Statistics NZ has reported core seasonally adjusted retail sales fell 0.1% in July from June as consumers spent less on recreational goods and liquor, but more at grocery stores and hardware stores.

Total seasonally adjusted retail sales fell 0.4%, sagging after a 1.0% rise in June. This was worse than economists' expectation for flat sales and reinforced economists' views that the Reserve Bank is likely to hold the Official Cash Rate at 3% on Thursday.

(Updated with ASB economist's disappointment and JP Morgan saying the pre-GST spending splurge may be less than expected)

ASB economist Christina Leung said the data was disappointing and reinforced ASB's view that the OCR would be held on Thursday.

"The small decline in retail spending in July is slightly disappointing, particularly given the declines in spending on discretionary items. However, the result does follow a substantial increase in June and given the monthly volatility in this data overall the result points to a recovery in retail spending taking place," Leung said.

"This is illustrated by the fact that the sales trend for both total and core monthly retail sales values are now at the highest levels since the series began in May 1995," she said.

"Nonetheless, the recovery appears to be taking longer to take traction than the RBNZ initially thought, and today’s result reinforces our expectations that the RBNZ will leave the OCR on hold until the start of next year."

JP Morgan economist Helen Kevans said the figures showed retailers were struggling as consumers reduced debt, also reinforcing the RBNZ is likely to hold the OCR on Thursday.

"The significant discounting still occurring among the nation’s retailers continues to weigh on sales in value-terms, but the retail numbers also suggest, to some extent, that the drag forward of spending ahead of the GST hike in October already may have run its course," Kevans said.

"Indeed, spending on big-ticket items was reined-in in July. Sales of furniture, for example, fell 2.4%m/m, and sales of household equipment were down 3.2%. There also were large falls recorded in discretionary areas of spending," she said.

"We suspect that sales volumes likely will suffer a significant hangover post-October, given a vacuum of demand and as households consolidate spending patterns. The government has announced measures aimed at encouraging saving and steering New Zealanders away from their debt-fuelled spending habits. With households set to realign their spending patterns and consolidate balance sheets, which have historically been too leveraged to housing debt, retailers likely will have little pricing power. "

Here is Statistics NZ's release below:

Seasonally adjusted core retail sales (which exclude the four vehicle-related industries) were flat in July 2010, down just 0.1 percent ($3 million), Statistics New Zealand said today. This follows a 1.5 percent increase in June 2010. “Sales in all five food-related industries increased, with supermarket and grocery stores recording their largest rise since March 2007,” business statistics manager Louise Holmes-Oliver said.

These increases in the food-related industries were offset by decreases in most of the other core industries. The main movements in core retail were:

* supermarket and grocery stores, up 1.9 percent ($24 million)

* cafes and restaurants, up 4.3 percent ($14 million)

* recreational goods retailing, down 7.0 percent ($14 million)

* liquor retailing, down 9.3 percent ($10 million). Total retail sales fell 0.4 percent ($24 million) in July 2010 following a 1.0 percent ($53 million) increase in June 2010.

Of the four vehicle-related industries, motor vehicle retailing had the largest decrease, down 2.3 percent ($14 million).

The sales trend for core retail has been rising since February 2010 and is now at its highest point since the series began in May 1995. The trend for total retail sales has continued rising since February 2009. Seasonally adjusted sales in the South Island fell 0.9 percent in July 2010, while sales in the North Island were flat, down just 0.1 percent.

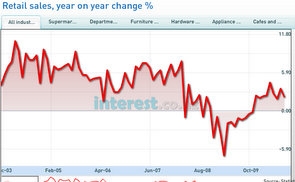

Auckland was the only region to record an increase in sales, up 0.5 percent ($9 million). In actual terms, total retail sales rose 2.2 percent ($116 million) in July 2010 compared with July 2009. Core retail sales rose 1.7 percent ($67 million) over the same period.

Retail sales

Select chart tabs

2 Comments

Yep... when I have been to the supermarket recently I've noticed quite a lot of wine heavily marked down in price - in fact some brands and wine styles are up to 50% off... what was selling for $40 is now available for $20.... $30 for $15 etc...

Now partly this is due to the fact that the wine industry overall is in the poo and winemakers are desperate for cash flow, but it also shows that they can't rely on their usual outlets to take the supply - one example, 2004 Bordeaux style cab sav - was $36, now $20... you just don't get 6 year old reds at the supermarket, but there it is! I bet if it was $15 it would fly off the shelves....

Point is that consumers are just not spending much above the necessaries and when they are it isn't a whole lot more - even in the so called affluent suburbs (where i live)...

Booze is generally pretty recession proof, but not this time...

This time is different HG.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.