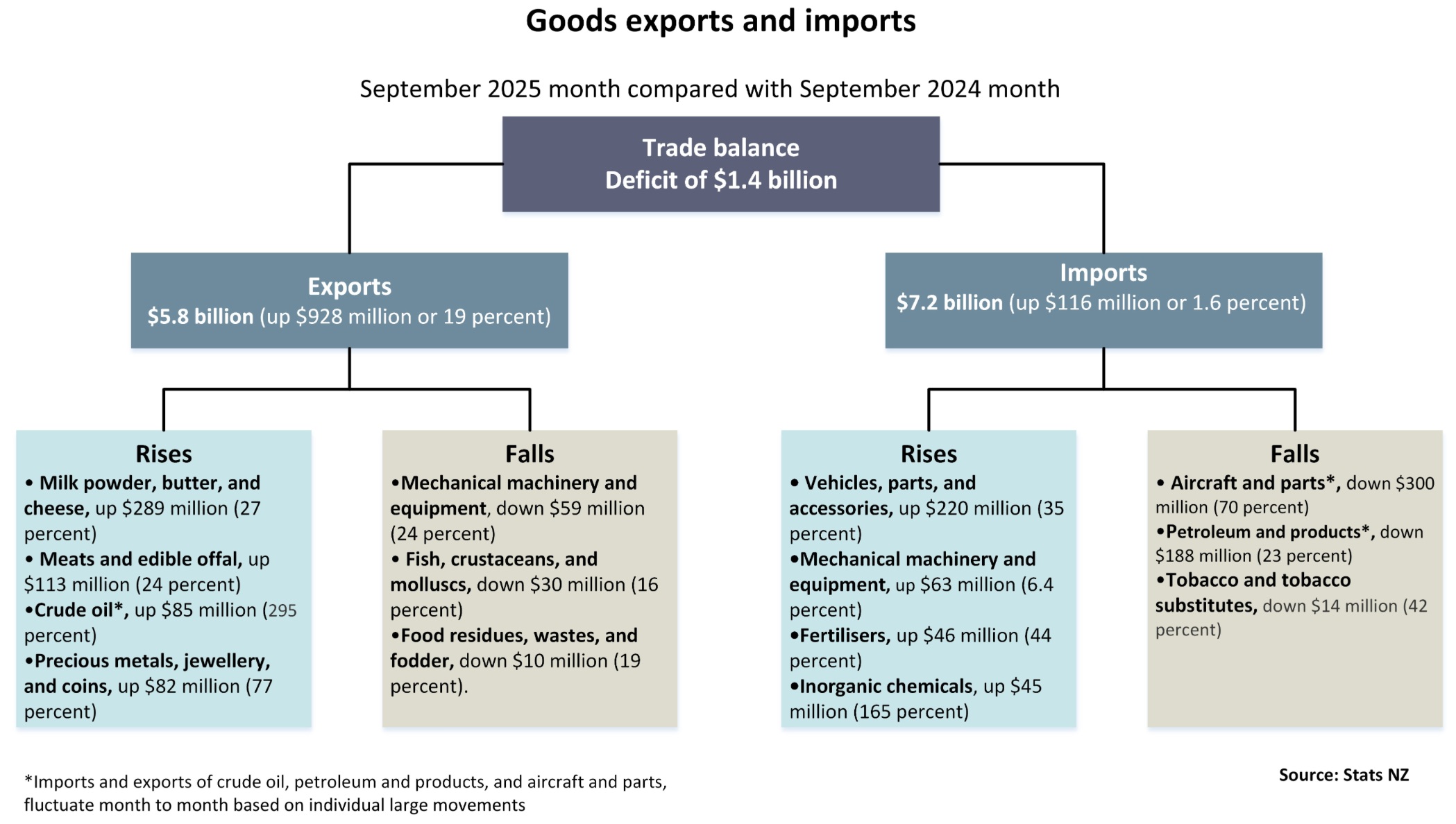

Our booming primary sector is continuing to provide the brightest of bright spots in a glum economic landscape, helping to drive our exports in September to $5.8 billion, up 19 when compared with the same month a year ago.

By destination, the biggest export rises in September were to Australia, up $205 million (28%) and to China, up $266 million (24%)

Statistics NZ says goods imports rose by $116 million (1.6%), to $7.2 billion, meaning our monthly goods trade balance was a deficit of $1.35 billion.

And that might not sound great, but due to seasonal patterns, we always rack up a deficit in September.

In fact, the latest deficit is down from $2.17 billion in September 2024 and is the smallest for a September since the pandemic-affected September 2020.

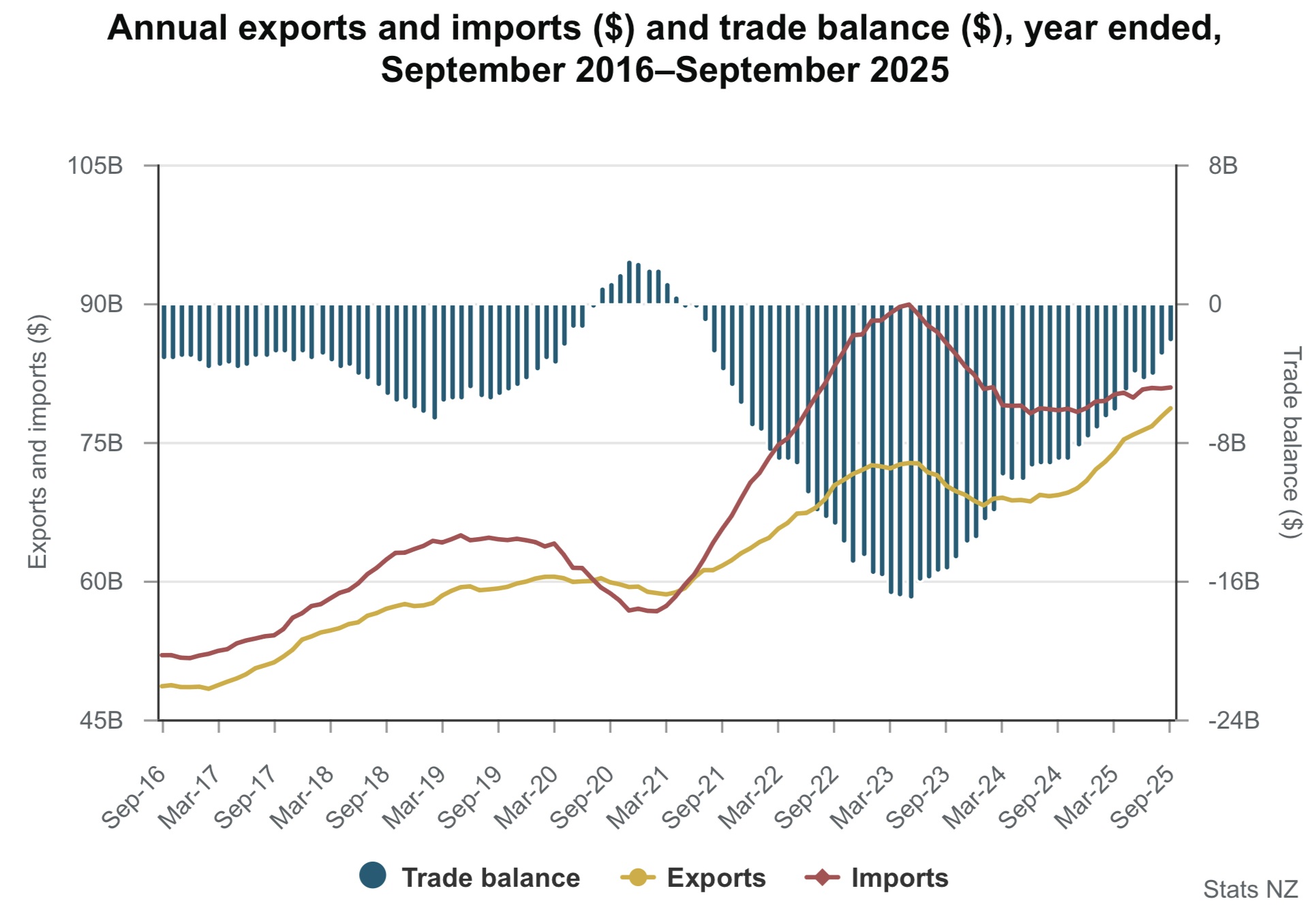

If we look at the annual picture, IE for the whole year to September, our goods trade deficit is $2.25 billion - that's nearly $7 billion lower than the annual figure as at September 2024 and over $13 billion lower than for the 12 months to September 2023.

In the recent past we've seen exports growing strongly, while imports have not grown by as much. And while that latter fact might point to slow demand in our domestic economy, the strong exports show we are taking advantage of the current high commodity price cycle.

In terms of the September 2025 month, the below table from Stat NZ highlights the major movements, with dairy and meat featuring strongly as usual.

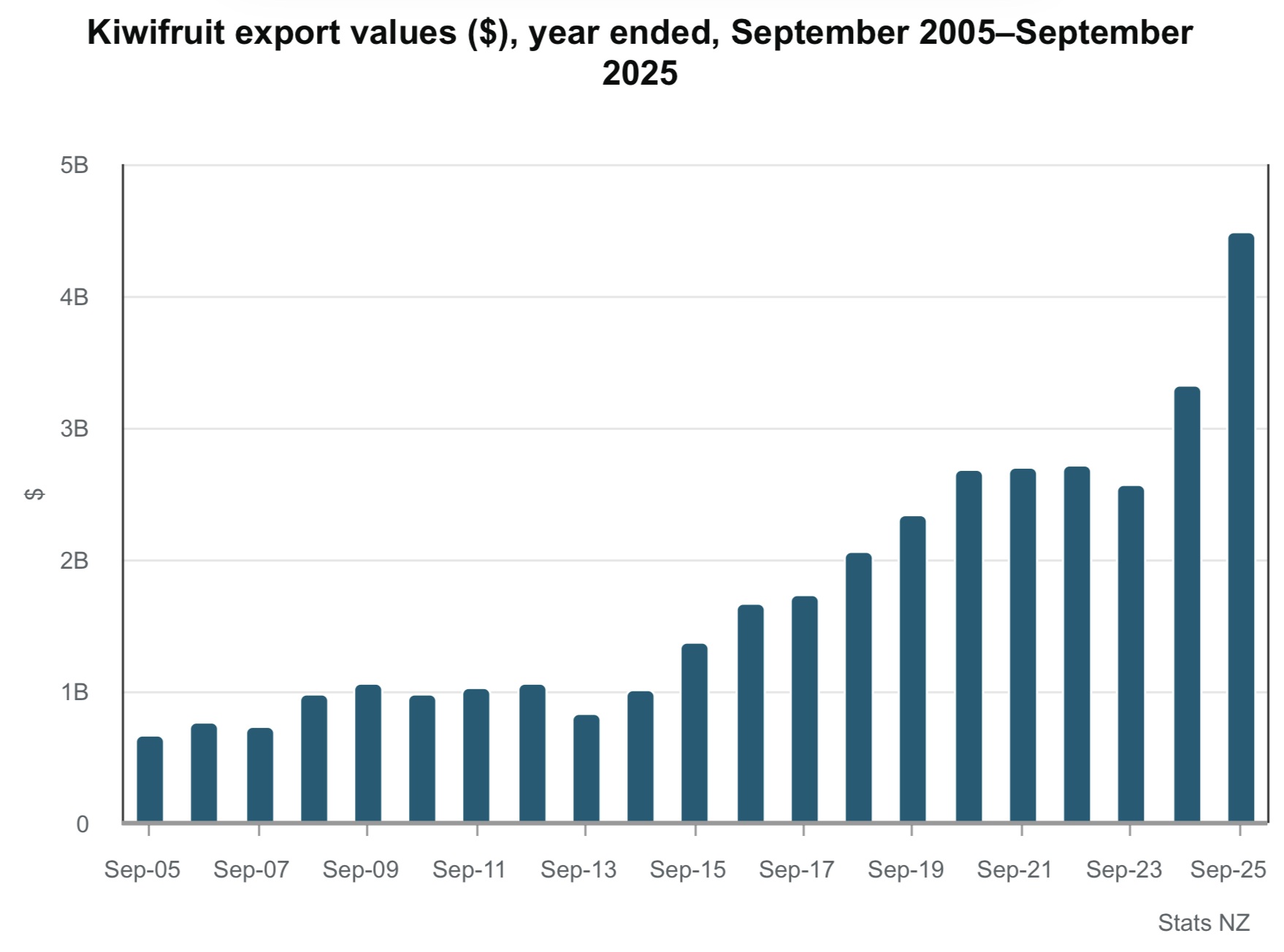

Kiwifruit doesn't feature in the above figures, but if we look at the 12 months ended September, Kiwifruit export values rose $1.2 billion (36%) to $4.5 billion in the year ended September 2025, compared with the year ended September 2024. And this highlights the spectacular growth of Kiwifruit exports in recent times.

Shannon Nicoll, associate economist at Moody’s Analytics said September and August usually represent the weakest time of year for New Zealand.

"...Exports are softer because of the end of the fruit export season, and the period is a regular low point for meat and dairy shipments." Meanwhile, Nicoll said, imports of consumption and capital goods tend to trend higher in those months.

"But this September, a soft currency and a weak domestic economy capped growth in imports and bolstered the price competitiveness of exports, while strong global prices gave export revenue an extra boost. The trend trade balance has not been stronger since the pandemic," he said.

"With the last month of data for the September quarter, there is a clearer picture of the domestic economy. Imports of machinery and plant grew 8.1% from the June quarter, the fastest clip in four years," Nicoll said.

"That portends well for domestic investment and meshes well with our expectations for the economic recovery to get back on track."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.