This article was supplied by Quotable Value. The full version is here.

A remarkable year for New Zealand’s residential property market has come to an unremarkable end, with a flood of new listings helping to dampen home value growth but also failing to stop it altogether.

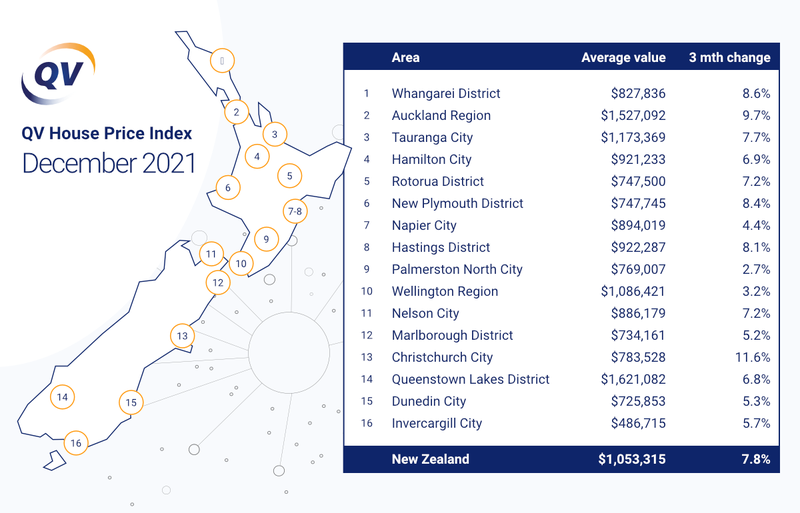

The average home increased in value by 7.8% nationally over the past three-month period to the end of December, up from the 6.9% quarterly growth we saw in November, with the national average value now sitting at $1,053,315. This represents an average annual increase of 28.4% for 2021.

In the Auckland region, the average value now sits at $1,527,092, climbing 9.7% over the last three-month period, with annual growth of 29.1%, increasing from the 27.9% we reported in November.

QV Operations Manager Paul McCorry commented: “It is fair to say that 2021 was a pretty unusual year for the property market. Never in recent times have we had so much external intervention in a housing market and yet, in the midst of a global pandemic, the market grew by a record 28.4% nationally.

“It became pretty clear towards the end of the year that this level of growth was not going to continue indefinitely as we started to see a decline in the quarterly rate of growth.”

Last month, we reported that three quarters of the major urban areas we monitor were still seeing an increase in the rate of quarterly growth. This time around, half are now showing a decline. “To be clear, they are all still seeing values go up – but at a much slower pace,” Mr McCorry added. “Of the other half that are still showing an increase in the rate of growth, five have increased by less than 1%. The market has definitely pumped the brakes, but it hasn’t ground to a halt completely.”

He said Christchurch City was the obvious winner of the unwanted ‘biggest increase’ title in 2021. The Garden City saw values lift a staggering 40.2% year on year, “a symptom of a market a little earlier in the growth cycle, where relatively speaking things were a little more affordable”. In real terms, that means in January 2021 the average Christchurch house price was around $560,000; today it is $785,000. Whilst the rate of growth has slipped a little this quarter, it is still in the double digits over a three-month period at 11.6%.

“Aucklanders have been doing the hard yards for the rest of Aotearoa throughout 2021, moving through the various lockdowns and traffic lights. After over 100 days in lockdown it is no surprise to see the Super City catching the wave of a now internationally recognised trend – a post lockdown boost to the property market, up 9.7% over the quarter. A prolonged period at home and now a relaxing of these restrictions will have people taking stock of their living arrangements.”

At every summer barbeque the conversation will have inevitably turned to what the market will do in 2022, but Mr McCorry said predictions can be fraught with danger. “Following the March 2020 lockdowns, doom and gloom was rife with predictions of a market correction. Yet since March 2020 values nationally have increased almost 41%. So what do the next 12 months have in store? Inflation and the interaction with interest rates will be key,” he said.

The Reserve Bank of New Zealand measures the average increase in the cost of goods and services and aims to keep that rate of price inflation between 1-3%. The third quarter result was 4.9% – so considerably higher than expected.

“The most likely lever to reduce this rate going forward is to increase the Official Cash Rate (OCR), which in turn increases interest rates banks will offer to prospective homeowners. We saw successive increases in the OCR in October and November, and it is no surprise that this was when we started to see the tide turn a little in the rate of growth,” said Mr McCorry.

“At this point in time, despite these increases, interest rates are still considered low by historic standards and this has most likely prevented the market being absolutely stuck in the mud. But any more increases could start to make both banks and their borrowers feel pretty nervous. More rigorous lending criteria that came into effect in December will also have banks really scrutinising every application.”

Meanwhile, in recent months we have seen quite a flood of listings to the market, mainly as people tend to hold off putting their home up for sale until the good weather. With increased listings, buyers have more choice.

“They won’t attend every open home and you won’t get as many multi-offer situations. The chatter about properties being handed in at auction is real, as is property sitting on the market beyond the initial tender period – often re-listed with an asking price. Managing vendor expectations coming out of 2021 and into 2022 will be a very advantageous skill set for an agent,” Mr McCorry added.

“If we had to draw a line in the sand, you could reasonably expect values growing in the smaller single digits towards the middle of the year and potentially remaining stable throughout winter, but 12 months is a very long time in a property market and realistic pricing and realistic vendors will prevail in 2022.”

46 Comments

"The chatter about properties being handed in at auction is real"

Oh for god sake, can any article say it as it is, without sugar-coating the current situation.

If the banks have stopped lending money then it’s becoming quite hard for most buyers to buy a house.

Credit squeeze, like what happened during the GFC, is the only truly effective way of slowing things down. But it's a numbers game, those still being financially qualified back up the truck.

Bit early for the trucks yet though. In many countries in the GFC, the time to back up the truck was after the 20-50% fall in price.

https://www.patreon.com/posts/new-liberals-61077693

Australian new liberal housing policy is interesting in that regard.

“It became pretty clear towards the end of the year that this level of growth was not going to continue indefinitely as we started to see a decline in the quarterly rate of growth... with increased listings, buyers have more choice.”

Failing to adjust for seasons and discriminate between discrete and continuous derivatives is the bane of every soothsayer.

A slowing of turnover numbers doesn't imply an impending price change pressure unless we're selling canned tunas.

Its going to be a tough 'ol year for real estate agents I think (bless their souls - if they have any). Volumes are going to fall off a cliff...

Hopefully they've some of the wage subsidies left that they stole last year to see them through.

All those hard conversations with the vendors having to explain why their original estimate was $200k higher than what is being offered.

They may have to trade in their new Audis, for last years models again.

Well THE MAN 2 was totally right about Christchurch. He got a lot of flak here in the comments section but I thought his advice was sound and indeed it was:

He didn't get flak for asserting that Christchurch was relative value for money. He got flak for his undesirable personality traits.

I got the impression that he wanted to help people increase their wealth and he was astonished and exasperated when people had such a bad reaction to his advice. He couldn't quite get his head around that.

You're spot on Zach, but many hate others being successful, they will rather argue than learn

I wouldn't put the MAN 2 on a pedestal just yet. Don't forget for a long time Christchurch just stagnated. - no one wanted to touch Christchurch - too risky with earthquakes and changes to planning which made residential development so much easier. When the rest of the country became unaffordable - even Christchurch gets a look in by people wanting to speculate , I mean "invest" .

Boss, After 30% gain annually, 3% to 5% rise per month or 7% to 10% rise every three month is huge.

Average Person who does not know swimming may survive if water rises from 1 feet to 2 feet to 4 feet to 5 feet but than every inch could be fatal and cannot justify that after rising in feet it is just an inch.

Government depends on so called experts and this so called experts depending upon what narrative they want to project, manipulate and government too follows them blindly as it suits their purpose.

It is very difficult to argue these days that we are not in a very substantial economic bubble.

Deep into the 'Critical Stage'.

Hastings District overtakes both Napier and Hamilton Cities for 5th spot. Average and upper quartile have doubled in 4 years, lower quartile up nearly 2.5x. Homes.co.nz about a month away from "valuing" at least one residential property in Flaxmere in the $1M range.

My unease is growing.

Edit: I've also just noticed homes.co.nz has added a "ranking" for homes in some areas: "HomesEstimate rank in [suburb], #[rank] of [count]", with a helpful "Check out the #1 home" link. Housing is now a sport. SMH.

I wonder if any of those new buyers in Christchurch have ever heard of liquefaction?

The era of cheap money is clearly ending. Unfortunately it seems political and reserve bank ineptitude has left New Zealand extremely vulnerable to changing economic conditions.

Let's be real. Last year was abnormal everything, especially with respect to lending speculative or otherwise. The big markets (China and US) are all signaling an increased cost of debt and more rules to curb speculative lending in their markets. We are already doing so with more to come.

My 5c is the karrrrrk moment is very close.

We can't really say that yet. Central banks may yet choose to destroy living standards with continuing high inflation rather than let nominal asset values fall.

Yeah I wouldn't put it by them. Majority of kiwis don't even know why house prices have increased so significantly or why inflation is increasing.

Yeah on balance I think they will continue to sacrifice confidence in currency to keep asset prices up - probably still years to play out.

I just hope I have enough popcorn stacked up to last until the Great Unravelling. Luckily it keeps for like 300 years.

Perhaps Lab/Grn could win the third term with the promise of an asset reset back to "normal" income levels. Let's face it debt stackers and bankers are never going to vote that side. Aka nothing to loose and all to gain.

One should look at the portfolio changes of left leaning Govt types going into the election...

We already know what Jacindas promises are worth.

She should find some courage and do a John Key, breaking her promise on tax. Put CGT in.

In Australia, cash out home equity withdrawals are now accounting for 4.6% of GDP each year.

https://www.afr.com/property/residential/borrowers-use-home-equity-as-b…

With an RBA Cash Rate Target locked at 0.10%, no chance of saving for essential expenditure. So house insurance, rates, etc liabilities have to be financed by adding to the mortgage liability. Just one of the realities of a government rate repression policy largely focused on supporting the outsized FIRE sector.

For goodness sake "realistic pricing and realistic vendors will prevail" has prevailed in the New Zealand property market since about 1,300 AD - hardly a prediction????

Clearly Homes.co.nz did not get the memo, house prices updated today and yet another $40k in a single month. Tauranga City Council are scrambling for excuses why the new RV's have not been released before Christmas and have now stated they will be out in February. Its like playing pin the tail on the donkey....with a live donkey.

I just had a look at that website for the first time, I reckon it's bollocks.

It says my townhouse is $1.17 million. I bought it for 750K just over two years ago, and I reckon it could be 950K now, but $1.17 million no way.

Also, what doesn't make sense, is one of the other townhouses opposite us, basically identical to ours (same design, land area etc), spits out a value of $850K!!!

What's the logic in that!

Homes undervalued my house by around 80k 2 years ago. But I agree with your main point: looking at my old neighbours' houses they were overvalued, not undervalued.

Algorithms eh?

Works out about right for property down here. Its also "Smart" enough to update the price to what it actually sold for last time. The RV and homes estimate on mine was low on purchase so it took quite a jump later on. Its an estimate so on the likes of units its going to be out but that also applies to a more unique property with say a decent view and only 2 neighbors. It all comes down to what you personally put value in, for me the view was worth $100K its almost priceless.

Are you on the high side of the street?

There's an excellent article in NZ Herald tonight (behind 'Premium' paywall) on an international consultancy, Capital Economics' forecasts. Far more logical and sophisticated than anything spewed out by most local economists.

They see the OCR peaking at 2% by end of this year (higher than I think), and that house prices will drop around 10% from peak by mid 2023 (I think it will be 5-10%). Along with falling house prices, consumption will slump as will economic growth. In response, the OCR will be cut in 2023.

The only real difference from my view is that I don't think the OCR will go to 2% ( I think it will peak at 1.5-1.75%), and that I think the OCR will start to be cut late by around October / November this year, rather than next year.

Sounds pretty benign to me, which is probably why Granny Herald ran with it.

Inflation in the USA just hit 7% in December, thats a 40 year high. Good luck with those low OCR figures, the shocks are coming and coming soon.

Well, the argument is likely that central banks will choose to ignore inflation's effect on the poor, the savers, the wage earners, and simply prioritise asset values. And nothing will be done about it.

https://www.patreon.com/posts/new-liberals-61077693

Steve Keen from Australia's new liberal party has developed this housing policy outlining what he believes needs to be done to stop the insanity.

Interesting. Compel house prices to fall while protecting equity. A summary:

monetary reset:

- Give every Australian adult an identical sum of government-created money;

- Require those who had debt to use that money to pay down their debt;

- Sell Treasury Bonds to banks, precisely as is currently done in deficit financing; and

- Require individuals with less debt than the amount issued to purchase Treasury Bonds from banks, from which they will earn interest income;

- This would not create any additional money and put inflationary pressure on the economy, but rather, it would change the asset backing the money from private debt, to reserves and government bonds;

Property Income Limited Leverage

We will introduce a law limiting the maximum amount that can be lent to buy a house to a multiple of its rental income. Initially this will start near the current ratio, but the ratio will be progressively reduced until the maximum amount that can be borrowed to buy a property will be ten times its annual rental income. So if a house would rent for $1000 a week, the most that could be borrowed to buy it, by anyone, would be $520,000.

Interesting. Ultimatley its all about limiting debt to reasonable income support. Something everyone seems to have lost the plot on. Kinda like it, though i would still like the risk takers to be responsible for the risk, vs a Govt bond market bail out.

Ideally yes. However, if something like what Keen is advocating doesn't happen, it's difficult to see social cohesiveness, and improved living standards for the many, moving in a positive direction.

It does smack of MMT thought, although inflation and taxes aren't mentioned. Still, it has some similarities with Michael Reddell's solution which was to take action and compensate the losers, which I thought was an equitable one.

MMT is what we already do, what exactly do you think QE is.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.