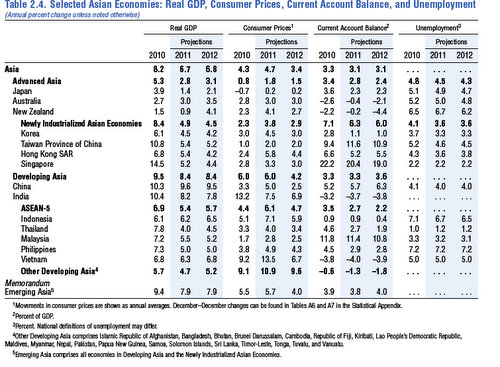

The International Monetary Fund has downgraded New Zealand's economic growth outlook for 2011 after the February 22 earthquake in Christchurch.

The IMF, which also downgraded its growth forecast for America and Japan, saw New Zealand's GDP growth slowing to 0.9% in 2011 from 1.5% in 2010, before rebounding to 4.1% in 2012.

The IMF forecast consumer price inflation rising to 4.1% in 2011 from 2.3% in 2010, before dropping back to 2.7% in 2012.

It saw unemployment rising to 6.7% from 6.5%, before dropping to 6.2%. The current account deficit would improve in 2011 to 0.2% from 2.2% last year, before blowing out again to a deficit of 4.4% in 2012.

The IMF's Mission Chief for this region Ray Brooks visited last month and warned that New Zealand should widen its tax base and control its budget and currrent account deficits.

See more here in Alex Tarrant's article.

Brooks also called for the Reserve Bank to use its macro-prudential tools more aggressively to reduce the vulnerability of New Zealand's banks and the economy more generally to a shut down on global financial markets. See Alex Tarrant's article here.\

Also see the full IMF report on New Zealand from March 21.

The table of forecasts from the IMF's global forecasts is below. See the full document detailing the forecasts here. The table below and the NZ commentary is on pages 73 and 74.

16 Comments

Jeez they sure do have some great dart throwing monkeys at the IMF...every day's an adjustment...what a load of old bollocks....

0.9% for 2011? Only 5.1% lower than Westpac's prediction of 6% for 2011!!!!!!

Unemployment will be higher than 7% I suspect

Thank you for reminding us of that Matt, I had already forgotten about it (having filed it in the garbage folder).

Now personally 0.9% will look optimistic in about a couple of months time. I'm picking real GDP to be seriously negative for the 12 months to Dec 2011, try -1.5% (my realistic pick) but given where inflation is at right now, plus the contraction in ChCh GDP and no rebuild likely anytime soon then surely -5% could be possible?

Chris - an absolutely farcical prediction of the greatest magnitude from the wankers at westpac

Remember O'Donovan at the start of the year saying he expected a "rip snorter" of a year from the Nz Economy!!!!!!

I think westpac meant 0.6%

regards

IMF *YAWN* another meaningless load of econobabble. Sounds like the report from 20 years ago with a change of date...

'NZ widen its tax base" The IMF's Mission Chief for this region Ray Brook obviously didnt get out much into the real world from his 5 star first class caviar visit to NZ. Hes all worried bout this and that but his banking mates created the mess, Yo hello

Cue Bono?

http://www.economist.com/blogs/freeexchange/2011/04/energy_prices

"The persistent increase in oil prices over the past decade suggests that global oil markets have entered a period of increased scarcity. "

No sh***t Sherlock....

"Given the expected rapid growth in oil demand in emerging market economies and a downshift in the trend growth of oil supply, a return to abundance is unlikely in the near term."

Not any term mate.....

"This chapter suggests that gradual and moderate increases in oil scarcity may not present a major constraint on global growth in the medium to long term, although the wealth transfer from oil importers to exporters would increase capital flows and widen current account imbalances."

Read, the Saudi's will own everything.....

"Adverse effects could be much larger, depending on the extent and evolution of oil scarcity and the ability of the world economy to cope with increased scarcity."

It cant it will collapse.....

"Sudden surges in oil prices could trigger large global output losses, redistribution, and sectoral shifts."

So thats a global depression, and mass migration as ppl move to to find food.

"There are two broad areas for policy action. First, given the potential for unexpected"

It isnt un-expected, its been thought through for those willing to think on it and not hide their heads in the sand...

"increases in the scarcity of oil and other resources"

Oh like Phosphos say....

"policymakers should review whether the current policy frameworks facilitate adjustment to unexpected changes in oil scarcity."

So its up to Govns and not free markets to dig us out of the doo doo.

"Second, consideration should be given to policies aimed at lowering the risk of oil scarcity."

I think they mean impact....this isnt a risk as its a certainty, 100%...

Like duh........all I can say is rather late and very weak wristed....

regards

Steven - don't worry. Our finance Minister doesn't think Peak Oil is important - according to a recent ODT 'editorial'.

One presumes he thinks (?) that at a certain price, an alternative will be found, in such abundance that we can double, and double that again, all that we do.

Did Muldoon have a PPL? Just a thought, might have been a precedent .......

He thinks? Ive not heard anyone say that about him....

regards

Inflation is running 5%...IMF dart throw means we will decline by 4.1%....and we will still have the $350ooooooooo in private debts...plus about $75ooooooooo in govt debts....and let's not forget rates are on the way up......on top of that the day the real Chch rebuild starts the price of every sodding building material and labour input will blast to the moon....hello stagflation my old friend...you have come to stay for quite some time.....am I right?

its pathetic Steve

when I did my first degree in the early 90s we were being taught about peak oil and climate change, anyone who believed in that stuff was considered almost a raving lunatic by the mainstream

Imagine if we acted on that wisdom then where we might be now in terms of being more resilient

some of us did, Matt. :)

but nowhere near enough of us did to make a difference in the bigger scheme of things

Globally i think thats right, but just NZ? small, agile, low population density, lots of hydro, fairly low tech renewables...still have minerals..."spare" food....etc.....and we are far enough away and have little enough that the chances of getting attention I hope are slim...we might not be too bad......provided some nutter in Pakistan or something doesnt sell a nuke or 6 to the Taliban that is....

regards

"raving lunatic by the mainstream"

What else can be said...........no one has listend to scientists or engineers in decades...how many are in Govn? None or virtually none....what we do see are the arty farty disaplines at best....or wonky failed business ppl or worse loony unionists...

Some of the ppl I sort of know have arts degrees or ancient greek degrees, try explaining to these uh deep thinkers and uh philosphers types that this is bloody awful and its going to be tough and they look at me like Ive lost it......drooling idiots every one of them.

So what can we expect but failure? how many of the Pollies have any concept of project management? or the scale of the financial cost and impact thats needed for the scale of the engineering challenges we face? from what I can absolutely none...

I think some lawyers said we need lawyers in Parliment as the law / legislation is so complex only they can understand how to write it properly....writing utter garbage "nicely" aint going to cut it mate....we are now into injury time no one knows when the whislte blows but when it does.......

regards

The IMF, which also downgraded its growth forecast for America and Japan, saw New Zealand's GDP growth slowing to 0.9% in 2011 from 1.5% in 2010, before rebounding to 4.1% in 2012

It appears that the IMF sees a strong growth in the economy in 2012 !! Why ?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.