The number of homes available for sale has almost doubled over the last 12 months, and asking prices are tumbling.

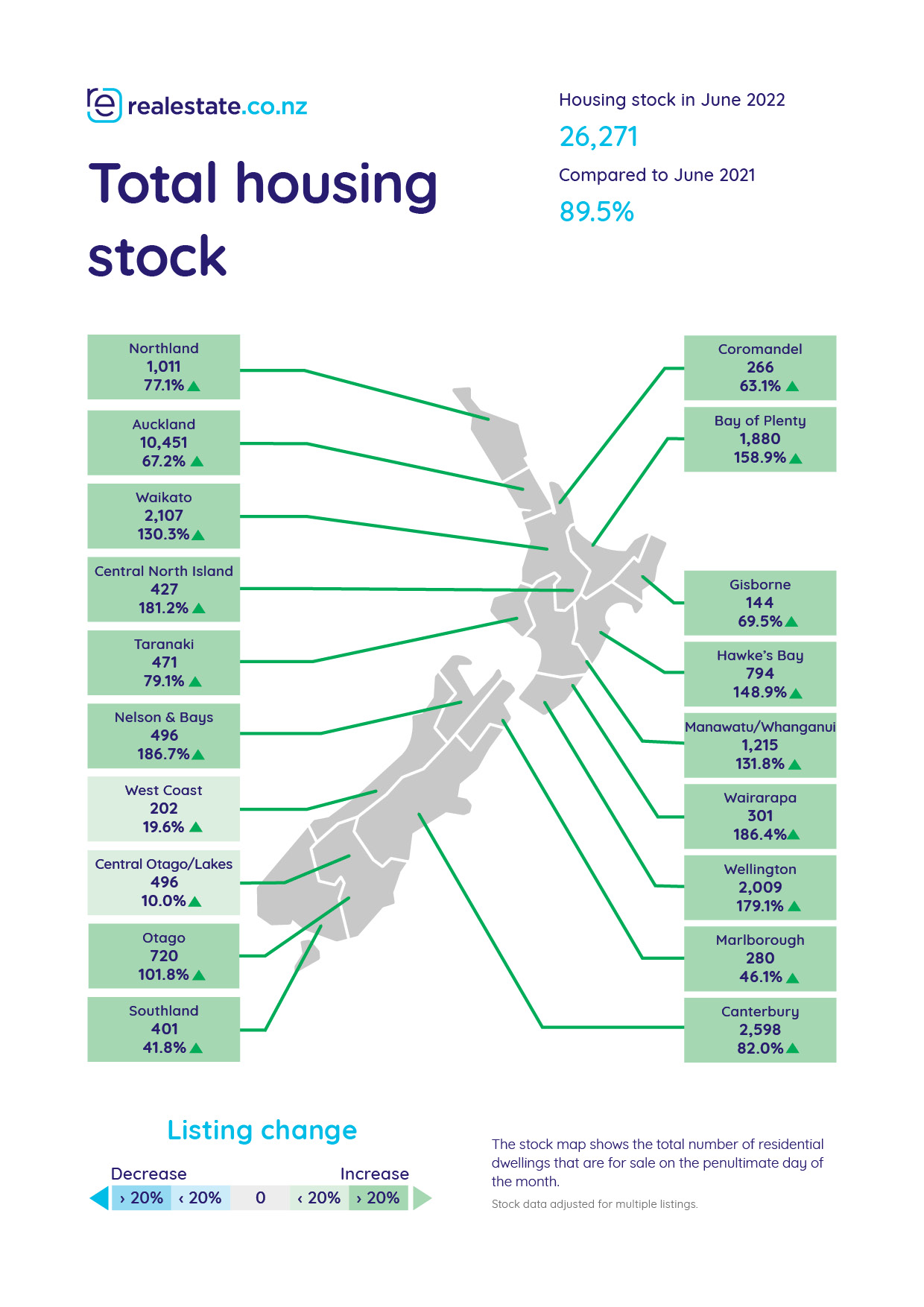

Property website Realestate.co.nz had 26,271 homes available for sale at the end of June this year compared to 13,861 at the end of June last year, an increase of 89.5%.

The number of homes available for sales was up strongly throughout the country, with the biggest annual increases in Wairarapa +186.4%, Nelson-Bays +186.7%, Central North Island +181.2%, Wellington + 179.1% and Bay of Plenty +158.9%.

The smallest increases in stock levels were in Central Otago/Lakes +10.0%, West Coast +19.6% and Southland +41.8%.

The chart below shows the annual changes in the number of homes available for sale in all regions.

The latest figures also suggest that vendors are recognising that buyers now have more choice, and are adjusting their price expectations downwards.

The average (non-seasonally adjusted) asking price of properties available for sale on Realestate.co.nz at the end of June was $922,432, down by $72,553 (-7.2%) compared to its peak of $994,885 in January this year.

In Auckland the average asking declined from its January peak of $1,279,330 to $1,167,121 at the end of June, a drop of $112,209 (-8.8%), while in the Wellington region the average asking price dropped from its January peak of $1,013,206 to $934,657 in June, a drop of $78,549 (-7.8%).

Average asking prices are now declining in all of the main urban regions and Waikato, Bay of Plenty and Wellington have dropped out of the million dollar club and no longer have average asking prices above $1 million.

The only regions where average asking prices remain above $1 million are Auckland, Coromandel and Central Otago/Lakes, and average asking prices are also declining in all of those regions.

Realestate.co.nz's June report said the Auckland and Wellington regions had remained buyer's markets for third and fourth consecutive months respectively, signaling that the slowdown in the rate of sales in those regions might be here to stay.

And the gap between the current rate of sales and the long term average was also starting to close in the Waikato, Nelson-Bays and Otago, suggesting they may be close to tipping into a buyer's market as well, the report said.

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

157 Comments

Faster than Ireland?

Yes, faster than Ireland… twice as fast in fact

Ireland fell -7.1% in first year after peak

NZ in 1980 fell -9.2% in first year after peak then so we’re looking good to go beyond that

https://en.wikipedia.org/wiki/Housing_bubble

FHB’s need to realise you don’t need to try and pick the bottom of the market… you know you’re there when the falls have stopped and prices have stagnated and stabilised.

It’s going to be a buyers market for a long time after the crash is over as the mentality becomes prices will never rise again

Indeed but even in Ireland they bottomed in 2013 and almost doubled since....... looking soft here as well

Inflation adjusted Indexs in ire I don't think have fully recovered from previous peak.

Given that the previous market upswing endured for 4-5 years (and that house prices increased by around 70 percent through this period) a cooling off of the market was inevitable. After all, housing markets are cyclical.

But, sorry folks, house prices have dropped to nowhere near the level that they were 4-5 years ago. The market is undergoing a correction - not a crash.

Yet again, the DGM will be disturbed and dismayed at the resilience of the NZ housing market. 😲

TTP

Interested in where you see the market bottoming out TTP. Instead of constructive posts, majority of these comments are anecdotal and at times sales pitches. What’s your prediction and what are you basing it on?

That’s expecting far too much of TTP. His specialty is throwing out very broad, cliched statements

You must have a good crystal ball TTP, given that we are in the middle of the cyclical downturn, calling it a correction rather than a crash. How many more months of price declines before it's officially >20% and a crash? Not many now...

I don't see a crash either however we are fast approaching a critical intersection with rising rates so it's really in the hands of the RBNZ now. Quit raising rates now to stabilise the market or keep raising rates because that's pretty much guaranteed to cause a crash.

I can’t imagine they’ll backtrack on increasing the OCR. Stranger things have happened, but it’s pretty clear the last priority at RBNZ is housing

Yes, they are totally blasé about housing prices. You know Shaggy's song "it wasn't me"?

Sending housing prices through the roof with OCR at 0.25%? "Wasn't me."

Crashing the housing market and the whole of NZ's economy into a great depression with consecutive double-shot OCR hikes to 2.00%? "Wasn't me."

And that’s where I was wrong. I didn’t think the RBNZ would hike rates that high, because their behaviour for god knows how long has been to avoid crashing the housing market. This time crashing the housing markets seems secondary to addressing inflation. However I still think there will come a point where the property market slump will cause them to pause the hikes, and likely start to reverse them…And I am picking OCR cuts by May 2023.

For my next gig I am asking 10% increase on my current salary.

It would be illogic for anybody to do otherwise.

As long as we are in "full-employment" mode ocr will just go up.

High skilled jobs are easy to be done remotely, and we speak english, so well... there is a big market out there

Not raising OCR will devalue NZD too, so being paid in USD will be even more acctractive.

That cover high paid peps, the ones with actual discretionary spending, the ones that can deal with inflation.

Lower paid people will need to be helped via govt spending and taxes, which again drives inflation up.

so no... I don't see OCR going to be cut anytime soon (it would be suicidal)

You're underselling yourself if you're asking for only 10% increase with almost that in inflation atm. I changed jobs recently and walked into 20% more for doing the same thing (software) and the new employer didn't even blink.

bravo! :D

I promise you that I am not at all underselling (I am talking money + something very close to unlimited time off policy)

But yes, that is my point. We have full employment, and that will last for a while.

Whenever people bark about losing ks of jobs because of higher ocr I feel they don't get how skills are (and always will be) the safest investment option

It is great to hear that you are soooo skilled. However, maybe it is you who doesn't get something here. Remember Weimar 1931? Economies in free-fall tend to send oh so highly skilled to the streets.

We have full employment and that will last for a while? Not if further OCR hikes trigger economic collapse.

I do wonder if the RBNZ will come to their senses at last. At the moment, it does not look like it.

Yes, you can always ask for a pay rise. Just like landlords can always just increase the rent. It is that simple, right? Wait.... Duh....

If you think further OCR rate hikes will help fight inflation and consequently help you, I think you are wrong. Further OCR hikes will cause a great depression, so you may not have any job to ask pay rises for, high skilled or not. You may not see this now, but this is the problem of limited economic foresight.

Your theory is about to be tested HM. I still think they will pause the rises the reason being all we are getting so far is softly softly rises as they see what effect it has on housing. Probably no need for drops next year if it's a soft landing.

I agree with you on all points, but reversing the OCR hikes in 2023 would be too late. By that time, we would already have a viable banking crisis.

The other thing, by the way, is INZ. I understand there are 200,000 unfinished residence visa applications. When are INZ going to complete those? How long will this drag on?

There are open mic spots on wednesday nights in the comedy cellar at 7pm of you want to potentially turn this into a career.

The average asking price of homes in Auckland is down $112,209 since TTP last said the market was resilient.

1000s of people are having sleepless nights fretting about how they will keep the lights on and feed their kids because parasites in the Real Estate industry told them housing was a one-way bet to wealth and security…. all for their own revenue and commission… when they all knew internally the market had turned downwards.

It will all come out in the wash - when this is over there will be a Royal Commission Inquiry into how it was allowed to happen.

It will be the easiest thing the ruling govt of the time can do to shift any blame.

Saw a listing today - sold in 2021 for $1.7m - relisted today for $1.5m and I suspect it will struggle to get anywhere near that. All I can think is I hope it's not a young family.

You hope this one listing is not a young family (first home buyers) but one of these greedy investors that have been called names here on this forum?

Well, emotional hoping, be that as it may.

The reality is, a collapse of the housing market would affect both first home buyers and investors.

They were literally invited to buy when the Reserve Bank had interest rates at 0.25% and lending restrictions for low equity were removed.

Now, they are in a liquidity trap. The Reserve Bank has literally trapped them by setting the OCR almost ten times higher, to 2.00%. Low or negative equity on their 20% or less deposit, high and rising mortgage cost on their 80% or higher debt portion.

Well done, Reserve Bank, for literally trapping people up. Some conspiracy theorists say this was a deliberate act, part of the Great Reset.

I too hope it's greedy investors that get burnt.

How on earth would a young family ever have been able to afford a $1.7 million house? They must have both been on extremely high salaries.

🤡

Here is some median multiple data for Ireland:

2007:

Cork 4.7

Dublin City/County 5.4

Dublin Exurbs 5.0

Galway 4.6

Limerick 3.5

Waterford 4.1

2008:

Cork 5.4

Dublin 6.0

Galway 5.6

Limerick 4.3

Waterford 4.9

2009:

Cork 3.6

Dublin 4.7

Galway 3.2

Limerick 4.2

Waterford 3.7

So let's get real. Percentages don't tell the whole story. Auckland's median multiple has been around and above 10 for a couple of years or more; several other cities are around or above 6. NZ's bubble is so much worse than Ireland in the 2000's, it is far too optimistic to presume our crash will be less painful. Yes, Ireland has "rebounded" since but the story is the same everywhere; it is a new "normal" only in the sense of housing being like a cancer on the macroeconomy., distorting investments away from productive investments, suppressing productivity, and requiring something like "chemo" from the Central Bank, which affects the real productive sector much like Chemo affects normal healthy tissue in the process of hopefully killing the cancer. Housing bubbles are not as easy to kill with monetary policy as cancer is to kill with chemo, the analogy is too kind if anything.

To date, yes, NZ house prices are crashing far faster than any recent housing bubble

yet all we hear from “property experts” is that it’s a soft landing

Please keep updating this!

Miguel - put it on steroids and make it look even more beautiful

The sooner the crash is over and done the better we will be as an economy without property as a get rich quick scheme

"Resilient is a term you hear a lot when discussing the New Zealand housing market"

- LCC

sounds like something TTP would say

"sounds like something TTP would say"

That's not something I would say......

It's something I DO say.

TTP

Rents down too ...?

https://www.stuff.co.nz/life-style/homed/renting/129128857/wake-up-land…

Wake up landlords, the rental market has changed, property managers say

exceprt:

Rental properties are sitting vacant because new tenants are hard to find, and landlords need to recognise it is now a “tenant’s market”, property managers are warning.

There are more properties listed for rent nationwide than ever before, and the national median weekly rent fell for the first time this year, Trade Me’s latest figures show.

In the Auckland and Wellington regions there were huge increases in supply last month, with their rental stock up 16% and 45% respectively from the same time last year.

Auckland property manager Tina Dunsmuir, from Professionals Onehunga, said there were so many available rental listings, her firm was struggling to rent properties, and it had become a “tenant’s market”.

A good news story for younger generations of Kiwis. Be good if it continues for a lot longer.

Absolutely. Empty rentals and falling rents could allow for an acceleration of deposit savings in the short term, and mid to long term the potential for FHB to lowball a landlord like we did as a FHB in 2017.

We were looking last night, and the vast majority of the currently available rental stock are, quite frankly, !@#$. Perhaps a cheaply renovated kitchen, but the rest of the house showing its 60s/70s heritage.

There are a handful of nicer ones, but they're listed a good 20% more than the equivalent a year ago - and at $1000+ for a 4 bedroom, not worth what they're asking.

Sadly, the suburb we're most interested in lost almost 30% of its listings on Tuesday - but I think that coincides with those properties being listed for sale.

We're in a nice, slightly over-priced house, so are happy to wait for something decent.

That's asking price also - in reality, they are probably getting 5-10% less than asking.

It's interesting because the article on the AM Show talked about the market stabilising and the article on Stuff has a different take (presumably reporting on the same data), for example:

“That means that although these regions are not buyers’ markets yet, they are showing signs of tipping.

But prices either rose slightly or remained flat in most of the other regions, except for Taranaki and Southland, where they were up by 10.7% to $732,684 and 12.5% to $553,997.

Wellington prices were unchanged with an average of $975,548, while the national average was down 1.0% to $961,512."

I suppose people take from the data what they want to see.

I suppose people take from the data what they want to see.

How they interpret the data is based on who's paying the bills...

Not hilarious if you trusted what they said and bought end of last year or start of this.

Don’t trust Stuff or any of these property industry economy experts that they wheel in for a vested opinion

CoreLogic chief property economist Kelvin Davidson, 31st Oct 2021 - 8 months ago:

'It does not mean prices will fall, but price growth will slow to single digits, probably to around five per cent, he says. “More listings could come on to the market, but with people generally feeling higher mortgage rates, next year will be a more subdued market"

https://www.stuff.co.nz/life-style/homed/real-estate/126698914/yes-the-…

If you want to know what’s happening in any market you need to get out on the street corner of it - so go to auctions, open homes etc with your eyes and ears open, and filter the BS

Talk to friends you trust that are trying to buy or sell etc

You very easily get a feel for where the market is at

I'd trust them just as much as articles on Opes Partners website - where you seek your info DDDDebt.

A sentence from Opes' newsletter yesterday:

You see, chasing yield doesn’t make you wealthy. Property going up in value makes you wealthy.

True, but seems like an odd sentiment to lead the newsletter with at a time like this. Also perhaps a tacit acknowledgement of how rife has been tax evasion in New Zealand over the last few decades of buying and selling for capital gains while pretending not to.

Did you see this one from them:

https://www.instagram.com/p/CfayhgZl0oj/?igshid=YmMyMTA2M2Y=

7 strategies to manage your property investment cashflow: (which of course is negative and bleeding you)

No.6 is my personal favourite: Charge board to your kids

Seriously, this is now a comedy

I can’t wait until someone writes the textbook they’ll teach in Economics 101 about the mess that was created in this country

Phew, that's really rather taking "live it up by passing the bill to the younger generations" to another level again.

Even the addition of the little "evil devil" emoji on the end of the title.

Opes historical graphs will show you how prices will stagnate for a very long period… once they finally stop falling

Need to make use of this data while it's still available... I'm picking that Opes will go the same way as Propeller and all the others that will disintegrate in the cycle once people work out that residential investment property doesn't stack up without capital gains

Funny ey, Stuff portray a woke veneer of caring about all sorts of things including housing, but underneath it all they are rapacious capitalists

I wonder what media outlet is paying his invoice

He's another very limited Economist.

They're using the average price, which can be heavily skewed. E.g. All house prices could in theory drop 10%, but if the lower quartiles aren't selling then the average could remain unchanged.

Median HPI from REINZ would provide a more accurate measure.

The am show ..?

😂😂

Remember they are talking to an audience that believes house prices will double every 10 year, forever into the future...

I could say it is lazy reporting. But it does allow many more generalized articles to be written that then generate a lot more comments as we try to interpret the info.

And let's face it, once you have taken the clink bait, then you can almost go straight to the comments section without reading the article to get, if not the real answer, at least a more balanced 'chip on both shoulders' approach.

Asking Price is not equal to Sales Price at present and they like to focus on Asking Price to obfuscate the reality of current Sales Prices.

It's transitory of course.

What I find interesting is not just that stock is way up (and it's way up), but the usual drop going into winter isn't happening so far. Could be a very interesting next few months if there's still huge stock on the market when the spring listings start up.

Stock may be way up, but where does it sit against historical numbers? Could it just be a reversion to mean after really low stock last year?

I've got data for the last 5 years. 6 months ago we were at 5-year-lows (seasonally adjusted). Now we're at 5 year highs (seasonally adjusted). So while last year was very low, and the year-on-year numbers reflect that, there's still a lot out there by broader measures.

Same with the drops. In most years, stock has dropped significantly during June (lockdown 2020 being the exception). This year it's just flat.

Thanks for sharing - interesting stuff for those us too lazy to seek out the data ourselves.

While the article says 'Houses for sale.' Are they existing houses, or houses under construction, or off-the-plan developments?

For example this one : https://www.trademe.co.nz/a/property/residential/sale/auckland/auckland…

If you look at the Thumbnail you think it is an existing property for sale, but click on it and it opens up and says that it is under construction.

There are a heap of developments like this that will be S*%$$%@) their pants to find the last of the true naive believers ie property only ever goes up, to clear the book before the inevitable.

The developer banks will be encouraging this as it's always easier to get their money from a lot of smaller purchasers who have bought the plan, than it is from one bust developer.

The only problem of course is, that while every Bank will want you to buy from the developer they have lent money to, the banks themselves will not lend to you as the homeowner to buy into that development or one like it unless you can put down a huge deposit and can afford to pay a mortgage on a property that will be less in value after you have bought it.

They must be selling Circus Circus cafe and Goodhome Gastro Pub.

If not, I wonder if they have permission to use photos of the companies establishments/branding to help drive sales of their product?

Plenty of people preparing to pack it in on the Facebook property investor pages…

so I would suspect we are going to see plenty more houses added still

Great news, the more the merrier. Bit ironic isn’t it, if they pack it in en masse it will accelerate the slump!!!

But where will people live if Landlords sell up? The pool of rentals will shrink as Landlords exit the market, dismantle their properties and sell the building materials to salvage companies.

well duh you have to have dropped this \s because...

In the heavily reduced priced houses and units the landlords are selling because they can now afford to buy instead of rent.

But rentals have a higher occupancy rate than owner occupied properties. For every rental that becomes owner occupied, 4/5ths of a person becomes homeless.

/sarc.

The hilarious part is when Tony Alexander constantly repeats the "No more than 15% drop" line. Like where is your source or evidence for that? What Source? Remember when it was only 5%?

These public 'economists' would better predict the fall if they read the innards of a Hare slaughtered at midday and devoted its remains to the stock market gods than relying on the title "expert" and social engineering via media.

Before that it was small gains

Yes as recently as January he was picking +5% for 2022…

TA never wanted to talk about Negitive Equity on the Oneroof property hour, but hey presto here it is.......

TA like many others are just snake oil salesmen, doing their best to line their own pockets. The more distrusting we become of people like him and the more people get out and do their own research the better.

Mike Hosking rates him...

Sign up to T Alexander's "Tview" and you will see his sources

I was once a ghost writer for one of TA's columns, many years ago. Content appeared unchanged and unattributed, though with permission. Claim to anonymous fame.

Why sign up to a newsletter from an economist who has clearly lost the plot in terms of objective analysis? He’s so beholden to his property audience. Even though I personally can’t stand the guy ( extremely obnoxious a few years back on FHBs and smashed avocados) I think he was capable of some quite good analysis at times.

I guess if you are in RE or are an investor he provides you with plenty of confirmation bias ammo…nice bit of morale boosting spruikerism

Like the band on the Titanic. Kept everyone in a good mood while plain sailing, and continued to play to keep people calm while the lifeboats were being loaded.

One could be forgiven into thinking the picture in this article, the house in the water is the iceberg that our economy is heading for.

Most of TA's analyses are based on surveys of investors and brokers.

Best interpreted as what is the state of mind of the survey participants -- (too) slowly adjusting to the reality of what comes next.

Of no value as an actual and rational prediction.

As soon as possible Inflation between 1-3 years my pick) interest rates will be cut down again to push back up any losses and then add mass inflow migration to fill any empty homes and before you even blink we will be back to under supply.

Maybe Labour will copy Australia and give first home buyers 25 to 40k towards first homes to slow the brain drain to Australia before the election.

Also look at new build costs if prices drop much more we will see zero new builds and that is why housing will only drop so far.

Also think about next black swan I think interest rates will go negative to stop mass debt defaults etc.

For now housing under some pressure but long term inflation will put a floor one way or another.

If we do, surely given the role of globalisation-driven low inflation through the likes of cheaper goods and electronics and tailored will be seen as farcical, and central bank policy as more about constant stimulus for assets through perpetual emergency rates...

There are still many people assuming rate hikes will be reversed, or at least stop, pretty soon as cracks get wider in the property market and second-order effects appear.

I think they underestimate the problems that we, the NZ economy specifically, face in a combination credit squeeze/inflationary environment.

Our exports are far from diversified. We face a permanent decline in tourism numbers, with China seemingly out of the picture. Our other major industry, pastoral farming, is being deliberately dismantled. No one else needs New Zealand dollars.

The $NZ is headed sub-50c. Of course that will only add to the inflation pressures the RBNZ faces...

Real estate was 29% of Chinese GDP. Fueled by middle class taking on massive debt to by apartments that no one on an average Chinese income could afford to rent. Now that bubble is popped they can not afford long haul travel anymore.

big hit to Queenstown

Great time to see this beautiful country without hordes of tourists.

I was down in Fiordland a couple of weeks back, magic.

Yeah, I certainly don't see us in very good shape to weather a GFC2, Great(er) Depression or (De)Globalisation Era - whatever it eventually gets called by the history books!

Yet, our government on a near daily basis tells us the opposite.

I'm starting to feel guilty about feeling relieved that I might not have to live through it.

I'm starting to feel guilty about feeling relieved that I might not have to live through it.

Huh...is something wrong, Kate? Health-wise?

All good health wise (thanks for asking) I'm just being a reflective kuia, and not feeling confident about the prospect for my children and grandchildren.

By reflective, I mean that in the past, it seemed each new generation was able to progress to a greater enjoyment in life than its predecessor generation. But that trend seems to me to have ceased with the baby boomer generation. For each new generation thereafter, life/happiness has become harder, it seems.

Agree...and glad to hear you're well!

Absolutely agree

Maybe Labour will copy Australia and give first home buyers 25 to 40k towards first homes to slow the brain drain to Australia before the election.

I sure hope not. Homebuilder has destroyed the construction industry in Aus. It brought forward so much demand that the prices skyrocketed. The queue of work (on fixed price contracts) has been so long that they're making a loss on just about everything now. Builders are dropping like flies.

https://www.news.com.au/finance/business/other-industries/sixteen-compa…

So now you've got a heap of buyers out of pocket sitting on half-built projects, tradies and subbies out of work and owed money, and another tranche of buyers liable for contracts that missed out on the subsidy because they didn't start on time. Absolute mess.

So telling that some politicians' response to out of control house prices is to subsidise house prices further...

I was thinking that a better way to help some of those younger, more recent homeowners would be to allow them to defer repayments on any student loan balances. I know both our kids went into their first homes still with student debt - and life became so much easier for them once those 10% PAYE deductions for student debt ceased.

What is free and what is paid, what is taxed and what is not, are symptoms of what it matters for a country (and for the electorate)

Right now becaming an educated person is very expensive, and taxes are mainly punishing productivity.

Sitting on assets is still pretty much not taxed.

How the F@#$k anybody is still voting for national or labour is a complete mistery to me.

I have a bunch of individual solutions for myself and my family, so I might say that I am good anyways.

But c'mon, the very same idea that nz complains that is "losing brains" but we don't offer free education is absurd.

With you there.

We can find $16+ billion per year for superannuation payments regardless of need without batting an eyelid, yet we cannot find less than $1 billion per year to abolish the need for student loans? On top of all the other economic headwinds e.g. housing young people face when entering the big bad world.

And people wonder why the younger generations are so anti-boomer.

You have to convince skilled labour to stay before any chance those above could happen. Inflation probably won't come down if skilled workforce keep leaving New Zealand. Based on what I see at the moment, it's hard to find reasons to convince them to stay... Remember after people got their resident visa, it also means they are free to leave or stay. Lots of skilled migrants they just want resident visa so they can more options. Some of them don't actually want to stay long.

I wonder what happened to Printer8.

Anybody paying heed to his insane "advice" last year has been financially wrecked.

Software update

Getting a new brain?

That's a firmware update.

I'm sure these recent FHBs are enjoying the intrinsic value and sense of pride that comes with homeownership.

Seems odd that he's gone so quiet - he was quite vocal that the DGM crew should show contrition to any FHBs that were dissuaded from buying on the way up, surely the reverse is true - all part of the folly of us armchair economists offering financial advise.

Ran out of ink.

The B&T auctions this week have been mostly fairly miserable however I noted a few vendors still didn't accept bids that would have given them a profit.

Nothing particularly cheap of note. Perhaps this property in Papatoetoe:

https://www.barfoot.co.nz/property/residential/manukau-city/papatoetoe/…

Went for exactly 600k (CV 770k. QV est. 810k)

Last sold in 1985 for 72k

Love the carpet

Thanks Zachary. And yet I look at that house, and say "that's way out of whack with lower quartile incomes" - long way to go to anything approximating 'fair value' or 'affordable' IMO.

Couldn't have said it better.

Seems like a relatively good deal. A two beddy unit not too far away on Omana sold in the low 700's.

Specarus is finally experiencing gravity.

But...who can buy, and for those that can, who would be dumb enough not to wait longer. The strategy of greed is unwinding fast. The run sheet of failure and greed looks like this...

- Waste time by Auction - FAIL -so sorry you are a year late for FOMO and almost free debt.

- Waste more time by moving to either PBN or an insane price. 2x FAIL - so sorry free debt is gone, plus tax rinse changes mean its worth less (basic math).

- Finally lets list for rent - more new stock arriving and all the educated good future renters are saying "bleep it" and moving to Aussie. Perhaps the homeless are an option or the ones Aussie is deporting back....?

But keep wasting time, houses always go up. FAIL. The only thing going up is interest rates and inflation, which means higher interest rates. New rental stock arriving weekly, increasingly less tax rinse, negative migration, and more and more of our educated youth renters leaving. Is the new Govt policy about to raise the middle finger to consent and intensification planning of the RMA, and allow mass intensification. What upside is there again?.

Forget FOOP, its time for POOP. I'm just amazed more of the speculative don't realise what an overshoot they are holding. They probably think sea rise is fake as well.

Popcorn...

Sorry but the numbers are wrong. Been tracking the total number of houses for sale in Tauranga now for three years and nothing has changed from pre COVID. Also nobody is interested in asking prices it's the sale price that matters. Yes the market is still full of dreamers and the asking price is falling but some were a joke to start with. Perhaps the next quarterly results will tell a better story.

I agree, REINZ numbers seem very low, but REINZ exclude private sales. I follow Wellington closely and publish the data, using weekly data, so having almost the same date available, 27th June.

Trademe sales inventory on 27th June was 2,766, up from just 1,074 on the same day in 2021, that is close to 270%.

REINZ say inventory for Wellington at ~2,000 is 170% of 2021, a big difference.

My page also covers the very fast increase in inventory for rental properties in Wellington. Linking through you can see the same data for Auckland, where rental inventory has been high for much longer.

Very useful site, thanks! Just subscribed..

Auckland is still pumping out 1000 plus new dwellings per month. At the same time Auckland population is flat to falling. New 4-6 town house developments on 600-800 m3 sections are popping up like mushrooms everywhere you look. What could possibly go wrong?

... anecdotal evidence from someone who has a friend in customs at Christchurch airport ... unprecedented numbers of 20 to 40 year olds departing for Australia on a one way ticket ...

Let’s hope they choose to vote at the ballot box as they have voted with their (feet) departure.

Nah better to vote with their feet. There is no good choice at the ballot box, both major parties are variations on an awful theme.

Good luck to those moving abroad. Their future here has been screwed over.

went for a walk round my area at lunch time, 3 recently completed townhouse developments are all still empty except for 1 unit, so around 20 still empty and either for sale or rent. Some have been for sale for months.

Almost at crisis point for those developers I would think.

Not much chance of IRD making much money from the brightline test extension in the near future.

Perhaps they should offer tax credits

What lessons will be learnt? None …

Just a crash before the next boom

I like how in Australia they say it how it is:

https://www.afr.com/wealth/personal-finance/the-aussie-housing-crash-is…

Instead of:

https://www.stuff.co.nz/life-style/homed/real-estate/129123898/slower-h…

The AFR has been reporting the issues for a while, quality news on that site...... calling fastest correction since 1980s

I think it’s at least partly a population size thing. Much of their MSM is as bad as here but with a much bigger population there might be a few more media outlets than here telling it like it is, who haven’t been corrupted by property advertising revenue….

The worst part of all of this is that it took JPOW at the Fed to restore sanity to our housing market. If not for him we'd probably have a negative OCR and be shouting about how fantastic it is to have expensive houses and thousands of homeless people.

FOOP .... FOOP ....FOOP .... FOOP ...

... good morning Vietnam ?

Not quite : just helicopters napalming the price of houses in New Zealand ... stand back ... keep your powder dry ... wait until the dust has settled ...

FOOP ... FOOP ... FOOP ...

I love the smell of the napalm in the morning, it smells of ..... (insert the line of your choice).

No doubt house prices are dropping but the "average" asking price drop is accentuated by many new townhouses coming onto the market at the lower end of the price bracket, thus dragging the "average" even lower than the HPI shows

There are all sorts of distortions in the market. I had a thought the other day that's it even hard to compare the median from place to place without taking into account of the average age of the stock. Building trends have changed for sure there are way more townhouses being built in an effort to keep the price down so it's impossible to make a direct comparison between now and even a few years ago.

That’s why the HPI is the best measure. And that’s also on a significant decline.

Our Independent Economist .....still trying to.....

https://i.stuff.co.nz/life-style/homed/real-estate/300626021/house-pric…

Despite Warnings :

https://www.oneroof.co.nz/news/flashing-warning-signs-nzs-housing-marke…

Actually Happening :

https://www.macrobusiness.com.au/2022/06/collapsing-mortgage-demand-ham…

I finally understand why people say NZ is full of sheep - It blows my mind when people believe the BS the media puts out there.

The main problem is you get to the point you don't trust ANY of the numbers. The numbers presented here are wrong so why would you believe any of them. You are better off just focusing on what's happening in your street it's working for me.

Annoying they paste the supply graphic in the article, but not the asking price.

This three bedroom house sold for 618k in Auckland this week:

https://www.barfoot.co.nz/property/residential/waitakere-city/te-atatu-…

The market is not as bad as people are imagining.

I'd say "less than perfect" houses are off their peak by about 25%. So something that would have sold for 800k November last year is now 600k if you want a quick sale.

That ratbox (would rats live there??) is overpriced at +600k. I suppose the flipper who purchased it will find out when they polish this turd and struggle to pass the debt grenade to a bigger fool.....and fail to get 525k in 6 months time.

Wow that's a beauty for sure. You would be hoping when they clean out the garage that they also take the garage and the house with them. If you only had the picture it looks like some 3rd world shack.

When you look closely it looks relatively easy to smarten up. Replace that gutter, waterblast the walls and paint the roof, remove the shed and cut those trees down. Probably a bit of work to do inside I would imagine. We may look back at these places and see them as bargains.

‘The market is not as bad as people are imagining’????

I call BS on that.

I think people can get a bit lost in the doomgoblinism that infests these comment threads.

That's bizarre. A mortgagee sale on a house with a GV of $800K - that homes.co.nz suggests its market mid-point is $870K - sells for $618K.

Last sold in 2006 for $285K, after which there was a related-party transaction in 2013 but no sales since.

So, let's think on this. A rental investor bought it in 2006 (probably outbid a FHB for it) - and then let it rot while occupied by (likely) low income families suffering rent increase after rent increase. Meanwhile, landlord borrows and borrows on its capital gains, time and time again - rinse repeat for many properties over, bought with no deposit.

By this time we can legitimately call the landlord a slumlord who owns a portfolio of shit holes (and no retained capital to speak of) and the bank(s) said enough.

I very much doubt it was a rental property or owned by someone with a portfolio of properties.

The bidding on it was very lively, hence my assertion that the market is not as bad as people claim. There were about 50 bids on this property and it kept going up once it hit the market price.

Once it hit the market price....

So you are saying that 23% below GV is now the market price in Auckland.

Not that I disagree - and it will drop lower.

The GV (RV) is not really a great indicator of actual market value, it being a crude instrument for determining the price of rates but, yes, the bidders that day set the market price for that type of property. There were at least two bidders and they fought to get it. However during the bidding the property "went on the market" (they lowered their original setting) which meant the vendor accepted that price yet it continued on up from there.

If the price is right the market is still lively. Currently that price is higher than what a lot of commenters imagine.

You're right. It was a very crude indicator on the way up too (properties selling for 20%+ above GV). Therefore, if something sells 23% below GV then that could potentially be a bigger discount to the market value since generally a property's market value (including shit holes) exceeds the GV.

The method of valuation for rating purposes is/has been a highly contributing factor to our inflated market prices. The reason being that everything goes up in dollar amount in accordance with the average percentage above GV for previous sales over the past 3 years in an area.

In other words, total dumps went up with the average percentage increase of the well maintained and upgraded homes.

When you inflate/revalue the entire bottom of the market, your on a very bad trajectory.

I have previously argued that valuation for the purposes of local government rating should be done on a points, not dollar value basis. With the sophistication of GIS systems these days, it would be really easy to assign points, on say a 0-1000 scale, for livability, desirability and infrastructure provision factors, such as;

- distance to public transport hubs/nodes

- tree cover in the surrounding area

- distance to public amenities, such as parks, libraries, swimming pools, hospitals, etc.

- availability of off-street (free) public parking in the vicinity

- delivery (or not) of reticulated services to the property

- floor area of dwellings and ancillary structures

- land size as a percentage of dwelling footprint

and so on.

On a cross lease site so will need other party's approval for any rebuilding. Other party may be happy for that shack to be rebuilt, although on the other hand rebuilding = disturbance.

Once you build a new townhouse you'd have spent circa $1 million. Doubt there's any upside to that for selling. If owner occupied, not brilliant value when prices could still fall 10% but perhaps not bad.

I don't think they will be knocking it down although, you know, it may have been the owner of the other cross-lease that bought it. That would have been a smart move.

Come on, the place is close to falling apart! Even if it’s substantially refurbished that won’t be far off a new build price

Shall we have a bet as to what happens?

It'll be advertised to rent. Many, many people have no problem whatsoever in housing others for a price in a place they wouldn't live in themselves. Easy as that.

A tidy up and painting will do wonders. The walls and windows are sound, the gutter is an easy fix and the roof could be treated and painted. Stick in a heat pump and it makes the perfect rental or even a first home. Someone could put in 20k and some hard work and transform it.

If you covert the price by our exchange rate with the US you get a number close to $375USD

Coincidentally close to the average US house price.

what a dump and what a racket

It's in New Zealand's premier city though.

I dont know if you are legally allowed to use NZ and Premier in the same sentence.

Why not? NZ is a premier country, extremely free and extremely well regarded. For individual human rights and freedom Auckland would surpass any city in Asia, Middle East, Africa, Central and South America by a very large margin.

Yep more people should watch the news on Al-Jazeera and see what a real shit hole looks like. Kiwis don't know how good they have got it.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.