The Commonwealth Bank of Australia, owner of NZ’s ASB Bank, is a remarkably successful institution. Originally government owned, in the 1990’s it was privatised by the Hawke/Keating Labor government and listed on the Australian share market. Thirty years on, it has a market capitalization of more than A$300 billion.

That’s over A$100 billion more than BHP, the world’s biggest miner and Australia’s second most valuable listed company.

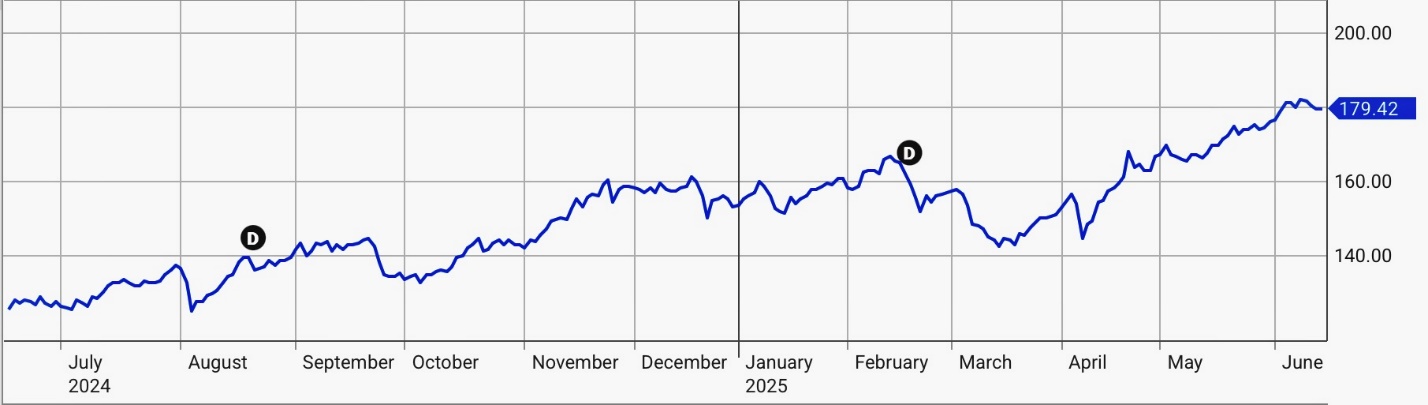

The last twelve months alone have seen the CBA share price rise by 45%.

Commonwealth Bank of Australia share price over the last twelve months

Source: ASX

Perhaps most surprisingly, CBA dwarfs the other three members of Australia’s (and NZ’s) Big-4 banks. As at the time of writing, Westpac’s market cap is $114bn, NAB’s is $119bn, and ANZ’s is $88bn.

Those numbers suggest that CBA must be vastly more profitable than its key competitors. But that’s not the case. Much of the market cap differential is due to factors other than profitability, as evidenced by the ‘price to earnings ratios’ at which the four banks trade.

CBA is currently trading on a PE of nearly 32. By comparison, Westpac’s PE is about 17, NAB’s 16.5, and ANZ’s just 13.3. In other words, CBA is trading on a PE ratio around double that of its peers.

And CBA is not just an outlier relative to Australian banks. Canada and Australia have much in common, but Canada’s big banks trade at much lower PEs than CBA – Royal Bank of Canada at 13.5, the Bank of Nova Scotia at 15.4, and CIBC at 11.5.

A similar picture emerges among the big UK banks.

From a PE perspective at least, CBA looks expensive. That’s why some commentators in Australia have started asking, only half-jokingly, whether it’s ‘the world’s most expensive bank’.

Given the high proportion of profits that Australia’s big banks distribute as dividends, CBA’s high PE is reflected in a markedly lower dividend yield than the rest of the Big-4:

| CBA - 2.6% | Westpac - 4.6% | NAB - 4.4% | ANZ - 5.6% |

What’s going on here? What explains the pricing gap between CBA and its peers, and the fact the gap has widened recently?

Normally a high PE is a sign of a growth stock. Punters price in an expectation that the company’s profits are growing rapidly. Take US market darling Nvidia which has seen profits skyrocket in recent years. It currently trades on a PE in the high 40s, but that’s projected to fall to the low 20s by 2028 due to soaring profits year on year.

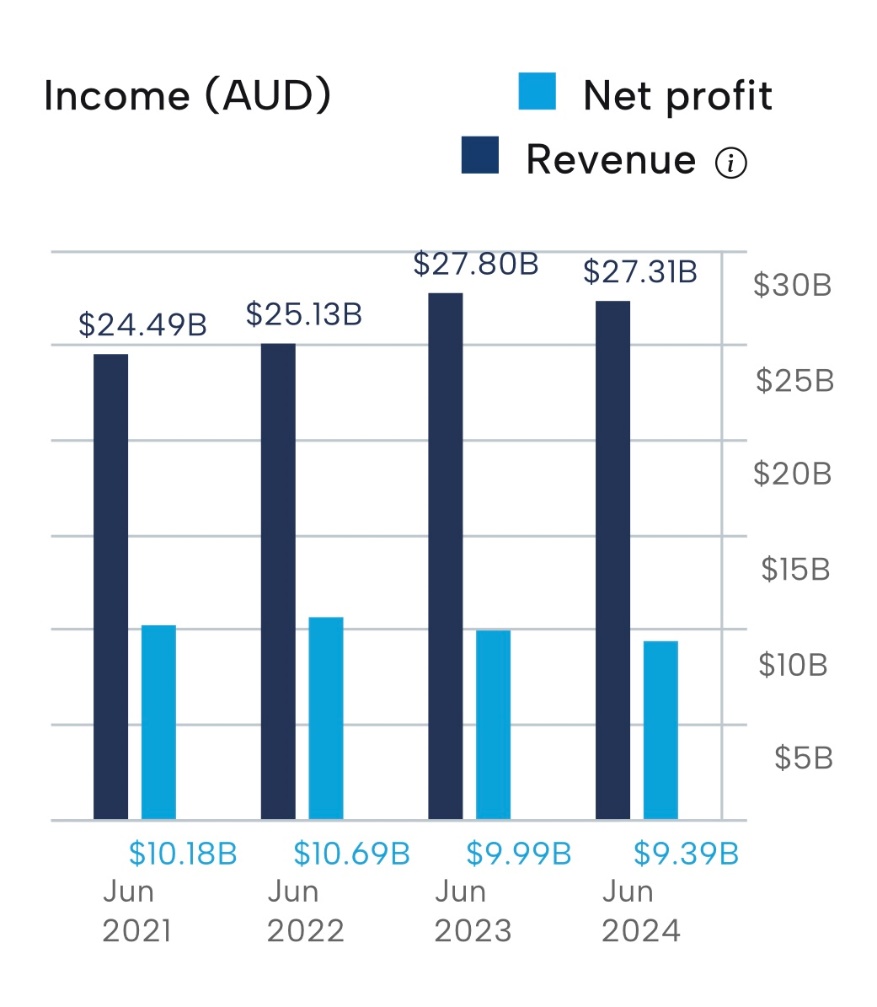

CBA is on a very different trajectory. Here’s the profit picture for the last four years. And current projections for the 2025 year don’t reveal a dramatic change.

Source: ASX

CBA is a retail and commercial bank operating in mature and competitive markets. Its major businesses already enjoy significant market share. These factors limit its potential for dramatic growth.

To be clear, CBA is a fantastic, well-run company. Better run than its three main competitors. But that’s also part of its share price challenge. CBA is so well run already that achieving further large efficiency gains will be difficult. In theory, there’s more room for improvement, and therefore potential financial upside, in Westpac, NAB, and ANZ.

So who are all the buyers pushing up CBA’s share price?

Foreign investors is one answer. Earlier this month, the Australian Financial Review reported that Texan investment giant Fisher Investments had spent ‘as much as a billion dollars’ buying CBA shares in the previous fortnight.

Some analysts attribute such offshore buying to international investors diversifying risk away from both the US dollar and US equity markets. As the bluest of blue-chip companies on the ASX, CBA might be expected to be the biggest beneficiary of such buying.

The bank currently represents approximately 12% of the ASX200 so it’s something of a proxy for the Australian market.

That relative importance also makes CBA an inevitable component of many domestic investment funds, including Australia’s all-important superannuation funds. (A major attraction for the latter is the fact that CBA’s dividends are fully ‘franked’ i.e. they carry full imputation credits.)

Any active investment manager who is underweight in CBA shares risks underperforming the market. Several active managers have learnt that to their cost over the last twelve months. Similarly, investors who have tried shorting CBA have been badly burnt.

Of course, there are numerous passive ‘index’ funds that must hold CBA shares. New money pouring into such funds, combined with a rising CBA share price, creates ever more demand for the shares.

No doubt, loyalty is also a factor in the remarkable performance of CBA’s shares. The loyalty of long-term retail investors. When CBA initially listed back in 1991, the minimum parcel was 400 shares. At $5.40 a share that meant an outlay of $2,160. Today, with the dividends reinvested, that parcel has grown to be worth well over $400,000.

That level of return, in a blue-chip stock, earns a lot of loyalty.

Only time will tell whether that loyalty will continue to be richly rewarded.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

4 Comments

You have to wonder if the other three major banks have crap management or if CBA is just overdue to

Regress to the Mean PE levels of its peers.

Hypothetically, if they go kaput, are all the ASB KiwiSaver accounts fully insulated?

The Funds are held in a different company structure by law.

ASB Group Investments Limited

I suggest if ASB Fall over your Kiwi Saver value may well be

Down the dunny

Due to what ever global event has caused such a bank to fail, not the failure itself.

As of June 2025, CBA's market capitalization is reported between AUD 299.87 billion and AUD 320.34 billion. That's bigger than the market cap of the Vampire Squid (Goldman Sachs) - approx USD 188.26 billion.

In recent years, the Ponzi has accounted for approximately 60–70% of its total loan book and about 50% of its total assets. This is consistent with disclosures in previous annual and half-year reports, where residential mortgages are the largest single asset class for the bank.

CBA has implemented significant restrictions on customer transfers to crypto exchanges, citing a sharp rise in scams and the need to protect customer funds. It enforces a $10,000 monthly cap on payments to accounts it identifies as associated with crypto.

Seems odd that CBA cares about degenerates allocating their own funds to crypto.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.