A study on brand intimacy by MBLM reveals the world's leading brands based on emotional connection. Artificial intelligence and big data were used in the study to assess and rank over 600 brands around the world.

The study examined over 1.4 billion words used across select social media platforms. The results of the study show media & entertainment and technology brands taking out six of the top 10 (Figure 1). Disney was crowned as the most intimate brand. One of the underlying reasons for the top ranking was the “nostalgia” embedded in the consumers’ emotional relationship with Disney. On the other hand, the main reason for Tesla’s high ranking was the consumers’ perception of “exceeding expectations, delivering superior service, quality, and efficacy”.

Figure 1: Top 10 brands based on emotional connection

(Source MBLM)

Branding and reputational change is an increasingly important piece of the puzzle for companies. One way to grow brand awareness and the customer base is through mass marketing with the goal of increasing universal appeal to everyone, not just one key segment of the market. To give you an example, one avenue used by Formula One was to use Netflix to create a docuseries. The docuseries used emotional storytelling by focusing on the racers, rather than the races.

Gaining a reputation, good or bad, can impact investor sentiment. While reputational risk is considered by institutional investors, retail investors can exert influence on the share price of a company. This was evident in the US company GameStop that wasn’t featuring in professional investment portfolios, other than short sellers. Through the power of the retail investor, GameStop not only grew its share price, but the stock also made its way on to the 2021 Axios Harris Poll 100, meaning it was a company on the minds of the US investor.

The MBLM study suggests that intimate brands continue to outperform the stock market, however the performance comparison is limited to 2021 versus 2020, so we can’t really draw conclusions based on that one set of data. Instead, the underlying drivers of a brand could be assessed to understand how the company could benefit from a strong brand in the marketplace. There are related advantages cited by the study which make sense, notably, price resilience, enduring relationships with consumers, and increased consumer engagement. Brand matters, but these are only one part of the business, what about fundamentals like the financials, corporate governance, human resource management?

Figure 2

Fundamentals of a company can be easily forgotten in the age of DIY investing. Many investors may be inclined to pick stocks based on brands they are familiar with, or even ‘intimate’ with. There is plenty of information easily available on the world wide web that might supplement their stock picks too, regardless of how qualified the information is (Figure 2). A side note of this is ‘availability bias’, which we’ll elaborate on in another article. Back to the point, investors need to consider the fundamentals of a business and how it can add value over the longer term, rather than solely being attracted by a familiar brand.

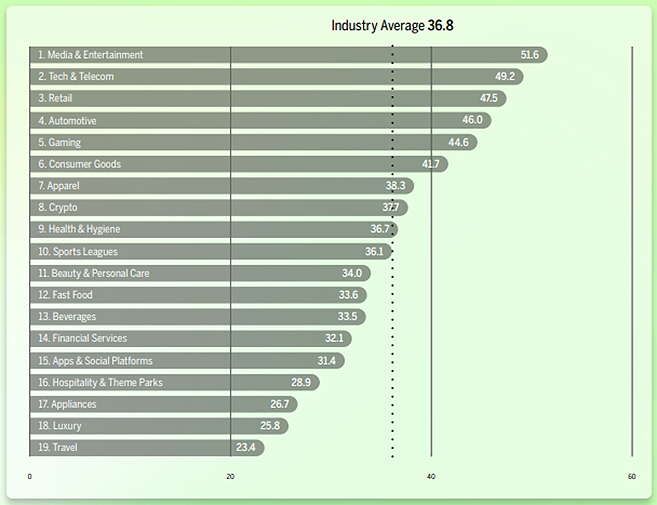

The MBLM study also gives a breakdown of industry rankings (Figure 3). There is the old adage ‘fashion is fickle’, with Apparel coming in 7th. This isn’t too bad considering it is higher than the industry average. Should the saying instead be ‘financial services are fickle’? Financial services were the 14th ranked industry for brand intimacy. The main driver of financial services branding according to the study is the “enhancement that occurs through better use of the brand - smarter, more capable, and more connected”.

A subset of financial services is funds management. Each fund manager has their own brand and associated style, whether they’re active or passive, equity specialists, or bond specialists etc. Perhaps the saying could be expanded, ‘financial services are fickle, but style is constant’?

How much does a fund manager’s brand matter to you as an investor? Does a fund manager’s advertisement strike a chord with you? Do the advertisements demonstrate their investment capabilities or is it just marketing spin?

At the end of the day, it is about trust, you want confidence and peace of mind that your savings are being managed prudently. A recent study by the CFA Institute focused on the concept of investor trust, which is distinctly personal – “there are two primary ways to have a personal connection to one’s investments: to have an adviser who understands you personally, or to have investments that achieve your personal objectives and resonate with what you value.”

Reliable data matters. Fees, investment professionals’ credentials, returns and benchmarks, ESG. Fundamentals matter. The focus on compounding returns over the longer term should dwarf the lure of short-term gains. Ongoing debate and differing perspectives should be pursued and based on fundamentals and facts. There is value in advice.

Figure 3: Top brands based on emotional connection - industry averages

(Source MBLM)

Access to the RIPPL Effect reports is here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.