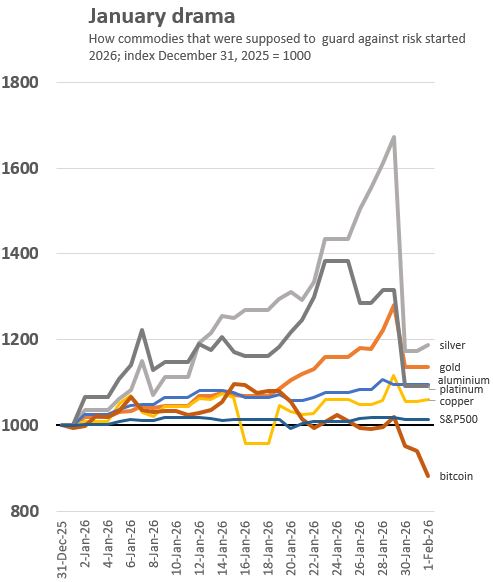

It has been a wild start to 2026 for investors who looked to insulate their portfolios with assets that are traditionally there for volatility protection and diversification. Those elements turned on their head.

For those seeking protection from fiat currency debasement, there have also been lessons about what works and what doesn't.

To be fair, one month isn't really a suitable timeframe to trigger a change of strategy on these issues, but January 2026 is kind of hard to ignore. It will at least have investors thinking about whether the rules of the past are going to be valid in a future where the only certainty is uncertainty.

And uncertainty is certainly showing up in precious metals, and cryptos, in 2026.

Your worldview will likely influence how you judge the causes of the current uncertainty. But there is no doubting the rise in uncertainty, despite it not actually showing up in the traditional measures like the VIX, Wall Street, or even yields on US Treasuries. Investors sense the aggravated uncertainty, even if financial markets aren't pricing it in - yet.

Financial markets have traditionally used 'past performance' as a basis for valuation. It isn't the only thing, but even when future prospects are priced in, it is usually with the credibility of past performance. And that is basically true for measures that are supposed to assess future risk, like credit ratings.

Investors can sense when those market signals aren't reliable however. The wisdom of crowds, even large crowds of investors, isn't infallible. But it does focus the mind.

Another aspect that is relatively new is the rise of 'betting markets' and their attraction to people, not only those with inherent addictive behaviours, but also people who a) have shallow life experiences, and b) are easily influenced by social media memes. These 'communities' are largely self-reinforcing and give momentum to herd instincts. The internet is turning more 'investors' into 'gamblers' - made worse because 100% these people don't recognise they have the addition - until it is too late. It is an problem that has always been there; it is now cascading though social networks and it a real force normal investors have to content with.

Warren Buffett championed the concept of 'value investing', saying financial markets are there to transfer wealth from the active to the patient. There are still many with this outlook, but it seems a quaint concept in 2026, being drowned out by shouting internet reels and the explosion of self-styled 'experts' and 'finfluencers'.

Traditionally, you include gold in an investment portfolio at modest levels (5-15% ?) as a countercyclical protector during market downturns, geopolitical crises, or periods of high stress. Due to its low or negative correlation with stocks and bonds, adding gold can reduce overall portfolio volatility and risk, improving risk-adjusted returns. It has also historically preserved purchasing power over the long term, acting as a hedge against currency debasement and rising inflation. And gold has been highly liquid - although current extended wait times to get possession might be calling that into question. It's still highly liquid into fiat currencies.

The sense that inflation isn't really under control spooks savers and investors, causing them to seek more risk to avoid negative real returns. There is work to do, sometimes painful, to get inflation contained. That will take real courage in an election year.

The January 2026 volatility is unlikely to extend for very long - if your judgments are based on past perspectives. But anyone who is certain of what the future will bring is a charlatan. We are back to the 'certainty of uncertainty'. Buyer (investor) beware.

3 Comments

Plenty of food for thought in this piece. What is particularly important for people to consider is the 'absence of certainty' and this is something that I pay particular attention to.

To be fair, one month isn't really a suitable timeframe to trigger a change of strategy on these issues, but January 2026 is kind of hard to ignore.

100%. Many people will be oblivious to what has been happening. Even during the 1970s, to see such extreme mkt behavior with gold / silver would have been impossible: access to mtks / information was completely different and mks were far less complex.

Traditionally, you include gold in an investment portfolio at modest levels (5-15% ?) as a countercyclical protector during market downturns, geopolitical crises, or periods of high stress.

Yes. However, if gold truly represents monetary debasement over time, then investment in equities in particular should be 'alpha' - adjusted for monetary debasement. We have been seeing that to some extent with picks and shovel AI stocks, but it will not last forever. Even the steady, reliable consumer stocks like FMCG companies are arguably losers in this inflationary environment. And even banking stocks like CBA look questionable (except for long-term boom investors who have been able to benefit from their reach into the Aussie/NZ economies).

"Another aspect that is relatively new is the rise of 'betting markets' and their attraction to people, not only those with inherent addictive behaviours, but also people who a) have shallow life experiences, and b) are easily influenced by social media memes. These 'communities' are largely self-reinforcing and give momentum to herd instincts. The internet is turning more 'investors' into 'gamblers' - made worse because 100% these people don't recognise they have the addition - until it is too late."

To put the cat amongst the pigeons; Does this sum up Bitcoin investors?

Any investment has an element of risk or a gamble. In my investments, I like to minimise the risk by considering the factors involved to develop a rationale to support it. I have not invested in Bitcoin as I see no - or at best minimal - factors or rationale that support BTC movement . . . to me, BTC has no more sound reason to invest than betting on a roulette wheel.

As an aside; I note that in the last few months there has been minimal posts regarding Bitcoin with more posts regarding PM becoming far more popular . . . is this an example of posters being “easily influenced by social media memes”

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.