By Alex Tarrant

New Zealand is better placed now than in 2008 to deal with global market turmoil, with a falling exchange rate cushioning export price falls, and room to move still on the interest rate front, Finance Minister Bill English says.

As the Australian government sets itself to revise down revenue forecasts due to the fallout from the European sovereign debt crisis, English said the most recent advice he had received from Treasury before the November 26 election was there were no significant reasons to change forecasts in the pre-election economic and fiscal update (PREFU).

Recent global market events were not as sudden as those following the collapse of US investment bank Lehman Brothers in 2008, although English cautioned current events may be as serious. The New Zealand economy was better placed to deal with the current crisis, he said.

Meanwhile, following reports the IMF might be in talks to help bail out Italy, English said the New Zealand government, as a stake-holder in the IMF, would expect to be part of any bailout talks. He indicated the European Central Bank was considered crucial to helping fix around the European sovereign debt saga, and that the biggest problem was a political one. It was vital Europe took responsibility for the costs and consequences of its actions, English said.

No December update

English will not be asking for December update of Treasury's forecasts for the incoming government, unlike in 2008 after the Lehman Brothers collapse sparked a global credit crunch which sent growth forecasts tumbling.

Treasury usually has to release a half-yearly forecast update in December, although not in election years, when the Pre-election economic and fiscal update (PREFU) serves that purpose.

Despite that, the incoming National-led government in 2008 asked for a December update as Treasury revised down its growth and revenue forecasts due to the international market turmoil that ensued following the Lehmans bankruptcy, which occured after the 2008 PREFU forecasts were finalised.

English's office told interest.co.nz early on Tuesday there would be no December update in 2011. The 2011 election was three weeks later than in 2008, and global events in 2011 since the October 25 PREFU were not considered as being to the same extent as in 2008. The next release from Treasury is set to be a Budget Policy Statement (BPS) in February.*

'It's not as sudden as Lehmans'

Speaking to media in Parliament Buildings later on Tuesday morning, English said global events since the PREFU had clearly not been as sudden as events following the Lehmans collapse in 2008.

"But I wouldn’t say they’re less serious. I would say that New Zealand is in a better shape to deal with those events than it was," English said.

The government had managed to raise NZ$20 billion of debt in the year to June 2011, while this year the net borrowing requirements were between five and six billion. Government had also just dealt with a very large debt maturity so was not under big pressure in the debt market.

“Our banks are similarly in better shape than they were in 2008, although they do have higher refinancing needs than the government does,” English said.

He would be talking to Treasury officials within the next day or two, after first dealing with the transition into a second term of a National-led government.

“The most recent advice I had from [Treasury] before the election was they didn’t see significant reasons to change what had been put in the Pre-election update,” he said.

On top of this, a report released by the OECD today pointed to the resilience of the New Zealand economy.

“They’ve got forecasts that are a bit different from the Treasury forecasts, but not significantly different. They’re a bit lower. We are a resilient economy. For instance, we’ve seen the exchange rate come back in a way that will cushion the effect of any drop in export prices. We’ve still got room on interest rates. We’re reasonably well positioned if things get a bit negative,” English said.

Aussies eye lower revenue due to EU crisis

Australian Treasurer Wayne Swan is set to release a mid-year budget review this afternoon which will show a revenue track A$20 billion lower than previously expected, due mainly to the European crisis. In order to stick to his government's 2012/13 surplus track, Swan is expected to announce spending cuts, with some government agencies expecting to have their budgets cut by up to 5%, the Sydney Morning Herald reports.

English said it did not look like currently that the New Zealand government would have to do the same.

“The Australians did have some fairly bullish growth forecasts early on, so it’s not a surprise that, in the light of what’s happening to their domestic economy, as well as confidence issues out of Europe, that they’re revising their plans downward a bit,” English said (see video above).

'Dear IMF can we have a say in EU bailouts'

Meanwhile, in respone to reports of a possible bailout from the International Monetary Fund for the Italian government, English said the NZ government expected to be part of any discussions on any kind of IMF bailout in Europe. New Zealand makes contributions to the IMF's coffers, and had done very recently.

“We expect to be part of any discussion about its ongoing role in any kind of [IMF] bailout in Europe," English said.

"We do all have a common interest in Europe finding its way through its problems. The IMF has played a growing but still constrained role in that,” he said.

“We have some say. We’re a contributor, we’re effectively a shareholder. I think there would be a collective sense that if the IMF can reinforce European efforts, then there may be a role there. But it is absolutely vital that Europe takes responsibility for the costs and consequences for its own actions. You wouldn’t want to see the IMF moving in to replace that responsibility.”

ECB crucial?

Asked whether his view was the European Central Bank was key to helping fix the Euro crisis, English replied:

“The two countries that have been down this road, the US and the UK, in both cases it took concerted action from the central bank and the treasury to rebuild confidence. In both of those places their actual debt levels are just as bad, if not worse, than Europe’s.

“It’s the kind of solution we know about, because we’ve seen it put in place. The issues in Europe are fundamentally political and about decision-making, rather than whether there are technical solutions. We know what the technical solutions are likely to be, it’s whether they can be implemented,” English said.

History repeating? What happened in 2008:

The 2008 PREFU was released on October 8, with the text being finalised on September 26 and economic forecasts finalised on August 28. It began:

“Between the finalisation of the economic forecasts on 28 August and the finalisation of the text of the Pre-election Update on 26 September, a number of developments have taken place, including:

• The international financial crisis has continued to develop, with the US government taking control of Fannie Mae and Freddie Mac; US investment bank Lehman Brothers filing for bankruptcy protection; retail brokerage Merrill Lynch being bought by Bank of America; the US Federal Reserve announcing a rescue package for insurance company AIG; and the US Treasury developing a comprehensive plan to purchase “troubled assets” in order to stem further financial collapse.

• On 11 September the Reserve Bank of New Zealand cut the official cash rate by 50 basis points to 7.5%.

• The price of oil (West Texas Intermediate) fell to a low of US$91/barrel on 16 September, but increased again to US$111 on 25 September, just below its close of US$116 on 28 August.

• The NZ dollar fell to 61.9 on the Trade Weighted Index on 16 September but strengthened again to 64.2 on 26 September.

These international financial crisis developments, while not leading us to change our overall view of the economy, have increased the risks of a sharper downward correction.”

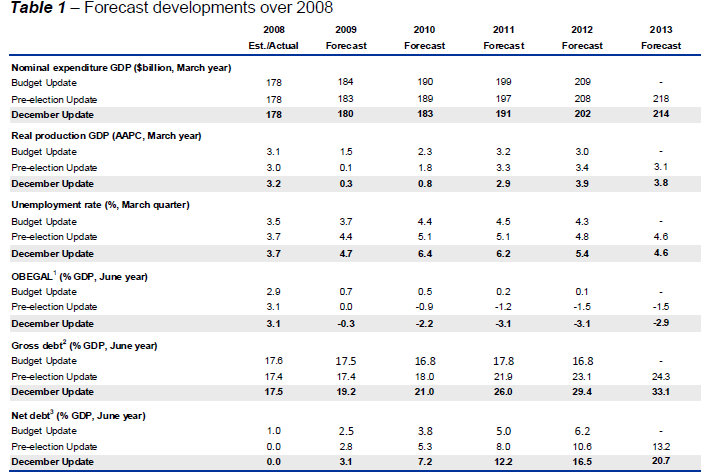

And they did. On December 18, 2008, Treasury, at the behest of the government, released a set of updated forecasts:

The outlook for global growth continues to weaken…

"The financial crisis has deepened and the outlook for global growth has been revised down significantly since the Pre-election Update economic forecasts were finalised at the end of August. In September, governments in the United States and the United Kingdom were involved in supporting a number of financial institutions and in October the intensified crisis spread to other parts of the world, with financial institutions in Europe and other countries affected. The impact of the financial crisis on the real economy has become more apparent with the United Kingdom, Euro zone and Japan falling into recession in the middle of 2008 and the United States economy contracting in the third quarter. Although governments and central banks have reacted to the crisis with fiscal and monetary stimulus, the outlook for world economic growth has been revised down sharply since the Pre-election Update.

Weaker world conditions are adding to the difficulties New Zealand is experiencing as it shifts to growth that is driven by more sustainable fundamentals than has occurred over much of the past decade. During this time consumers in New Zealand and in many other developed countries have accumulated considerable levels of debt in an environment where credit was easily obtained at attractive rates and rising house prices provided a sense of security for many homeowners.

…resulting in a period of lower growth for the New Zealand economy

New Zealand is forecast to experience a period of weak economic growth over the next couple of years as the economy is affected by low global growth and unwinds past imbalances. Real production GDP is forecast to grow by 0.3% in the March 2009 year. Growth is expected to remain weak over the 2010 March year at 0.8%, down from 1.8% in the Pre-election Update. Real GDP growth is expected to lift to around 3% in 2011 and just below 4% in 2012 and 2013, as growth in our trading partners recovers and monetary and fiscal policy responses help confidence to recover. As this occurs export and investment growth are expected to increase.

Read Treasury’s full December 2008 comments in the December update on its website here.

What's happening in 2011:

Outlook for the world economy

The outlook for the world economy is one of the main assumptions in our forecasts and also one of the major uncertainties. The greatest uncertainty is associated with the euro area sovereign debt crisis, which we expect to be resolved only gradually, with risks around key developments. The outcome of meetings of European leaders scheduled to occur between the finalisation of this text and its publication, and in the period closely following publication, could change the outlook for the euro area and the global economy. Future developments and responses will carry similar risks.

Our forecasts for economic growth in our main trading partners have been revised down from the Budget Update as outturns have been lower and the outlook has deteriorated (Table 1.1). While temporary factors, including natural disasters, account for some of the weaker growth to date, there is increasing acceptance that the recovery from the global financial crisis will be more protracted as household income growth is low and governments reduce debt.

Our forecasts for trading partner growth are similar to October Consensus Forecasts (released after we finalised) and the IMF September World Economic Outlook (WEO), released just before we finalised. Our forecasts assume an orderly resolution of the euro area debt crisis, although it is acknowledged that this may take a few years to be fully resolved. Euro area growth is expected to slow to 0.9% in 2012 and to rise to 1.5% thereafter. A scenario where the euro area debt crisis is not contained is explored in the Risks and Scenarios chapter. The scenario is based on the IMF’s recent WEO downside scenario, but the impact of the crisis is twice as large with trading partner output 3% below the main forecasts at the end of the period in our scenario.

The downside scenario does not envisage as sharp a downturn in the world economy as in the Global Financial Crisis (GFC) when our trading partners’ output contracted. In essence, we think policy makers have learned from the GFC and are better placed to respond should financial markets become disorderly. A rapid recovery followed the GFC as authorities responded with monetary and fiscal stimulus and stocks were rebuilt. In the downside scenario presented here, growth dips to 1.7% in 2012 and remains subdued through the forecast period because authorities’ ability to stimulate their economies is more limited now and households and governments still need to strengthen their financial positions.

_____________________

* From Treasury's website: The requirements of the BPS are to:

- state the overarching policy goals that will guide the Government's Budget decisions

- state how the Budget accords with the Government's short-term fiscal intentions

- state any changes to the Government's long-term fiscal objectives

- state any changes to the Government's short-term fiscal intentions, and

- explain how any changes in long-term fiscal objectives and short-term fiscal intentions accord with the principles of responsible fiscal management.

(Updates with video of English in Parliament buildings Tuesday morning)

35 Comments

NZIER gives a pretty forecast...

http://www.stuff.co.nz/business/industries/6051350/Economic-situation-s…

But hey, surely it can't be that bad?

But hey, surely it can't be that bad?

It is probably going to be worse.

Why else are we not going to get a December update from Treasury? Their credibility/competence would have been on the line.

Life is good my friends : 'Tis summer , the cricket season is here , the election is dunne & dusted , and we have our Edmonds cookbooks .....

..... what could possibly go wrong , .... apart from buggering up the pavlovas ?

what could possibly go wrong

In brief: The clueless idiots in charge will keep on digging, and worse, 30+% of the population will support them doing so.

Colin, yep its going to be much, much worse, because the Eurozone is fundamentally broken and the Merkel/Sarkozy plans for a fiscal Union merely represent a futile effort to desperately paint over the cracks in hopes that it will convince investors that Europes structural integrity is still intact.

"To understand why the euro has turned into such a disaster, let's revisit why it exists in the first place. The idea was that a European currency would make all of Europe feel richer. The poorer PIIGS (an acronym that stands for the peripheral countries Portugal, Ireland, Italy, Greece, and Spain) wanted to share a currency with Germany so that they could borrow money at affordable rates. Germany wanted a euro, too, because if its neighbors felt richer, they would buy more German products.

And that's basically what happened. Germany thrived off exports sold to peripheral economies that borrowed money at low-risk rates. It was a marriage of convenience. Thrifty Germany got the trade surplus it thought it needed to grow. Profligate PIIGS got the cheap money they thought they needed to get rich.

The euro arrangement either worked out horribly, or a little too well, depending on how you choose to look at it. Investors lent lots of money to peripheral economies, which led to large capital flows from the core to the periphery, and corresponding trade deficits, or "current account imbalances."

http://www.theatlantic.com/business/archive/2011/11/fiscal-union-cannot…

The above article is corroborate by this Europen Union paper blow.

Since the introduction of the EMU we can observe a strong divergence between the balance of current accounts of the different Member States. This development is distinctive in particular between Greece, Spain and Portugal and the active trade balance countries such as Germany and the Netherlands– thus between the core & periphery of

the Eurozone.2 Here the fundamental problem is the growing divergence of competitiveness. The macroeconomic indicators of the so-‐called PIGS countries show that they do not form a homogeneous group. Until the financial crisis broke out Spain,

Greece and Ireland even grew stronger then the rest of the Eurozone.

http://www2.euromemorandum.eu/uploads/wg4_kropp_kulke_greece_and_its_st…

“The most recent advice I had from [Treasury] before the election was they didn’t see significant reasons to change what had been put in the Pre-election update,” he said.

Perhaps Bill should be a bit more specific and ask TSY when their projected 11% increase in dairy export receipts are going to start showing up. At the moment the numbers seem to be going in the wrong direction.

NZIER are one of the few decent economist outfits, I respect them a lot, and think they are on the money with their comments

Of course, they are truly independent, unlike the bank economists who proclaim their independance but have clear vested interests in spruiking (I'm not sure if they intentionally spruik or whether it is the subconscious at play)

We are at the fork in the road and we don't know which path we are going to take

Asset deflation - been looking for batch. Here's one with history of changes in RV (no improvements between rating periods - just inflation):

2001 $82,000

2002 $102,000 up 24%

2005 $155,000 up 34%

2008 $265,000 up 71%

Most of the properties in the area that are selling (and there aren't many!), go for around 15% under RV - taking this one to perhaps a $225,000 sell price today which is still a 64% increase on the previous valuation.

So, if we assume the 2008 value rose only at the long run rate - it's 2008 value would have been around $207,000 + another say 10% for inflation during the subsequent three year period - which takes it back to that roughly $225,000 value.

These are going to be very expensive scones Kate.

Updated with comments from English on Aussie move to cut revenue forecasts, comments on any IMF European bailout.

If the IMF contributes to a European bailout, then NZ is effectively helping bail out a first world economy.

Hi Hugh. Treasury's website is absolutely hopeless since they changed it a year ago. I assure you it's the right link.

Not sure on the other bit. Will check.

Cheers

Alex

Hugh, I am interested in the answers you/Alex come up with.

Somehow TSY's magical PREFU forecasts move to government surplus as the current account blows out to a $15 billion annual deficit. Someone other than the government almost certainly has to be spending up large on things that don't provide much in export returns, but increase GDP and tax take.

Hugh perhaps they are assuming a big house building surge in chch off a low base

Hugh, some good points.

Here's a further thought. Despite the massive disruption imposed on chch, nz apparently did not return to recession. Why? Perhaps because with less than 10% of the nz population chch is a small part of the economy. Thats why even assuming a strong rebuild i'm not convinced gdp growth for the country will necessarily be strong

So lets just see what Alex has to say on this "optimistic" 2011 PREFU issue.

I agree Hugh, but it need not be Alex - the opportunity is available to all journalists. "Optimistic" though may turn out to be more a choice between "incompetent" and/or "corrupt".

Treasury should be able to make this issue with their credibility go away simply by providing their models and assumptions, and allowing others to use them to provide supporting forecasts.

Hi all, touched upon this slightly in the PREFU report: http://www.interest.co.nz/news/56346/treasury-forecasts-govt-still-trac…

Big boost to growth

Treasury said the larger-than-expected Christchurch rebuild, combined with a cyclical rise in residential building activity, and the repair of leaky buildings, would result in the construction sector contributing around 1.5 percentage points to GDP growth in each of the next two years to December 2013 as activity rose to, and maintained a peak in activity.

BUT here's some more from PREFU:

"Higher damage extimates flow through to more investment in the forecast period, but this investment is less than it could have been owing to this delay, the nature of the extra damage (some of it is to land), and the capacity of the building industry.

Wider impacts on the economy

Investment related to the earthquakes contributes around 2 percentage points to the rise in gross national investment from around 20% of GDP in the March 2011 year to over 26% of GDP in the March 2016 year. Although gross national saving is also expected to rise, it is not expected keep pace with investment. The excess of investment over saving is reflected in the annual current account deficit widening to 6.9% of GDP in the March 2016 year"

GIVEN that, on pg 12 of the PREFU (at least in the hard copy) in table 1.2 - Economic forecasts, it shows Treasury expecting (you can find table 1.2 in the spreadsheet at the bottom of the link below):

Residential investment to fall 8.4% in the 2011/12 year, before rising 37.6% in 2012/13, 34.9% in 2013/14, 14.2% in 2014/15 and 5.5% in 2015/16.

Thanks Alex.

I will just translate what PREFU implies, and let Hugh comment on its practicality.

TSY forecasts residential investment to grow from this 2011/2012 year by:

38% for 2012/2013

86% for 2013/2014

112% for 2014/2015

124% for 2015/2016

And an increase in GDP from the December 2011 year by:

1.5% for the December year 2012 (approximately $3 billion)

3.0% for the December year 2013 (approximately $6 billion)

And if we are getting the increases in residential investment growth suggested above, presumably from that we will also see an increase in GDP from that increased residential investment of $9-10 billion pa to December year 2015.

I won't say anything else because it wouldn't be polite.

Hugh, those residential 'investment' numbers, optimistic or otherwise, still don't explain more than a part of the current account deficit blowing out.

What I didn't see (maybe I missed it) in PREFU were any numbers on debt other than the government's.

I suspect TSY's forecast relies on GDP growth driven by increasing debt, and some heroic assumptions regards exports and exchange rates.

Bill, simple question:

Who do you think your fooling?..........

ohhhhhhhhh, "yourself". right go it now

Just watched English interviewed live on Bloomberg. He put a brave face on things but looked tired as he talked about the SOE sell off and the prospects for the economy with the shadow of Europe looming large. He was hardly going to say "we're all gonna die"

Very challenging times ahead.

URL?

regards

I saw the interview on the Asia stream, here is the archived copy

http://www.bloomberg.com/video/81759252/

Bloomberg live here. Definitely worth watching as the crisis unfolds.

"...the biggest problem was a political one".....RUBBISH

Seems like the US doesn't want to be embroiled in the Euro debacle. And the Germans aren't liking the implications...

haha. Hilarious. I remember during the Global Financial Crisis, the Europeans were smugly crowing that the collapse of the Financial system was America's fault and how prudently they'd managed their financial affairs. haha. Good job Europe.

We've had nearly 4 years of this now - banks being basically insolvent and bullshitting their way through it all while the pollies bend over backwards - but it hasn't fixed anything!

At least if they'd let it all sort itself out way back then we'd probably on the mend by now.

VL,

"At least if they'd let it all sort itself out way back then we'd probably on the mend by now."

Nah, the neoclassical premise that the economy should be left to nosedive into recession, so as to wring out out the excess in the system, from which the markets will swiftly recover and move onwards and upwards into greater prosperity no longer holds true. The reason being is that most of us are net debtors now since most of us either have a mortgage or we're renting and paying off somebody else's mortgage, a situation inconceivable historically. During prior depressions, property ownership was both freehold and heavily concentrated in few hands with the rest of the population as tenants or alternatively business cycles occured in times where the primary landlord was the State as in the case of New Zealand during the European settlement period or in Australia where settlers were granted title merely for occupying and claiming lands. We therefore have a far greater debt overhang to a degree which is unprecendented save for perhaps the Great Depression in the 1930s. The economic harm produced by the GFC would have been far worse, without the intervention of the world's governments in its wak, though I don't at all approve at all the way the intervention was carried out.

FYI on Aussie budget

http://www.smh.com.au/business/budget-surplus-to-narrow-to-15b-20111129-1o45z.html

also http://www.smh.com.au/business/the-big-picture-we-should-be-so-lucky-20111129-1o4im.html

"The risks to the outlook remain firmly on the downside. In the context of an already fragile global economy, rapidly evolving events in Europe have shaken confidence and financial markets, and pose a significant risk that the global economic outlook could deteriorate quickly. In this environment, Australia's terms of trade could also decline more sharply than currently forecast."

And this could be equally as relevant to the New Zealand numbers.

"The promised budget surplus at $1.5 billion is little more than a rounding error one way or the other, but it becomes a flag for Swan to wave both for domestic political purposes and for international feel-good reasons. It enhances Australia's growing perception as a safe haven in a dangerous world, instead of being part of the "risk on" trade. It should help Australian bond yields continue to fall, but it also could help maintain the strength of the Australian dollar."

NZ for sale - be quick!!

http://www.trademe.co.nz/business-farming-industry/other/auction-427899402.htm#qna

All - keep in your memory Westpac's prediction for 2012 that unemployment will drop to 5.3%, and GDP growth will be 3.7%

seems farcical to me

I predict:

GDP growth: 1.5 -2%

Unemployment: somewhere between 6.4-7% by end of 2012

All - keep in your memory Westpac's prediction for 2012 that unemployment will drop to 5.3%, and GDP growth will be 3.7%

seems farcical to me

I predict:

GDP growth: 1.5 -2%

Unemployment: somewhere between 6.4-7% by end of 2012

How's the crisis going? Italy...one eye in the piigs....last night...

"Yields on three-year bonds rose to 7.89pc"

Some positive perspectives on NZ's economic advantages & how to move forward (or not):

http://www.stuff.co.nz/business/6065021/NZ-at-economic-crossroads-Enrig…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.