Conversations about migration often just assume that wages are being depressed because the arrival of new people is at record levels.

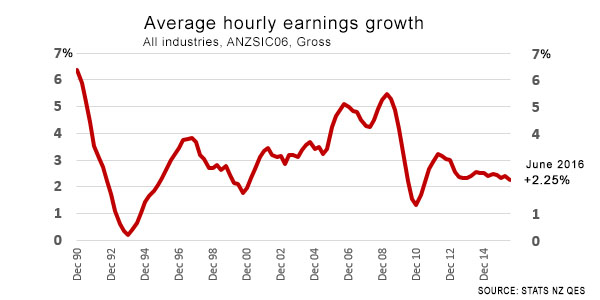

The basis is the data in the Quarterly Employment Survey (QES) which showed that average wages rose only +0.4% in the June quarter, or +2.25% in the full year.

It is easy to pick data that supports a political stance, but what I want to fact-check here is that pay rates are lower than they have been because of the population increase due to fast-rising immigration.

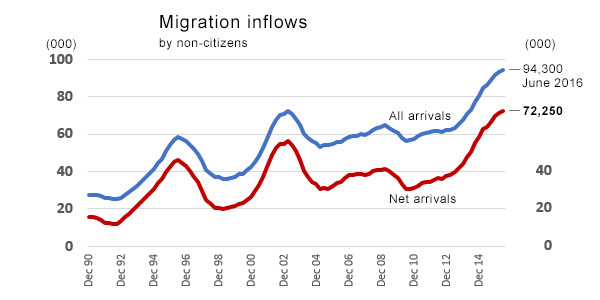

Here is the migration change in its full historical perspective for all non-citizen arrivals:

And here is the change in wages over a 25 year time span:

It seems clear from this data that pay rises have been at the lower end of the range recently.

But this ignores two pertinent facts.

One is that there have been three income tax rate reductions. One was offset by a GST rate rise. None of these changes show up in this chart, but they do have the net effect of making net pay higher.

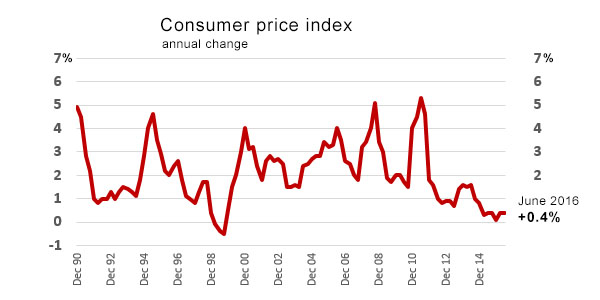

The other is that inflation (price increases for living expenses) has been much lower recently. That also improves spending power, making any pay increase go further.

This we can measure, deriving a 'real' rate of wage change. This chart deducts the CPI from the first chart:

On an inflation-adjusted basis, current pay increases actually benchmark well over the past 25 years.

It is not possible to see a drop in 'real' earnings growth in the period of rising migration.

What you can see is the impact of inflation. But not migration.

Those who say more arrivals are causing pay rates to stagnate or even go backwards can't support that argument with the data.

What they seem to be confusing is the fact that lower wage increases are here because lower inflation is here, but as the inflation rate is much lower, real wages are actually rising at the upper end of the range they always have over the past 25 years.

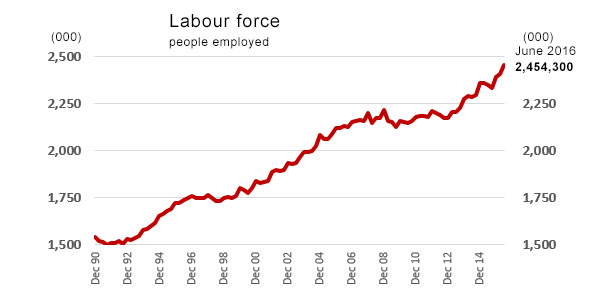

At the same time, the number of people employed is rising quickly, now growing at a rate as fast as in other strong expansion periods and faster than the growth in migration.

For the record, here is the CPI series on the same basis as the charts above:

57 Comments

Excellent article. I do like facts.

Facts and the truth are two different things.

Do these facts include the large number of Immigrants paid illegal wages (less than minimum wage)? i.e. not recorded in official wage/earnings calcs.

Do they differentiate between the CEO/exec salaries that have gone up significantly more than the lower end of the scale? i.e. skewing of the average.

Do they factor in legal minimum wage? i.e. forced earnings growth.

Do they factor housing inflation and mortgage repayments into the CPI and earnings? i.e. actual living costs for those with mortgages.

What would these same figures look like without immigration? i.e. a base level from which to see changes.

Quite often the truth is very different to the stats. Just look at housing

3% foreign buyers ring a bell? Lets ignore those "Facts" and look at the truth - What is the percentage of non-citizens buyers?

This article hasn't analysed the question that it set out to in the beginning. All you have said is that inflation is low, therefore real wage growth is comparable to history.

There is no analysis as to what effect immigration is having on wage growth. Further, you claim that lower inflation is actually driving lower wage inflation. Can you please explain how that works?

I think he did..."It is not possible to see a drop in 'real' earnings growth in the period of rising migration."

From the data/graphs there doesn't seem to be any correlation between migration numbers and pay.

True - the data indicates nothing either way. Common sense on the other hand....

Common sense (whos?) trumps data and facts?

Yes, exactly this is what we need. Common sense, instincts, anecdotal evidence. What's next? Bedtime stories of mythical fairies?

LOL. Already taken, as the mythical fairies is the status quo argument.

Exactly - where is the data to show wage growth without the migration.

All the article is doing is showing what happened. Not the impact (or lack of) from migration.

Yeah, I had a laugh when I got to this "evidence";

It seems clear from this data that pay rises have been at the lower end of the range recently. But this ignores two pertinent facts. One is that there have been three income tax rate reductions. One was offset by a GST rate rise. None of these changes show up in this chart, but they do have the net effect of making net pay higher. The other is that inflation (price increases for living expenses) has been much lower recently.

That also improves spending power, making any pay increase go further.

Talk about shooting oneself in the foot :-).

It would be interesting to see the disposable income after housing costs are deducted

The data does not show much at all - including that it does not show any benefit from migration.

A much more useful reflection on the question;

https://croakingcassandra.com/2016/08/18/woodhouse-on-immigration/

No traditional or neo Phillips effect, either..

David talks of 'three income tax reductions' when talking about pay increases but doesn't talk about what extra we have to pay because of these reductions. As my Mother used to say there are lies lies and statistics.

It depends how you look at the graphs. From a distance there seems no effect. But the main impact hasn't been until the last 18 months. if you look at the end of each graph the trend may be changing it will be interesting to see the graphs in 12 months time.

But (non) correlation does not imply (non) causation.

The lack of a correlation between real (inflation-adjusted) wages and migration could be due to the fact that migration boomed because the economy was doing well. In other words, people migrate when jobs are plentiful and demand for labour is high. But as workers migrate to NZ, that reduces the upward pressure on wages, and we don't end up with any observable change in real wages.

The counterfactual we are interested in is what real wages would be in the absence of record migration. But we cannot tell what that would be by just eyeballing the data.

And for the record: I do not have a dog in this fight. I am not for or against changing our immigration policy; I do however appreciate a careful approach to data.

Good work and article David ... it should open even the most politically blinded eyes to see some data and facts ...

Forget about CPI and deflation .. etc for a second ... Just follow the first two graphs for the same period from mid 2011 till current .... Note that the sharp increase of migration started taking shape and totaled a number north of 260,000 did not really affect the Average Hourly rate by much if any at all ... remembering that 2012,2013, even some of 2014 were bad years for employment and layoffs .... the hourly rate did not GO DOWN .

Some who can hardly count the paper money in their wallet, just follow nominal numbers ..they struggle to understand the changes in CPI and the net purchasing power of their dollar ... so it needs to be further simplified or they just want to make a political point out of repeating the same line ... because good news is unwelcomed in the doom and gloom atmosphere some are working hard to promote !!

In every other nation, a 3 - 3.5% growth is celebrated and used to boost the momentum to maintain the growth and benefit from its consequences - But we are becoming experts in killing positives with any negative glitch we could find ( be it by facts or claims) to make the moaning and whinging last longer ... and just becoming a grieving nation ...

It was clear before this article that the net income has been generally going much further in the last two years, be it in petrol prices, the cost of shopping, goods and services and the effect of tax breaks and lower interest rates ( for home owners) enough to compensate for higher rent ( for renters) and the increase in booze and sigi prices.

Now we have data to prove it....

Thanks again David.

"Note that the sharp increase of migration started taking shape and totaled a number north of 260,000 did not really affect the Average Hourly rate by much if any at all"

It didn't impact the data presented (i.e. the legal data supplied), but what would it look like if we took into account all the wage abuse of migrants? i.e. where they are paid less than minimum wage.

good point, ... the answer would most probably be: None! ... most people who are old enough to be adults in the 1990s know well that wage abuse of migrants by some has been going on since and before that time , and that will not change as long as we have |some| greedy employers and exploiters taking advantage of needy people ...

migration did not start 3 years ago ... we continuously had migrants coming in since the year dot , its just that the gates were open and shut depending on need .... and sometimes the same issue surfaced ...

On the other hand , since the 1990s a lot of service businesses started changing ethnic ownership mostly because of migrants accepting lower wages to keep these businesses afloat .. 25 years later these businesses are predominantly run by "Other cultures" examples: fruit and vege shops, courier services, some fast food chains, Taxi, bakeries, takeaways, laundromats, dairies ...etc ... the businesses did not disappear , the service is there, but previous owners have moved on.

"good point, ... the answer would most probably be: None! ... most people who are old enough to be adults in the 1990s know well that wage abuse of migrants by some has been going on since and before that time , and that will not change as long as we have |some| greedy employers and exploiters taking advantage of needy people ..."

That kind of is the point isn't it?

IF the migrants that are coming are vulnerable and in need, then why are they coming? Aren't we meant to be encouraging quality high-skilled migration that benefit New Zealand as a whole?

Indeed, but we live in the real world and cannot be disconnected from the World's economy

To be competitive and be able to sell your products o/seas you have to keep costs down ... anyone who thinks employers have an open wallet to pay what workers want is day dreaming

... So idealistic theories and "perfect world" wishlists aside, we cannot import engineers to do fruit picking, or students to be ICT technician jobs, and we cannot import an Specialist and ask him to leave his family and kids behind -- that is third world attitude - Not us !!

I don't know of any NZ government since the 80s that allowed Immigration NZ to have any specific category to bring in poor and needy migrants ... But there will always be people in need be it local or imported, Just like there will always be exploiters of such people.

If locals were to fill the low wage vacancies which would mostly be at the minimum wage then employers would have never resorted to bringing in migrant to be waiters, tour guides, chefs, and labourers etc !!

There are rules and processes for that and its not done willy nilly - these positions are offered to NZers first ... For example: Surely we could find 7000 deck and hammer hands among the 70,000 unemployed young guys (which are being bluntly used as a political football) !! and surely these were advertised for some time locally ..

So applying the same logic to those tax cuts the data here clearly shows that tax cuts do not not lead to greater real income, and instead all we have gained is a large amount of government debt.

Tax cuts mostly go to the rich, and then they get spent on property. The national tax cuts were basically the government borrowing to give money to the rich to then use as collateral to borrow more to use to increase the value of houses.

"We fact-check the claim that high migration levels are depressing average wage growth and find that is not really the case on an after-inflation basis" is the headline but actually the article just shows how kiwis/aotearoa-ans (what is the correct word?) have become better off over the last twenty-five years.

There needs to be an article comparing Aotearoa with countries that do not have immigration or have low levels of migration to see their average wage growth.

I googled "do countries benefit from migration" and found openborders.info. It's a pro migration website but with lots of well thought out articles. Give it a burl

Chile: undermining the NBR editor’s own argument

https://croakingcassandra.com/2016/09/01/chile-undermining-the-nbr-edit…

The concern has (largely?) been about low skilled and fraudulent immigration in large quantities - forcing our students, low skilled and folk made redundant to compete with third world labour. You shouldn't be looking at average income - less than 20% of us earn average ($75K) or better. Look at the median - $32,000 before tax but including Government transfers - that's where the pain is. Fully half of us on a below living wage. If we really did have a need for this level of low skilled immigration one would have expected to see high and rising wages for the median Kiwi. That has simply not been the case, I suspect the Government have been well and truly taken in by vested interests reinforced by their natural inclination to shaft the lower orders. Sorry, I think this is a case of selecting statistics to fit your agenda.

You nailed it Kiwidave

The housing boom has meant good profits for many New Zealand companies supplying materials and building services, but it implies investors would rather invest in their country’s homes rather than its businesses (Bollard 2005). The high returns for property has attracted finance and reduced the capital available for productive investment (Moody, 2006). The consequence is investment is going in to industries with limited capacity to increase per capita incomes. For example, real estate and building are domestically bound and do not have the market potential of export industries. They also have less opportunity to increase productivity through new processes and products. The irony is, as these sectors grow, they have incurred skills shortages which in turn has increased demand for skilled immigrants. The Department of Statistics ‘Long Term Skill Shortage List’ of 28/3/2006 includes carpenter/joiner, plumber, electricians, fitter and turners, fitter welders; all indicative of a nation building it's construction/property sector.

There is a danger that a sector of the economy is being augmented that is totally reliant on a small domestic economy. Not only do these industries have limited potential for per-capita growth but ‘deriving growth via factor inputs such as labour places pressure on infrastructure such as transport and land supply, and ultimately have a further negative impact on growth (ARC 2005). Finally, as the sector gets larger, it gains in lobbying/political strength and can lobby for immigration regardless if it is the best interests of the economy as a whole. This could be seen in Canada where the development industry has lobbied hard for high sustained immigration levels (Ley and Tutchener 2001).

http://kauri.aut.ac.nz:8080/dspace/bitstream/123456789/205/1/clydesdale…

Good work JH. Just replace 2006 with 2016 - only more so.

Average bloody schmaverage, how about median, what MOST people earn not some "average" skewed by the top end of town gaining by so much.

OK. But the data is not available in such a way it can be compared. We do source 'median' incomes by age and gender (and region) from the LEEDS releases (ie what employers report to the IRD), but that data is released 12 - 15 months old. We can update it using QES as the basis (no age/gender/region filters though).

Where QES says 'average' is $29.67/hour (ie $61,700 pa gross) growing +2.25% pa, the LEEDS-based median data says:

- for 25-29 year olds = $ 49,820 growing +2.7% pa

- for 30-34 year olds = $ 55,900 growing +2.6% pa

- for 35-39 year olds = $ 67,650 growing +3.0% pa

Yes, I know, the national average data we used is not strictly comparable to the national median data we have available.

But the bottom line is that medians actually suggest higher incomes, growing slightly faster. In this case, using 'average' is much more conservative than using 'medians'. Medians undermine your view.

Our analysis is for a 25 year time-span. Medians are not available of such a long period.

Not one single solitary one of those medians could purchase a house in Auckland and after all, isn't that one of the major things one goes out to work for each day, to house oneself. You'd be gasping at rental prices as well, so while there is some increase, in the end, it is about as much use as an ashtray on a motorbike

True for a single income. But housing loans are usually based on household income. It's tough in Auckland, but that data above is "NZ" and not 'Auckland' which is higher. See our Home Loan Affordability series for how this income data plays out in each NZ city.

Just wish the property rates were calculated on household income.

Family of eight with six wage earners using resources compared to one pensioner next door, for example...

This burst of immigration is three years old, what happened to median incomes prior to that which would indicate labour shortages?

2011 Median weekly income from all sources: $550

2012 Median weekly income from all sources: $560

2013 Median weekly income from all sources: $575

Obviously next to nothing. What happens to all this surplus labour when this current debt bubble bursts.

http://www.stats.govt.nz/browse_for_stats/income-and-work/Income/nz-inc…

Great article David, well done. Don't stress over commentators who rubbish it. They have made up their (narrow) minds and nothing will ever change their opinions

That the price of housing is far, far outstripping wage growth is utterly undeniable

Yes PA, and day following night is also undeniable but the topic here is migration vs wage growth

Which should be much, much higher to keep up with house prices, so it does relate.

This narrow mind isn't buying it sorry, (i know you ain't selling it) The top 30% of incomes have risen by loads. The pain is at the mid and lower end of the scale, which also happens to be where the rising pool of workers sits. I cannot think of an example where a burgeoning workforce resulted in wage increases?

But i am not a fan of huge population increases for many reasons other than just incomes, for me it signals policy failure.. as wages slip behind inflation. Driven mostly by housing.. caused (mostly) by huge population rises, more Kiwis fall down the ladder to be replaced by eager 3rd worlders who will work for less. It just does not seem sustainable or beneficial to Kiwis... And I love New Zealand NOT full of people and houses.

Here is a more POSITIVE view to make your day.

I shall give you an example of "Climbing UP the ladder" ...

My current neighbour ( of 6 years) is an immigrant, he is a qualified engineer, landed in NZ in 1995 with a young family at the age of around 40 , came in on the skilled category.

He tried to work in his trade but was rejected, after few months on the dole and when all his savings were exhausted he borrowed money and with the help of WINZ bought a vege shop which went broke after 18 months, the couple started working very hard in the trade and Hospitality ( right from the bottom of the ladder - broke and in dept) - !! today he is about 60 years old and semi retired ( by choice) he owns the mansion he lives in, and few investment properties .. etc

this guy taught me that when there is a will there is Hope ... and certainly some tangible results

So if he can start at the bottom at 40, how come that our younger people can't??

Hang on to the ladder ... with a smile !!

NZ is full of nice places where there are No people and NO houses

so the moral to get ahead in NZ don't train ( engineer) don't go into business (vege shop)

instead buy investment properties (rentals)

that in a nutshell explains what is wrong and why we need to import growth

Just have to hope that some other dude holds up their end on the productive business front, so that somebody out there will be earning enough to pay the rent, la la la la.

Shit, I think I've just found a tiny flaw in the scheme.

hmmm, I guess the moral of the above was summed by Jim Lovell one day, it goes like this:

“There are people who make things happen, there are people who

watch things happen, and there are people who wonder what

happened. To be successful, you need to be a person who makes

things happen.”

Oh, just in case you missed it, You actually Need the training or being in business to be able to buy the properties to invest in your future and retire early !! --- Wasn't that difficult , was it?

More likely you need to have bought in 1995. Wasn’t difficult then, near impossible now.

I think the moral of the story is your neighbor got in before National destroyed the Auckland property market, and did lots of other stupid things too like racking up 80 billion in government debt in record time with absolutely nothing to show for it.

Thanks right Eco Bird. Those with glass half full mindsets with the determination, tenacity and creativity can create their own luck and overcome the odds.

All of the above + a time machine.

Tonight, a pumped de Roos tells his audience that he wants people to invest in property and write to him 12 months down the track and tell him they’ve “made one million or three million, or you’ve got 16 properties, or we’re taking six months off because our cash flow now exceeds our outflow!” He says, “I don’t know any other activity where the rewards are so huge. If you want to invest a million dollars in the sharemarket, you need a million dollars. If you want to invest a million in real estate, you only need $100,000.”

You can buy one property, get it revalued, use the equity to buy another property and then buy another and another. “And you do it all with OPM. Other people’s money. OPM. It’s like being high on drugs!” What’s more, the wonder of depreciation claims on the building and contents means “the government subsidises your investment! It’s delightful!”

Pamela Stirling House of The Rising Sum Listener

A small correction to this:

"If you want to invest a million dollars in the sharemarket, you need a million dollars. If you want to invest a million in real estate, you only need $100,000.”

There is no such rubbish, if you want to buy an investment property, then you need 40% of its value in cash or equities ( can use 20% of your own home) PLUS have to pass the serviceability criteria which is loan payment calculated at a rate of 7.55% ( no matter what your loan is) and 75% of your gross income and future rent , all that NOT to exceed 40% max of your total income... and you can only do that if you have a SOLID income ....

Dont take my word for it, ask any bank ...!

Now if the world is going to burst and the sky will fall,

why do you think that 46% of current housing buyers ( investors) believe otherwise - they can't be all fools and gamblers? i bet they know something we don't ...

That is an old piece but it shows how many property fortunes have been made up to a few years [?] back and with government policy pushing immigration they had a good chance of success.

http://www.stuff.co.nz/business/money/4622459/Government-policies-blame…

Well, that wasn't worth a damn really was it. It has though reinforced my view that trying to congregate such weak stats data to make the specific case highlighted from the outset was an abysmal failure!

Somehow I seriously doubt the employers taking on these fresh labour slaves (in most cases) are paying more than what a local would ask for. But no, according to these NZ employers, they are hiring people who will do what kiwis won't do......at a price...

Actually the data IS suggestive of at least correlation between migration and wages:

- Spike in migration 01-03 and flatness in wages

- Spike in migration 2013 onwards and flatness in wages

The big drop in wage growth after 2009 will be mainly the result of the GFC and disassociated with migration

Those two charts clearly show how the Philips Curve seems to be redundant. The Fed is still banking (excuse the pun) on falling unemployment having a positive impact on inflation. But it's not happening there, it's not happening anywhere.

Paul Krugman believes immigration affects wages:

My second negative point is that immigration reduces the wages of domestic workers who compete with immigrants. That’s just supply and demand: we’re talking about large increases in the number of low-skill workers relative to other inputs into production, so it’s inevitable that this means a fall in wages. Mr. Borjas and Mr. Katz have to go through a lot of number-crunching to turn that general proposition into specific estimates of the wage impact, but the general point seems impossible to deny.

Paul krugman

Notes on Immigration

http://krugman.blogs.nytimes.com/2006/03/27/notes-on-immigration/?_r=0

I find this debate a little depressing. Unless the laws of supply and demand no longer operate,then in some parts of the workforce, increased levels of immigration must have the effect of constraining or actually depressing real wages. In other areas, it will have little or no effect.

Surely, the real question on immigration is what sort of country do we aspire to be? From my standpoint-admittedly that of a comfortably-off retiree-unrestrained immigration is simply exacerbating existing problems.I don't live in Auckland, but Auckland's problems have an effect on the country as a whole and this is becoming ever more evident in the house market.

We need a more targeted immigration policy,coupled with more restrictive policies on foreign property ownership and we desperately need a government willing to spend much more on infrastructure.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.