By Amanda Morrall email

1) Spending and Savings

Food. It's the second largest household expense and yet by some estimates we dump as much as half of it. That estimate comes from the United States but I dare say New Zealand is not that far off. The collective cost of all those spoiled cabbages and rotten fruit? A whopping US$48 billion in the United States, according to the Stockholm International Water Institute.

With no end in sight to spiralling food costs, this is one area that householders will have to do better on as they surely aren't getting any financial relief anywhere else any time soon. If not for financial reasons, then for the sake of our planet.

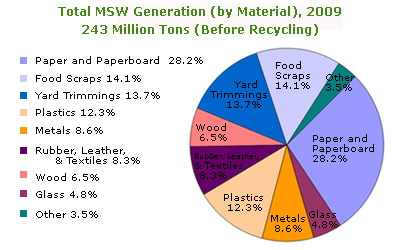

Check out the following dismal statistics on where our waste goes and how we've doubled our individual rubbish loads over the past few decades. Households CFOs, can calculate costs here.

/>

- In 1960, the per capita generation of waste was 2.68 pounds per person per day, and total waste generation was 88.1 million tons.

- In 1965, the per capita generation of waste was 2.96 pounds per person per day, and total waste generation was 104.4 million tons.

- In 1970, the per capita generation of waste was 3.25 pounds per person per day, and total waste generation was 121.1 million tons.

- In 1975, the per capita generation of waste was 3.25 pounds per person per day, and total waste generation was 127.8 million tons.

- In 1980, the per capita generation of waste was 3.66 pounds per person per day, and total waste generation was 151.6 million tons.

- In 1985, the per capita generation of waste was 3.83 pounds per person per day, and total waste generation was 166.3 million tons.

- In 1990, the per capita generation of waste was 4.57 pounds per person per day, and total waste generation was 208.3 million tons.

- In 1995, the per capita generation of waste was 4.52 pounds per person per day, and total waste generation was 217.3 million tons.

- In 2000, the per capita generation of waste was 4.72 pounds per person per day, and total waste generation was 242.5 million tons.

- In 2005, the per capita generation of waste was 4.67 pounds per person per day, and total waste generation was 252.4 million tons.

- In 2007, the per capita generation of waste was 4.63 pounds per person per day and total waste generation was 255.0 million tons.

- In 2009, the per capita generation of waste was 4.34 pounds per person per day and total waste generation was 243.0 million tons.

2) Credit and Debt

Pssst. Want to endear yourself to your bank? (The right answer here is no)

Here's Suhaimi's 20 step programme to full-blown credit addiction that will endear you to your bank and debt forever. Identify with any of them?

- Take cash out on credit cards then make partial payments

- Using third party ATMs, get even more hosed on fees from every party

- Visit your bank teller on a regular basis, human interaction comes at a premium now, didn't you know?

- Paper statements. Forget internet banking ask for the paper, some banks charge $5 for it

- Pick up the phone and find out how your bank account is faring, for the pleasure of the chatter you can watch your account drain down in real time

- Get an over-draft or keep revising your limit, you pay for the pleasure

- Drip feed the minimum balance on your credit card, bank CEO's will love you for it and it might help George Frazis (the NZ$6 million man at Westpact) with his tenancy tribunal woes

- Abuse or lose you bank cards, replacement cards are dearer than lattes

- Leave a low balance account left to languish for a year and watch yourself go into the red on fees

- You're a lucky credit card carder, reap the "free rewards'': "Yeah, right!"

- Writes cheques without reconciling the balance, you'll never know where you stand financially

- Keep the saving balance less than the minimum saving required, the bank might just take your shirt too

- The more the merrier; get a wallet full of plastic and as many savings account as you can. You'll be nickled and dime into poverty

- Take out foreign currency on an overseas trip using another bank's ATMs

- Who cares what's going on in your account, "She'll be right."

- Vanity cards to go with the vanity plates. Why not? More money in the banker's pocket.

- Stop cheques before they're cashed, then see how much paper is worth.

- Subscribe to email or texts alerts, some of free but most will charge you

- Don't visit our website, you might get the upper hand on banks.

3) Real-estate

Did anyone other than me read our finance and banking editor's article on how grossly over-valued our housing and rental market is in NZ? (Read Gareth Vaughan's story here).

Are renter's really that apathetic that they don't care about over-paying by as much as 43%? It's a sharp reminder to research market rents thoroughly before signing a contract and to brush up on your negotiating skills before caving into demands by landlords deluded by how much their property is worth to rent. Check out the Department of Building and Housing's market analysis as a starting point to gauge median rents in the area.

We've also just launched a new section on interest.co.nz where you can chart and measure whether it makes better sense to buy or rent in a particular region. This is aimed at first-time home buyers (aged 25-29) who already have a 20% deposit saved and who are on average incomes. The narrowing gap between rent affordability and housing may signal a buying oppportunity but if interest rate's starting going back up, that could turn the equation rather quickly.(See our rent-ratio charts here).

4) Retirement and taxes

KiwiSavers got squeezed in the budget with Government announcing plans to cut the Member Tax Credit in half and can the tax exemption on employer contributions however fund managers are sitting pretty. While fund managers with predominantly low-wage clients on their books won't see that much change, those higher income earners who will be paying more into the KiwiSaver pot will enrich the fund manager's fee revenue's in a happy way.

Take an KiwiSaver earning NZ$90K a year.

Under the 2+2 formula, they were paying NZ$3,600 a year into their fund with providers taking 1% in fees. Under the 3+3 formula that Government has proposed to bring in effective April 2013, contributions will rise by $1,800 to $5,400, less $521 from the reduction in the Member Tax Credits. That brings it down to $1,279.

So whereas the fund manager used to charge fees of a total of $4,642, they'll receive instead $5,921, a net increase $1,279 with fees adjusted appropriately.

Rest assured I won't be cracking the bubbly this weekend, I'll be stewing while sipping a strong brew of bitter tea.

5) Books and Film

Sceptics will no doubt cringe at the following, but new research suggests a vital key to success at the work place is happiness. That's right, if you want to get ahead, climb that corporate ladder, get one of those mythical wage increases John Key is talking about, you should turn up at work a happy camper.

It's interesting stuff this positive psychology business but it's getting more and more attention and not just by the likes of Oprah. Harvard Professor Shawn Achor, in his book "The Happiness Advantage,'' says employees waiting on the big break to make them happy are chasing rainbows.

A more effective way to capture the pot of gold is build your personal happiness first, by whatever means, then success will flow naturally. It's a tough one to grasp especially as the mind tends to default most comfortably to a Standard & Poor-ish negative outlook.

I interviewed Mr. Achor awhile back about why such a simple formula is so hard to follow for many. Click here to read the interview in full.

Here's an even simpler guide to being happy: being kind.

Don't take my word for it, or anyone else's for that matter. Test the validity of the argument by measuring it against your own experience.

And in the spirit of happiness.....HT MP

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.