By David Chaston

If you are in a conservative KiwiSaver fund, you have clearly made a choice to prioritise low risk, even lower than for the default funds. (We reviewed default fund performances here).

Low risk as a priority can be important if you cannot tolerate your fund balance decreasing due to financial market volatility.

Often that is important if you are contemplating needing the value for retirement living expenses soon. Or you have a view that the future may not be positive.

But you also have to ask, why are you even in KiwiSaver?

At this end of the risk spectrum, you need to be sure that keeping your retirement savings in these types of vehicles is better than in a bank term deposit (or a guaranteed Kiwi Bond deposit). For many of these funds, the earnings will barely have managed to keep your capital inflation adjusted - that is, zero real earnings.

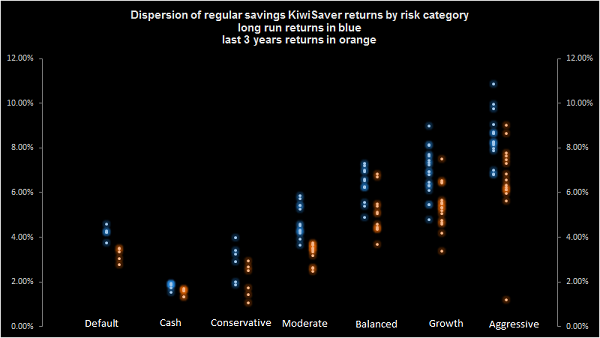

Here are how these conservative KiwiSaver funds have performed since inception, and over the last three years:

| Conservative Funds |

|

|

|

Cumulative$

contributions

(EE,ER,Govt)

|

=+Cum net gains

after all tax,fees

|

Effective*

cum return

|

=Ending Value

in your account

|

Effective

last 3yr

return%p.a.

|

| Since April 2008 |

X

|

Y

|

Z

|

|||||

| to March 2018 |

|

|

|

$

|

%p.a.

|

$

|

||

| Kiwi Wealth Conservative | C | C | C | 31,116 | 6,693 | 4.0 | 37,809 | 2.9 |

| ANZ OneAnswer New Zealand Fixed Interest | C | C | FI | 31,116 | 5,606 | 3.4 | 36,721 | 2.5 |

| Lifestages Capital Stable | C | C | C | 31,116 | 5,282 | 3.2 | 36,398 | 2.7 |

| ANZ OneAnswer International Fixed Interest | C | C | FI | 31,116 | 4,718 | 2.9 | 35,834 | 1.1 |

| Fisher Funds Two Preservation | C | D | Ca | 31,116 | 3,158 | 2.0 | 34,273 | 1.7 |

| Mercer Cash | C | D | Ca | 31,116 | 3,029 | 1.9 | 34,145 | 1.6 |

| ANZ Default Cash | C | D | Ca | 31,116 | 3,006 | 1.9 | 34,121 | 1.7 |

| ASB NZ Cash | C | D | Ca | 31,116 | 2,962 | 1.9 | 34,078 | 1.7 |

| Westpac Cash | C | D | Ca | 31,116 | 2,956 | 1.9 | 34,072 | 1.7 |

| Aon Nikko AM NZ Cash | C | D | Ca | 31,116 | 2,942 | 1.9 | 34,058 | 1.6 |

| Booster Enhanced Income | C | D | C | 31,116 | 2,906 | 1.9 | 34,022 | 1.4 |

| ANZ OneAnswer Cash | C | D | Ca | 31,116 | 2,902 | 1.9 | 34,018 | 1.6 |

| AMP Cash | C | D | Ca | 31,116 | 2,694 | 1.7 | 33,810 | 1.3 |

| Aon ANZ Default Cash | C | D | Ca | 31,116 | 2,383 | 1.5 | 33,498 | 1.3 |

| ANZ Cash | C | D | Ca | 30,247 | 2,835 | 1.9 | 33,083 | 1.7 |

| Quaystreet Fixed Interest | C | D | 26,914 | 3,004 | 2.6 | 29,918 | 2.9 | |

| Milford Conservative | C | C | C | 19,344 | 3,637 | 6.1 | 22,981 | 4.4 |

| Kiwi Wealth Cash Plus Fund | C | D | Ca | 20,074 | 1,314 | 2.2 | 21,387 | 2.1 |

| Kiwi Wealth Cash Fund | C | D | Ca | 19,540 | 1,154 | 2.1 | 20,694 | 2.0 |

| BNZ Cash | C | D | Ca | 18,558 | 928 | 1.9 | 19,486 | 1.8 |

| Booster KiwiSaver AC Conservative | C | B | M | 13,814 | 960 | 3.4 | 14,774 | 3.3 |

| Booster KiwiSaver Capital Guaranteed | C | D | Mi | 13,814 | 434 | 1.6 | 14,248 | 1.6 |

| Quaystreet Income | C | C | 11,576 | 253 | 1.3 | 11,829 | 1.3 | |

| --------------- | ||||||||

| Column X is interest.co.nz definition, column Y is Sorted's definition, column Z is Morningstar's definition | ||||||||

| C = Conservative, D = Defensive, Ca = Cash, FI = Fixed Income, M = Moderate, Mi = Miscellaneous Booster was previously known as Grosvenor | ||||||||

You have to conclude that most of these are not very good if you use the "bank term deposit" benchmark. Those returned an average of 3.3% gross, or after-tax 2.7%. Only two conservative funds did better than putting money in the bank over the past three years (and the list may be even shorter if you just look at the past year).

It is very hard to see why anyone chose a cash or conservative fund based on track records.

Fees are paid on any managed fund, whereas they are not charged for a straight bank deposit. Paying someone to 'manage' a cash fund that returns anything less than that is hard to fathom - and that applies to all but about half a dozen of the funds listed above.

Further, you might also want to know where these fund managers have invested your KiwiSaver monies. These details are set out in each of our fund pages, and here is a summary:

| Conservative Funds |

------ how allocated, approx. ------

|

|||||

| at March 2018 |

Cash

equivs. |

NZ fixed

income |

Intl fixed

income |

Equities | Property | Other |

| % | % | % | % | % | % | |

| Kiwi Wealth Conservative | 12 | 19 | 53 | 15 | 1 | |

| ANZ OneAnswer New Zealand Fixed Interest | 100 | |||||

| Lifestages Capital Stable | 65 | 15 | 20 | |||

| ANZ OneAnswer International Fixed Interest | 100 | |||||

| Fisher Funds Two Preservation | 35 | 65 | ||||

| Mercer Cash | 100 | |||||

| ANZ Default Cash | 100 | |||||

| ASB NZ Cash | 100 | |||||

| Westpac Cash | 100 | |||||

| Aon Nikko AM NZ Cash | 100 | |||||

| Booster Enhanced Income | 3.5 | 96.5 | ||||

| ANZ OneAnswer Cash | 100 | |||||

| AMP Cash | 100 | |||||

| Aon ANZ Default Cash | 100 | |||||

| ANZ Cash | 100 | |||||

| Quaystreet Fixed Interest | 10 | 59 | 31 | |||

| Milford Conservative | 11 | 28.5 | 46.5 | 9 | 5 | |

| Kiwi Wealth Cash Plus Fund | 65 | 10.5 | 24.5 | |||

| Kiwi Wealth Cash Fund | 100 | |||||

| BNZ Cash | 100 | |||||

| Booster KiwiSaver AC Conservative | 2 | 61 | 27.5 | 6 | ||

| Booster KiwiSaver Capital Guaranteed | 52 | 41 | 1 | 6 | ||

| Quaystreet Income | 9 | 39 | 41 | 6 | 5 | |

That list shows why you need to do some homework on them. Just relying on their 'name' or their risk class may not reveal where the manager has the fund allocated. There is a surprisingly wide variety.

But bank funds who invest in 'cash' just put the money in their own bank term deposts - and then charge a fee for doing so!

I accept that the 10 year track record of any fund is not a certain basis for forecasting what it will be in the future. But a track record is not something that should be ignored either.

Now, compare that with the default funds.

| Default Funds |

Cumulative $

contributions

(EE, ER, Govt)

|

+ Cum net gains

after all tax, fees

|

Effective

cum return

|

= Ending value

in your account

|

Effective

last 3 yr

return % p.a.

|

|||

| since April 2008 | X | Y | Z | |||||

| to March 2018 |

$

|

% p.a.

|

$

|

|||||

|

|

|

|

|

|

||||

| Mercer Conservative | C | C | C | 31,116 | 7,887 | 4.6 | 39,003 | 3.5 |

| ANZ Default Conservative | C | C | C | 31,116 | 7,281 | 4.3 | 38,397 | 2.8 |

| ASB Conservative | C | C | C | 31,116 | 7,155 | 4.2 | 38,271 | 3.4 |

| FisherFunds2CashEnhanced | C | D | C | 31,116 | 7,129 | 4.2 | 38,245 | 3.5 |

| AMP Default | C | C | C | 31,116 | 6,230 | 3.7 | 37,346 | 3.0 |

| BNZ Conservative | C | C | C | 18,558 | 2,253 | 4.3 | 20,811 | 3.6 |

| Kiwi Wealth Default | C | C | C | 13,814 | 1,009 | 3.6 | 14,823 | 3.5 |

| Westpac Defensive | C | C | C | 13,814 | 978 | 3.5 | 14,792 | 3.3 |

| Booster Default Saver | C | C | C | 13,814 | 944 | 3.4 | 14,758 | 3.1 |

| --------------- | ||||||||

| Column X is interest.co.nz definition, column Y is Sorted's definition, column Z is Morningstar's definition | ||||||||

| C = Conservative, D = Defensive | ||||||||

Only you can decide your tolerance for risk. Nothing in life is truly risk-free, so understanding it better can help you target where you have your KiwiSaver invested. And a qualified professional adviser can help with that too.

If you are invested in the top conservative fund, you would be $1,194 worse off than being invested in the top default fund. Every conservative fund except the top one in our list gave a worse return than the bottom default fund.

You have to have a very dour and pessimistic outlook to choose to invest your KiwiSaver nestegg in a conservative fund. The track record shows you have made a mistake over the past ten years. In fact, it is hard to know why you are in KiwiSaver at all if you just park your savings in a conservative or cash fund.

For explanations about how we calculate our 'regular savings returns' and how we classify funds, see here and here.

There are wide variances in returns since April 2008, and even in the past three years, and these should cause investors to review their KiwiSaver accounts especially if their funds are in the bottom third of the table.

The right fund type for you will depend on your tolerance for risk and importantly on you life stage.

You should move only with appropriate advice and for a substantial reason.

14 Comments

Yes indeed David. Returns are very poor. But so many people have cash deposits (various terms) and return are just as low. So it's not just Kiwisavers.

Yes, but people may have cash savings that is not tied up in superannuation because they want access to money.

A couple of my 5 yr Kiwibank ones which have yet to mature are on 5.75%. And I'm on 10.5 tax rate. Implies 5.15%. Interest at maturity, so lets say 5% pa. Not bad.

You're not counting inflation. So -1.5% ish for the last couple of years, 3.5% maybe. Don't go spending all that in one place.

"The track record shows you have made a mistake over the past ten years. In fact, it is hard to know why you are in KiwiSaver at all if you just park your savings in a conservative or cash fund."

That's rather rough. I can think of three significant reasons to invest in conservative kiwisaver funds.

1. Low volatility.

2. Free money through employer match.

3. Free money from government contribution.

4. Difficult to get money out.

If you're going to make these statements, do some real journalism and compare conservative kiwisaver funds with the associated benefits, verses investing in term deposits without the benefits before you draw conclusion, and belittle people who at the very least have started their investing journey.

Yes Gooki. It's a distinct advantage Kiwisaver has for many folk in that it it's difficult to get money out. Helps even the financially competent to tick parts of the plan as 'sorted'

Well said. At least people are providing for their retirement. Better returns could be achieved if tax was not deducted from the fund until withdrawal on retirement

It is very hard to see why anyone chose a cash or conservative fund based on track records.

Not necessarily if people are selecting those funds based on an objective such as "return of investment" as opposed to "return on investment."

David, Kiwi Bonds aren't guaranteed... which is made clear if you read the prospectus. The prospectus does point out that a government (unlike a bank) can't be wound up and that the govt can always raise money through taxation to cover its debts, but there is no explicit guarantee.

Semantics

One thing puzzling me is why there are so many choices for Kiwisaver particularly taking that most contributors will have no idea what they are signing up for - I don't mean conservative v balanced v growth, I mean all the confusing subsets.

I am so gun -shy about equity markets you have no idea , there has to be a correction of epic proportions on its way , and thats why at our age my wife and my Kiwisaver is in CASH

.

All this is why investors should diversify as much as possible. Kiwisaver should be broken up into conservative and growth funds, the proportion depending on age etc.

Investments also should be divided up between real estate, bonds and equities, without investing any more than 10percent in any one company.

Eventually, history tells us, there will be a major correction or depression sooner rather later.

Many people have invested all their money into rental residential properties and borrowed as much as they can for tax purposes. I consider this very risky.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.