By Patrick Watson*

The latest US monthly jobs data showing employers created 379,000 new jobs in February generated much celebration and, for those who fear inflation, a little fear.

We should always take these numbers skeptically. They have many statistical limitations, and even if they’re exactly right, the trends over time mean more than any single report. But this one concerns me—not so much for the data itself, but for the way it excites some people.

We are, I hope, on the way to controlling COVID-19 in the US (though certainly not the rest of the world). The vaccines are proving as effective as the clinical trials showed. Manufacturing capacity is growing. President Biden says there should be enough for every American by the end of May—less than three months from now.

Meanwhile, the possibly worse variants haven’t yet taken off here as they did in other countries. That could still happen, but some experts seem a little more confident now.

And yet… some version of the coronavirus will keep spreading as long as we give it opportunity. It doesn’t care about the economy. It just does its viral thing.

This much-anticipated economic recovery, and the jobs it would generate, may not get far if we relax too soon… and the employment data suggests some of us are doing exactly that.

Source: Flickr.

Nuked job market

This pandemic hit the labor market like a nuclear bomb last spring. The US alone lost 22.4 million jobs in March and April 2020.

Since then, the US economy added a total of 12.9 million jobs. So we are still down 9.5 million jobs from where we were.

And it may be even worse. When all this started, US jobs growth was averaging about 200,000 monthly. So the economy is really down almost 12 million jobs from where it would be now, had job creation continued at the previous rate.

Nonetheless, any progress is better than none. But was this even progress? Maybe not.

The pandemic didn’t simply nuke the jobs market. It took out certain kinds of jobs—mainly those requiring non-essential personal contact.

In the official reports, most of those jobs fall into a “Leisure and Hospitality” category. It includes restaurants, bars, and hotels—all big employers of relatively low-wage workers.

A seeming reversal of this accounted for much of the excitement around last week’s report. Leisure and Hospitality (L&H) alone added 355,000 of the 379,000 new jobs.

But RSM Chief Economist Joseph Brusuelas pointed out that this was simple payback from the prior two months, when the L&H segment lost 523,000 jobs.

Source: Pixabay.

Lost hours

So February’s job gain was top-heavy in one industry, and simply restored that industry to where it had been a few months earlier, which wasn’t great.

February’s other bright spots were retailing, which added 41,000 jobs, and education/health, which added 44,000. Those three industries collectively added 440,000 jobs in a month when the total was only 379,000.

Economist Dave Rosenberg noted the arithmetic: This means other industries must have eliminated 61,000 jobs. Not what we want to see.

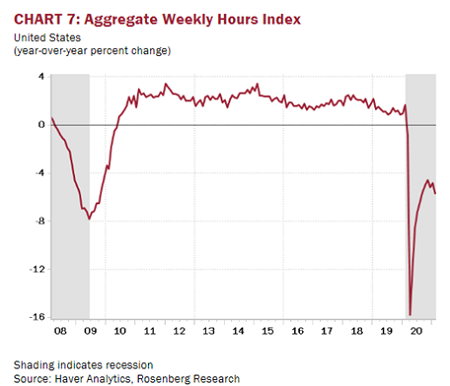

It gets worse. The same report shows a sharp decline in total hours worked. It looked small but adds up, as Rosenberg explained.

I have yet to see anyone discuss the elephant in the room, which was the 0.9% decline in the private sector workweek, and the contraction was in those areas (retail, leisure and hospitality) that saw the greatest job strength. The key feature of the report was the decline in the workweek to 34.6 hours from 34.9 hours in January. That, my friends, is equivalent to a job decline of over one million!!

In other words, if the workweek was held at the January level and the total labor input into the economy was the same in February as this report indicated, payrolls would have plunged 700k!!

The data shows an economy demanding less labor, not more. That’s not what would be happening if a hiring boom were gathering steam.

Source: Rosenberg Research.

Again, February was just one month. A lot can change, and hopefully will change as the virus threat recedes and consumers regain confidence. But that’s going to take time.

And maybe longer than many think.

Self-limiting recovery

As noted above, vaccination progress is accelerating. We are now in a race to stop a variant-driven spring surge from delaying the economic recovery.

We will have better odds if people keep exercising the precautions we’ve all learned, just for a few more weeks. The jobs report suggests many are not.

Why are restaurant owners rehiring so many workers? Probably because restaurant traffic is increasing.

Some restaurants are pretty safe but we know unmasked gatherings in poorly ventilated places are a top infection source. More people visiting them helps the virus spread and, if it sparks another surge, could make the jobs recovery self-limiting.

The next month is critical. Cross your fingers.

*Patrick Watson is senior economic analyst at Mauldin Economics. This article is from a regular Mauldin Economics series called Connecting the Dots. It first appeared here and is used by interest.co.nz with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.