By Alison Brook*

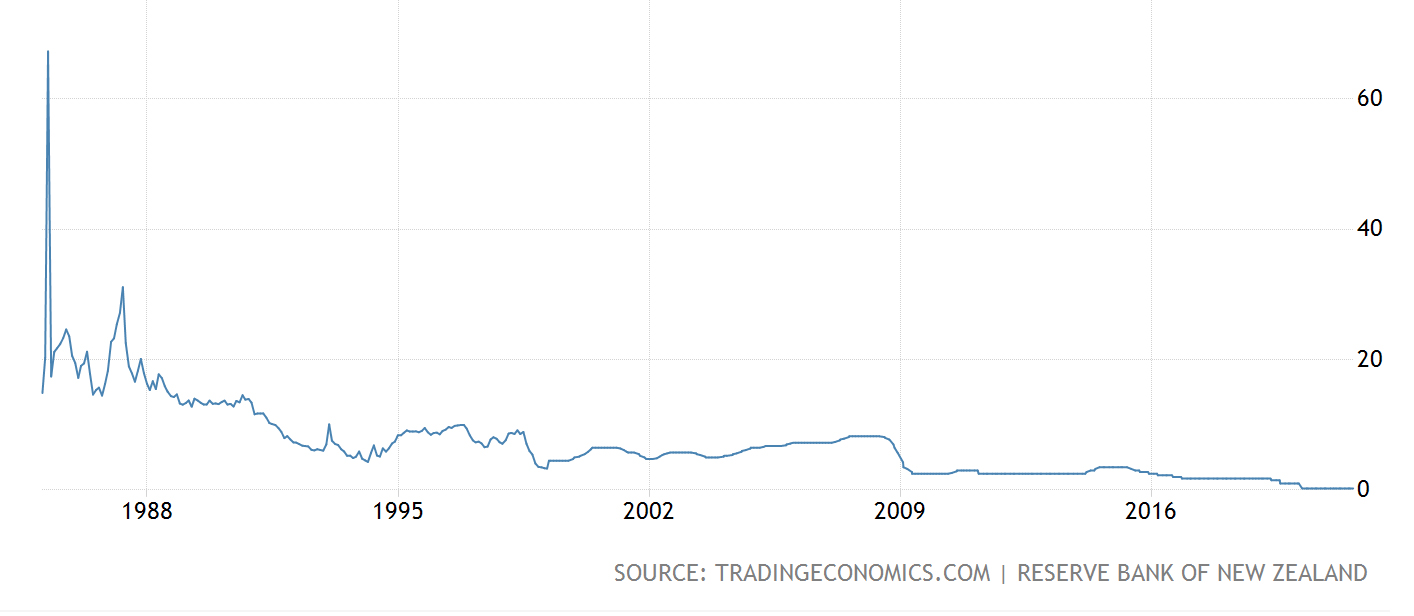

Declining interest rates have been a semi-permanent feature of the global economy since the 1980s.

In that time the long-term interest rate has trended downwards from 4 percent to almost zero. The pandemic-induced recessions around the world have encouraged central backs to reduce rates further with even some emerging economies using quantitative easing for the first time.

Despite maintaining ultra-low rates for many years central banks have struggled to boost global economic growth which the IMF warned in 2019 was in a “synchronised slowdown”. Rather than stimulating growth as conventional wisdom suggests, there is increasing concern that the persistently low interest rates may in fact be causing the low growth.

Interest Rates New Zealand

Market dynamism

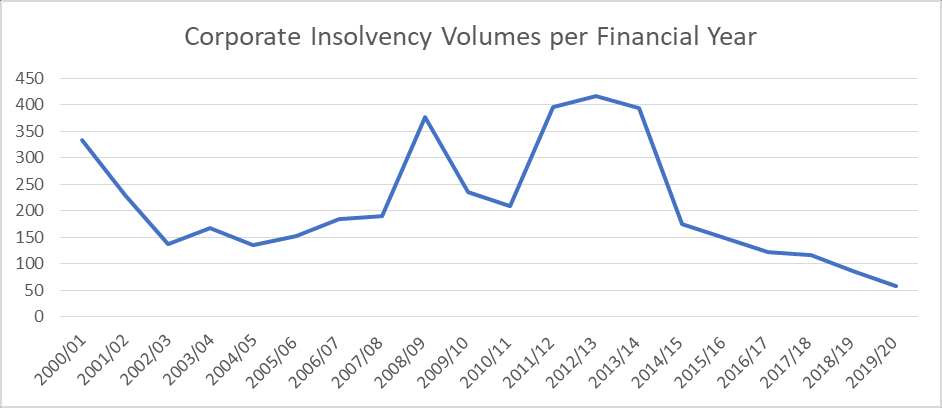

A well-functioning economy allows for companies to both exit and enter. However, according to William White, former economic adviser at the Bank for International Settlements easy monetary conditions discourage these processes from work effectively. As a result, both liquidations and company start-ups have fallen sharply in many countries in recent years alongside productivity.

Low rates can also encourage the development of so-called “zombie companies” – highly indebted firms that are propped up by cheap borrowing but act as a drag on economic growth over the long term.

Source: NZ Insolvency and Trustee Service

Competition and Market Concentration

In New Zealand access to capital has been a central theme for those concerned about the country’s persistently low productivity growth – thin capital markets, a traditional banking sector and effective duopolies in many industries have all been cited as contributory factors. But could our decades-long decline in interest rates also explain our poor productivity performance and relatively low GDP per capita?

Recent research by E. Liu and A. Mian from Princeton and A. Sufi from the University of Chicago suggests that while low interest rates have traditionally been viewed as a good thing for economic growth, at a certain point they may actually slow growth by increasing market concentration and monopolies.

The traditional view has been that when long-term rates fall it encourages firms to spend more today on technologies that enhance productivity, boosting growth. However, it seems that when interest rates are already very low, further reductions can also have the opposite effect – reducing the incentive for firms to invest in productivity-enhancing technology. This contractionary effect is caused by industry competition. While low interest rates encourage all firms in an industry sector to invest more, market leaders have even more incentive to do so as the “prize” is gaining an outsized control of the market. As a result, industries tend to become more monopolistic over time, reducing competition and ultimately long-term rates.

Liu, Mian and Sufi’s analysis suggests this contractionary effect helps to explain many global economic trends since the 1980s: growing market concentration, rising corporate profits, weaker business dynamism, declining productivity growth and rising inequality. Their analysis suggests that additional cuts to interests rates off a very low base will hurt the economy even further by increasing market concentration and reducing productivity growth.

Cause or Effect?

But are low interest rates the cause or the effect of low economic growth? Economist Robert Gordon argues in his 2014 book The Rise and Fall of American Growth that declining interest rates since the 1980s have been the effect of low productivity growth. The cause for this has largely been technological. Gordon suggests that the third industrial revolution of computers and digitalization has been less important than the second industrial revolution. Not only has growth been slower since 1970 than previously, but the improvements in everyday life are less profound than the benefits of the industrial revolution.

Harvard professor N. Gregory Mankiw in a New York Times article makes a similar point, suggesting that while old-world technologies like railroads were capital intensive, new technologies require smaller capital investments. This reduced demand for capital, in turn, depresses interest rates.

Whether low interest rates are the cause, effect or even in a circular relationship with growth, there is increasing concern that persistently low interest rates may be doing more harm than good. Not only do they lead to debt accumulation and increasing asset prices, but they may ultimately be damaging our economy by limiting its ability to grow.

*Alison Brook is from the Knowledge Exchange Hub at the Massey University campus at Albany, Auckland. She is on the GDPLive team. This article is a post from the GDPLive blog, and is here with permission. The New Zealand GDPLive resource can also be accessed here.

51 Comments

Great article. An original view well summarised in the headline.

Everyone knows that only one growth matters in NZ - Orr and Jacinda are doing it very well In maintain the ponzi so why even raise this question.

Great article?

It's nonsense. Chanted mantra. No University should be this ignorant - and her superiors need challenged. We are a long way past 2008, to be still back here discussion-wise. Take a look at the two simple flow diagrams in this article, and ask which one she's addressing:

https://www.interest.co.nz/opinion/112445/murray-grimwood-traces-long-h…

We are in a cleft stick; up interest rates and the bubble pops, drop them and the debt increases. All the while the real underwrite - planet earth - is being depleted at never-bigger rates; that fact cannot be changed by any financial manipulation. We've had decades of increasing betting on virtual wealth, orders of magnitude more of it that on the real. But all that virtual tokenry expects to be exchanged for real stuff.

Talk about flying blind - how can intelligent folk (Professors are mentioned) be so blinkered?

Read Werner. It's all been documented since the 80s.

The rate of interest – the price of money – is said to be a key policy tool. Economics has in general emphasised prices. This theoretical bias results from the axiomatic-deductive methodology centring on equilibrium. Without equilibrium, quantity constraints are more important than prices in determining market outcomes. In disequilibrium, interest rates should be far less useful as policy variable, and economics should be more concerned with quantities (including resource constraints). To investigate, we test the received belief that lower interest rates result in higher growth and higher rates result in lower growth. Examining the relationship between 3-month and 10-year benchmark rates and nominal GDP growth over half a century in four of the five largest economies we find that interest rates follow GDP growth and are consistently positively correlated with growth. If policy-makers really aimed at setting rates consistent with a recovery, they would need to raise them. We conclude that conventional monetary policy as operated by central banks for the past half-century is fundamentally flawed. Policy-makers had better focus on the quantity variables that cause growth.

Might have to call you 'The Mailman' Audaxes as you always deliver on time and on the money.

Audaxes is one knowledgeable brother from another mother.

Great reference indeed. The good thing about interest.co.nz is that there are commentators like Audaxes.

"Growth" induced by un-justifibly ultra-low interest rates is just an illusion, whose only effects are inflationary risks, asset bubbles, mis-pricing of risks, unbalanced allocation of capital, zombification of the whole economy, lack of productivity increases and many other structural highly damaging long term effects. We have seen very little, if any, of the so-called "productive credit creation" - most of the effects have been to just further inflate the housing Ponzi.

It is time for the RBNZ to aggressively normalize its current highly damaging monetary policy, and start raising interest rates, significantly and repeatedly, starting from next week.

It is so painful watching (some) economists come to terms with the hard reality that many of the things they hold true are grossly over-simplified and often just plain wrong. The idea that you can speed up or slow down a hugely complex economic system by dialling the interest rate up or down has always been completely nuts - the empirical evidence (see Audaxes link above) has never supported it - apart from one 'fluke' in the 70s.

There is some evidence that increasing interest rates can have a positive impact on inflation - e.g. Govt pay more interest to non-Govt bodies, futures prices increase to reflect increased inflation etc. Maybe these inflationary drivers are more powerful than the deflationary drivers of people paying more to service debts (noting that if someone is paying more to service a debt, someone must be getting more too!)

'Easing' Monetary Policy Is Missing a Key Component

Financial repression, he admitted, yes, this was neither a mistake nor an unlucky coincidence. It had always been an intentional pro'Easing' Monetary Policy Is Missing a Key Componentvocation, the occurrence of ridiculously low interest rates and the negative effects these have on savers. The difference was that Mr. Kocherlakota would never speak so explicitly in public. Like corruption, cowardice comes in many forms.

The President of the Fed’s Minneapolis branch, Narayana Kocherlakota’s tenure at the FOMC was as the typical Economist. In times of trouble, the master neo-Keynesian playbook tells policymakers they had better disadvantage grandparents; discourage saving in any way possible. The fact this is harmful to their financial comfort really is the whole point.

“MR. KOCHERLAKOTA. The comment that I’m tempted to make, but which I have not made yet in public, is that this is actually a feature, not a bug. [Laughter] We’re trying to get them to consume, as opposed to saving, to spend money on their grandkids and lend to that promising young entrepreneur down the street, as opposed to holding money, and so this actually would be a sign of the program working.”

The “sign of the program working”, Kocherlakota had already explained, was the constant complaints and worse hurled at him by the righteously angered who were not always gray-haired retirees. That promising young entrepreneur down the street didn’t exist by 2011’s economy, yet the Keynesians always put them in the future.

We've left it too late to unwind this disaster in an orderly manner.

"World's $281 trillion debt pile set to rise again in 2021"

"Global debt is an issue that has become especially troublesome since the financial crisis of 2007-2009....following this crash, and Great Recession, the planet has experienced a debt problem that has never before been seen in the whole history of the world."

Global debt is impossible - who do we owe money to, aliens?

Actually its just logical. The price of everything goes up faster than wage growth and you just borrow more and more. The population goes up and we borrow more and more per person. The bottom line is the total debt NEVER goes down it only ever goes up. Nobody is lending, every country is in debt, that's how the current monetary system works your borrowing more and more now to be paid back in the future. Its called new money creation, new money is injected into the system in the form of debt, you borrow something that doesn't actually exist yet and then pay it back with "Work" done to make it physically exist. The problem is that as debt increases the resources decrease so there is no way its all going to end well for everyone.

I agree it won't end well for everybody - because we are operating a financial system without due regard to real resources.

But, total net debt is by accounting definition equal to zero. Whenever a person or an organisation has a debt (or liability), another person or organisation has an asset. If you take out a $1m dollar mortgage, you have a debt, and the bank has an asset (your mortgage). Other banks and investors will buy that asset from your bank and trade it. When students take out student loans from Govt, the student has a debt, and Govt has an asset. Everything has to balance. https://en.wikipedia.org/wiki/Sectoral_balances

Prices may well be going up faster than wage growth - but if someone is paying more, someone has to be getting more. If the higher prices are not filtering down to wage growth, then it is because someone is hoarding wealth.

Prices may well be going up faster than wage growth - but if someone is paying more, someone has to be getting more. If the higher prices are not filtering down to wage growth, then it is because someone is hoarding wealth.

No. The money supply is being debased and impacts the low-income households first then the middle and even upper as they scramble for more debt. This is essentially neo-feudalism at work.

Exactly. Asset prices to the moon means everyone is rich in equity and capital.

Move along, nothing to see here.

Asset prices to the moon means everyone is rich in equity and capital.

Depends. If the monetary system is being debased, the hoi polloi think they're 'rich', but actually they aren't.

You and I know that. The hoi polloi love their baubles and trinkets though.

I forgot the sarc tag above.

Great! Now someone forward this to Mr Orr.

The ability of economics as a discipline to ignore empirical reality in favour of models continues to amaze.

Hmm, do you really think Mr Orr doesn't know this? New Zealand is following US's path, trying to create unlimited debt that we have no intention to pay it off by buying government bonds to keep rates low. They have been planning it this way, If there is too much money, then just keep pumping up the property prices to soak up the extra money so we can keep the inflation low. So what if the price is unsustainable? Easy, just import more migrants working as slaves to continue to push the price higher.

The fundamental problem is that govts/Central Banks have given themselves the power to control money supply and the price of money. By controlling the price of money, of course they distort and create strange incentives. If they lost this power somehow we would not need to debate the ways they have screwed us up and whether they could fix this.

Alas, we are going the other way, and the more successful cryptos become the more they will try to crush them.

The money supply is 90% driven by private banks issuing of credit!!

The fundamental problem is that Govts have forgotten that they are supposed to be provisioning for their populations rather than fawning over the financial sector

But aren't they using the OCR to drive rates down and "stimulate us"?

The original idea was that low interest rates would stimulate business investment and drive economic recovery - although this has been disproved countless times (businesses borrow when they are confident about expanding). Now, low interest rates just stimulate house price growth - and push investors away from term deposits and Govt bonds into riskier investments (hence the spike in share prices). So, yes, low OCR 'stimulates us' to spend more money on houses, and encourages investors to bid up the price of speculative financial assets (shares). Whoopee.

We are heading into a demographic event not unlike black death where labour will fundementally revalued by declining workforces, ageing population and even outright population decline in most countries [link]. Don't worry about deflation because that will be blown away as the working age population declines.

Thoughts on automation?

My thoughts are the same as always on Automation.

We should Automate all Bankers, Politicians and So-called Public Servants, so they do not put us all into debt, into harm, into Mortgage slavery and pay them over the odds on an inflationary cycle that will end in the greatest Printed Debt and Online-Debt and Fund-a-mental Growth, like never before.

I could explain, have tried before, but "Stupidity reigns".

Covid is one example of how our Finances and Housing Issues have Flown to the moon from China and Back. Now we are totally indebted to our Dear Leaders for ever and a Day.

Over Rated, over Spent and over Here. All talk. No Ability. And unfortunately, that you can Bank on. Print and be damned.

Alison Brook, only one growth matters to RBNZ and Government and that is house price growth everything else is .........

Lol NZ! We're zero bound dude

Indeed.

Why invest in businesses or productivity? Or waste money purchasing goods and services?

You can plow everything you have into speculative asset bubbles instead.

You can plow everything you have into speculative asset bubbles instead.

"Have"?! Borrow, more like.

If there is a probable 300,thousand, thousand, million US$ worth of debt sloshing around the globe at the moment, just a 1% rise will add another 3 thousand, thousand, million dollars worth of cost to servicing that debt. A cost that will eventually be borne by cut-backs in spending on something else.

And then, just imagine if "Inflation!" takes hold and something akin to a Volker Moment happens.......it doesn't bear thinking about.

Ha, wasn't it said a long time ago that this is where capitalism would end up?

Interest rates are just the donkey show on the sidelines.

Indeed. This captures the moment well: https://medium.com/@renegadeinc/chinas-fortune-cookie-crumbles-3191c696…

Nice link:

“China understands the difference between earned income and unearned income, between productive investment and unproductive investment.”

By contrast:

“The United States realize that you can parasitically make wealth much quicker than you can actually create wealth. It’s cheaper to be a parasite than a host. And so most of the financial strategy of Wall Street thinks, how can we get something for nothing? How can we get a free lunch? They’re looking to grab Chinese assets on the cheap. They’re looking for monopoly rights”, says Hudson.

I'm no economist but it seems to me that many of the long held mantras of economics are either being found to have serious holes in them or are simply no longer applicable in our 21st century world. Controlling inflation with the OCR is a joke and expecting currency values to react in line with rising or falling interest rates is no longer tenable. Unfortunately central banks the world over, and ours especially, seem to be applying old economic theory to deal with newly faced situations and hoping like heck that something works.

Spot on. The last 50 years of mainstream economic theory is crumbling - but the damage it has done is incalculable.

Growth, schmowth.

We cannot grow forever in a finite world.

New thinking, please

You can always add another zero

Crypto!

There are so many ways this could go - right, wrong, up, down, backwards, forwards, badly, goodly & many more besides. It is data overload, quickly followed by money overload & we're already well into the trillions in many places. I have no idea about what's going to happen next. It could be a number of options but I'm not bright enough to know which one. The only thing I can remember from school, was that whatever went up.... usually had to come down. At least, that's what happened to me, anyway. And you know, I learnt from down. It hurt. I had to be better. Wiser even. But even when it broke (which it did a few times) it eventually mended & I got up & got better. Even wiser! These days you can up & up & up & up &.... you're off to outer space & beyond. I wonder what happens when the oxygen runs out?

Crypto!

Yes, it also needs to be mentioned that government/central bank interventions favor the bigger companies, as they are closer to the money tree. The relatively lower interest rates they enjoy allow them to leverage up and buy the smaller companies.

The most egregious example has been the ECB buying up corporate bonds, as well as the Fed during the Covid crisis. Winner take all...

They are not Bonds, they are Handcuffs, also known as Mortgage debt. Flipping insane is the only way to get ahead......A no Brainer...is buying into it.

Banks want you in their vice. Nuts ....is another way of Holding onto you. Got you by the shorts and curly. And that you can Bank on.

Save your Breath...Save yer Pennies....it is all turning to crap.Gold, EverGrande, Petrol Shorting, Pumping and Dumping Stocks....its a mad mad World. But Housing will rise forever and ever Aye Man....

Become a Lorry Driver....Join the Army........and Fly to Britain... Jobs for Life over there.....Boris will fix you up for life...a Pound to a Penny......Aussie Rules, USA will back you......against The Chinese Great Wall.....of our Discount Tent...

Just Biden their time......But at least you may have a cheap Roof over yer head....until the Shite hits the Fan. Plus 3 square meals a day......Yellen google her....Talks more crap than the USA National Debt...

Manipulated interest rates=risk/reward imbalance=moral hazard=broken economy.

The economy was broken regardless of financial shenanigans.

There ain't enough good quality energy left, nor enough compact resources, and we're sh---ing in our nest too fast.

None of which is measured by these clowns. Except they're not clowns - they work in a University. So we need to ask why a branch of Academia has to prolong the projection of porky-telling? Emperors Clothes and tailors incomes.......

Great Article

The central bank inflation targeting through Cash Rates has been hijacked as a tool to smooth out every economic bump. Thanks for Don Brash for for inventing such a tool used by Global Reserve banks to achieve nothing useful while at the same time delivering Asset Bubbles.

Remove Kiwisaver and see NZX fall like dominoes.

It's a social version of those firms which, knowing they were tanking, issued shares rather than wages to their staff.

Worthless post-collapse.

1. Low interest rates fuels speculation bubbles.

2. Higher interest rates require a better business case to justify borrowing capital.

3. Pursuing growth is the wrong metric, given the real biophysical limits to growth we have.

In my view persistently low interest rates have led to malinvestment on a massive scale along with the destruction of honest price discovery across all asset classes. The article mentions zombie companies which reminded me of a recent article reporting that 20% of all companies on the U.S. Russell 2000 Index are now classed as zombie companies.

With inflation now on the march, largely as a result of the extraordinary amount of liquidity pumped into the markets by central banks, real interest rates are set to go deeply negative.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.