The trend for residential building consents continued to rise in July after hitting record lows at the start of 2009, figures released by Statistics New Zealand (Stats NZ) show. (Update 2 includes non-residential consent chart.)

There were 1,214 residential building consents in July, an increase of 10.4% from June and at the top end of economist expectations.

The rise was attributable to a 19.9% jump in the number of consents for houses from June, which were up to 1,159 in July, its highest level since September. Consents for houses were down 12.3% from July 2008 but this was better than the 24% year-on-year fall seen in June.

The number of apartment consents fell by more than 50% from June to 55 in July, its lowest level since October 2008. Figures for apartment consents had been held up in recent months due to an increase in retirement village building. In July 2008 there were 113 apartment consents issued.

The trend for residential building consents continued to rise in July after hitting record lows at the start of 2009, figures released by Statistics New Zealand (Stats NZ) show. (Update 2 includes non-residential consent chart.)

There were 1,214 residential building consents in July, an increase of 10.4% from June and at the top end of economist expectations.

The rise was attributable to a 19.9% jump in the number of consents for houses from June, which were up to 1,159 in July, its highest level since September. Consents for houses were down 12.3% from July 2008 but this was better than the 24% year-on-year fall seen in June.

The number of apartment consents fell by more than 50% from June to 55 in July, its lowest level since October 2008. Figures for apartment consents had been held up in recent months due to an increase in retirement village building. In July 2008 there were 113 apartment consents issued.

Seasonally adjusted, there were 1,151 residential building consents issued in July, up 5% from June. Trends are based on the seasonally adjusted figures.

"Excluding apartments, the seasonally adjusted number of new dwellings authorised in July 2009 rose 11.2 percent, after rising 3.8 percent in June 2009," Stats NZ said.

"Although the level is still low, it is at its highest since September 2008. The trend for the number of new dwellings authorised, excluding apartments, has been increasing since March 2009, although it remains at a low level."

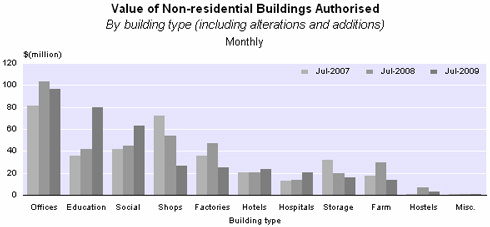

The value of non-residential building consents in July was NZ$371 million. This was up from NZ$307 million in June, but still below the NZ$383 million in July 2008.

Seasonally adjusted, there were 1,151 residential building consents issued in July, up 5% from June. Trends are based on the seasonally adjusted figures.

"Excluding apartments, the seasonally adjusted number of new dwellings authorised in July 2009 rose 11.2 percent, after rising 3.8 percent in June 2009," Stats NZ said.

"Although the level is still low, it is at its highest since September 2008. The trend for the number of new dwellings authorised, excluding apartments, has been increasing since March 2009, although it remains at a low level."

The value of non-residential building consents in July was NZ$371 million. This was up from NZ$307 million in June, but still below the NZ$383 million in July 2008.

ASB economist Jane Turner said today's consent issuance suggests the construction industry is close to reaching a turning point.

ASB economist Jane Turner said today's consent issuance suggests the construction industry is close to reaching a turning point.

Nonetheless, overall consent issuance remains weak and the economic recovery remains fragile, threatened by rising longer-term interest rates. Looking ahead, demand for new housing will be underpinned by the recent increase in net migration. However, rising unemployment and slow wage growth will moderate the increase in demand as households remain slightly cautious.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.