By Bernard Hickey

It's been just over 4 years since US banks began reporting heavy losses on sub prime mortgages, triggering the worst Global Financial Crisis in almost a century.

Since then financial markets have been on the brink of total meltdown at least twice and countless bailouts and collapses have cascaded through the global economy and into New Zealand. See the GFC timeline here.

But the world hasn't ended and many believe the worse is over. I should be celebrating like everyone else.

So let me explain why I'm still staggering around like a bear with a sore head.

Firstly, the context.

I'm regularly told by many more qualified and informed than me that I need to lighten up a little. Everything will be ok, I'm told. Be a bit more positive, I'm advised.

Many times over the last four years I've been told to stop with all the glooming and dooming and just accept the world will eventually be a better place reasonably soon. Our Prime Minister John Key is just such a beacon of positivity and belief.

Every time the markets have recovered and economists have emerged into a patch of sunlight with bright, shiny new forecasts of economic growth I have heard we've turned the corner. Green shoots seem to be sprouting in every direction, I'm reliably informed.

At least three times in the last four years it appeared as if the storm was over and we could all get back to normal levels of growth and economic activity.

Firstly, there was a patch of confidence in late 2009 when the markets were stable, the oil price was down, China was growing strongly and American house prices were rising. Then the European Debt Crisis blew up in January 2010 after Greece begged for a bailout, causing chaos on European financial markets.

Then things seemed again to calm down in late 2010 before Ireland was forced to accept a bailout, raising fears again about financial market stability. Meanwhile, America was forced into a second round of quantitative easing or money printing because its economy just wouldn't grow fast enough to reduce unemployment, despite interest rates being near 0% for over 2 years.

Finally, in early 2011 some hope appeared again on the horizon. China had managed to avoid a big slowdown, America seemed to be growing again, stock prices were back near three year highs and Europe had settled down somewhat.

Even New Zealand seemed to have turned the corner. Commodity prices were rising and unemployment had stabilised.

Then a big earthquake destroyed the centre of New Zealand's second biggest city, Japan's economy was driven back into recession by a devastating tsunami and the European crisis blew up again. America has slowed down again and even as I write this financial markets are bracing for another round Greco-Roman debt turmoil.

It seems as if every time some light appears, another even darker cloud scuttles into view.

Aside from the natural disasters, I'm now not surprised when there's another 'accident' on global markets or a mysterious slowdown in a major economy. Regular readers of my daily Top 10 at 10 reports will know how unrelentingly bearish and sceptical I am about the traditional economic outlook.

Finance Minister Bill English even told me once my Top 10s were the most depressing things he read regularly. I took that as a compliment.

So why so glum?

The global economy's basic problems have not been fixed. The bailouts and 'reforms' have actually made the system more exposed to catastrophe while failing to deal with the debt overhang and an imbalanced system of trading and capital flows. To Big To Fail banks are even bigger, but now they have actual or implied government guarantees to backstop their gambling.

China is still racking up massive trade surpluses with America that is being funded by Chinese lending, while hot money fresh off the zero % printing presses races madly around the world in search of a return. Some asset values are being pumped up to unsustainable levels and America is exporting inflation as fast as it can print it.

Here's 5 reasons why I think the Global Financial Crisis is far from over, why economic growth could take another decade to get back to anything like 'normal', why New Zealand will be lucky to avoid the fate of Ireland and Greece, and why I'm sticking to my view that house prices will not recover to their 2007 peaks until 2018 (although I admit they probably won't fall much more than 15% in nominal terms)

1. The developed world is groaning under a debt mountain

This long term chart showing America's total debt to GDP ratio is the most sobering thing I've seen the last 4 years. I come back to it regularly. It expresses the weight of the problem facing the world's largest economy.

Essentially, America has borrowed beyond its means for at least 20 years, pumping up share prices into bubble territory at least once and inflating its housing market to disastrous levels.

The debt-to-GDP chart looks like a mountain that has been climbed up and now needs to climbed down from very carefully. The last time debt-to-GDP was anything like this was before the Great Depression and World War II. It took massive public stimulus, artificial and brutal restrictions on personal consumption and then a sustained period of economic growth with inflation to bring it down.

How does America get out of this mess without either an almighty restructuring (ie haircuts on debt and huge losses for banks and pension funds) or massive inflation to lift the denominator in the debt to gdp ratio, essentially defaulting by devaluing the currency? There has been a little restructuring, but mostly the toxic assets have been shifted from private to public balance sheets in the hope that growth will solve all the problems.

When it didn't, the US Federal Reserve turned on the printing presses. It is near the end of its second round of Quantitative Easing or QEII. Many believe it will have to restart the presses in fresh rounds of QE III and QE IV. As recently as today prominent economist Brad Delong said just that.

Meanwhile the Federal Reserve has kept its Official Cash Rate at 0-0.25% since December 2008.

2. That debt is only sustainable while interest rates remain at record lows

What happens when short term interest rates are raised by central banks to fend off inflation? And what happens when long term interest rates are driven up by bond market investors?

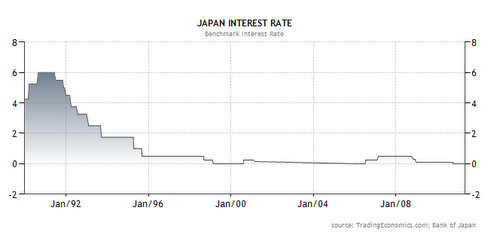

One way to get a sneak preview of what happens to an economy after a housing bubble bursts and the debt is not restructured is to look at the experience in Japan after its property bubble burst in the early 1990s.

Its short term interest rates dropped to zero almost 15 years ago and every time the Bank of Japan tried to raise them the economy ground to a halt. They were then promptly cut back to 0% again.

Anyone remember the Reserve Bank of New Zealand's interest rate hikes in June and July of 2010? They took the wind right out of our sails because we are so indebted.

Here's a chart showing Japan's short term interest rates.

3. New Zealand households have a lot more deleveraging to go

The government and many economists assume that consumers will get right back on the debt bandwagon and start spending again soon. This year's budget assumed just that.

There's even a hint of pleading in recent comments from various bank executives about the need to start borrowing again. Westpac NZ CEO George Frazis said New Zealanders needed to move from 'caution to confidence'. See Gareth Vaughan's article here on Westpac 'match fit and ready to help'.

See also Gareth Vaughan's article on bankers pleading for customers to start borrowing again, where BNZ CEO Andrew Thorburn said New Zealanders need to be 'stepping out more confidently'.

There's a reason we don't want to borrow much more.

Everyone knows that they're up to their gills in debt and that any move in floating mortgage rates up to nearly 8%, which is what is implied in the Reserve Bank's March Monetary Policy Statement forecasts for the 90 day bill rate, would make life very difficult. They are also sceptical about the promise of higher house prices needed to make any gearing up profitable. It's been four years now since house prices peaked and in almost every area except for central Auckland they have shown little signs of life.

So what is a normal level of debt? Where might it go over the next couple of years?

This Reserve Bank chart of New Zealand household debt to disposable income shows it rose to around 150% by 2007 and hasn't dropped much. Our servicing costs have dropped, but only because the OCR has been cut to 2.5%.

I think it would need to drop back to something like 100% to be something like normal. I've asked the Reserve Bank and Treasury what they think normal might look like. They don't have a view, but I think this de-leveraging (or at least a stall in the leveraging growth) will be enough to keep New Zealand's growth lower and slower for longer. About a decade longer.

4. New Zealanders won't be able to fund new debt out of income growth

New Zealand's economy has a structural problem. We have borrowed so much from foreign creditors and sold so many assets to foreign owners that the interest payments and the dividends are making us poorer every year, even though we're producing more.

This chart below shows the effect of the foreign drain on New Zealand's GDP from interest payments and dividends growing from around 3% of GDP in 1987 to around 8% now.

It shows that our Gross National Income per capita (the portion of our production we get to keep after paying the foreign master) has actually been falling since 2003. See my earlier article here on the 3 charts showing why New Zealand is getting poorer.

Unless there is a turnaround in our propensity to sell assets and borrow offshore I think this will continue to be a handicap on growth for some time to come.

As it is, the government is borrowing more than NZ$10 billion offshore this fiscal year and plans to sell down state assets to raise up to a further NZ$7 billion, although it is giving locals first crack in these asset sales. Meanwhile, our largest companies and land holdings such as Crafar Farms and Dairy Holdings (two of Fonterra's biggest suppliers) are still being sold overseas at a great rate so we can continue to live beyond our means.

As recently as last week the Treasury forecast our current account deficit would rise back to 6.9% by 2015. That is banana republic stuff, as former Australian Prime Minister Paul Keating once said.

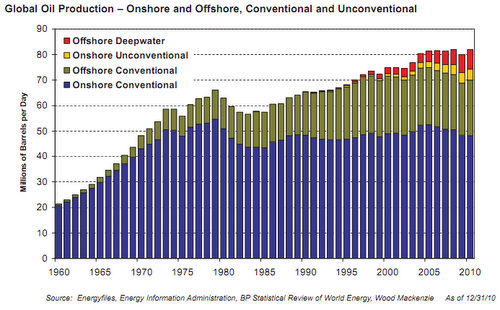

5. Peak oil will constrain growth globally and here for some time

Sharply higher oil prices in recent months have again thrown a road block in the way of a recovery in both the biggest developed and the fastest growing emerging economies.

Production of the cheapest oil has clearly peaked and the introduction of big new demand from China (an extra 200 million cars will clog its roads within five years) will further inflate oil prices.

It will take years if not decades to find cheap alternative energy sources to power our modern economy. Meanwhile, growth will be slower than it has been in the past.

This chart below from Jeremy Grantham's epic April newsletter tells the story. His argument that the "Days of abundant resources and falling prices are over" convinced me.

So why do I get out of bed every morning?

I'm actually very optimistic about the future. It will just be different from the last decade or so.

I just don't think we will repeat the same old story of the last decade of never-ending and strong growth powered by rising house prices and increasing foreign debt.

I think New Zealanders, but not necessarily our government, have got the message.

Despite all the temptings of the bankers, we are sitting on our wallets and buckling down to repay debt. People are changing habits of a lifetime and we are heading towards some sort of balance.

Our government will eventually get the message and seriously try to balance the books. We are fairly socially cohesive and have an enormous wealth of physical and human resources to call on.

Our IT and technology exports, which don't rely on scarce resources and also generate high paid and interesting jobs, are now over NZ$5 billion. See more here at NZHerald.

We have a beautiful country with plenty of talent and goodwill. We're the second most peaceful country in the world and have the fourth best standard of living in the world.

Unlike at the same time after crash of 1929, there is not an obvious prospect of any sort of global conflict.

Lots of bright, well intentioned people are working very hard to get us all out of this hole.

It may mean we all consume a bit less and spend less time grasping for more.

Meanwhile, in my own little way I'm trying to help create some of these interesting jobs that compete with imports and foreign owned companies (Google/Facebook/Fairfax/APN) to try to help us balance our books. I hope, also, that we're providing some useful information and a platform to debate these issues and improve the quality of decisions made by borrowers, savers and a few policymakers.

Interest.co.nz now has nine full time 10 staff, more than triple what it had three years ago. We're also profitable, debt free and growing. Today we even moved the currency, albeit in the wrong direction! See Gareth Vaughan's article here on China's sovereign wealth fund preparing to lend/invest NZ$6 billion to/in New Zealand.

But mainly, I have fun every day 'fomenting happy mischief' as David Farrar at Kiwiblog might say.

It's just that my form of fun is spending all day grumbling about the state of the world.

cheers

(Updated staff numbers)

86 Comments

You're ok by me Bernard, I'm always on here first thing in the morning to see whats up ( or more likely down ).

Having a similar disposition, I applaud you(r) "Bear-heart ". Bearishness, as I see it , is things going back to what they were, or contunuing the same. Neither will happen ....:)

You poor old coot Bernard...silly you for believing the liars.

As was said before..." we live in interesting times"...and there are opportunities galore to both lose fortunes and make them.

The sad fact is equality does not and never will exist...even Castro eats off gold plate.

So sit back and have some laughs as the liars try to paddle their way past the black holes in their financial game. Count the banks that get sucked down. Watch as pollies are knocked off the wall and whole govts get the boot. You may be wrong about the decade call...this could blast on for 50 years or so. Oh and don't forget to learn Mandarin before it's too late mate.

I prefer you doomy and gloomy Bernard and to encourage you, have further bad news: a relative out house-hunting in the $550,000 to $600,000 range in Auckland over the past few weeks found potential buyers thronging to open homes and prices are high, high, high, particularly in inner city and surrounding burbs like Grey Lynn, Pt Chev etc. Those structural problems in the housing market sure are persistent.....

The bad news hasn't arrived at your relatives door yet, GNB. But it will, if they buy, and at the doors of those who have bought and are reliant upon debt to keep their property. But, hey, at least we're not Japanese consumers, or UK consumers, or US consumer or even Aussie consumers.....we're different...

"UK consumers are technically back in recession after household spending contracted for the second quarter..."

" (Australian ) Retail gloom will deepen...."

$550-600 range in Grey Lynn, Poiny Chev? They'd need to go back to the '2007 peak' to have a chance of getting a house in those burbs for that price - need to add a few hundred K to budget to get there today.

They surpased the 2007 peak in 2008 - 10 years ealier than Bernards prediction.

Bob - i like your style...

President of Property

Bob,

I'm curious. How much higher do you think those prices could go?

What might sustain them in terms of new stimulus or changed conditions or higher interest rates or higher incomes?

cheers

Bernard

That's easy Bernard. Cashed up foreign buyers, particularly Chinese people who can see the writing on the wall in China.

Auckland house prices are strongly pushed by immigration. People moving to New Zealand move to Auckland, by and large. People leave from all over.

Right so essentially the only thing supporting prices in central Auckland are uninformed foreign buyers rushing in and willing to pay more? People who are clearly not basing their purchasing decisions on any financially sound fundamentals... reminds me of a similar market i've seen.. apartments in Queenstown.

But I guess aucklands different?

Actually hamrod having been one of those buyers who purchased an apartment in Queenstown and watched it's value almost halve, I can assure you it wasn't just uninformed foreign buyers...

Who knows how much higher they could go? I'm not saying it's good or bad - just saying what's happening.

There's barely any immigrants in these areas and most people seem to have small or no mortgages so interest rates are not very relevant. The only stimulus seems to be that there are more people are keen to live there (close to town, good schools etc.) than houses available.

Perhaps supply and demand does have an effect on prices after all?

Well and succinctly put, BH.

About right.

We just have to collectively dissociate 'better' from 'wealthier', and today's Morning Report interview with John Whitehead suggests we're on the right track.

You might want to check your bike seat. Many a seat has been the source of grumpiness. Typically, the best ones have something covering the springs......

ps - mind you, some of us will be miffed here. We were telling you what Grantham said, somewhat earlier. Ye of little faith. :)

#5 Every (note EVERY) oil spike has resulted in a recessionary period.

Where JK gets his idea that we are going to come out the other side of this one quickly and smoothly I have no idea.

However that is no reason to be upset. Complacency is the enemy.

So Bernard, if we all get out of the right side of the bed each morning we will get through (in spite of our Government of the day, I suspect)

nice piece Bernard :)

Like you, I think these negatives can turn into positives. Time spent in the Pacific Islands recently showed me how people living with little (in a materialistic sense) can have so much

Also, I know 5 is a tidy number, but I would add a number 6 - the ageing of the baby boomers

And a (7) MIA. "The kiwi is at nye on 0.8100 this evening...and looking perky"

Here it is in different form.........

Bernard, I think your tone on all this is just a necessary part of the chatter. I suspect this Govt and the one before it are acutely aware of the magnitude of the problems, it just isn't politically expedient to discuss the cold hard light of day constantly.

This country actually needs optimism and confidence from it's leaders to continue to navigate these waters, and while the learned amongst you might write off their predictions as fanciful and baseless, the masses need a reason to get up and keep going.

All the info needs to be out there for those who want to look for it, but for those that don't, it's nice to wake up and hear about a light at the end of the tunnel occasionally. I personally think they are trying to navigate a long slow bubble deflation with a soft landing for as many as possible, and sometimes talking it up is part of that process.

but doesn't that strategy just amount to lying and setting false expectations?

I understand the point you are making, and have some sympathy for it. But while it may keep the masser happy (ier) in the shorter term (opiate for the people), it may backfire significantly in the mid to longer term

I'm not sure it's lying, more just choosing one possible interpretation of the picture. Just the way any marketing campaign does, any advertisement, any set of financial accounts, valuation or any of Bernard's articles.

Do they aim to set false expectations, or aim to create a self fulfilling prophesy? I would suggest the latter, which is fine by me. I'm pretty sure the only true goal of governance is to keep the masses happy, calm and orderly.

The catch is that people flock wildly on emotion, from euphoria to despair en masse and the outcomes are often painful. Bernard's observation that good news is regularly swallowed up by bad isn't really surprising, but we have to remain optimistic to get anywhere.

How do you motivate a poorly performing sports team? Probably not with the stats!

I would suggest that in terms of coming to accept that governments lie, you are still in the first stage - denial.

You appear to be saying that the purpose of government is to control the populace.

This is the true purpose of a perverted government, of the government of a Hitler, Stalin or Mao.

I rather hope it is not the case here in NZ.

What is the purpose if not to maintain order? Why else would we subscribe to any form of rule or regulation if not to provide an orderly and somewhat systematic way of life free from chaos. Their purpose is maintain happiness, calm and order.

I get so bored of all of you suggesting anyone who doesn't 'see' how bad its going to get, are actually 'in denial'.

Its you who are in denial. Denial of the fact that the a large part of the population just plays the game. We are happy to be fed our good news and bad, and react accordingly and flock one way then the other. We will live in fear of war because we are told to, and now of economic meltdown. Most people are more worried about their ill family member, or the next kid being born to care about the PIIGS or the US debt ceiling being raised or not.

It is the case here in New Zealand, and its the way it should be. We currently dont live in fear of our lives or a World War, so it could be a lot worse. People need some optimism to have happy lives, so I for one, dont mind when our leaders paint a picture that has some upside.

If everyone started to believe this armageddon scenario, we would go into a very rapid downward spiral. the whole reason we haven't is because a whole bunch of people choose to remain optimistic - despite all your best efforts. Thank goodness for them.

We do need urgent changes on many fronts, but everything takes so bloody long – including the NZmedia landscape – good night my bear.

Bernard – real friends call me bear too, but right now I rather like to be a tiger – strange isn’t. We are all well behaving, because the days are good for us – still.

--

I personally think world problems are not only accumulation, but accelerating on many fronts to an extent that solution findings should not be lead by politicians, policymakers, bankers, lawyers etc. but by philosophers.

My prediction for the next 10 years: Climate change/ natural events combined with mismanagement of economies and greed will financially ruin economies/ societies with severe political consequences.

http://www.youtube.com/watch?v=nEOs7RCUncA

Houses are priced in New Zealand Dollars. One thing that has not been mentioned is that the purchasing power of New Zealand dollars halved in the last few years- say 2001-2006. say 5 years, If that seems a bit extreme make it 7 years 2000-2007. So where have house prices gone exactly? Our currency has been debased as any monitariest would tell you. You get inflation when you increase the money supply beyond the ability of the economy to increase productivity ( I think that is about how they call it). Anyway we have been following inflation as measured by the Reserve Bank and ignored inflation in housing - always blaming something else, never the rapid increase in money in the system.

Keep up the good work Bernard!

Cheers from sunny California

"2. That debt is only sustainable while interest rates remain at record lows"

"What happens when short term interest rates are raised by central banks to fend off inflation? And what happens when long term interest rates are driven up by bond market investors?"

Simple, THEY won't raise interests rates! They will let 'inflation" grow & grow while dismissing it even exists. 'Inflate the debt away' at the expense of the real cost of living

Yeah! Some good comments here. Regarding where we are all headed. Im trying to remain positive about NZeds future. Its quite funny really. Australia are digging up there country to build china and we are compromising our most vital asset, our land and water systems, to produce obese chinese and for our efforts we receive a fiat based currency in exchange which loses value over time, (inflation). Our real wealth is our environmental capital. I see my children (5th generation kiwis) having to maybe learn chinese to survive in the new post world financial meltdown NZ. I recently read an article concerned about nz not looking after the new emerging chinese inbound tourist market, it suggested more signs in chinese and more attention to their food requirements-Yeah right! Imagine that.

Bernard : Just don't sell interest.co.nz to the bloody Australians as those plonker Morgan's did with TradeMe !

....... Can we keep just one totally brilliant thing , Kiwi created and run , 100 % pure in Kiwi control .... Please !

Rock on , for years more of robust debate , and an ever-lasting stream of Dilbert , Muppet clips , and of Clarke & Dawe .

... Gummy Bears to one and all ...... ahhhhhh , yummy mango gummy ......... ahhhhhhhh ......

And maybe a Friday caption 'competition'.....

"The purpose of our lives is to be happy."

- Dalai Lama

(Discovered a new peer group - great quotes....)

"There is nothing like returning to a place that remains unchanged to find the ways in which you yourself have altered."

- Nelson Mandela

" Even when you've eaten so many gummy bears that you think your face will fall off , your belly aches , and you can't even feel your own balls .... It still just isn't enough.... Have some more ." ..

....... - the Gummster .

You may be in need of an earlier invention of mine GBH...The Nether Nether Scratcher...for that wee out of reach problem of yours there...I had intended it for the Australian market as the name would suggest....but alas it never got past the prototype...which I keep handy as we speak. ...You my good man are most welcome to... have it .....as it appears your need is greater than mine...(I'm starting to tingle with benevolence) may you share in the joy and comfort it has brought me.

Speaking of which ...what the Devil happened to Wolly's rubber thingy....? he went all quiet on us about that.....hmmmm note to self.......

You're dead right Bernard, and least you tell it like it is, and aren't out there just trying to win a popularity contest, saying what people want to hear.

Don't expect the government to admit it, they want to keep peddling the happy joy joy story so they can get re elected.

They'll only mention things aren't not so great when it suits them, to explain why they have to cut and sell assets.

Now they are about to go further down the road of selling assets.

So the country as a whole will be effectively renting basic services like power generation from overseas, and wasting all our income paying the rent.

We will be effectively importing even more and more if they go ahead with asset sales.

There's our point of difference, Hugh.

I've always been able to rattle off "The Long Trail".

:)

The internet is also full of all sorts of misleading, incorrect and flawed information.

There's even websites that claim Auckland is one of the world's most densley populated cities - denser even than NY and half as dense than Tokyo. Also websites promoting urban sprawl and increased reliance on cars as the only transport option.

A very sobering summary.

A couple of Economics Music/Rap videos sumarise the situation very well.

These are especially good for making economics "cool" and "trendy" to those who would normally have little interest in economics.

These videos are very well made a well worth watching.

1. Fight of the Century: Kaynes vs. Hayek Round two (has had 770,000 views)

www.youtube.com/watch?v=GTQnarzmTOc

2. "Fear the Boom and Bust" a Hayek vs. Keynes Rap Anthem (has had 2.3 million veiws).

Yep. They're cracking videos. Worth showing to all economics classes.

cheers

Bernard

Heads up Bernard, this is a fine place to find opinion and healthy debate, and hilarious comments too

Bernard, your site is great on the road I just go for 10 @ 10 and its about all the reading I need. Last night I had to drive through a thunder storm of biblical proportions. The hail was inches deep and a few pickups in front of us slid of the road, thank God for ABS.

In California there is still lots of wealth, just jobs are hard to get for the lower income earners. A friend who is a nurse is on $50 an hour and others are doing well even the swimming pool people are busy enough. However if you fall off the horse then you have big problems, as one of my friends has due to real estate investments going sour. Farmers are mostly doing fine prices are good, production will be up again this year. Cattle ranches are cheaper buying, however cropping land with irrigation is around the 5k an acre still cheaper than home and these guys have Mexicans.

Local taxes are limited to %1 of your house value set when you buy so friends who have had their house a long time hardly pay and local body incomes are down. The closest city to us is broke and if you drive of the main roads then its a bit rough. However the general feeling is its their own fault, they shouldn't have promised what the couldn't pay and most are happy to sit back and watch.

Most people I talk to are well aware of the problems facing the west, however this is a big ship to turn around and most are expecting more pain. Gas prices are high and consumption must be back I paid 4.30 a gallon yesterday which was the dearest yet mostly around the $4. So even with the USA driver using less, the gas prices remain high probably because of growth in Asia, thats a worry. I try and read Stuff every day but its all crime and over here I think they are tougher. On the Radio a guy who molested a 5 year old boy just got life with min parole of 15 years, at home he would have got home detention.

Wish sir James Goldsmith had lived longer and why didnt we get that interview in NZ instead of the dribble from Mike Moore.

Have a great day

Excellent piece Bernard....very closely matches my outlook, except im more bearish on oil....somethings to comment on...in there.....later maybe, Im knee deep in 3 projects at the moment....one has a 20 year time line!....its jobs like that as to why I get up out of bed and want to get to work every morning.

Funny but the external optimists think im a depressive (I on the other hand see myself as a realist with open eyes.), They complain I see the negative aspects and the faults and problems in anything they or I am asked to do.....thats because I take risk seriously, blindly doing something and solving the problem when it blows up on you is too late often. And my attitude is not a reason to not do something, its a map/path to get to the end goal without stepping on land mines.....so hey I make my managers think about the technical risks and then they rarely are they/we out think them.....some thought costs the odd few hours up front but its way less stressful later on.

I think the blind optermists have run the place for 30 years and we are now all paying the price, but some realism is now there and many ppl at the botom (ie voters not pollies) are starting to act sensibly on debt etc. Im hopeful that the Pollies will catch on that ppl are starting to act differently and that Pollies can start to lead again without fear of being dumped when some hard secisions are made.....

regards

"we could all get back to normal levels of growth and economic activity."

We cant of course, Peak oil guarantees that we cant....if you look at WW2 that was a massive change to economies. I think solving the transportable energy problem is one such event of this scale....and it is really about petrol and deisel not fixed energy production, its fairly easy to expand hydro, tide, wind and conventional power stations...its not easy to change transportable fuel sources....thats a huge challenge and the sooner we start the better off we will be. The ethos of market signals is way too late and way too slow, but it seems thats what its being left to....its going to hurt more than it needed to in a shorter time frame...we have made that choice by default.

"...to something like 100% to be something like normal. I've asked the Reserve Bank and Treasury what they think normal might look like. They don't have a view...." that is frankly shocking it should be blindingly obvious that this is now a quite possible scenario....maybe ask IRD ie where they see tax recipts going 5 years out?, they seem more switched on.....maybe their economists are the ones to chat to. Or maybe ask BE to ask them to make one.

"About a decade longer." at least i think.....bear in mind the huge cost to GDP that moving off fossil fuels will entail....and that has to go on at the same time as debt reduction....its goign to be tough to do two "10% of GDP like things" at once.

"It will take years if not decades to find cheap alternative energy sources to power our modern economy. Meanwhile, growth will be slower than it has been in the past."

Best data I can find says to grow global GDP by 4% you need 2.5% more oil, realistically oil availability will decline at 5% globally per year shortly.....So thats a possible 8% decline of GDP while we sort this out....plus of course 5%~10% of GDP to do so plus some % to pay down debt....that could be 10%+ of GDP sucked out of our economy every year.....thats pretty bad IMHO....but doing so will create jobs just in different areas....so a change of direction for our economy.....For instance I think we will export less as farmers etc switch to bio-fuel type crops....we have to have [bio-]deisel.....20% of a farmers crop could go to that...just to support his own fuel needs to actually output anything!

The Hirsch report said 20 years or 10 maybe with an effort like the ramp up to WW2...so yes decades is quite possible.

regards

This is the most useful and interesting site I read. Grumpy bear or no grumpy bear.

One in 175 people in Shanghai have a net worth of over $1.3m. The realestate industry will save us, we will just replace the crew:

“Chinese economy we all know about…

Chinese government says it’s time to grow offshore…..

Let’s take a good selection of New Zealands “products” over….

“We’re all New Zealanders, we all love the country so I think it’s healthy for us to have the debate and make the right decisions for our country…. but hey!…. young people coming through see it as “our planet” rather than “our country”

http://static.radionz.net.nz/assets/audio_item/0011/2385074/mnr-20100824-0842-More_than_800-million_dollars_worth_of_property_on_display-m048.asx

Bernard, another valuable service you provide is that of a 'buy signal' . The more you complain, the stronger the signal.

Regards.

Bernard .....Don't worry.....for the most part it's all going along spankingly.......your moment in the sun will come.......it may have even been there on occassion but you had your head down ass up...and so missed the glow as it crossed your cheeks.

Never lose sight of why ....."cause you don't know what you got ....till it's gone"..

Happiness is what we do around here in a unique way..!! yay...!

Quite right, Your Landlord. But it's not property that the 'buy 'signal is for....

"Sectors which depend upon either private borrowing or public spending .. are now set to contract rather than expand, which renders aggregate economic growth implausible. And, without growth, there may be no way of avoiding a debt disaster.....So what are these debt addicted sectors? Unsurprisingly they are real estate, finance, health, education, construction and public administration..."

Bernard,

I know Iain Parker comes across like a bit of a nut, however he does seem to have a point with his comments about privately created money through debt. Proponents of publicly created money point out that if money is created as debt, then even more money has to be continually created to service the interest on that debt. From a logical perspective this seems unsustainable and I can see how the allegations arise that this is responsible for creating / deepening recessions.

I've done some digging and I can't find a decent rebuttal to this concept. Rather it seems that the issue is broadly ignored. I have heard the odd comment along the lines of "Social Credit has been discredited" etc., but never any evidence.

Is that because we are so heavily indentured to the existing financial systems to take any alternatives seriously?

Related to this, if we have in fact reached Peak Oil, and GDP can longer grow exponentially (as asserted by folks such as Power Down Kiwi on this site), then would that not make the existing system of debt based money creation even more flawed? If the economic paradigm is going to be forced to a shift to sustainability rather than growth then it would seem a logical corollary that the monetary system would need to change from one requiring exponential growth (in order to service interest) to a non-debt based one that circulates in a stable fashion.

This is interesting stuff - and articles in plain English explaining how financial systems work are much appreciated.

Keep fighting the good fight BH. I have been an avid reader of the Top 10 for about 18 months now and the thought provoking articles and links are fantastic. They have inspired me to do my own research and form my own ideas of what's happening, most of which is fundamentally not positive.. During the boom I, like many kiwi's came to this site to check out interest rates. Now I come here for my daily update... Your site provides an opportunity for the great unwashed to perhaps learn what's really happening in the world, outside of the 6pm news. The silent majority appreciate your work.

On that note, dunno if it's already been posted but in reference to #3 above, this from stuff this morning about Sales targets for Westpac in Chch.

Cheers. Yes. Will pop that in today's Top 10

Westpac are the most prominent with their 95% home lending.

And George Frazis is quite a prominent fellow.

Bernard

Anecdote, Bernard, from ASB chappie last night. ASB are "re-incentivising" their lending staff ( upping the commission rates payable to them to pump out more lending, as their volumes dropped off, and the monthly commission calculations were not enough to keep the staff on. Maybe they're all off to Westpac!)

Nicholas,

Very interesting. I hope the Reserve Bank is watching.

We are hearing similar things from some of the other banks. Westpac has also been very aggressive.

We hear from mortgage brokers that 100% plus loan to value loans are going through.

cheers

Bernard

Unbelievable. No way would I risk my own money on financing someone into a residential property to the tune of 100% of it's value (be it RV or market value) these days.

Perhaps what's wrong with our present system is that the banks here (unlike the States) have full recourse loans - and so perhaps that's why our banks remain ready to fund to that level on depreciating assets?

It's not that they're taking a bet on rising prices because that matters not to their balance sheets given they don't have to write off any monies in the event of a borrower defaulting.

Maybe what the Reserve Bank needs to lobby for is a policy of non-recourse mortgage instruments - rather than prescribing loan-to-value ratios. Then leave it to the banks to begin properly assessing risk again.

That used to be the case in a de facto sort of way, Kate. 30 odd years ago in Aussie ( I assume maybe here as well?) banks etc. could lend whatever they liked as a LVR, but once it was over 33% of a single gross income's ability to service ( the man's in those days) it could be deemed predatory lending if the loan fell into default, and the lending institution had no call on the security in that case. It wasn't so much caveat emptor in those days, as 'lender beware'!

Fascinating - the notion of predatory lending has virtually vanished from our vocabulary. Indeed I understand that many of the voluntary sector budget services here in NZ support a private members bill (not sure which member) that seeks to introduce some kind of 'loan shark' regulation here in NZ.

National doesn't support it.

At least that's what I think I heard.

How depressing! Here's a few things to cheer you up:

1) http://www.realeconomy.co.nz/175-kerry_mcdonald_dangerously_in_.aspx

"He told the group the economy was seriously weakened because of poor Government policies during the past 10 years, which allowed the housing boom to run unchecked, large incentives to invest in rental housing and a lack of response to the declining tradeable goods sector."

2) http://www.johnwalley.co.nz/151-slip_sliding_away.aspx

"Start thinking in terms of our National debt not Government debt and get real. Currently our cost of funds is being tolerated, but if current trends continue the cost of offshore funds will begin to increase as will the cost of domestic lending (regardless of the OCR) compounding the debt problem (as more of whatever funds are available are soaked up in debt servicing) exacerbating the difficulty of investing and earning more.

We are on a slippery slope and it is getting steeper."

3) Peak Oil is no problem if we stay pals with US. I found "The Oil Factor: Behind the War on Terror", in my local vid store, it's online here, enjoy:

http://topdocumentaryfilms.com/the-oil-factor/

Some have appreciated the problem for a while, if this is to be believed?

Maybe the security of supply would be worth the downsides of a TPP?

4) Money is a proxy for energy and exponential creation of the former has enabled exponential demand for the latter, commodity. So we have a commodity backed currecny then, (as some advocate will solve our inflation woes,) so what's wrong with that?

Cheer up (just kidding), Les.

3) "The american way of life is not up for negoitiation"....they have no pals, just ppl they get considerably more from their "mates" than they give back....and I quite expect when push comes to shove we'd get cutoff....only a fool deals with such as these....

and of course teh Iraq invasion was about oil....its the last country with a decent easy to get at oil capacity.

regards

Just one BIG problem with the simplistic theory that the American intervention in Iraq was because of oil... nobody can explain,if oil politics is the dominant motivator,how come America in the Middle East is so supportive of Israel. Obviously nothing to do with a foreign policy motivated by oil considerations!

"Die Glocke"

"Die Glocke, Glocke tönt nicht mehr, die Mutter hat gefackelt,

und welch ein Schrecken......

Ding Dong........Happy weekend Walter....no horror for you.

Easy, big problem solved, the amount of Jews in the USA....big voting block. Plus of course Israel is relatively stable and in the centre of the action...eyes and ears for the US.. Big difference of course between the lovin they had in the 60s~80s where the arab world went russian leaving israel only one place to go, these days its a cooler relationship....pragmatic maybe.

And as for it being oil....there is not other logical or other explanation, so occams razor....etc.

regards

Personally I think you do an excellent job of drawing attention to the serious problems that most people choose to ignore.

I tend to disagree with many of your suggestions for what to do about the problems but the service you provide is invaluable.

Most of the day to day discussion is so very poorly informed and you try to draw attention to people who do understand something about the issues that affect us. That is a great thing. It's why I keep reading your site and keep commenting.

Most people wilfully choose not to confront their money problems. This is not surprising because it leads to identifying one's weaknesses, which is not a pleasant thing. If you don't confront them you are of course going to remain a slave to them, which is far worse.

Nassim Taleb in The Black Swan observed that faced with financial hardship people are derpressed, even suicidal; whereas during a war everyone not directly involved parties.

This is a thoughtful piece Bernard and does you credit.

Thanks Bernard good stuff

Cheers for the summary Bernard and keep up the excellent work!

You may indeed be a miserable sod, but I read your reports daily for that very reason. I’ll take the hard facts over the Herald drivel any day.

One factor to add to the list is global unemployment.

Look at the UK market for a warning of future troubles. Their government is slashing public jobs with the hope private business will take the slack. The opposite is happening; private business is getting the wobbles and following the public sector in downsizing. UK unemployment could hit 10% in 2012 and from there it’s a slippery slope!

NZ should pray the Chinese continue to buy our milk powder!

A very good lesson in pro-Keynesian and anti-austrian economics will be learned by the UK by the looks of it.

The US, if it does'nt do a QE3 will be another great real life example....

Of course the 1930s GD has similar, obvious examples....but it seems we are hell bent on repeating the mistakes just to make sure....

At some point of course, it maybe QE4 or QE8 it will simply implode.....

Other interesting fact, businesses with their eyes open who have Govn contracts prefer Labour govns....and as the money is respent this flows though the economy....so with care Govn spending isnt bad IMHO....

regards

Nice article. I keep coming because despite the negativity...it's a great source of useful, interesting information and good debate. Not to mention that some commenters make up for the doom and gloom with their hilarious comments (thanks to them btw). So, keep up the good work (oh, and like GBH said, please please please don't sell to the Australians) :)

rumor on the street is that Fairfax are talking 700 million. Bernard is thinking about it.

....until he realised the figure was in renmimbi.....

Whats to think about?

sell!!

;]

regards

I like Bernard's reference to John Key being "a beacon of positivity and belief." Key is known as "Smile & Wave". So what should we call Bernard?

Bewail & Howl? Handy Bickerer?

GBH ! ........... Grumpy Big Head .

[ ...... " chicken little " Hickey ...... still my favourite ...... ]

"Sulk and Finger"???

I drew up a short list......Bad Hairday

Buster Hyman

Brok.en Hating.it

Broken Horsie

Busting Housebubbles

Actually Gareth when you think about it......All work and no play makes Jack a......

Dull Boy.

Israel is Americas pitbull in the middle east..Reports of their Airforce training in Iraq,getting ready to finish off what the Stutnex virus started shouln't be taken to lightly.Remember the fuel for a big show was ordered and recieved September last. All the Arab states are in disaray and demanding Democratic reforms..Any intervention to support reforms wouldn't have the widespread opposition it would have done a few months back.

Untill the West has uninterupted cheap oil in return for true Arab democracy, we will suffer oil shock after oil shock,and the western economies will continue to have economic uncertainty..Iran has supported Bin Laden as he popped in and out of Pakistan, so to say a theatre of trouble has been long overdue, isnt an understatement...personally i thought it would have happened by now.

It should say:

Give this Government another (2nd) term, a larger majority, so more rotten eggs can join the club.

----

Vote for capable politicians - not for parties

..... and reduce the number of parliamentarians.

FYI from a reader via email.

Bernard, I think you're right on the money about the current state of affairs. I like to use humanomics in conjunction with economics. Humanomics is a simple method where you can wander around Dick Smith, main streets of places like Onehunga, Mount Eden, look at numbers of people in restaurants and bars and also listen to what friends are saying, what banks are advertising 'like you say PLEASE BORROW MORE MONEY' repair appliance vs brand new etc. Have to say I'm amazing no one has taken to George Frazis the guy thinks he's Gordon Gecko. Born again as an ex Westpacker myself he's just another string of CEO's from Oz, although at least Anne Sherry and co managed a tight desk. Anyhow I think you need to work out or find out what a reasonable level of household debt should be like you said in your article. If you rely on Treasury then you're asking the same guys that give us outstanding growth to clear our current deficit. I own a home that's conservatively worth about $1m and my personal debt on it is bugger all but then I sit back and manage each repayment where my next target is. Being an ex beanie, finance, banker it doesn't take much, but I do that for friends and tell them their debt is too high and they need to reduce it down. And I show them scenarios if rates rose, fixed vs float etc and a budget and also just how hard it is with wife and kids to even pay down $20,000 of a mortgage on good money. It's funny because if you asked someone their home equity in a group and they said 10% I think people would go oohhh really. But then how many people are in that situation and we need to be telling people if you've got $20k deposit then go for a unit at $250k so you've got already around 8% equity rather than a $400k townhouse and have 5% equity. But I think we need to start putting out what is reasonable levels of debt. Personally if you have a big old villa on a section I think there is less risk you can carry less equity. But for a townhouse, little unit maybe more equity needed. But I think we need to find out what the current % is at so we can put it to the media that it's as big a problem as obesity or other crap they harp on about. But to do that let's face it you have to do it for idiots to understand, not economics geeks or people that read interest.co.nz. It needs to be done so that young people getting on the ladder know what levels of equity are really bad to take on. Personally I'd like to see banks requiring a minimum 10% equity for any property purchase and maybe 50% total equity for any 2nd home purchased or something like that anyway. I do think the banks are beginning to wind up again and push it and you say houses are not going up, but seriously in Onehunga now, you put the house up, put a price you're 100% happy with, it'll go no problems. Where these people are coming from no idea but things are starting to move again. That said if you've got a central city apartment you got a decade to wait! Anyhow great articles keep whingeing. I agree you don't take decades of over spending and building debt to then say ok we've been doing it tough for 2 yrs it's all coming good. There's just no logic to that. I do think though you need to start putting targets out there in the media and saying this is where we're at and really making it a national issue to get our own personal levels of debt down. Eg if you own a house and have less than 30% equity then you're in a dangerous and expensive situation. By expensive I mean all your income is just going on paying interest at present and 90% of it is going offshore. Cheers,"By expensive I mean all your income is just going on paying interest at present and 90% of it is going offshore."

Indeed, which is awful IMHO, its as bad as the Govn selling the family silver and 10 years later we've paid more than that back...its plain dumb. So for me its a double whammy....its not as if the re-payments go to other NZers...the banks are just middle man taking a bit of a cut...but are very agressive about it and the rest just disappears off shore....its a huge tax burden in effect, yet the far right wingers seem to think its only Govn tax thats the problem....like get real guys....it all counts as lost....

regards

Sensible level of debt?....same as it has been for centuries, own at least 1/3 of what you posses

Damn that means we are going to have to take a trip to the bank, borrow a few heaps...

Trouble is, what will we use it for?..a good long term investment that can be used......

I know, a 3 month holiday in the States and bring back a limitted edition big block 6L 2012 Camaro....maybe a Dodge challanger for the missus to drive to work in to....and another workshop.

Still not working out, havnt spent it all yet....Genius shares?

Well it's late but it is still Friday........YAY and in honour of the Big Guy..."Mr Grumpy"

But not everyone is as lucky as I am...... The economy is so bad that I got a pre-declined credit card in the mail. I ordered a burger at McDonald's, and the kid behind the counter asked, "Can you afford fries with that?" CEO's are now playing miniature golf. If the bank returns your cheque marked "Insufficient Funds," you have to call them and ask if they mean you or them. Hot Wheels and Matchbox stocks are trading higher than GM. McDonald's is selling the 1/4 'ouncer'. Parents in Beverly Hills and Malibu are firing their nannies and learning their children's names. A truckload of Americans was caught sneaking into Mexico. Dick Cheney took his stockbroker hunting. Motel Six won't leave the light on anymore. The Mafia is laying off judges. BP Oil laid off 25 Congressmen. Congress says they are looking into the Bernard Madoff scandal. Oh Great!! The guy who made $50 Billion disappear is being investigated by the people who made $1.5 Trillion disappear! And, finally... I was so depressed last night thinking about the economy, wars, jobs, my savings, Social Security, retirement funds, and our bleak future, that I called the Suicide Lifeline and was connected to a call center in Pakistan . When I told them I was suicidal, they got all excited, and asked if I could drive a truck.

Further to the email Bernard posted 3-4 above, I think the other % ratio that people need to focus on is the percentage of their total net worth that they hold in a non-performing asset (i.e. their own home). Yes it will change over time, for my 20's something son with his first house, 85-90% might be typical, but for a baby boomer it should be well under 50% by now ( for me its 15% and still striving as I have for years to make it even less).

To me if youve got a mortgage free home worth $1m, and total not worth of 1.25m, you're failing (badly)

Yes...and no. What if, in due course, you have that same house and, all things being equal, it's now worth $500k and you are worth $750k? Much better...... ( ie: your asset purchasing power has just increased)

Look, things can't be too bad in some places. There is this provincial city in little ole Aotearoa which recently had a charity ball and auction to raise money for cancer respite place- people forked out $100,000 on the spot that evening (reported in the local paper). And the local Presbyterian Church is doing $3 mill site developments, and straight up has collected $2 million from parishoners within the past year (that's over and above the usual giving) plus got a $1 mill loan. Just thought I'd share that to give a bit of balance to the tone of many comments on this site.

FYI from a reader via email

Bernard,

I too have been jawboned about being too pessimistic about the possibility of restarting the party. Well, here is a another potential knock coming our way.

In an article several months ago in one of Canada's two national newspapers, The Globe and Mail, a story chronicled the effects of very low interest rates on Japan's life insurance companies. Fully one-third of the insurers in business a decade ago are gone. They couldn't keep their promises.

I suspect the same will be true for their brethren in North America and maybe down under too. As you undoubtedly know, life insurers in Canada and the US have sold so-called cash value life insurance policies for almost two centuries.

For the last one hundred years, governmental regulations have required that there be contractual provision of interest guarantees and non-forfeiture values. In addition, the carriers have made promises above and beyond what various laws mandate. The underlying investment returns even discounting unreported market losses just aren't high enough to support the promises.

Another huge issue are annuities. Increased longevity of increased numbers of annuitants are pushing the actuarial assumptions underpinning these contracts.

This may be the reason that the Washington State Insurance Commissioner introduced the most radical change in the state's insurance code since it was adopted in 1947. Beginning July 1st, 2012, Washington domiciled insurers will be allowed to greatly increase their investments in high risk assets, including some for the first time.

These include junk bonds, private equities, commercial real estate and foreign sovereign debt. Were House Bill 1257 in force three years ago, Washington insurers would been authorized to buy the debt of the PIGS.

The Washington Senate was alerted to the real intent (not the putative "modernization") of Kreidler's Law,as I have dubbed it, at the 11th hour. The bill was amended prior to full passage requiring a report from the Insurance Commissioner before implementation. The Governor vetoed the amendment. The report would have revealed that the State's largest insurance companies could invest more than 100% of their assets in high risk securities.

The bottom line is that the Wall Street crap game can move to Seattle next year. The insurance industry may be the last great pool of solid assets in North America.

It's a bummer to someone whose career was in this important business. I hope the Kiwi and Aussie insurers are not going to follow suit.

I guess this is a gloomy heads-up.

Brian

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.