By Brendon Harre*

Actually rather than the middle-class the evidence points to the working class and the lower middle-class being the largest groups leaving California. Image Source

The first three parts of The New Zealand Rack-Rent Housing Crisis series focused on housing inequality, an issue that feeds into and underpins numerous societal ills. Bold political action is needed to make housing affordable and prevent the entrenchment of New Zealand society into a class system based around inherited property wealth. This paper though focuses on productivity.

Jenée Tibshraeny, a journalist at interest.co.nz, has done excellent work investigating the inequality effect of printing money, a strategy employed by the Reserve Bank in response to the forecast economic downturn associated with Covid-19 (articles here and here, video here). In New Zealand, that effect mostly relates to housing, raising the question: does housing inflation cause a long-term decline in productivity in addition to its inequality effect?

This is an important issue because of its policy implications.

There is an assumption — held by the Reserve Bank at least — that when house prices inflate homeowners feel more wealthy and they spend more, making it an effective way of stimulating the economy. But perhaps this housing wealth effect is only short-term, within the one to two-year forecasting window of the bank.

In the long-term, an associated decline in productivity could be the more significant effect because of how towns and cities function as labour markets (see here and here). Some economists estimate the productivity cost of unaffordable housing at $1.6 trillion a year for the United States. Housing-related productivity decline might be a slow acting yet strong long-term effect, because changes in the labour market often take time to eventuate.

For example, high house and rent prices affect where a trainee nurse will consider living in five years’ time — after they have completed their training, gained a year or two of post-grad experience and are nearing their peak productivity and employability. Entrepreneurs, too, need affordable space to focus on developing innovative products and companies; many will fail, but the long-term payoff for some will be huge.

The Green Party’s wealth tax policy has merit as a means of addressing the short-term effects of housing inflation, the distributional wealth effect dividing the country into property-owning ‘haves’ and ‘have-nots’. Green Party co-leader James Shaw last year discussed this with Tibshraeny in the linked video above. This week the Green Party continued this line of enquiry with questions in select committee from Chloe Swarbrick to Treasury and the Reserve Bank and in parliament with Grant Robertson being asked by strong>Julie Anne Genter — “Does he agree that it’s now time to respond with bold fiscal policy, including taxation, to mitigate the current wealth inequality impacts of this unconventional monetary policy?”.

But if housing inflation also causes productivity to decline then a different set of policy reforms becomes necessary. There are implications for the governments planned reforms of the Resource Management Act (RMA), active land management by public sector agencies, housing-related infrastructure funding, and for ensuring at least some public housing is responsive to the employment requirements of low-income renters — i.e. adding the Austrian public housing model into the policy mix rather than further expanding the Income Related Rent Subsidy scheme and the Accommodation Supplement.

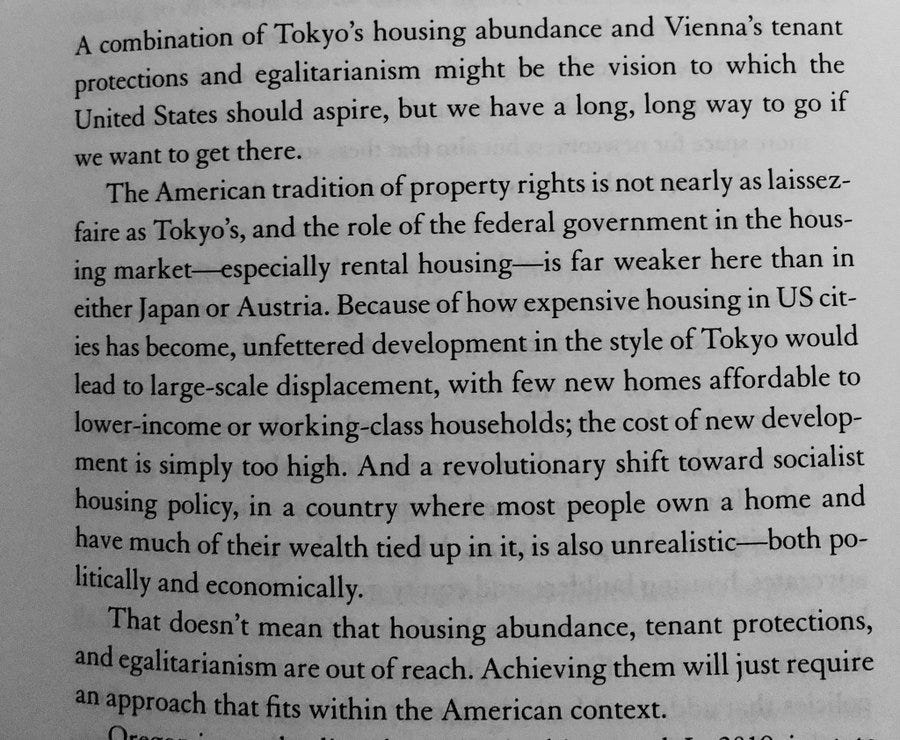

Quote from “The Affordable City: Strategies for Putting Housing Within Reach (and Keeping it There)” by Shane Phillips

Reforming housing in New Zealand so that it is affordable for all levels of society — the idea of housing as a human right — will require a combination of Tokyo’s housing abundance and Vienna’s egalitarian housing (a video explaining the social housing fund responsible for land acquisition, infrastructure provision, project development and urban renewal in Vienna can be viewed here).

Acquiring land in advance of the need for new housing is one of the reasons social housing is so successful in Vienna. Source

My New Zealand Rack-Rent Housing Crisis series describes how the government could reform housing in New Zealand. If the state fails to intervene with sufficient boldness, to put the handbrake on housing costs rising rapidly out of step with incomes, the housing crisis will become existential — an issue which shatters the foundational myth of New Zealand as an egalitarian society.

In addition to academic theories and models, there is plenty of overseas evidence showing how unaffordable and insufficient housing affects the labour market if there is an extreme imbalance like is being experienced in California.

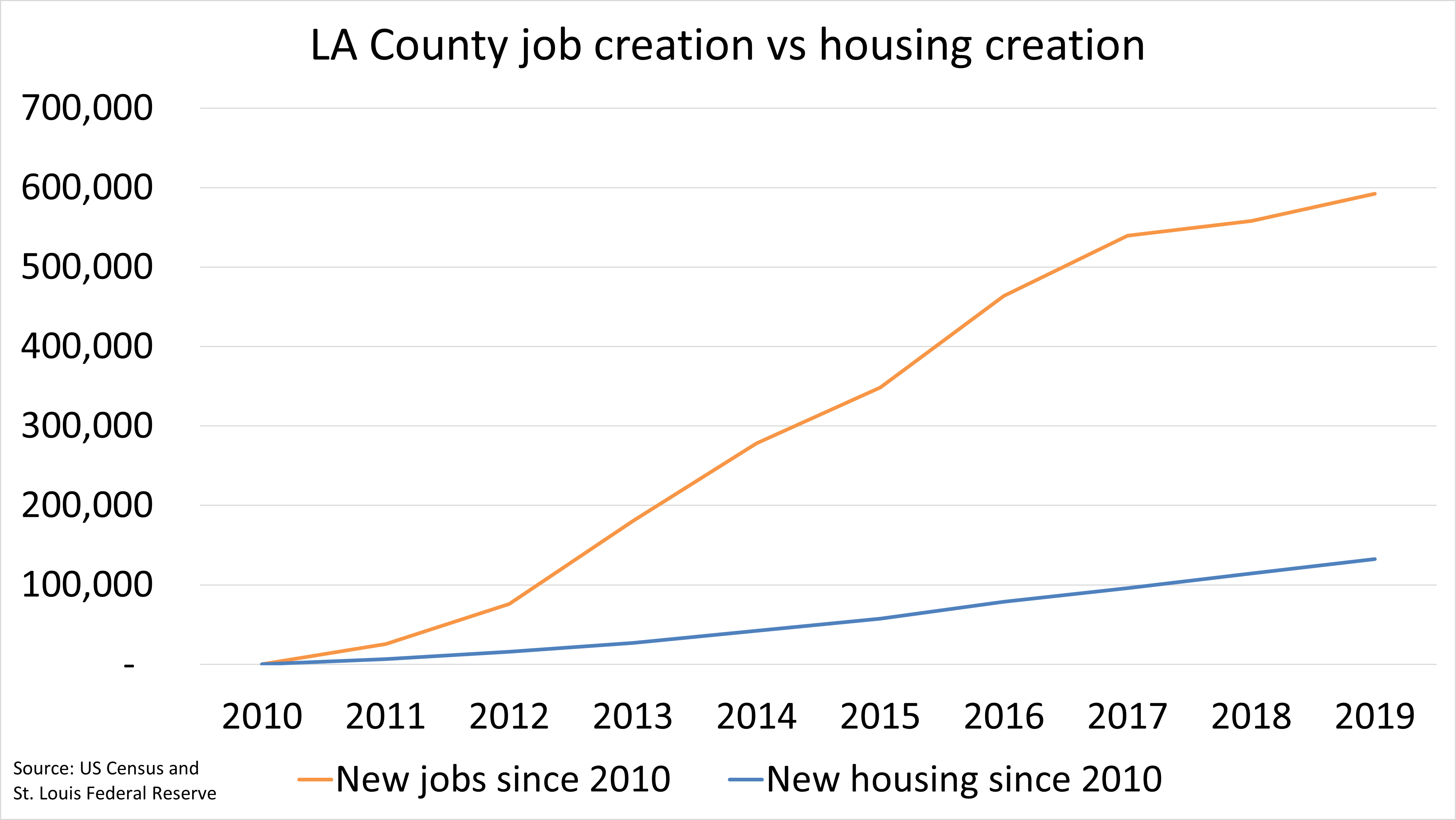

LA County is building only one new house for every 4.5 jobs that are created.

The way housing affects the labour market may not be linear. If house prices, rent and new builds are unresponsive to demand factors, such as job creation, there might be a tipping point or series of tipping points — each creating an exodus of business and employment.

Policymakers in California are concerned the state has reached a tipping point where the exodus of businesses and workers is now greater than the factors leading to innovation and inward migration that previously powered the state to be the fifth largest economy in the world (a video titled “What’s Driving California’s Mass Exodus?” describes this well).

Other parts of the world are having similar conversations about how housing is undermining society and the need for bold reforms to housing policy settings. For example Irish economist David McWilliams has a podcast with the following description. “Public housing should be addressed with the same urgency as public health. If we can close down the economy, borrow billions, furlough millions and stop the world in the name of public health, we should be able to tear up the rule book when it comes to housing. The property market in Ireland and the rest of the English speaking world is a scam, rigged to push prices upwards, indenturing working families and exacerbating the wealth divide. Here’s how to fix it.”

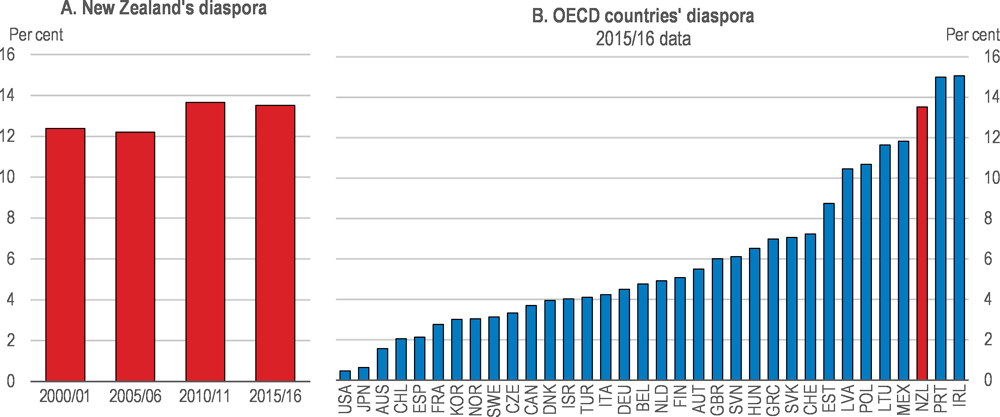

It would be easy for New Zealand to reach a housing-related labour market tipping point; there are already large expat communities of New Zealanders overseas who would aid others leaving the country as the housing situation becomes more dire.

Reforming our housing settings will be a difficult task, fraught with finger-pointing and the shifting of blame. It is naive to think any one government minister — such as Environment Minister David Parker, who is leading the RMA reform process — is capable of solving the housing crisis. Successful housing reform will require coordinated action from ministers of the environment, housing, local government, transport and finance at a minimum. It will require a prime minister — or entity the PM has given executive power to, such as a housing commissioner — who can coordinate these ministers by publicly expressing a clear set of housing targets and tools. Without this strong, coordinated approach the various housing-related institutions will pull in different directions.

For example, Auckland Council is already pulling away from the National Policy Statement on Urban Development (NPS-UD), a directive released last year which requires councils to relax height restrictions, remove car parking minimums and encourage density. Councillors and the mayor seem to believe the issue is not the restrictive nature of the district plan but the lack of infrastructure funding (see the second half of this video of the council meeting debating the NPS-UD).

Will a future Auckland Council faithfully implement the new RMA legislation if it directs local government to further liberalise planning restrictions, or will they find excuses to obstruct it? The Resource Management Act 1991 (RMA) will be repealed and replaced with three new laws this parliamentary term, namely:

- Natural and Built Environments Act (NBA) to provide for land use and environmental regulation (this would be the primary replacement for the RMA)

- Strategic Planning Act (SPA) to integrate with other legislation relevant to development, and require long-term regional spatial strategies

- Climate Change Adaptation Act (CAA) to address complex issues associated with managed retreat and funding and financing adaptation.

“I expect that the complete NBA and the SPA will be formally introduced into Parliament by the end of 2021, with the NBA passed by the end of 2022,” Environment Minister David Parker said. A full explanation of this process can be read in the Richard Harman article titled — Parker is playing the long game with his far reaching RMA reforms.

Business journalist Bernard Hickey explains the viewpoint that reform to urban planning and environment laws cannot deliver the necessary housing supply without first dealing with the politically untouchable roadblocks of population policy, infrastructure funding and the need for a wealth tax.

It is hard to know the size of New Zealand’s housing related infrastructure deficit and need for additional tax funding, it is probably sizeable but how big is uncertain. Transparency is not a hallmark of our urban development system. Overseas, more transparent systems, such as, Austria’s gold standard public housing provision that houses a quarter of their population and anchors their housing system is funded by a regionally applied 1% PAYE tax. Not an impossibly onerous level of funding. This indicates the infrastructure deficit and taxation/funding issues might not necessarily be the political untouchable roadblock that Bernard Hickey describes.

Although how any additional funding or taxation is spent could be an issue. If the Finance and Infrastructure Minister Grant Robertson does assess local government infrastructure deficits to be genuine and therefore increases funding to local government, would councils faithfully spend it on the required housing infrastructure (much of which is below ground, or not immediately obvious)? Or would they find other spending priorities, kicking the can down the road and allowing infrastructure deficits to mount up, as has happened in Wellington with embarrassing consequences — the raw sewage flowing down city streets and into the harbour.

What is required is an honest broker between local and central government, an entity which is not beholden to either parties’ flawed political processes. What is needed is an independent housing commissioner loyal only to a set of housing affordability targets. A housing commissioner could fairly adjudicate the issues of planning restrictions and infrastructure funding in order to get central and local government on the same page. Being independent, they would be expected to advise and direct government ministries and local councils — whatever is required in order to meet their affordability targets.

A bipartisan approach to the housing crisis at the central government level seems possible. A housing commissioner could be widely accepted across the political spectrum. Opposition National Party leader Judith Collins says suburbs will need to change their character in order to solve the housing crisis. In an interview with Stuff, Collins said Kiwis need to understand that New Zealand needs more housing and that would require some change to suburbs. Her party is now backing the Government’s National Policy Statement on Urban Development, which will stop councils from enforcing height limits of less than six storeys near major transit routes in an attempt to intensify cities.

It should be possible for New Zealand to start solving the housing crisis without blame-shifting and finger-pointing. And the sooner we act the sooner we prevent our towns and cities being priced out of contention, becoming failed labour markets that are not attractive for the next generation of kiwis.

To prevent an exodus, to address housing-related inequality and its attendant social markers — think poverty, families living in cars, rheumatic fever — New Zealand must pursue a path where housing is seen as a human right. Action is needed, not later but now.

This is a repost of an article here. It is here with permission.

156 Comments

Sir Humphrey Appleby might suggest " What is needed is an independent housing commissioner"; one ensconced in plush offices somewhere outside the Beehive; well staffed and well funded, so that all sides of politics can respectfully ignore both their presence and any recommendations that are made.

It's what politicians do (as this well-intentioned article suggests) - blame each other, or even better, someone other than them.

We elected a majority MMP Government to 'get on with it'. It's the best shot we've had. They are ignoring their mandate, and to expect any future Party or unelected appointee is unrealistic.

I'm sorry. But this problem is going to have to escalate into a social and economic disaster for it to be resolved now; one that is sorted out by us as - The Market (and that's going to hurt more New Zealanders than we can imagine), because the 'possum in the headlights' RBNZ and the likewise Government have slightly less than no idea of what to do.

(NB: New Zealand is not alone with the Haves/Have-Nots issue. Turn on the TV and see it in all its horror on any channel brave enough to show it. What we should have done, right after the last election, was set about ameliorating our problem. We haven't. So it's only a matter of time until scenes playing out on our TV are not of Rangoon or Paris or Washington - but of Wellington)

A housing commissioner and an independent housing commission with a proper set of housing affordability targets and tools could be as powerful as the Reserve Bank. There would be no point in creating a housing commission if it was something to be ignored.

Also what do you mean by having to wait for the problem to escalate into a social and economic disaster? The housing crisis is already an existential crisis to our most fundamental values - if that doesn't induce action what further calamity will?

These are my suggested housing commissioner targets and tools.

Targets;

-That rent is less than 30% of income for the lowest income groups

-That house price inflation be slower than wage increases

-A stable housing market that does not destabilise the wider economy

And the following tools:

-The ability to direct an increase in public housing placements where and when needed

-To purchase and release land as needed (probably releasing land to Kainga Ora)

-And the power to review planning regulations, by creating, directing, and appointing Independent Hearing Panels

Brendon... did you overlook targets and tools related to work and study visas and immigration in general? Possible suggestions:-

Targets;

-that immigration does not exceed x number per year total. (x = 15K PA?) which would include students, workers, residencies and citizenships.

-that total number of foreign students in NZ at any one time does not exceed x. (x = 10k ?)

- that total number of foreign workers in NZ at any one time does not exceed x. (x = 10K?)

-that the total number of people granted citizenship and PR does not exceed x. (x = 10K PA?)

-that annual immigration from any one country does not exceed x% of our total immigration. (x = 2 or 3%?)

Tools;

-the authority and ability to apply immigration settings, which are reviewed on a five year basis.

-the authority to set a minimum amount of money a student must transfer to a NZ bank (and spend during that year) before day one of study each year (maybe 30K PA?)

- the authority to ensure only certain, very specialized, study courses can be undertaken by foreigners.

- the authority to ensure only a select number of jobs can be done by foreign workers.

You are making a radical suggestion in arguing that immigration ought to be planned. Some of your suggestions make sense and others maybe extreme but all are worth a debate.

I think you are missing 'reciprocity'. Although I have no particular liking of Australians we cannot in all fairness stop them coming to NZ since they take in so many Kiwis. We have Kiwis working in almost every country in the world however they usually find freehold purchase of land and permanent residency difficult and citizenship even more difficult - our regulations ought to mirror those of the country of origin but with a modicum of generosity.

Lapun what you say is totally correct. Those who advocate restricting immigration by numbers are missing the point - we need to restrict on a skill basis that is honest and not being gamed by vested interests. There are imo many deficiencies in INZ's criteria. The Student visa/work visa/PR pathway would be one I'd close, people can come to study and work to cover tuition costs but then they leave at the end of their study.

Hook. Agree and disagree. Entrance only by contribution to the country. High standard. One component would be income. Say $150K

Target is keeping a population from increasing short and long term.

The student approach has been so rorted by private and education outfits it is not a useful path.

The problem with high skill immigration is how it's diluted by all the extras that come with them.

For instance, one genuinely high skilled person earning a large amount can bring a partner and as many dependent children as they like, plus a high salary allows parental visas to be granted also. Before you know it those skills one person has are distributed over 6 or more people, so on average the contribution per migrant is low.

sparrow... exactly. And the damage it is doing to NZ is huge. Why did we not need all these highly skilled people till the 90s. And let us not pretend it is IT. There are no IT jobs that Kiwis cannot be trained to do. The South Asian IT workers we import en masse are not (generally) even the best. They are just the cheapest. We could compare them to South Asian pharmaceuticals. Nearly as good as the real thing but far cheaper.

What a good question ..... any answers?

"Why did we not need all these highly skilled people till the 1990s".

Answer - we were in a deficit then but the gates were opened around the '90s. Cheap international air travel, Rogernomics, The Mother of all Budgets, - all contributed to NZers leaving. The fashionability of "the great OE".. higher wages offshore for skilled workers.. take your pick

The exodus of kiwis with talent I believe started under Muldoon. He made a joke about - it was a gain in IQ for both NZ and Australia. But NZ's poor productivity relative to its peers was apparent even back then. It is not just poor housing and bad town & city building process. It's the tall poppy syndrome, the kiwi 'knocking' tendency, political tribalism that favours authoritarian leaders...

Lapun.. agree.

Karl Seastrand. Immigration can be a demand shock to the housing market, which would affect the proposed housing targets and therefore would result in the tools being applied. This process would bring some honesty to the housing and immigration debate because the housing commissioner could demand an increased housing related infrastructure spend if there was a immigration shock to the system. Central government wouldn't be able to boost tax revenue from increased immigration (rising PAYE, GST etc) without paying the appropriate infrastructure cost to keep housing affordable.

Targeting work visas, student visas residency visa etc more directly is problematic because the number of kiwis (and Aussies) leaving and returning cannot be controlled. Governments can to some extent control immigration levels but it is a blunt instrument.

The article doesn’t mention Ardern’s response to questions from Genter and Co, which was basically a deflection. Given the ongoing Kiwi adoration for the Labour Government I sense Ardern knows where the pressures and votes are. Expect no transformation because Kiwis basically don’t support it, yet.

Genter asked the Q to Grant Robertson and Chloe Swarbrick asked questions of Treasury and the Reserve Bank in select committee. So Ardern did not deflect those specific questions. But I agree in general she is deflecting the issue. I disagree that there isn't an appetite from the public to rewrite the housing rule-book.

John Key told us we had a problem 14 years ago. What got done? Nothing. He probably had more kudos as a business person to act than Ardern, and yet he didn't act.

To expect Ardern to out-do Key is unrealistic.

Whatever stopped Key from enacting reform is also stopping Ardern. If I had to have a plump at the answer I'd say - it's the RBNZ, as our local member of the Collective of Globalised Central Banks; the "more debt is better" crowd. But whatever it is, it's tangible enough to scare the political daylights out of whomever we elect to 'do the right thing'.

(What is the overriding, common factor between the Key Government and the Arden one? The unelected RBNZ)

Key was pathetic. Relied on his one-two punch of expanding low value tourism and low value immigration to pump up GDP numbers. Destroyed the amenity values of south island wilderness and ensured our biggest cities are an inefficient overcrowded mess for the foreseeable future. All for no increase in the average NZers standard of living.

Amen

I suggest follow the real money. And no, i don‘t mean our famous ma&pa investors. Who is the biggest profit earner in NZ?

People who appoint or approve the top echelon of those organisations are the ones who most likely scare the living daylight out of our dear leaders regardless of party colour or decade. And the big scare is that “people will lose their money and their homes en masse”.

The questions I saw deflected were in Question time. Act also had a go. Again, deflected. I see no political will to transform. Maybe in their third term when another term is unlikely.

Third term is too late. Reforms enacted in the third term do not stick. Lots of examples - like Bill English's social investment model. Housing is such a massive beast if Ardern and Robertson are going to tackle it they must do it this term. Basically it is now or 15 years from now.

National are not stepping up, Labour will get another free pass.

I agree, and I also think a sizeable percentage of the public would approve of a (limiting) population policy.

The public probably would approve of limiting our population and so might our unions and Maori but the main influences on our politicians lies with academia, the media and businesses - all three have a vested interest in eternal growth.

The appetite isn't strong enough, yet. Give it 10 years...

As I say above. Labour have a choice - start fixing housing - commit to making affordable housing a right all kiwis can expect - now in this term or wait another 15 years to have a go at it.

And if NZ has to wait 15 years what are the chances that some sort of Trump-like populist rises up to exploit the political vacuum before then?

You've pretty much answered your own questions there!, except that we all know that what we have today (the social and economic disaster we see about us) will pale into insignificance in the future.

Residential property investors represent a significant lobby group in Government.

Labour or National will never solve the housing crises due to self interest. There are plenty of things that could be done but the propaganda by vested interests would be huge.

They only tinker around the edges to make it look as though they are genuine.

During 1984-87 any vested interests were brushed aside quite easily by no less than Labour government. Why? Because they had simply no choice other than being bankrupt as a country! Lange and Douglas even openly admitted that quite frankly. So iv you think about this for a while you will find the answer what it will take for a country to say no to banks’ freedom to create our money supply without much (any) restriction.

I agree - the future looks bleak for the young who are saving for homes. Many will still be renting in their retirement. I'm surprised thousands of them are not camped out in front of the Beehive.

Sorry Brendon but this comment is naive. Commissions of Enquiry, reports of all manner, investigations, working groups and so on are often set up at huge cost by an incumbent government. It's their way to say "We're taking this seriously and really looking into it."

And then the report becomes a doorstop, the commission's finding are ignored (or maybe 1 or 2 items implemented), same with the working groups and on and on.

As an example: What happened after the investigation into petrol price fixing in NZ? Nothing. They found problems with lack of competitiveness, but no on the ground changes have occurred as far as I'm aware: https://www.rnz.co.nz/news/national/397061/fuel-market-not-as-competiti…

Don't call the position the housing commissioner then. Call it the housing tsar or whatever. The delegated executive power of the proposal is not in the title. It is in the legislated targets and tools given.

I first wrote about the housing commissioner idea here - where I said the need was for a 'housing jedi knight'.

https://www.interest.co.nz/opinion/108376/brendon-harre-offers-part-two…

just need to give then independence from Govt and unobstructed power

So you are proposing an unelected effective housing dictatorship? Can't really see that gaining much traction tbh. We already have the Urban Development Authority which is at least answerable to the relevant Minister - we should leave it at that.

Davos, your example of the Fuel (Pricing and Supply) Inquiry isn't a very good one. You didn't see a dramatic drop in price at the pump because the industry is already pretty competitive there. The changes that occurred revolved around price displays, wholesale contracts to vendors and provision of (and changes to) supply contracts to independent retailers. Not really anything the retail motorist would be affected by. The biggest change for retail has been in the South Island with NPD now accessing Z's storage terminals and thus opening new outlets and increasing competition.

A new working group perhaps

Our distorted house prices are New Zealand's social disaster. From those pushed off their end of the shelf to become homeless. To the middle class with mortages that will keep them life long poor.

Why do we do this to our citizens.

It's making us rich silly! :)

We need a total BAN on housing investment. I have been saying this for years now and the more the Government waits the more the housing sector keeps supporting a need of doing so. Let the market cool, for a few years, until prices reach 3-5 times household incomes, monitor each region individually and reintroduce investors once we can afford it as a country. The only thing stopping us to do this are the neoliberal gods and those with blind faith in them.

What do you do with all the rental properties that are owned by investors currently? Where do renters live in the meantime until this big price reset happens?

They would be able to keep them as long as their investment still works for them. We would just not allow new ones to enter the market.

The properties themselves are either on-sold to another landlord (at a lower price?) or current renters, who buys them and turns them into owner/ occupied dwelling. You know - homes not speculative assets (which no matter how you cut it - they are).

People seem to think rental properties will disappear in a cloud of smoke if landlords get out of the business!

Someone will eventually live in them. (owner occupiers).

Nothing will be solved while we have journalists, politicians and the general public believing that the government needs other peoples money in the form of taxation before it can do anything. The government as the currency issuer is not financially constrained in any manner, it may be constrained by the availability of resources though.

The government must always spend first and so create our currency before taxation and borrowing can then happen after this. The Levy Economics Institute tells us this.

Publications

Working Paper No. 244 | July 1998

Can Taxes and Bonds Finance Government Spending?

This paper investigates the commonly held belief that government spending is normally financed through a combination of taxes and bond sales. The argument is a technical one and requires a detailed analysis of reserve accounting at the central bank. After carefully considering the complexities of reserve accounting, it is argued that the proceeds from taxation and bond sales are technically incapable of financing government spending and that modern governments actually finance all of their spending through the direct creation of high-powered money. The analysis carries significant implications for fiscal as well as monetary policy.

http://www.levyinstitute.org/publications/can-taxes-and-bonds-finance-g…

We just had an election~!! PM Ardern is doing what she promised to do.

It's like jumping off a cliff then complaining you're dead. Sucks for people like myself who are responsible and did NOT vote for Labour, but we have a democracy - it is what it is.

Again: PM Ardern is doing what she promised to do.

What promises you're referring to, KiwiBuild, reducing child poverty, affordable housing, growing inequality, billion trees or some other promise?

Lies! I'm referring to the election just gone where she promised increasing house prices.

Ardern never said anything about house prices prior to the election. She used the term 'sustained moderation' in November or December in response to a question from Jenee (who might have the details).

Lies~!! PM Ardern said ON LIVE TV - 'The Leaders Debate' that she wanted house price increases. Judith said (same debate) she thought house prices needed to come down in certain areas.

Stop TELLING Lies~!! If you voted for Labour I don't want to hear your complaints. Before people call me a National shill - I voted for TOP.

I am not lying and do not appreciate the "stop telling lies" accusation. I take a lot of time and effort in fact-checking and referencing my work.

Here is the evidence from TOP Facebook where there is a video of the housing part of the 2020 leaders debate in response to Paddy Gower asking if house prices should fall. Ardern said she wanted to stop the escalation of house prices. Collins said in some cases that houses needed to fall. Both though clarified that they wanted a stable housing market.

https://www.facebook.com/watch/?v=647474686199046

So Arden refused to answer the question which was “should house prices fall?”. That therefore implies she wants them to rise which she later doubled down on that when she said “I think that is what people expect” when asked does she think house prices should continue to gradually rise. She has no place managing the poverty portfolio if she believes house prices shouldn’t decrease.

So the logic is if Jessy didn't answer A then it must be B. How conclusive!

Prove your proposed link between rising house price and poverty!

I think Jessy is in every way fit and proper to manage the poverty portfolio as it is.

Who the fook is Jessy? Arden had the third option of choosing she didn't want house prices to rise or fall but she didn't say that either. When you have JC providing Labour with the correct answer (house prices need to drop in some areas) then that is a major concern for a true Labour supporter (of which I am not). Higher house prices lead to reduced affordability which leads to increased demand for rental accomodation which leads to increased rent inflation ( greater than wage inflation, see recent spinoff article by Duncan Grieves) which leads to greater demand for social and emergency housing (which can only cater for so many people) which leads to increased poverty.

I love the way you jump from one haphazard conclusion to another and then to another.

You should make your own spin to give Duncan a run for his money.

Nice retort! Slow hand clap*

Is a blunt point.. pointy?

You're right she did, I heard her

Dragging up yesterdays policies, it's all about the "climate crisis" now. Try to keep up.

The 2020 election was about Covid, that was what the public were interested in last year and Ardern was rightly rewarded for the way she competently handled that crisis. Other than Covid Ardern did not really make any specific promises. The question going forward is what does she do about the other crises that the country faces. She has a mandate to act if she wants, or not to if that is her intent. It is her decision and like Covid she will be held to account in the next election.

If there were no specific promises then what was the mandate? Carte Blanche?

It appears that she can deal with only one crisis at a time. You are right - the past election was all about Covid (perhaps the media's fault), but we are still waiting for action on the housing crisis.

Saw a great cap someone was wearing today. MAGA..........Make Adern Go Away

#MAGA

Hahaha - not unlike the original iteration.. wishful thinking

Agreed. Promised to do nothing. Still doing nothing.

Let'$ do... nothing!

No she is not, she run a platform on social equality, she is just afraid she'll loose the votes of those that will end up in negative equity.

My guess is many people will be leaving NZ once travel is back to relatively normal level. But do not fret fellow citizens, our Dear Leader Supreme Comrade-in-Chief Her Divine Highness will replace all those Kiwis with wide-eyed grateful folk from third world countries. Easy fix.

They might be better off staying in their 3rd world countries, especially if they have secure housing.

That is a big if when so many of our immigrants now come from South Africa, India and Philippines. A bed at one of our prison farms would probably be a step up in lifestyle for many of these economic migrants.

What are you complaining? Didn't you want to maintain the social fabric in NZ? The white SA bringing their fortunes from old apartheid money into this country to boost the economy and keep the demographic ratio balanced. Those younger SA are currently oppressed by a ruthless dictator trying to rob them of their future. I would say, bring in more SA, we hit 2 birds with one stone.

As for Indians and Filipinos, many worked in farms for the food on your table. You want a $10 lettuce in Pak N' Save or internet down, go ahead and kick them out.

CWBW... $10 lettuce and a dodgy Porn Hub connection would be a small sacrifice for helping more of our marginalized people obtain jobs at decent wages, avoid excessive rents and keep their dreams of home ownership alive. And can't kiwis be trained to handle all IT issues including neural computing? It is not exactly rocket science.

Neural programming is rocket science in case you aren't aware.

CWBW... think you mean neural programming is (one of many things) used in rocket science. Neural programmers are not even smart and skilled enough (yet?) to beat humans in some of the more technical games. Nowadays online poker is (unfortunately) infested with bots created by neural programmers but because the programmers just aren't that smart (compared to the best players) they are not (that) effective against the truly deep thinkers. But they are learning.

Maybe you should ask Garry Kasparov for an opinion.

Chess is a solved game because there are only 64 squares and it is a game of complete info. The best neural programmers have been desperate to outwit the best poker players for years but have always failed. They have designed ML bots that can now (just) beat the best players in a one on one game (due to its relative simplicity compared to normal poker) but they just haven't reached the level of intelligence and skill to beat the best in a normal multi-person poker game involving experts. Until the very best players chose to become the neural programmers they are destined to fail.

Neural programming may be able to create the best wife or beautiful secretary for you but they still need to up their game (significantly) in order to be on the same level as the best poker minds.

I am white. P, B4 to D4. your move. LOL

Those immigrants you so willingly denigrate actually contribute a pile more to NZ than the core underlying 3% or so of generational layabouts we have here. I believe your comment is based on stereotypical and ill-informed opinion rather than fact.

I would argue that the percentage of NZers who have come through intergenerational welfare is continually growing. If average house prices fell 25% they still couldn’t get ahead. This subset needs to be considered against those working and trying to move forward against an accelerating target. Disclaimer, I am a racist privileged white boomer (can a boomer be 54yrs?).

Some of you guys need to watch Aljazeera news and not our fluffy MSM in New Zealand and you will quickly realise what living in a true shithole really looks like. New Zealand is as paradise compared to many places around the world so rushing off to somewhere "better" makes me laugh. Why do you think we have 10's of thousands trying to pour into NZ every year ? Thats right there are countries where people are just happy to escape with their lives and what they can carry. Its all relative, some people need to be more grateful for what they have rather than expecting a multimillionaires lifestyle.

Enjoyed the article. There is a no risk that this government reforms the housing market, that's why you don't see it being priced into the market for existing houses.

The fact the Resource Management Act will be replaced by three separate new acts suggests to me that consenting is about to get far more complex and burocratic.

Put simply. When housing prices are so stupidly high, the rest of the economy has to pay for this one way or another. Have we forgotten what we learnt in the late 80's. An economy based based on free and healthy competition drives down all cost including housing, maximizes productivity and we are all better off. That is how we got out of the catastrophic situation that we had gotten in to. Remember, we just about had to call in the IRB receivers. We are heading to that sort of situation again. This time property speculators have replaced the protected interests of the farmers, importers and industry. Off all the sectors that we could sacrifice our economy to, I cannot think of one less worthy.

Last time the debt spiraled out of control in the government sector. This time it is private debt backed by unsustainable high house prices (remember what happened to all that worthless paper written on the back of ponzie scheme house prices in the USA), and huge social deficits that are increasingly turning into government debt. As noted above the Ardern thinks that this housing price ponzie/pyramid scheme is just fine and something that we all should embrace. Surprisingly National do not (A bit of change now that Key has gone). At the end of the day it is all going to have to be paid back. There is no such thing as a free lunch. Nor is there any moral basis for the belief that should be.

Exactly Chris-M "This time property speculators have replaced the protected interests of the farmers, importers and industry. Off all the sectors that we could sacrifice our economy to, I cannot think of one less worthy."

How quickly the 1984 Douglas reforms are forgotten. Under National the rort du-jour had Queen St Farmers buying up farms for the subsidies. Lamb, Butter, Fertiliser. Money for jam. Didn't have to work the land too hard. The profits came from subsidies. Douglas went after them hard. Eliminated the subsidies and the tax benefit of standard livestock values. The ag sector was reeling. Reminds me of the story plastered all over the news, of a 35 year-old sharemilker who had sharemilked for 10+ years, built his herd up, saved $250,000 and bought his first farm for $500,000 with a mortgage of $250,000. Just before the reforms. Exactly one month later his farm was worth $250,000. He was wiped out.

Will the Ardern-Robertson-Machine have the courage to go hard?

Very similar to the stories that we are now hearing from property investors.

All a commission will say is it's supply etc RMA and land blah blah... Bank credit it responsible. Not supply.. Although that plays a role but not the fundamental cause.

House prices doubled between 2002 and 2007 with rates above 8 percent. Low rates are not the cause. This low rate high growth and high rates low growth is a fake narrative.

High rates have almost always led to high growth. In 2004 the reserve bank started raising rates to cool the economy and house prices. Yet growth kept climbing with assets. Low rates since 2012 have lead to lower growth in comparison. The credit created by banks in the 2001 to 2008 period was far more than 2012 to 2019. The last 2 years bank credit has soared to the 08 era causing asset inflation. Once leverage occurs any drop in assets will require bank bail out.

Stagflation is upon us... High unemployment and high prices. Its like losing weight on the couch eating pizza all day...

Ideally the housing commission would be more direct. Based on indepth knowledge of NZ's various urban housing markets and the associated district plans. It would buy land - like the Austrian social housing agency - prior to zoning. It would appoint and direct Independent Hearing Panels to change district plans if more elastic supply was needed. And they would request more public housing where and when needed.

Wow, if only there was a diet like that.

Mass immigration (arguably) really picked up in the 1990s. Huge house price inflation really picked up 5 or 6 years later after the expected lag time.

While there is much that could be achieved by a housing commission with the right tools are we willing to accept the restrictions and impacts of implementing that which result?

As Brian Easton notes in his most recent (excellent) piece...

"The neoliberal hands-off framework tends to argue that dealing with speculative booms is not a concern of a minimal government. While the social costs from speculating on a lottery, bitcom or a game may be negligible, once there is borrowing lenders will be exposed too. It is not so much the speculative boom that is the problem but the speculative bust which follows, especially the pressure from those collaterally hurt for taxpayer bailouts. Government stabilising the boom before the bust is prudential.

The neoliberal pays little attention to the distributional consequences of a speculative boom. Leveraged speculation is only possible for those who have some wealth (or can convince the financial markets they have it – Trump?). So during the boom there is an increase in wealth inequality. Practically that means that those low in financial wealth – as most of the young are – are excluded and cannot buy their own homes.

In the bust, the increased inequality may not simply reverse. Certainly some high flyers do badly but often it is those with a modicum of wealth who suffer, while those who were arranging the lending go scot-free."

https://www.pundit.co.nz/content/the-sources-of-house-price-inflation

The bubble will burst either way so we should at least attempt to manage it but lets not kid ourselves that those responsible will pay for the excesses, it will be those middle class of exodus you fear....the poor dont have those options.

I don't think the housing commission proposal is Neoliberal or necessarily favouring small government.

I dont believe I suggested it was...in fact if done right it would be the antithesis. What I asked was whether the wider public will accept the restrictions such a programme would entail?

Apologies I misinterpreted. I think the public would accept the restrictions if it resulted in better housing, better communities and better towns and cities.

In Austria the public happily pay a regionally applied 1% PAYE tax for social housing, which basically builds huge chunks of cities like Vienna - so quite intrusive. But because the results are so good - the public is all good with it. Check out the video.

https://www.youtube.com/watch?v=69mIwvdPTkQ

But as Mr Eastons analysis shows the drivers are largely offshore...are we willing to accept the consequences of (attempting) to mitigate that? And it means a loss of wealth to the consumer class and the consequent reduced economic activity in the short/medium term not too mention the implications for capital flows and exchange rates.....theres no painless solution hence extend and pretend.

But personally I would prefer to see us attempt to manage the pricking of the bubble at a time of our choosing rather than waiting for it to be imposed upon us.

I think Mr Easton over-eggs the speculative housing boom argument. Clearly lower interest rates, removing LVRs etc have been a significant fact in the house price boom in the last 12 months. But rents have been inflating faster than wages for a lot longer than that. Inflating rents are a classic sign of under supply of housing as opposed to evidence of a speculative boom (which affects prices more than rents). Also his credit story doesn't tally with rising house prices in the 2002 to 2008 period when interest rates were increasing - up to 8% from memory.

I think Mr Easton over-eggs the speculative housing boom argument

You're correct to some extent. But you can still have a credit-driven bubble with an under-supply. There was no great 'under-supply' in the early 90s when the banks started shifting their business models to housing.

I agree that the banks are not innocent bystanders in this housing mess. Better regulating credit settings is a worthy idea. But I believe supply being unresponsive to demand (inelastic supply rather than under-supply) is the larger factor and if it is not fixed then housing cannot become affordable.

Hmmmm....can supply really be responsive when demand is apparently insatiable??

Both supply and demand measures are needed to work in unison, they are equally important.

With cities that have very good supply mechanisms - where property investors know it - then credit fueled demand is not insatiable. It is just one of many factors. Cities with good supply responses by various means - from Houston to Singapore to Tokyo to Vienna have all managed to create housing markets with more abundance and egalitarianism than NZ despite the same global cheap credit being present.

And that should give us confidence we can change tack without tipping over....if we have the will to try

His argument is around liquidity not interest rates ...the effect of interest rates is marginal and it may be argued a consequence of liquidity...i.e. the serviceability of the increased liquidity (debt). The undersupply issue is overstated, there is an under supply of affordable housing but there is a large portion of underutilised and empty housing made possible by the capital gains of a speculative bubble....those properties would not be so underutilised without the prospect of (largely) untaxed capital gains.

The period 2002 -2008 its worth noting that US interest rates went from 1 to over 5% as the effect of the tax cut slowed..QE started in the US at the end of 2008....despite what some may believe we are constrained by the actions of the major economies.

Rising house prices 2002-08 is squarely down to the stupid Welcome Home Loan debacle, which, by setting floor prices over huge areas - being the loan available to qualifying applicants - promptly removed every sale below that value from the market. The response, as applicants discovered that their loan no longer bought them anything? Raise the loan amount.......

Universal Pricing Signals by Gubmints are a classic own goal.....

Although it wouldnt have helped the impact will have been marginal.

Yeah it was one of several factors. Auckland's old district plans were incredibly restrictive and we had a lot of poms and expat kiwis returning from the UK in the wake of 9/11 with pounds in hand (then 1 pound equaled $3 rather than $2)

I don't think the housing commission proposal is Neoliberal or necessarily favouring small government.

The use of 'neoliberal' is used without much thought. However, the thrust of his argument is quite solid and is the least addressed. The bubble has been created by the monetary system and has built up since the early 90s when the banks found their 'cunning plan' to make money for jam. Everyone's generally been pretty happy with it, but unforeseen circumstances are now exposing how mad the idea is. The only thing that seems to be able to correct things is a financial collapse that prevents the banks from lending into existence.

"The use of 'neoliberal' is used without much thought"

"Neoliberalism is contemporarily used to refer to market-oriented reform policies such as "eliminating price controls, deregulating capital markets, lowering trade barriers" and reducing, especially through privatization and austerity, state influence in the economy"

https://en.wikipedia.org/wiki/Neoliberalism#:~:text=Neoliberalism%20is%….

His use is accurate

His use is accurate

OK. Does 'neoliberal' also encompass crony capitalism and Keynesian economics? Because those are essential components of our economic world (and NZ's). I would suggest that a proponent of 'neo-liberalism' would say they are not.

And therein lies the problem....what happens to the parties proposing more state ownership/direction of the economy?...parties that propose increased taxation to redistribute the shares of the economy?....they back down due to the public pressure, so the small government, low tax, private investment narrative remains....and in NZ although there is some stomach for it the powers that be have one eye on the international investor class (who most certainly do adhere to neoliberalism, and why wouldnt they) for fear of what will happen if they move too far out of step.

Either we bite the bullet and move early with all the known risks and try to mitigate or we wait for the major economies to shift, which IMO will only occur once the whole house of cards falls in upon itself.

So your affirming that neoliberalism is incompatible with free markets. You're supporting what I said.

There is no such thing as an unfettered market in a civilised society...i am categorically not supporting what you said, im outlining our options....and I plump for the former

OK, so you're OK with the use of 'neoliberal' as long as it fits within your definition (Wikipedia). Once again, you're supporting what I'm saying.

This is important. The problems related to housing are not necessarily related to 'neoliberalism'. Keynesian economies and crony capitalism have more to do with housing bubbles.

if you wish

Without a tax base change to force speculators and land bankers to have to pay something, nothing will ever change. Labour are just letting inequality hit more and more on their core voting block and pandering to bank profit and debt leverage speculation.

Labour needs a name change to the "Sellout" party.

Wow in the article linked to by Bernard Hickey (https://thekaka.substack.com/p/dawn-chorus-wheres-the-population) he dares to mention the P word. Yes he said 'po**lat**n. On more than one occasion.

I suggest interest.co.nz users start a campaign to have him removed from his job. It is of course a topic no well meaning person ever brings up. We know for a fact that bringing in as many poor people from 3rd world countries is the most wonderful thing we can do for our country. And anyone who disagrees with this is xenophobic and racist.

Surely this is wrong-think and Bernard Hickey must be removed.

Agreed Davo

I will email Paul Spoonley to have Bernard reprimanded...

Spoonley needs to stop spouting racist nonsense and rewriting history

This article by Stuff aided by Spoonley claims racism drove Pasifika out of Ponsonby and Grey Lynn in the 1970's

Utter nonsense. The oil shocks and car-less days dragged the (wealthy) rural lifestylers back into the inner CBD where property prices doubled in a short time. Rental properties became owner-occupied overnight

https://interactives.stuff.co.nz/2021/02/our-truth-history-aotearoa-new…

A lot of kiwis didnt vote or have ever voted to have millions more move here. He is also right in that a land tax (oh lordy the sacred cow) is the only way to pay for infrastructure.

If only Labour had the gut vs current sell out to bank profits.

Moderate the rules and regulation underwriting elevated residential property price rises at the source:

Banks will always look to maximise return on capital on behalf of shareholders, hence lending priorities will be determined by the asset class that demands the least capital and provides the most liquid collateral - there is a reason why the risk weights for sovereign bonds are zero.

Residential property standard risk weights can be reduced by implementing 'the internal models based approach'. ANZ has reported a figure as low as 27%.

Banks have migrated away from lending to productive business enterprises because the risk weights can be as high as 150%. Thus around 60% of NZ bank lending is dedicated to residential property mortgages held by one third of already wealthy households.

The number of households eligible to participate will inevitably diminish as the value of bank lending to this sector ratchets upward.

Bank lending to housing rose from $50,788 million (48.36% of total lending) as of Jun 1998 to $292,645 million (59.71% of total lending) as of November 2020 - source.

Never forget, Nazis tore down statues. Banned free speech. Blamed economic hardships on one group of people. Instituted gun control. Sound familiar?

Tell me, who today here is being scapegoated to the extent that horrendous acts could be performed on them, as much as Jews were in Nazi Germany?

Boomers seem to be fair game.

Really?

From the vitriol and cheap shot comments I read on this site, yes absolutely. I don't deny there's reason for people to be angry but its a slippery slope towards "well they deserved it".

Edit: For the record, no I'm not a boomer.

First home buyers with FOMO, oh wait...

I get the feeling any supply shortage is already being addressed, there seem to be 3 story houses going up everywhere. But it will take a while.

Prices won’t come down until interest rates go up.

Good article - sobering stuff. Couple of quick points...

- The ‘printing money’ (LSAP) causes house price boom is nonsense. Large Scale Asset Purchase (QE) is designed to inflate the price of *financial* assets (bonds and shares) - and that is what it does. The causal link from QE to stimulating the residential housing market is very very weak. House prices are booming because of low interest rates, high rents, and buyer confidence

- A Housing Tsar or Commissioner with some clout might make a difference. But no amount of hot air will make the numbers add up. The full cost (inc infrastructure, land, build etc) of one decent quality house is too high for that house to be either sold or rented at an affordable price to people on low to median income. Government needs to plug the gap - most sensibly by making funding available for local Govt and housing partners for the full costs of new infrastructure plus any supplement needed to get the unit cost down to a level that enables the house to be let at an affordable rent (with no further govt subsidy)

- If this wasn’t hard enough, Govt also needs to work out how to control inflation in the construction industry as the private and public sector are competing for labour and materials.... but that’s another story!

Yes you are correct. The RBNZ itself tells us this with this video from The Bank of England that QE is not free money for the banks to lend and that it only adds to their reserves.

https://www.rbnz.govt.nz/research-and-publications/videos/money-creatio….

During the 1960s the government with its own ministry of works was building large numbers of houses in places such as Porirua East, but now since the 1980s with the sell off of all of the governments assets the government doesn't have the capacity to do anything much for itself and it now just relies on hiring the private sector to carry out what it once could do for itself. Kiwibuild was always going to fail for this reason. Just as bad is the fact that we are told that the government doesn't have the financial capabilities to do anything and that all of its spending must be financed by the private sector through taxation and borrowing.

The Bank of England that QE is not free money for the banks to lend and that it only adds to their reserves.

This is a boring argument though. QE does enable lending.

How? Banks lend whenever they think that a loan is going to be profitable. How much money they have in their reserve account at RBNZ is irrelevant.

FFS.

Certainly doesn't enable CPI inflation, which has been positively correlated with easy money conditions in past decades.

This is what Milton Friedman called the interest rate fallacy, and it indeed refuses to die. We can tell what monetary conditions are in the real economy, as opposed to financial liquidity, though the two can be linked, by the general level of interest rates. When money is plentiful, interest rates will be high not low; and when money is restricted, interest rates will be low not high. The reason is as Wicksell described more than a century ago:

[The natural rate] is never high or low in itself, but only in relation to the profit which people can make with the money in their hands, and this, of course, varies. In good times, when trade is brisk, the rate of profit is high, and, what is of great consequence, is generally expected to remain high; in periods of depression it is low, and expected to remain low.

When nominal profits are expected to be robust, holders of money must be compensated for lending it out by higher interest rates. Thus, the same holds for inflationary circumstances, where nominal profits follow the rate of consumer prices. During the Great Inflation, interest rates weren’t low at all, they were through the roof well into double digits and higher by 1980. At the opposite end in the Great Depression, interest rates were low and stayed there because, as Wicksell wrote, the rate of profit was low and was expected to be low well into the future. High quality borrowers were given as much money as they could want while the rest of the economy was deprived of funds; liquidity and safety being the only preferences in what sounds entirely familiar. Link

The banks have capital requirements of 10% of lending and QE does not add to their capital. QE does not alter their other liquidity balances either in so much as government bonds and exchange settlement account reserves both rank equally as shown here. https://www.rbnz.govt.nz/-/media/ReserveBank/Files/regulation-and-super…

Banks lend first and then seek reserves afterwards, they can always obtain further reserves even if it means going to the reserve bank for them. It will only affect their profitability but not stop them from lending. They have no set levels of reserves that they must hold relative to lending.

Economist Bill Mitchell gives us an understanding of banking here. http://bilbo.economicoutlook.net/blog/?p=14620

What is required is a massive public house build, initially as rentals/leases only and enough so that there is not a single renter left in the private rental market in need of a top up from the public purse.

This build will need, in the main, to be infill housing, probably renewing all the state houses on large sections growing wild, as hardly anyone gardens anymore.

Any green field growth will be on non-horticulture land, that having been made strictly out of bounds, as we realize concreting over food baskets is insanity.

Once all of the most vulnerable are affordably housed, the state can enter rent to buy schemes with those who are able to/want to buy but are shut out of the current market.

Tenancy laws shredded, new laws more resembling German or even our own commercial ones come into effect. More co-operative ownership of dedicated long term lease properties, so that even those who rent/lease can participate to some extent in ownership via shares.

Rinse and repeat till there is little requirement for individual, short term rentals, which would still be available for those who only need something like that from private landlords.

I assume you haven’t walked down a dark alley way in a state housing area with the supposed vulnerable? The state makes a terrible landlord (too PC to kick out the scumbags) and a terrible property owner (look at all that undeveloped land they have held onto).

I wouldn't recommend NZ build entire suburbs of only state housing - like we mistakenly did in the past. I would recommend NZ copies the Austrian model for its good social integration, environmental, construction/architectural quality and economic benefits (for instance it doesn't waste undeveloped prime located land). That public housing be a mix of state and community housing provider housing and that public housing is mixed with general market housing in a manner that is seamless.

The Austrian model of state-led egalitarian housing has not made the state a terrible landlord and a terrible property owner. Watch the video.

https://www.youtube.com/watch?v=69mIwvdPTkQ

'high house and rent prices affect where a trainee nurse will consider living in five years’ time — after they have completed their training, gained a year or two of post-grad experience and are nearing their peak productivity and employability"

The exodus of nurses has been increasing for years, as has the average age of a nurse in NZ, now 46.7

They just happily replace the nurses with more from the Philippines, india, etc. They are liked because they are a compliant lot that don't question things or voice opinions.

If you are describing top experienced nurses earning over $90pa (that is with overtime and unsocial hours payments) then I'd be happy to have them. Those that arrive and hold down already low wages and accept poor working conditions are the ones that worry me.

Average nursing wage in NZ is 29.07 per hour

If we can't rip off immigrants then to get nurses we have to pay em well. And more Kiwis would train for it.

Nope sorry, there will be no nice Filipino nurses left as they are leaving NZ, I am told. They came here for the dream too and its out of reach now

Nationalise land. Trading land in a capitalist system makes no sense since it does not respond to the law of supply and demand. I believe most land in Singapore is owned by their govt so why not the same in NZ?

I think the main problem is that it does respond to the law of supply and demand: The supply is fixed, the demand is increasing, and hence so is the price.

Housing is as much as a human right as it is when you are ready to pay for it.

You can't have a free lunch. Even the 'free' handouts outside WINZ queue this morning ain't free- the working tax payers paid for it.

Even influencers can make piles of money (mostly tax free), the problem is not the system.

Stop dreaming and get some real work.

Don't see Brendon's Tsar is realistic. The wise, knowledgible all powerful rule maker just does not exist.

If we allowed population to slip downwards demand would be reduced and house prices would fall.

The 'investors' business model is capital gain and without that many would exit, FHBers would buy and rental would revert to the business of providing a service driven by rental income only.

Homeowners would not have huge mortgages. No longer poor for life.

Thanks KH for giving me a fair hearing, even though you think my housing tsar proposal is unrealistic. You are a fair man (something I have observed before). I doubt Labour or National or the wider public would commit to a falling population target if the widespread opinion is the housing tsar targets and tools are unrealistic. Although it is not my position I think it is reasonable to advocate for a falling population as a solution to the housing crisis - it is an option to consider. Unfortunately, I think the more likely outcome for NZ is nothing is decided (we are good at politely not making a decision) - the can is kicked down the road - and NZ's housing crisis continues.

Thanks Brendon. Appreciated. Yes we specialise in can kicking. And never look further out than the next kick.

The passage highlighted from the 'The Affordable City' makes a huge generalization when it says USA Cities are expensive and mentions California as if it was representative of all of the USA. We know it's not.

And of course, as the cartoon shows, people are leaving California in droves, and where are they going? They are going of course to the more affordable states like Texas.

Also, Vienna has a number of different development models which included Public-Private Partnerships that include houses being able to be sold on the open market. This what Kiwibuild should have looked like.

Both the Austrian and Texas models are over 100 years old and have evolved over time but the foundations are on a first-principles basis.

The main points I take from the Vienna and Texas models is that whatever role the Govt. participate in, it is in the form of a right for affordable housing to be developed, ie a presumptive right for this to exist.

Our model is based on No presumptive right, and in fact is actively discouraged by both the market rules (taking the lead from what the public rules allow) in the form of landbanking rentier behaviour, and public rules, re State policies and local Govt. planning rules and consenting delays and fees.

Thus the intent or culture of the Govt is just as important as the rules, and just like we could not do anything 'Big" until Covid caused a catastrophic event, I don't think we will be able to really fix housing until that happens as well.

It's just not in our cultural DNA to be proactive and presumptive.

Good thoughtful comment Dale

I think that if we are going to go down the tax route we need to be very clear what our objectives are. Housing is the problem and getting side tracked in to wider tax reform is likely to have unintended consequences and much higher public resistance. I.e. as occurred with Cullen's proposal for global capital gains tax.

I also think that we have to understand the distinction between investing and wealth creation. I view investing as the process of taking profits from a productive enterprise and buying increased capacity to produce more goods, profits and employment. In other words it has a very beneficial to the whole of society. Purchasing property is predominantly focused in preserving or increasing wealth. In a constrained market such as the New Zealand property market, speculators do not add any new service and simply reduce the opportunity for families to be independent and secure. There is little or no benefit to society. Distinctly different from business investment. The fact that some property speculators are prepared to own property without any tenants illustrates that the intent of their activity has no beneficial public good. I think that we need to stop calling them property investors as it conflates what they are doing with the very positive aspects of investment that I outlined above. They are purely speculators interested in only increasing their own wealth. Totally different from an investor.

Looking at the moral aspects. Property speculators are focused on making money from either inflation or ever increasing price rises. I.E. they expect to increase wealth without adding any thing of material benefit to society. Home owner/occupiers have similar attitudes about their own homes but really they have no moral right to expect something for nothing. On the other hand it seems far more morally justified to reward somebody who invests in an enterprise that creates goods for society and meaningful employment.

Accordingly I think that they need to be treated totally differently in tax law.

Having said all of that I think that the most meaningful thing that the government can to is totally remove the artificial blockages to supply of residential land and do everything within it's power to encourage highly competitive housing construction and material supply markets. If they are doing their job correctly there will be no house price rises and prices should progressively fall in real terms like just about everything else we produce. So what use would a capital gains tax be if the market is behaving correctly.

Chris that was the point of my article. I believe housing costs inflating faster than income is an economic cost for our society - any wealth effect is short term and illusionary - so rather than tax the illusionary wealth effect we should use all the available levers to eliminate the excessive housing costs. And if we achieve that we will improve inequality and in the longer term productivity.

Bollocks Brendan. Incomes have fallen at an exponential rate, vis-a-vis houses. Not the other way around. Our accounting system was predicated on growth, which was a short-term epoch. All over. Try thinking of house-prices as reflecting energy-degradation and resource stocks ditto. Logically, wages would fall exponentially behind - inflation by any other name, purchasing-wise. It amazes me that so few can think; Emperor's Clothes and all that.

Inequality can be solved by hammering the relatively 'rich', but the lid is sinking overall and the number clamoring for tickets just get bigger.

And I have long pointed out that productivity is just energy-efficiencies. 99% of work-done on the planet is not labour, and the 0.7% that is labour, levers off fossil energy anyway (fed, for one). It's how much work is done, is how productive you are, sorry if some economist gave you a bum steer. That's why 'productivity' has plateaued (to the bemusement of economists); it's running up against the Second Law and Mr Carnot.

Longer term sustainability (able to be maintained, given available energy and resources) is the only measure. Oh, and there re no such things as 'Rights' with an unfettered population on a finite planet. The UN SDG's are therefore largely hokum. Quite an arrogance in one species, is the claim of 'Rights'.

Not bollocks PDK. See my comment below.

It is an awful situation.

Bad enough that we may well lose a whole bunch of our children overseas because there simply is no future here for them. Further if you owned your own house and believed prices were close to peaking, you would be very tempted to sell up, lock in the gains and shift overseas until sanity returns. And if it doesn't you may never return.

Like many, this writer chooses to believe.

But the facts are not a matter of belief, there a matter of.......... fact.

https://surplusenergyeconomics.wordpress.com/

Yes, you can have 'cheaper housing'. But not in this financial system, at this point in the energy story.

Even your sweat equity housing option has been taken away PDK not by energy depletion but by regulation.

The housing crisis is not economics or energy but politics. It is the societal choices we have made and continue to make.

PDK make your environmental arguments elsewhere because on housing you are just a useful idiot to the pro-rentier crowd. Some of your thinking is worth considering but you have massively over-egged your argument.

PDK - Given what you are saying is that you believe the end result is now predetermined 'in this financial system, at this point in the energy story,' then you might as well just reply with 'The end is nigh,' and leave it at that.

And I agree with Brendon that you are now feeding the wasteful rentier behaviour by giving them the 'everyman for themself' excuse, damn the women and children (well that's equality for you), and a justification to not even try any alternative.

Or, why don't you tell us, your cunning plan, to save yourself, your family, your region, your Island, your country, your world? And from what you have said in the past, it does sound as though the first two on that list you might have covered, at least in the short term.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.