By Hites Ahir, Nicholas Bloom, and Davide Furceri

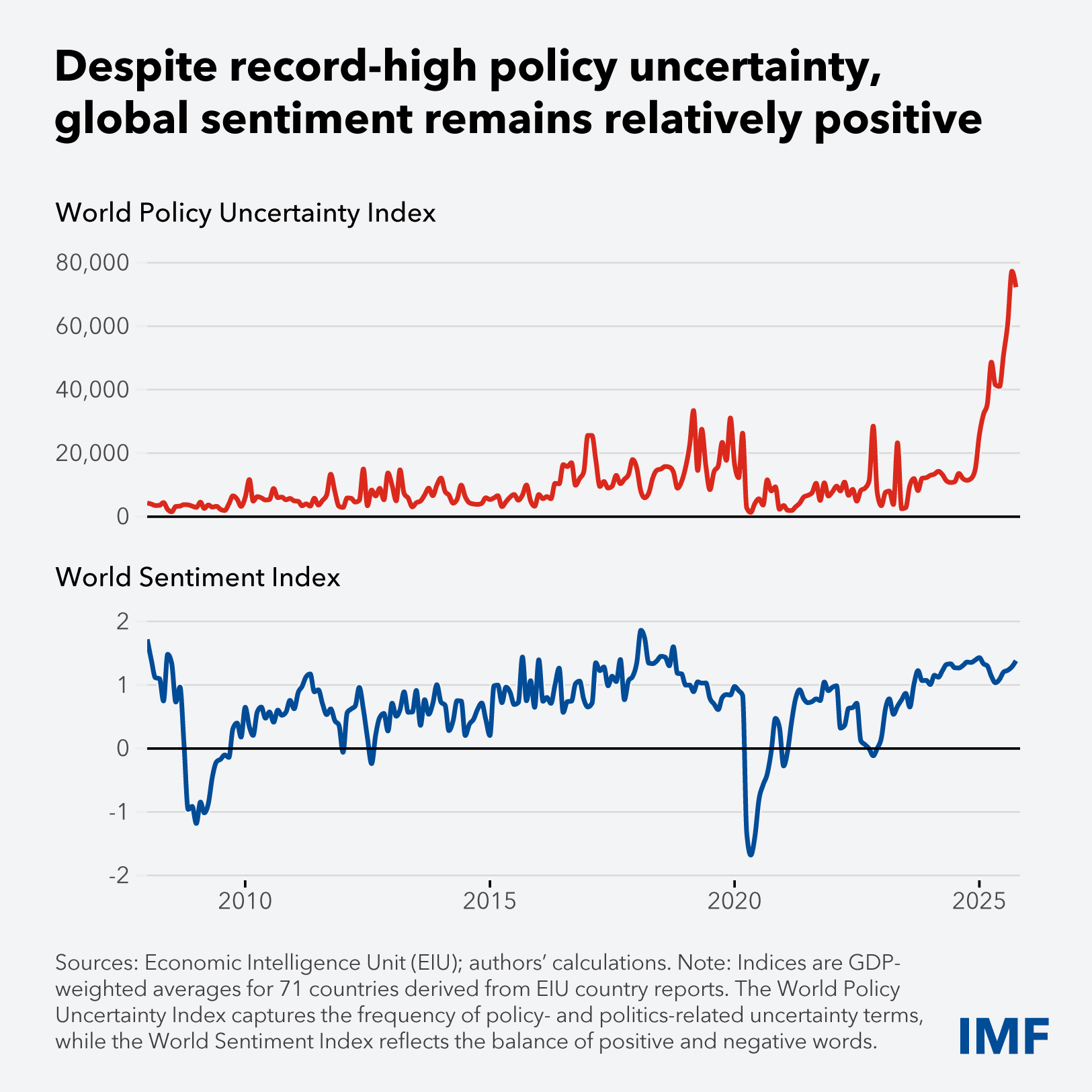

Major policy shifts this year have been adding to unknowns about the future and policy decisions, according to our World Uncertainty Index, which has doubled since January.

Uncertainty has surged to an exceptionally high level globally, and it’s likely here to stay, as the IMF noted during the recent Annual Meetings.

To better understand what causes this and what it reveals, we developed a new subcomponent of that measure, the World Policy Uncertainty Index, which, like its counterpart, is drawn from textual sources. Our new gauge tracks reports by the Economist Intelligence Unit by tallying country-level references to “uncertain,” “uncertainty,” and “uncertainties” in passages related to “policy,” “policymaking,” as well as words related to politics, such as “election,” “government,” and “vote.” It covers 71 advanced countries, emerging markets, and developing economies.

The Chart of the Week shows that a recent record monthly level for policy uncertainty was accompanied by relatively upbeat readings for our World Sentiment Index—echoing recent IMF forecasts that the global economy remains resilient and is slowing only modestly. This resilience can be attributed to improved policies, especially in emerging markets, alongside better business adaptability—but elevated uncertainty may be a new normal.

In addition, despite high uncertainty, beliefs about current and future economic prospects remain positive. Our sentiment index, which tracks the same 71 economies in Economist Intelligence Unit reports, uses word lists developed in a 2016 paper by Herman Stekler and Hilary Symington to assess views of the economic outlook. The approach groups and weights terms ranging from positives, like “solid” and “steady,” to negatives, such as “crisis” and “recession.” Index levels are negative during major global recessions and spikes in uncertainty—such as the global financial crisis and the pandemic. Although the index temporarily dipped earlier this year, it remains positive and above the historical average.

—For more, see “Uncertainty about Uncertainty,” in the September 2025 issue of Finance & Development and a related 2023 blog, “Global Economic Uncertainty Remains Elevated, Weighing on Growth.” The methodology is based on a February 2022 National Bureau of Economic Research working paper. Nicholas Bloom is a professor of economics at Stanford University, and a co-director of the Productivity, Innovation and Entrepreneurship program at the National Bureau of Economic Research.

This article was originally posted here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.