By Rodney Dickens

Executive summary

The Transtasman Taskforce is investigating whether New Zealand should drop the NZD in favour of the AUD. An implication of doing so would be that the Reserve Bank of New Zealand (RBNZ) would abdicate responsibility for setting the OCR to the Reserve Bank of Australia (RBA).

In the context of this debate, it is interesting to see how the RBA and RBNZ stack up in terms of monetary policy decisions. Being a proud Kiwi it is with some reluctance that I concede New Zealand would be better off with the RBA running New Zealand monetary policy. But in my assessment the RBA is operating monetary policy much closer to international best practice than the RBNZ.

An upshot of the RBA running New Zealand monetary policy should be a reduction in Reserve Bank of New Zealand sponsored boom-bust cycles in the economy.

Are the RBA and RBNZ proactive or reactive?

In preparing for a business trip to Fiji a few years ago I checked out the Reserve Bank of Fiji's website because the central bank's acting chief economists and I were scheduled to present at a gathering of local business people.

One of the documents on the website spelt out what I believe to be the fundamental challenge facing monetary policy. The document stated that interest rates take around a year to impact fully on economic growth and that economic growth takes around a year to filter through to inflation.

An implication of this view is that to be proactive the RBA and RBNZ need to adjust official cash rates based on expectations of economic growth outcomes one year hence and inflation outcomes two years hence.

By contrast, if they are reactive and wait until undesirable economic growth or inflation outcomes occur before hiking or cutting they will be between one and two years behind the game. Reactive monetary policy is likely to exacerbate economic growth and inflation cycles, as well as undermining the credibility and ultimately possibly the independence of the central banks. So how do the RBA and RBNZ stack up?

In my experience there is more to be learnt about what motivates central banks' decisions by analysing their responses to the economic data than by running a fine-tooth comb through monetary policy statements. In assessing especially monetary policy in New Zealand I have found that the words of central bankers too often contain platitudes and/or are based more on wishful thinking than on quality, forward-looking analysis of economic growth and inflation prospects.

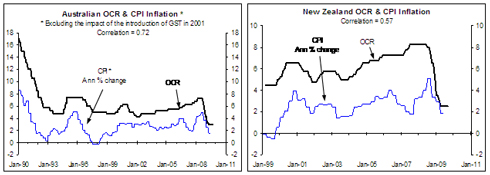

The left chart shows the relationship between the Australian cash rate and Australian annual CPI inflation, while the right chart shows the same for New Zealand. In New Zealand's case the OCR only came into existence in March 1999, so the RBNZ is a relative novice at operating monetary policy using an interest rate as the primary tool.

The charts suggest both central banks have at times been caught reacting to historical inflation data. The hiking of the Australian cash rate in 1994 looks to be a classic example of a central bank reacting to rising inflation, just as the cutting of the cash rate in 1996-97 appears to be in reaction to falling inflation.

Between 1990 and 1997 the correlation between the Australian OCR and CPI inflation is 0.85 (1.0 being a perfect fit), which suggests the RBA largely operated monetary policy in response to historical inflation data over this period. Similarly, between 1999 and 2006 the correlation between the New Zealand OCR and annual CPI inflation is 0.8.

By Rodney Dickens

Executive summary

The Transtasman Taskforce is investigating whether New Zealand should drop the NZD in favour of the AUD. An implication of doing so would be that the Reserve Bank of New Zealand (RBNZ) would abdicate responsibility for setting the OCR to the Reserve Bank of Australia (RBA).

In the context of this debate, it is interesting to see how the RBA and RBNZ stack up in terms of monetary policy decisions. Being a proud Kiwi it is with some reluctance that I concede New Zealand would be better off with the RBA running New Zealand monetary policy. But in my assessment the RBA is operating monetary policy much closer to international best practice than the RBNZ.

An upshot of the RBA running New Zealand monetary policy should be a reduction in Reserve Bank of New Zealand sponsored boom-bust cycles in the economy.

Are the RBA and RBNZ proactive or reactive?

In preparing for a business trip to Fiji a few years ago I checked out the Reserve Bank of Fiji's website because the central bank's acting chief economists and I were scheduled to present at a gathering of local business people.

One of the documents on the website spelt out what I believe to be the fundamental challenge facing monetary policy. The document stated that interest rates take around a year to impact fully on economic growth and that economic growth takes around a year to filter through to inflation.

An implication of this view is that to be proactive the RBA and RBNZ need to adjust official cash rates based on expectations of economic growth outcomes one year hence and inflation outcomes two years hence.

By contrast, if they are reactive and wait until undesirable economic growth or inflation outcomes occur before hiking or cutting they will be between one and two years behind the game. Reactive monetary policy is likely to exacerbate economic growth and inflation cycles, as well as undermining the credibility and ultimately possibly the independence of the central banks. So how do the RBA and RBNZ stack up?

In my experience there is more to be learnt about what motivates central banks' decisions by analysing their responses to the economic data than by running a fine-tooth comb through monetary policy statements. In assessing especially monetary policy in New Zealand I have found that the words of central bankers too often contain platitudes and/or are based more on wishful thinking than on quality, forward-looking analysis of economic growth and inflation prospects.

The left chart shows the relationship between the Australian cash rate and Australian annual CPI inflation, while the right chart shows the same for New Zealand. In New Zealand's case the OCR only came into existence in March 1999, so the RBNZ is a relative novice at operating monetary policy using an interest rate as the primary tool.

The charts suggest both central banks have at times been caught reacting to historical inflation data. The hiking of the Australian cash rate in 1994 looks to be a classic example of a central bank reacting to rising inflation, just as the cutting of the cash rate in 1996-97 appears to be in reaction to falling inflation.

Between 1990 and 1997 the correlation between the Australian OCR and CPI inflation is 0.85 (1.0 being a perfect fit), which suggests the RBA largely operated monetary policy in response to historical inflation data over this period. Similarly, between 1999 and 2006 the correlation between the New Zealand OCR and annual CPI inflation is 0.8.

All the central banks I have analysed show signs of reacting to historical economic data rather than being proactive. The Fed Fund Rate, for example, has a high correlation with my leading indicator for global inflation.

By implication most if not all central banks exacerbate rather than smooth economic growth and inflation cycles. However, some react much earlier than others. The less reactive central banks don't wait for inflation data or the leading indicators of inflation to go astray before hiking or cutting, they at least react to economic growth data. This means they are one year behind the game rather than two years.

Reactive behaviour by central banks can be partly justified if they have little faith in inflation or economic growth forecasts.

In my assessment, economic forecasters have a poor track record, so it is understandable that central banks have little faith in operating monetary policy on the basis of inflation and economic growth forecasts, including their own. However, central banks would be less behind the game if they reacted to leading indicators of economic growth rather than waiting for the official GDP data to confirm they had allowed an undesirable growth outcome to occur.

Do the RBA and RBNZ respond quickly to leading indicators?

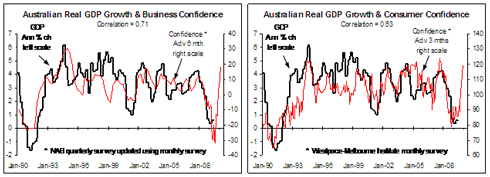

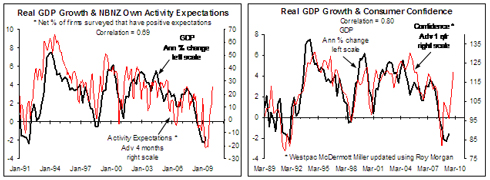

The top two charts below show what useful leading indicators of Australian economic growth are predicting, while the second two charts show the same for New Zealand. The red leading indicator lines have been advanced or shifted to the right based on the lead-times that optimise the correlations between the leading indicators and annual real GDP growth. These leading indicators point to annual GDP growth rebounding to around 4% over the next couple of quarters in both countries.

Leading indicators are not perfect substitutes for the official GDP data but when a number of them are pointing in the same direction it is unwise for central banks not to take them seriously.

If V-shaped economic recoveries unfold over the next couple of quarters then leading indicators of inflation will start rising in the first half of 2010, implying that the RBA and RBNZ should already be moving cash rates from stimulatory to neutral levels if they want to avoid exacerbating economic growth and inflation cycles.

All the central banks I have analysed show signs of reacting to historical economic data rather than being proactive. The Fed Fund Rate, for example, has a high correlation with my leading indicator for global inflation.

By implication most if not all central banks exacerbate rather than smooth economic growth and inflation cycles. However, some react much earlier than others. The less reactive central banks don't wait for inflation data or the leading indicators of inflation to go astray before hiking or cutting, they at least react to economic growth data. This means they are one year behind the game rather than two years.

Reactive behaviour by central banks can be partly justified if they have little faith in inflation or economic growth forecasts.

In my assessment, economic forecasters have a poor track record, so it is understandable that central banks have little faith in operating monetary policy on the basis of inflation and economic growth forecasts, including their own. However, central banks would be less behind the game if they reacted to leading indicators of economic growth rather than waiting for the official GDP data to confirm they had allowed an undesirable growth outcome to occur.

Do the RBA and RBNZ respond quickly to leading indicators?

The top two charts below show what useful leading indicators of Australian economic growth are predicting, while the second two charts show the same for New Zealand. The red leading indicator lines have been advanced or shifted to the right based on the lead-times that optimise the correlations between the leading indicators and annual real GDP growth. These leading indicators point to annual GDP growth rebounding to around 4% over the next couple of quarters in both countries.

Leading indicators are not perfect substitutes for the official GDP data but when a number of them are pointing in the same direction it is unwise for central banks not to take them seriously.

If V-shaped economic recoveries unfold over the next couple of quarters then leading indicators of inflation will start rising in the first half of 2010, implying that the RBA and RBNZ should already be moving cash rates from stimulatory to neutral levels if they want to avoid exacerbating economic growth and inflation cycles.

The following is an extract from the RBA's 1 September 2009 media release, when it announced that it would leave the cash rate unchanged at 3%:

The following is an extract from the RBA's 1 September 2009 media release, when it announced that it would leave the cash rate unchanged at 3%:

"Economic conditions in Australia have been stronger than expected, with consumer spending, exports and business investment notable for their resilience. Measures of confidence have recovered. Some spending has probably been brought forward by the various policy initiatives; in those areas demand may soften in the near term. Some types of capital spending are also likely to be held back for a while by financing constraints. But overall, it now appears that investment may not be as weak over the year ahead as earlier expected. Higher dwelling activity and public demand will also start to provide more support to spending soon and, hence, growth is likely to firm going into 2010. "The Board's judgment is that the present accommodative setting of monetary policy remains appropriate for the time being. The Board will continue to adjust monetary policy so as to foster sustainable growth in economic activity and inflation consistent with the target."The latest official statement suggests that the RBA has found reason to downplay what the leading indicators of growth were pointing to at the time of the statement. There is possibly some justification for downplaying the leading indicators in this case, but in my experience once an economy gets up a head of steam growth doesn't suddenly subside significantly, even if one-off stimuli played a key part in fuelling the initial growth. However, to his credit RBA governor Stevens has been warning for some time that interest rate hikes are coming. The following contains excerpts from the governor's statement to the Senate Economics References Committee on 28 September 2009:

"Economic growth forecasts are being revised up. "¦ In due course, both fiscal and monetary support will need to be unwound as private demand increases. "¦ In the case of monetary policy, the Bank has already signaled that interest rates can be expected, at some point, to move off their current unusually low levels, as recovery proceeds. "¦ These adjustments back to more normal settings for both types of macroeconomic policy are what should be expected during a recovery phase of a business cycle."The latest statement by Stevens confirms that the RBA will hike the OCR as the data confirm the economic recovery, which means they will be around a year behind the game. However, in my assessment being a year behind the game is close to international best practice in the operation of monetary policy. By contrast, RBNZ governor Bollard has been digging his heals in over an earlier commitment to keep the OCR at or below 2.5% until late 2010. The following contains excerpts from the governor's statement on 10 September:

"There is more evidence that the decline in economic activity is coming to an end, and that a patchy recovery is underway. "¦ However, the medium-term growth outlook remains weak. "¦ For growth to be sustained in the medium term there is a need for improved competitiveness in the export sector and a continued recovery of household savings. This rebalancing is required to stabilise New Zealand's external payments position. If the exchange rate were to continue its recent appreciation and/or the recovery in house prices were to undermine the improvement in household savings, then the sustainability of the present recovery will be brought into question. "¦ As we have said previously, the forecast recovery in economic activity is based on monetary policy continuing to provide substantial support to the economy. We expect such support will be required for some time. As a result, we continue to expect to keep the OCR at or below the current level through until the latter part of 2010."The market has been pricing in OCR hikes occurring in New Zealand well before the end of 2010. In an interview Governor Bollard has suggested that financial markets can get it wrong and that they need to learn that interest rates are not always either falling or rising. The governor's stubborn commitment to keeping the OCR low for a protracted period despite the surge in many leading indicators looks like an attempt to prove that he is smarter than the financial markets. Being in the game of trying to outguess financial markets, I am the last person to say they are always right. But it is perplexing to see a central bank governor to effectively suggest publicly that he knows better than the financial markets, especially when the leading indicators point to the markets being on the right path. In the RBNZ's defense, the surge in the September quarter Westpac-McDermott Miller consumer confidence survey wasn't released until after 10 September. However, existing house sales are a useful leading indicator of consumer spending in New Zealand and have for some months pointed to the likelihood of a strong rebound in spending over the second half of 2009. In the 11 June 2009 Monetary Policy Statement (MPS) the RBNZ revised down its predictions for consumer spending growth but at the same time released an alternative scenario that predicted an earlier and stronger recovery in consumer spending. The following comments in the June MPS are relevant (page 29):

"While improved housing market turnover may well continue for the next couple of months, we expect the pick-up ultimately to be short lived, and dominated by the risk of unemployment and high debt levels facing households. That said, house sales have historically proved to be an extremely good early indicator of future movements in household spending. As such, there seems a clear risk that, over the next few quarters at least, household spending turns out stronger than we currently project."The RBNZ dropped the alternative scenario in the September 2009 MPS despite the leading indicators suggesting it should be the central scenario. This reinforced my suspicion that the RBNZ was likely to repeat the same "go for growth" mistake it made between 1999 and 2006, which I have written about previously. The irony is that by committing to keep the OCR low the Governor is ensuring that the domestic economic recovery, led by the housing market, will be strong and that the desired recovery in household savings will not eventuate. Strong economic growth is just the sort of thing forex traders love so the NZD is likely to head higher this year, undermining the international competitiveness of exporters and firms competing against imports. By taking insufficient notice of what the leading indicators are pointing to, Governor Bollard risks looking unwise, but of more concern it means the boom-bust cycles that the RBNZ has sponsored in the past are likely to continue. Some industry groups will understandably applaud Governor Bollard's stance and his view that the market is misplaced in betting that he will start hiking the OCR before late 2010, but by burying his head in the sand he risks condemning New Zealand to a continuation of boom-bust cycles. Consequently, I have been recommending our clients gear-up and/or invest on the expectation of an earlier and stronger economic recovery than the RBNZ is predicting. Equally, I have been warning that reality will win out eventually, meaning interest rates will most likely be hiked both earlier and more than the RBNZ is predicting.

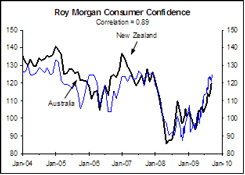

The Roy Morgan consumer confidence surveys provide the most frequent updates on Australian and New Zealand leading indicators. It is no accident that consumer confidence has rebounded strongly in both countries.

In NZ's case the combination of sub-6% mortgage interest rates, a surge in net migration, a recovery in global growth, some fiscal stimulus and some healing of the local credit crunch were always going to result in a strong rebound in growth despite a high NZD.

Similar factors are driving the Australian recovery. There is a moral hazard in central banks using confidence surveys as key inputs into OCR decisions.

However, I would hope that central banks are smart enough to make use of confidence surveys without corrupting them in the process, although maybe that reflects wishful thinking and poor judgment on my part.

_________________

* Rodney Dickens is the Managing Director and Chief Research Officer for Strategic Risk Analysis (SRA), which is a boutique economic, industry and property research company. Rodney produces regular free reports on topical issues and on specific property markets. Find out more about SRA here and sign up to SRA's free reports here.

The Roy Morgan consumer confidence surveys provide the most frequent updates on Australian and New Zealand leading indicators. It is no accident that consumer confidence has rebounded strongly in both countries.

In NZ's case the combination of sub-6% mortgage interest rates, a surge in net migration, a recovery in global growth, some fiscal stimulus and some healing of the local credit crunch were always going to result in a strong rebound in growth despite a high NZD.

Similar factors are driving the Australian recovery. There is a moral hazard in central banks using confidence surveys as key inputs into OCR decisions.

However, I would hope that central banks are smart enough to make use of confidence surveys without corrupting them in the process, although maybe that reflects wishful thinking and poor judgment on my part.

_________________

* Rodney Dickens is the Managing Director and Chief Research Officer for Strategic Risk Analysis (SRA), which is a boutique economic, industry and property research company. Rodney produces regular free reports on topical issues and on specific property markets. Find out more about SRA here and sign up to SRA's free reports here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.