The first figures out for the property market in September paint a picture of a subdued market where inventories of unsold houses are rising in a buyers market.

The September NZ Property Report from Realestate.co.nz measures the number of new listings, asking prices and levels of inventories. It is the first to show the impact of the September 4 earthquake in Canterbury and the first to give an indication of activity in the first month of spring.

Barfoot and Thompson are expected to release their sales figures for September next week, followed by Quotable Value and then the Real Estate Institute of New Zealand's national sales figures on October 14.

"While September through November are typically the strongest months for new listings, only 10,559 new properties came onto the market nationwide last month, fewer than the winter months of June or July, and up only 8 percent on August," Realestate.co.nz reported.

September's new listings were down 17% on September a year ago. Christchurch new listings fell 26% from August.

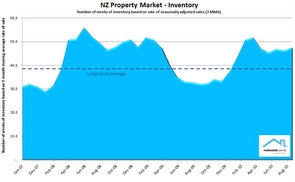

The inventory of unsold houses on the market in September rose to 47.5 weeks of sales from 46.1 weeks of sales in August, Realestate.co.nz. This inventory level is up 48% from the same time a year ago.

"With consolidated long-term data indicating 39 weeks to be the national threshold between a market favourable to either sellers or buyers, current inventory levels indicate that most parts of New Zealand remain a buyer’s market," Reealestate.co.nz reported.

“Traditionally, there is a much-anticipated rise in new listings in Spring, however the September figures this year point to a modest increase in line with the overall context of a subdued property market throughout 2010," Realestate.co.nz CEO Alistair Helm said.

Realestate.co.nz said the 26% fall in listings across the Canterbury region in September from August was not as significant as some expected. On a seasonally adjusted basis and in comparison with other regions, listings were down around 20% in Canterbury.

The asking price expectation rose slightly allowing for the seasonal rise which is evident at this time of year as properties are listed to meet the seasonal activity. "This 1% rise on a seasonally adjusted basis would seem to signal a confidence amongst sellers, that buyers who have for so long been sitting on the sidelines will become more active," Realestate.co.nz said.

The asking price expectation of new listings increased again in September up to NZ$411,745 from NZ$403,423 in August. This represents a 2% fall from September last year. It is up 2% from 3 months ago. The current asking price is 4% below the peak reached in October 2007.

55 Comments

Isn't it curious how asking prices rise just as inventories rise?

Mass delusion?

Or do asking prices not mean much these days?

cheers

Bernard

If it's not going to sell, it may as well 'not sell' from more $, rather than less!

Now that's Nailing it Nick.....

What I think is unethical is when a house is passed in at auction , with the vendor's bid x being the highest, and then it's reported in the local newspaper as having been passed in at x. If there were no genuine bidders at the auction, it should be reported as such and not reported as having been passed in at what is a somewhat inflated amount....

Too right Joseph...I found out that the vineyard mortgagee auction in Marlborough where the bank was owed 4.4m and the reported bid at the auction was 2 million.....is all crap.....it is likely no bids were received at all.

Greedy ppl hoping there are stupid ppl out there.......

regards

One of our neighbours dropped the price of their 2.5 acre lifestyle block/house from a cool $ 1 million , to a bargain $ 740 000 , and it sold soon-after . The QV is a touch above $ 500 000 !

Problem is Steven stupid people are being considered ...no longer bankable.....they're just out there now with no dosh to slosh.

Of course it means nothing Bernard, unless it's the opposite:

"Asking prices fell 1.1% on a seasonally adjusted basis in July from June and have been cut 5.2% in the last four months as sellers adjust their expectations in the face of high inventory levels and weak buyer demand"

BH, not long time ago.

The property market is tanking, as we all knew it would. Well, as those of us who aren't clueless suckers knew it would. LOOK AT IT BURN! LOL.

Maybe its a case of the buyer will expect a 10% discount so we will ask 12% more knowing this....

Ive seen that one before........Im sure some buyers will be that dumb....but most....no...

and in fact they seem to be expecting a selling glut and a drop in prices,

http://www.stuff.co.nz/business/4192047/Valuers-warn-of-spring-property…

Remind us how last summer's selling went....

Apart from Gummy bear I dont see too many ppl (in fact anyone else) saying we are recovering [well]...in fact many ppl seem to be thinking things will slide....Funny thing is this isnt the "socialists" sayiing this but the analysts and economists who seem to be right of centre politically....these should be Gummy bears poster boys and girls....

Funny that.

regards

Verdict.

1. If you are a buyer - Don't

2. If you really must - make a silly offer

3. If it gets accepted - maybe you should have stayed renting until next year

Or is this all too negative?

B.H. it's spring and you know full well there will be a flood of listings with the r.e. boys a singing ...here we go here we go.....in anticipation of a flood of spring time buyers.....there will be much fanfare surrounding any sale.............. spring will come and go......and the R.E. boys will have had their confidence severely tested........Sellers will balk......Buyers will bail....Bankers will wish they had never been so short sighted in the name of profit............. oh Ponzi why have thou forsaken us......oh dear.....oh woe

RE's still get their %

regards

Yes, mass delusion alright Bernard, cant see where these people are coming from?

If you are selling in this market its a D reason.

Death.

Divorce.

Desperation.

The buyers are smart enough to know this is their market, cant see it getting any better.

if there isn't a demand you don't supply to it and things remain static and when there is a demand you can name your price... or at least get it....

almost time to fill up the shopping trolley as the impatient call it quits and have a spendathon on property me thinks

prices will lift from the sideways creeping they have been doing at some stage and everyone will want to be on the band wagon again, but most will be too scared to act

property right now is okay if you can afford it, or can't afford to be without it...

We have just sold (5% under GV).

Not sure what to do now.

We dont work and were already living off our substantial savings in the bank. We are too young for the pension.

Didn't really want to put more dosh in banks. Didn't have a mortgage and just over 900k from house sale added to the bank deposits.

Yes wolly, we have a small amount of silver and gold....and too late to move it to Aussie at .75 in the dollar.

Doesn't feel right not owning some Real Estate. Just 0 and ones on the internet banking sites....

After 2 years in the same boat, I can say, unequivocally, "You'll get used to it... and it's great!"

Take a drive around the town ............ See all the " For Sale " signs . Lots of them ? ............ You may have done well , to get out successfully , when you did .

Munny in the bank , but ? C'mon , you can do better than that !

yeah you can do better - like entrusting it to a finance company, your favourite lawyer or accountant, business partner etc - as they all have your best interests in mind - Yeah Right!!!

Or become financially literate , and trust yourself only . Then if you stuff up , as most of us do occassionally , you can blame only yourself , and learn from the experience .

But...but...but...THAT'S TAKING RESPONSIBILITY FOR MY OWN ACTIONS!

No sir, I prefer to trust the RE industry. They've never let me down yet. My last mortgage broker was even kind enough to send me a sympathy card after I was bankrupted and mortgageed. Now THAT'S class!

Get a Camper and chill out..join the Caravan association and get free parking at the DOC Campsites..read some good books,and be patient.

maybe you can find a property that stacks up and go to work on that. $900k left over from house sale meant you had a gold plated roof in investment terms....

perhaps now rent a nice penthouse, and pick up something you might not necessarily live in, but plenty of others would love to rent

and if you do have gold - know where it is. like property you need to see it. i lost out with goldcorp way back when they 'held it safely on my behalf'. i suggest buy a good GPS and bury it in your favourite forest - not in your own back yard. BUT make sure you have documented somewhere its location. I know of people passing away or losing their marbles and with that the location of the treasure.

but a house is always going to be easier to find.

and look up http://en.wikipedia.org/wiki/Bank_run and you will see money in the bank really is it is only zeros and ones

It took me 2 years to get used to it. Lots more free time at the weekend, no repairs, a nice house to live in and no worries during earthquakes/floods/storms/OCR reviews.

Just make sure you rent a house you enjoy living in and don't let the real estate thieves make you feel like a second class citizen (on that score I would never again use a real estate agent as a property manager).

What to do with the $ is a tricky one. Personally I think commercial real estate gives a good return that is linked to inflation and the economy. I'm not wealthy enough to afford to own the good stuff ($2million plus) on my own and you need a property manager who is good at managing commercial real estate. The main thing is to split the money up into parcels you are comfortable dealing with. I used to have it all in my own business but the problem is that if I don't do what needs doing it doesn't get done. I sold my house just as the GFC hit and found it hard not to freeze with all my money in the ANZ. So I went round town opening a new account every day or two and putting a sum I could cope with in each one. After I had done that they brought in the government guarantee but it was all rather peculiar for a bit there.

What about that huge SCF gg bene payment you recently collected? Why is it that you welfare bludger losers will always find something to whinge about even after taking big handouts from the hardworking taxpayer?

I haven't had the "huge" payment from the SCF investment yet!

Had the smaller one for the bonds a week ago.

I have about $800k in bonds of which the SCF ones made up $260k.

I didn't invest for SCF to crash or to rip off the government. I would have preferred SCF was still ticking along paying 8%. I am still getting over 8% on most of my bonds. Even have two large investments at asb bank that pay well over 8% with two years still to run. Most people didn't invest at SCF to bludge. If a trading bank collapsed under the GG I suppose that would be OK with you?

At this stage we are going to live on the boat for a while while we look around for another RE investment. Our house formed around 23% of our net worth so don't really need that extra money invested to live.

The house was mortgage free and the just over 900k sales price didn't include any RE agents fees as we sold privately using trademe.

Wouldn't invest in anything other than physical gold. I have been buying sovereigns for years. Bugger the paper stuff.

On the other hand, rents seem to be rising http://www.stuff.co.nz/business/personal-finance/4187756/Quake-hits-Christchurch-rentals. Up 11% in Auckland, that's significant (and listings down 30%, which is in line with the inventory of "for sale" houses going up). That'd push me to buy if I was renting.

Wasn't the argument that rents couldn't rise unless wages did because people wouldn't be able to pay rents anymore? Looks like there's a bit of a margin to play with here and people are in fact abley to drop some "nice-to-have" stuff from their expenses to meet higher rents...for now anyway.

In the Far North new capital valuations arrived yesterday. My place has fallen from 400k to 350k over the three years since the last valuation - that is 12.5%.

My mates place has dropped from 1 060k to 890k - that is 16%.

Everybody else I have talked to has seen falls of this nature also.

It seems to me Mr BH is exactly right in his analysis of what has happened and will happen to property prices (at least here).

I don't know about the rest of the country but we've been looking in central Auckland suburbs - not much out there and people seem to hold off selling their (good) houses. The ones that we've been thru' were either leaky or needing a massive renovation.

Yeh we were 315k and now its 250k....the future has arrived.

Hang on a second mate - hang on! I thought property prices never fell... At least thats what the guy at the seminar said...

But in reality - yes you are right. The future has arrived and will continue to arrive for some time. I'll continue to live cheaply until such time as I feel that property prices are reasonable and I've actually decided where I might be living for the next 10 years. Kia Kaha to all those who had patience and weren't put off course by all the nonsence of the last few years.

It's Friday ....yay....its time for the Friday smile....whoohoo!

Living wills

While I was watching the rugby last weekend, my wife and I gotinto a conversation about life and death, and the need for living wills. During the course of the conversation I told her that I never

wanted to exist in a vegetative state, dependent on some machine and

taking fluids from a bottle. She got up, unplugged the TV and threw out all my beer.

lol

And that is why I'm a firm advocate of " wife swapping ".

.............. I got a second hand bicycle for mine

.......... At least I can ride it whenever I want to .............

Good for you GBH.........at least you know when your coming or going.

Wondering about average listing prices.

Two from East Auckland

A. cv $1.45m. Was originally listed at $2.95M and after a few months listed by a new agent at 2.45M

B. cv $3.45M. Listed this week at $8.0M

Are these included in the listing averages?

Dream on.

well there you go. after being a happy renter for my whole life, and a fully paid up member of the property is stupidly overpriced club, we just returned to nz and bought a home in devonport, auckland. we paid 20 percent under govt valuation and ten percent under an independent valution. everyoen thinks we got an amazing deal but as a member of aforementioned club, i just think we just got a pretty fair deal.

Your being alittle too optimistic actually. Does the bank now own you or are you 'free'hold ?

maybe, there's always that possibility afterall, but on balance for the price we got for the house and street in which it is, i don't think so. i was born and raised in devonport and have family and friends still living here so know the area well. our home was purchased for many personal reasons so while economics definitely played a major part in our decision as it should, it is exactly what suits us now. and we own the house not the bank. screw them. have always enjoyed your posts, justice...

Well that's great! If it's a 'home' your after then all power too you and excellent you screwed the banks by not borrowing their blood money. Nice to here. If your 'free' of debt. Some still have their heads screwed on and that gives me hope

Hey Justice,

I think you mean "are you mortgage free or unencumbered?"

Freehold relates to the land. ie, not leasehold.

Yes, well it wasn't meant to be taken so literally. I take your point though.

There is a time to buy,and a time to sell!Now,still is not that time to buy-no matter what the R.Es say.

Patience is a virtue when it comes to buying property.Anon

Bernard - I find it a bit irritating that each month there are about 4 releases on the state of the property market - each one for the same month - and for each one you cover it as if it was ground breaking and newsworthy. We have unconditional's preliminary report, followed by Barfoot, followed by QV, followed by REINZ. The only one that should matter really is REINZ. The problem with this is that any good news or bad news get reported 4 times - and it becomes a self-reinforcing accelerator - driving up prices and volumes in good times and the reverse in bad times.

I do hope you show some journalistic intregrity when the REINZ/QV data comes out for September - given there was an earthquake in the 2nd largest city that will have stopped sales completely. Of course it will be a record low. And a disaster for that local market. But it is also unrelated to the broader market - and I hope show some restraint when the data comes out.

"Bernard - I find it a bit irritating that each month there are about 4 releases on the state of the property market..."

Yeah mate...it totally sucks to be reminded. LOL!

KS the REINZ report is the last one anyone should put any weight on as it is produced by spin doctors on behalf of an organisation who are never going to tell you the truth. Bernard is right the market is going to drop by 30%. What he got wrong is how long it was going to take.It is going to happen slowly but surely over a number of years. The Sunday Star Times this morning has a refreshing honest article by an NZ valuation firm. There is a growing glut of houses coming on the market at present as people try to get rid of some debt they no longer want to support. The housing market in NZ has been in a downward trend for several months and it is gathering steam. Spring is only going to make it worse for vendors. Buyers should just back off and be patient as paying rent is costing them pennies but waiting for prices to fall further is going to save them tens of thousands that they will not need to borrow. This is great news for my kids and your kids who will be able to buy a home like we did without needing help from mummy and daddy.It can only be good for the nation. i am not concerned about the stupid and greedy who borrowed to much for their big home or for their rentals as they should have known better.

Keyser you killjoy - the more times Bernard releases RE reports the better . PI's and anti PI's slug it out round after entertaining round - best show in town.

Personally I'm a 'don't gamble with the roof over your head, always own your own residence just in case you call the market trend wrong and get left on the street ' kind of guy but accept the renters might just have it right for the meantime.

Bollocks to your view BH should 'show restraint' when releasing reports and giving his views on the data. It's called freedom of the press and may it thrive for ever.

Yeah , and bring back the Duke ............. Want some fireworks around here to relieve us of the tedium of Bernard's endless " self-fulfilling-negativism. "

Gums

Yes, a bit relentless but I like a passionate advocate so still enjoy his unswerving devotion to the downside. Suggest however that his hefty doses of negativism have been well justified at times over the last couple of years.

We are far from out of the woods but one or two little stars starting to maybe align in the economic universe - perhaps suggesting prophet Bernards recent prediction that ' all the signs are there that something BIG ( read .. bad, really , really bad) is about to happen (to the world financial system) ' might not in fact come to pass after all.

Notice his recent article conceeding that the landscape is possibly not as unrelentingly grim as he had been suggesting ?. The first halting steps of the atheist towards the door step of the church perhaps?

The problem out there is that there's stil people who want to buy houses for the right reasons. Everyone wants their own little piece of land and house but the sellers and the market is so unrealistic that these people are forced to rent or lose their patience and eventually buy in this expensive market. The great thing about the stockmarket is that drops happen instantly. Sellers need to get on with it, get realistic and stop this mexican standoff.

Dr Housing Bubble in California points out again and again, that their price crashes took 2 years to come after the sales dropped and the number of listings started to bank up.

Reading "The Big Short" by Michael Lewis, I am impressed with just how LATE in the piece the clever hedge fund operators in the USA started to "short" mortgage backed securities - and how late in the piece the big insurers were still willing to sell them derivatives. The bubble markets had well and truly banked up with stock already, and the mortgage defaults had begun; it was just that the price falls hadn't really started. The big insurers like AIG - indeed, virtually everybody, were still saying that the market was sound and that a few signs of trouble were only temporary.

Right now, things are hotting up on this front in Aussie.

http://www.theage.com.au/business/cba-takes-the-advice-of-the-agency-it-parodies-20100914-15b0o.html http://www.theaustralian.com.au/business/industry-sectors/analyst-blasts-cba-for-denying-home-bubble/story-e6frg96f-1225919848419 I LOVE this line in "The Australian": "........The Australian housing bubble debate is running hot, with hedge funds looking at short-selling opportunities......" And this one from "The Age" article: ".......At this point, if I’m an international investor, I’m thinking ‘we gotta short these chumps’......" Google "Shorting Australian Housing" or "Shorting Australian Mortgages". If you've got money to invest at big odds, there are some hedge fund operators out there right now who want to talk to you about this. (Presumably NZ is too small to bother with). Just bear in mind that the market can stay irrational longer than you might be able to stay solvent. Michael Lewis's book talks about some people who abandoned their "short" bets on mortgage backed securities after about 2 years waiting for their crash. These people must have felt SOOOO sore about the successful betters who did their "short" bets late in the piece. The big banks on Wall Street who were acting as middlemen on the derivatives transactions, one by one over a matter of days, ceased to take the bets - just as they were getting a "wave" of people who "got it" and who were making inquiries how to get in on what was becoming an obvious way to gain BIIIIG from others mass stupidity. What I find all the more ironic about all this, is that in this part of the world, we love knocking the stupid Yanks. Yet even with their negative example to learn from, us and the Aussies are guilty today of almost exactly the same collective illusions about our property markets.Asking price up 2%, BH suggests it’s meaningless anyway. 3 mnts ago, asking price fell 1.1% BH concludes: “...sellers adjust their expectations in the face of high inventory levels and weak buyer demand...”

Ha,ha, you are a legend

BH makes sense to me, Alen1 ! Inventory up; buyers fewer - lower asking price. Same parameters doesn't make sense at all ie: to put asking price up- unless you know it's not going to sell under any circumstances!

http://www.stuff.co.nz/sunday-star-times/news/4192070/House-prices-spring-a-leak

An article in the Sundat Star Times (not yet on line) analyses the relative benefits of buy v rent for an average house with an average income and suggests you could be $100k better off by renting for the next five years.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.