Covid-19 aside, house prices are unquestionably the hottest topic in Australia this summer.

Last week Corelogic, the country’s largest property database, released the definitive figures for Australian house prices in 2021. It was great reading for existing homeowners but depressing for those looking to enter the market.

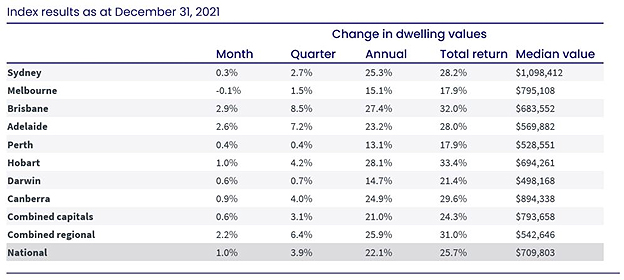

Source: Corelogic

Nationally, house prices rose 22.1% in the 12 months to 31 December 2021. That is a remarkable rise, although it needs to be seen in the context of rises of only 3% in 2020 and 2.3% in 2019, and a fall of 4.8% in 2018.

Unsurprisingly, the gains were not evenly distributed. Affordability, state border controls for Covid-19, the rise of ‘working from home’, interstate migration, rising interest rates, and the lack of international immigrants and students all played a role in widely variable price movements.

Among the major cities, Perth prices rose ‘just’ 13.1% while in Brisbane they were up an impressive 27.4%.

There was a marked difference between the performances in Australia’s two largest cities. Sydney prices were up 25.3% for the year while Melbourne’s rose a more modest 15.1%. Interestingly, those rises occurred despite population declines in both cities, largely due to the collapse of immigration and student arrivals.

Melbourne’s result probably wasn’t helped by its status as the most ‘locked down’ city in the world.

Significantly, for the second year in a row, price growth in regional Australia was stronger than in the capital cities. The outperformance of the regions looks set to continue with their growth in the last quarter of 2021 more than double that enjoyed in the capital cities.

Perhaps the most striking figure in the table above is the result for Melbourne last month – a decline of .1%. And Sydney eked out a monthly gain of just .3%. That raises the crucial question of whether the housing market is now turning.

In many places the ‘fear of missing out’ among would-be buyers is now being replaced by the ‘fear of not getting out’ among potential sellers. Some regions have seen a surge in new listings as vendors seek to take advantage of elevated prices. This has altered the supply and demand dynamic.

According to Corelogic, there is evidence that the rate of growth is now slowing everywhere except Brisbane, Adelaide, and regional Queensland. Tim Lawless, the Research Director of Corelogic, explains that “these regions show less of an affordability challenge relative to the larger capitals, as well as better support for housing demand with Queensland in particular showing strong interstate migration”. (The threat of global warming doesn’t appear to be dulling the appeal of sunny Queensland to Australians from more southern climes.)

In an environment of rising interest rates and stretched affordability, Brisbane’s median value of $683,000 compares very favourably with Sydney’s $1,098,000. And Adelaide’s $570,000 appears a steal at barely half that of the NSW capital.

The availability of funding is an issue for the housing market going forward. Last October, the Australian Prudential Regulation Authority “increased the minimum interest rate buffer it expects banks to use when assessing the serviceability of home loan applications”. This is reducing the scope for bank lending.

A more significant issue for house prices in Sydney and Melbourne is likely to be the speed with which immigrants and foreign students return to Australia. The business sector is constantly hectoring the government to fix the shortage of skilled staff and to keep the population growing. Many in the Liberal/National Coalition are sympathetic to this lobbying. But with a federal election expected in May, many are also conscious of the political implications of two perceived downsides of a major influx of people – health risks during a pandemic and the suppression of domestic wages.

The upcoming election also brings into sharp focus the tension between existing homeowners who oppose any policies that might undermine house prices and would-be first home buyers who want the government to stop rapidly escalating house prices. It seems certain that neither major party will propose tax reform that would dampen the market for investors or owner-occupiers. By contrast, both parties are likely to offer more new incentives and subsidies to first home buyers.

The latter inevitably just increase demand and push up prices further, thereby benefitting all the existing owners and exacerbating the problem. The real solution is to facilitate increased supply not to stoke demand.

What are the experts predicting for Australian house prices in 2022?

Real estate agents say, correctly, that different markets will perform very differently in the year ahead. However, there is a broad consensus that the rate of increase in 2021 cannot be repeated in 2022. That rate is unsustainable because wages growth has been much, much lower and the fear of interest rate rises over the next two years is making buyers more cautious.

The predictions of the major banks should be more accurate than anyone else’s. They have hundreds of billions of dollars at stake in Australia’s property market, and they have in-depth knowledge of what their customers are thinking and planning.

In a research note last November, ANZ predicted “capital city housing prices to rise just over 6% in 2022, and to decline around 4% in 2023”. Its expectation is for Brisbane to be the best performing market, and Adelaide and Perth to be the worst, although the differences are not great.

CBA, Australia’s largest bank and biggest home mortgage lender, also issued a research note on housing last November. It picks “national dwelling prices to peak in late 2022 around 7% higher than end-2021 levels” followed by “an orderly correction in home prices of around -10% in 2023”. Again, Brisbane would be the strongest market.

Disturbingly for those of us who live in Sydney, CBA is suggesting the correction here in 2023 would be -12%.

Westpac provided its predictions last October. It expects price growth “to slow to 8% in 2022” and that “markets will move into the first year of a correction phase in 2023 as official interest rates rise, with prices forecast to retrace by -5%”.

So, a consensus of sorts. A rise in 2022 and a fall in 2023. 6%-8% on the way up; 4%-10% on the way down.

However, Westpac’s “first year of a correction phase” sounds ominous. As if the drop in 2023 might be followed by a further drop in 2024. If so, it will be a shock to those who buy their first home in 2022. ‘Negative equity’ is an ugly concept and not one with which many Australians are familiar.

The reality is that house prices are notoriously difficult to predict. Few forecast the current boom in the middle of the worst pandemic in a century and no one can be sure what will happen next.

Ross Stitt is a freelance writer and tax lawyer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

22 Comments

Are the Australian main banks executing the same degree of borrower scrutiny on potential home loan borrowers in Australia as they are in NZ?

If not, then their house price growth is likely to be stronger than NZ in 2022.

Wow look at that median price table, houses are much cheaper in Oz than NZ.

look at Perth. The most wealthy state in Australia. 47% of Aussies exports and 10-15% of its population.

Young Kiwis are mad hanging around here waiting until they can afford to buy a home. This is unlikely to happen for most and if they do manage to bury themselves in debt for the rest of their lives, they risk loosing all their equity and remain saddled with the debt when and if prices normalize. Just plain stupid and dangerous for them to contemplate the NZ housing market.

I have friends in Perth who say its a really lovely place to live. But it's remote and an expensive flight to go anywhere else.

Back to NZ for sure but $400 return to Bali etc.

I have recent pre-approvals in both countries.

New Zealand banks were willing to lend me 65% more than the Australian banks were. Even with the Australian banks shading 20% for FX uncertainties, what the NZ banks will lend on a rot-box is ridiculous in comparison.

But where is the source of your income? Banks will discount foreign income in their calculations.

Correct. They shaded 20% because my income is currently denominated in NZD.

Just playing with numbers here, but supposing NET income of $130K and expenses of $70K resulting in disposable income of $60K.

If they only consider 80% of your income in Aus due to foreign sourced income then that $130K becomes $104K and disposable income becomes $34K.

So it's no surprise that the NZ bank would offer a 65% bigger loan.

The situation would likely be similar if your income was in AUD then the Aus loans offered would be bigger than the NZ loans offered.

The mindless growth drones have a cunning plan to combat over priced real estate. https://www.afr.com/politics/australia-needs-explosive-surge-of-2-milli…

Trying to expand the size of the cake by bringing more mouths to the table.

Do they include stupidity training or turn off your brain courses when becoming a govt advisor these days?

Must surely be sociopathy at higher levels driving such thinking. It seems to matter little what's left to the young and the new to the country, as long as higher house prices and lower wages are maintained.

"... who oppose any policies that might undermine house prices and would-be first home buyers who want the government to stop rapidly escalating house prices"

Anyone see the nonsense?

The policies in place are promoting house price rises.

No policies are required to undermine house prices. Just take off those that promote.

The BS narrative continues.

It will continue to grow.

Demand is strong over there and is unlikely to abate in any meaningful way for years to come.

You can try buying some of theirs to diversify geographically.

Unless you are an Australian citizen you will be stung with an 8% foreign buyer stamp duty charge without being physically present in Australia.

Plus stamp duty adds many, many thousands to the buyer.

Those median prices look like a dream compared to here. Not long until we have a nationwide median house price that exceeds that of metropolitan Sydney. But it's totally not a bubble right guys?

Southeast Queensland currently provides relatively good value for money and lifestyle. But many people are migrating there with remote working now being widespread and lots of infrastructure upgrades coming for the Olympics.

Yes when covid finally eases there will be a flood of young kiwis off to Oz where they have a chance at a house.

I have friends in central Melbourne who are paying ~$400 per week for a large 2-br apartment while enjoying higher salaries than they had in NZ and lower other living costs. Even renting it makes a whole lot of sense for young NZers. Then there's the whole ability to buy a home...

No need to wait for an easing. My daughter and her family sold up in NZ and moved to Brisbane 2 months ago. They flew to Sydney, did 10 days self-managed isolation in a hotel, then took a family holiday trip for a week sightseeing as they drove up the coast from Sydney to Brisbane.

He had better career prospects and immediately higher income to go to, along with subsidised rental housing provided while they buy their own place. She got the first job she applied for on "Good pay for what the job entails".

It seems that the opportunities are there for the taking?

Sounds similar to NZ?

More human imports to keep the property and construction sector afloat, profits up and wages down?

"A more significant issue for house prices in Sydney and Melbourne is likely to be the speed with which immigrants and foreign students return to Australia. The business sector is constantly hectoring the government to fix the shortage of skilled staff and to keep the population growing...many are also conscious of the political implications of two perceived downsides of a major influx of people – health risks during a pandemic and the suppression of domestic wages."

Sounds similar to NZ?

More human imports to keep the property and construction sector afloat, profits up and wages down?

The real difference is there's just such a large amount more land available for housing in Australia. You can get a section in a non popular area for 30k, in NZ that would barely cover your reserve contribution.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.