice-to-haves," with spending on housing durables, motor vehicles and fuel, hospitality and apparel remaining flat.

Grocery and convenience store spending was up 4.2% year-on-year, below the level of food price inflation.

ANZ noted its data is "typically" from ANZ-issued debit and credit cards, with some data from merchants who bank with ANZ.

Because of the volatility of month-to-month data series, ANZ's economists presented data in rolling 3-month average terms, seasonally adjusted.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.