This Top 5 COVID-19 Alert Level 2 special comes from interest.co.nz's Gareth Vaughan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz. And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

1) Government Response Stringency Index.

As we debate moving from COVID-19 Alert Level 2 to Alert Level 1, the chart below gives nice context of where we are compared to a range of other countries. It comes from Our World in Data here. The countries displayed are ones I selected.

Confused about the differences between Level 2 and Level 1? There is some explanation here, and here.

On Friday the Ministry of Health reported no new COVID-19 cases for the seventh straight day, and says there's now just one active case in New Zealand.

For those interested in the real standout in the chart above, Taiwan, I took a look at its lessons from SARS and epidemiologist vice-president, here.

2) Being in the right business when disaster strikes.

Zoom founder and CEO Eric Yuan, born in China, applied eight times before being accepted as an immigrant into the United States. Now aged 50, Yuan was among the first 20 staff hired at WebEx, which as CNN Business puts it had the goal of leveraging rapidly increasing bandwidth capabilities into online meetings where people could share their desktop screen easily and cheaply.

As Zoom got a big spike in use this year from the COVID-19 lockdowns, so WebEx benefited in 2001 after 9/11.

WebEx even received an unlikely boost after 9/11. Amid global panic, companies who didn't want their employees flying unnecessarily instead turned to a service that could enable cheap and easy virtual meetings. And because WebEx was built on the cloud, Yuan and his engineering team's software could scale and meet the increasing demand.

After first fielding an offer from IBM, Iyar and the WebEx board decided to sell their company in 2007 to Cisco for $3.2 billion.

Yuan, who was so attached to WebEx that he referred to it as "his baby," now found himself an employee of the one of the largest technology companies in the world.

He hung around after the Cisco acquisition until 2011. And the rest is history.

Yuan left Cisco in 2011, along with around 40 China-based WebEx engineers. Initial funding for his new company came from his acquaintances and former colleagues, including Subrah Iyar. "If he told me he was sending a person to Mars I would have put money in," recalls Iyar. With funding and staff in place, Yuan could launch his new baby: Zoom.

The pitch was simple. Build a better WebEx.

"He didn't try and revolutionize it. He just made it better and cheaper and higher quality and simpler and video-centered," said Knight, who left WebEx shortly before Yuan.

Yuan's plan to capture WebEx's enterprise market relied on building Zoom video-first. It would be cloud-based, run on Macs and PCs, iPhones and Androids, and you could make it work without downloading any software in your browser.

But above all else, Yuan wanted to make his customers happy.

Chart: Bernstein.

3) Singapore's dark side.

Singapore was one of the early standouts as countries around the world battled COVID-19. But then the sheen came off when case numbers spiked dramatically in April, highlighting the plight of poorly paid foreign workers in the city state. Writing in The New York Times Magazine, Megan K. Stack points out from the first cases of COVID-19, Singapore's government made it clear a lack of cooperation with health officials would be treated as a crime.

But despite all the threats, through collective complacency or failure of imagination, the government was blindsided by a vulnerability it might have easily anticipated. In April, a dramatic surge of infections among poorly paid foreign workers crushed Singapore’s sense of invulnerability. The city is built and maintained by an army of laborers who come from other Asian countries — Bangladesh, India, China. They can be lodged as many as 20 men to a single room; one toilet is legally considered enough for 15 people. Last year, some of the dormitories suffered a measles outbreak. Migrant-worker housing has been connected with illness ever since the British colonial rulers called tuberculosis “a disease of the town-dwelling Chinese” because it raged among the “lowly paid migrants living en masse in congested and insanitary dwellings in the municipal area,” Loh and Hsu write. In other words, the notion that packed worker lodgings could weaken public health was neither new nor surprising.

And yet the city reeled at the dizzying reports of illness emerging from the worker dormitories — hundreds of people, sometimes 1,000 or more, tested positive day after day. It was as if the entire city had fallen so completely into the habit of regarding the laborers as some other kind of person that the basic fact of our corporeal interconnectedness never occurred to anybody. Workers’ rights advocates had tried to raise the alarm earlier, but their warnings went ignored. Now these perpetually marginalized workers have, at last, grabbed the city’s attention. A strict citywide lockdown was enforced and has been extended and tightened as the government scrambles to curb the outbreak in the dormitories.

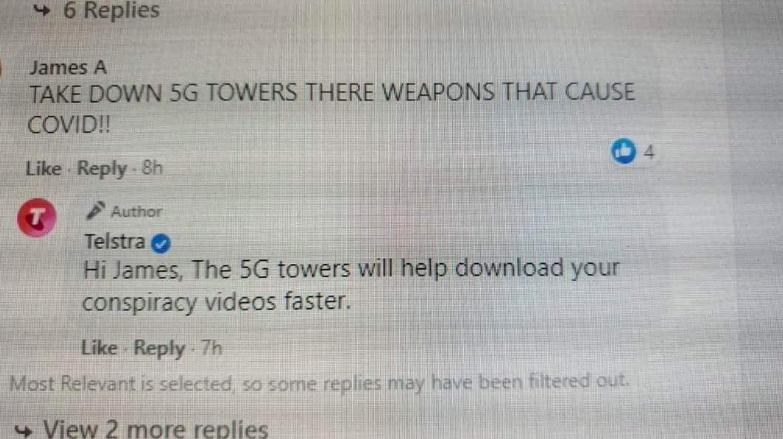

Below, a great response from Telstra to a 5G conspiracy theorist.

4) New Zealand made products.

Spending a month in level 4 lockdown certainly made us take more interest in our neighbours and neighbourhoods. And with the world battling COVID-19, dreams of overseas trips are off the agenda for now. Against this backdrop the economic fallout of fighting COVID-19 is big and growing. The combination of isolation and economic hardship is making many of us refocus on what our own country has to offer. Hence it's not surprising to see groups like this Facebook one being created.

This New Zealand made products group has 480,366 members. Scrolling through to see what's on offer is certainly interesting. And a good way to kill time...

New Zealand businesses face a tough time with no end in sight due to COVID-19. This group was created out of a desire to support New Zealand businesses through this time and after. Support New Zealand Made Products.

5) Are we turning Japanese?

In my interview with Raf Manji earlier this month we discussed what he learned from trading the yen and Japanese government bonds in the 1990s. Manji, a strategy and risk consultant, former investment banker and ex-Christchurch City Councillor, suggests Japan's last couple of decades could be a pointer to New Zealand's future. Manji argues this wouldn't be such a bad thing as Japan's economy has still functioned well. Having lived there for three years, I tend to agree with him.

Here Bloomberg takes a look at the Japanese experience.

The Covid-19 shock could spur an acceleration in global inflation driven by massive monetary and fiscal stimulus or a spell of deflation as demand craters. Japan’s experience suggests the latter is the bigger risk.

Years of anemic prices after the bursting of an asset bubble in Japan at the beginning of the 1990s prepared the ground for a deflationary tumble late in that decade. The bad news for Japan, and possibly the precedent for others, is that the world’s third-biggest economy is still struggling to get prices rising again.

And:

The worry is that a similar pattern takes root across other developed economies after years of feeble price growth. Under that scenario, the coronavirus blow entrenches a deflationary mindset, where people hold off buying everything from household appliances to new homes because they think they’ll be cheaper in the future.

And as Japan’s experience shows, even decades of near zero interest rates and quantitative easing haven’t been enough to turn that mindset around.

Plunging global demand, constrained activity and sharply lower oil prices could act as the triggers that send inflation negative across many economies after years of weak prices following the global financial crisis. Once that happens, the danger is prices keep falling.

Dominic Cummings: "I didn't break the lockdown rules"

— Parody Boris Johnson (@BorisJohnson_MP) May 28, 2020

Durham Police: "He did break the lockdown rules"

I'm afraid this leaves me with only one possible course of action. I'll arrange for an immediate Inquiry into the failings of Durham Police. #dominiccumnings

11 Comments

5) Raoul Paul recommended Princes of the Yen. It gives a solid understanding of how the Japanese economy operated, the asian finacial crisis and so on. It would be best for us to avoid the Japanese style economic failings by avoiding neo liberal ideology.

https://www.youtube.com/watch?v=5-IZZxyb1GI

I have never felt the future to be more uncertain. If the world was more politically stable, I would have thought the mostly likely outcome of the pandemic would be a bursting of asset bubbles followed by a long deflationary or very low growth era. However, with possible trade/cold war, retreat from globalism and some major political upheavals afoot... bugger knows.

I've booked a holiday in Queenstown in July but that is about the length of time I am prepared to plan into the future right now.

Carpe diem, GN....

A longer view than politicians, by a country mile.

https://www.nytimes.com/2020/05/28/upshot/should-we-fear-inflation.html

"In the next few years, if the Fed has to raise interest rates and Congress has to cut budget deficits to stop inflation from settling in at excessive rates, that will reflect an economy that has returned to full health.

So, is inflation on the horizon once the pandemic is contained? Maybe the answer is yes, and maybe it is no. But maybe the best answer is: We should be so lucky."

It seems to me that Reserve Banks have made deflation inevitable in the long term. Mechanistically this is because RBNZ has purchased a large volume of bonds to increase inflation in the present or near-term. As those bonds are now repaid both the principal and interest will be repaid, not back into the wider economy that would previously have generated inflation, but back to the Reserve Bank. In this way fiscal policy only moves inflation between the present and the future. Essentially inflation is conserved.

4) "" dreams of overseas trips are off the agenda "" with Australia dragging its heels clearing Covid-19 now is the time for our Govt to get a PI bubble working. Many Covid-19 free Pacific Islands suffering from zero tourists. It will be an astute political move to build our tourism and trade bubble before China does it. Our govt should provide insurance to airlines and travellers in case of another out-break and get the industry underway by rewarding the essential staff with subsidised holidays. Useful as a small scale experiment beofre Australia opens up in September(?).

The Taxpayer should subsidize me with a trip around the outer islands of the World, that never had the virus and I will gladly report on just why New Zealand and the rest of the World should listen to me, via Skype on a Weekly Basis, and a Daily Facebook reference as to why a lock down in a Virus Free Zone is preferable to a Twitter Based Rant from a leading Figure Head who killed off over 100K of his own people. I believe in myself and so should the entire civilized World, that those who cannot see the woods for the trees as to what is the issue, it was his mothers fault, but the entire World will pay, if we are not careful. There is also a perfect match made in China, but I digress. Being at Logger Heads with those in Power all around the World, has been why the Covid19 spread so wildly. There is no Come Back. They are all Leaders of ill-repute, but we have to cow-tow to their desires of denial and Megalamania and violent protest amongst their own People, never mind us poor s-ds who have to pay them lip service.

A remote Island would be just the ticket...Can I put my name down first....I feel I need a rest from these World class killers and I believe we need to scale up a daily and weekly rant, for the Whole World to see what I mean.

Thanks, in anticipation..

PS, I can include many Countries who have killed far more people in past endeavours....but this is getting critical...and so am I.

I will keep it short and to the point.....2020 vision is what is needed...I am not as blind as a Bat...Open your eyes everyone.

Pick me....

I'm still waiting for an analysis of the last 30 years and whether we could have been better off. I get the feeling that as long as the A's were doing well the B's were expendable?

I don't get the criticism of Japan. Seems to me the people do well and have a better standard of living than us, good healthcre etc.

Seems folk are unhappy it's not the same as us.

Housing. Prices not rising at crazy rates. Great for everybody, especially the FHBs.

Population. Stable. So great infrastructure because not always playing catchup.

I see a bye-bye to the growth predominantly related to China as we saw since the beginning of 2000s. Just like everyone else, the Chinese economy is taking a massive hit due to Covid19, and the Chinese middle class takes most of that hit. They are the primary consumers of NZ products and services (primary exports, tourism, international education and properties) who contributed significantly during the last two decades. They now have less money to spare, and the Chinese government is already convincing them to spend the remaining cash domestically. Geopolitically, the relationship between the West and China is to future deteriorate, and it will complicate the Sino-NZ relationship in general. After all, I believe we won't see the rock-star economy powered by China ever again.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.