By Bernard Hickey

Victoria University Economist Geoff Bertram has proposed the Reserve Bank force New Zealand's banks to reduce their foreign currency borrowings to reduce the pressure on New Zealand's dollar and its export sector.

Bertram delivered a paper detailing the recent history of New Zealand's monetary policy, foreign borrowing and the New Zealand dollar to a Fabians' Seminar "Fresh Ideas for a Productive Economy" in Wellington last week. A full version of the paper is here.

In it he argues that New Zealand's inflation-targeting regime, its free floating exchange rate, unregulated capital flows and a sharp increase in foreign currency borrowing by New Zealand's banks since 1993 have had the effect pushing up the currency.

This has helped the Reserve Bank use the currency to suppress tradeables inflation and offset relatively high non-tradeables inflation.

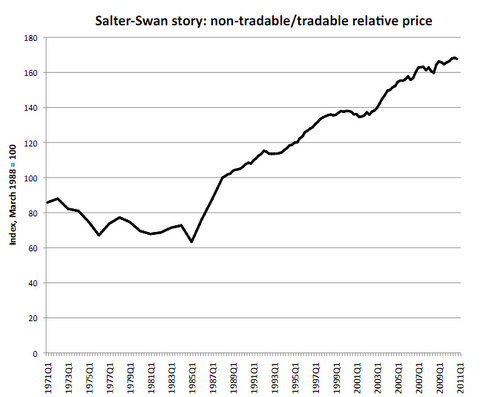

Since the mid-1980s non-tradeable inflation, which includes such things as government charges and electricity prices, had signficantly outpaced tradeables inflation, which includes prices of imports, Bertram said.

The chart below shows relative non-tradeable and tradeable prices.

This included much stronger growth in prices of former government owned monopoly prices, such as electricity, vs the prices of tradeable goods and services such as hotel nights and imported goods.

Conventional inflation targeting had delivered unbalanced relative prices and raised the need for regulation of non-tradeable prices such as electricity as a tool of monetary policy, he said.

The Reserve Bank targets overall Consumer Price Inflation at 1-3% over the medium term, but does not break down its target into tradeable and non-tradeable components.

Bertram described the inflows of foreign currency to fund asset sales and foreign borrowing as a distant relative of the 'Dutch Disease', where an influx of oil revenues pushed up the Dutch Guilder in the 1960s after a gas discovery in the North Sea and slammed manufacturing jobs.

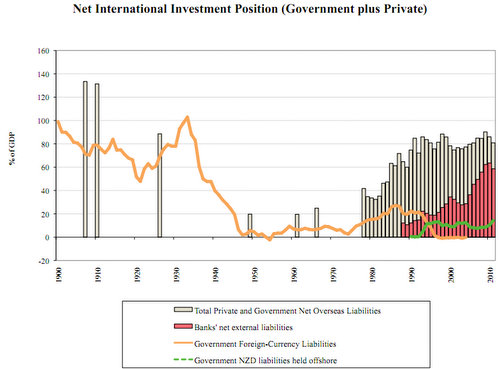

There had been a sharp increase in New Zealand's net foreign debt since the late 1980s, with an acceleration since the early 1990s as the local arms of the Australian banks began borrowing heavily in foreign currencies.

This sucked in foreign currency and pushed up the New Zealand dollar. The biggest growth in foreign debt by the banks was through the mid 2000s, which coincided with the biggest strength in the New Zealand dollar.

It also created a mis-match between New Zealand dollar lending and foreign currency borrowing. This bank borrowing in foreign currency rose from nothing in 1993 to NZ$80 billion by 2008. (See the red bars in the chart below. The yellow line shows government debt in foreign currencies now at zero)

Bertram said this currency mismatch exposed the banks to two types of shocks: a sharp depreciation of the New Zealand dollar would reduce the value of the assets relative to their attached liabilities, and credit rationing on international markets.

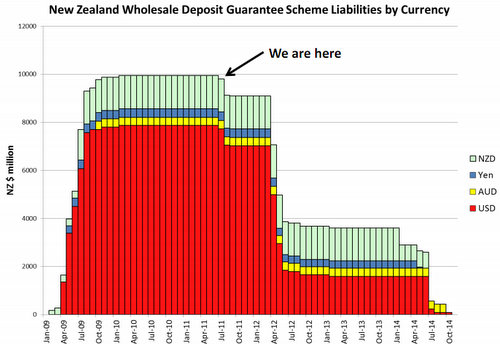

The provision of the Government's Wholesale Deposit Guarantee allowed the banks to banks to borrow with government backing, effectively forcing the taxpayers to pick up a NZ$8 billion foreign currency liability and parking it off balance sheet, Bertram argued.

"Putting the interests of the banks' (mainly offshore) shareholders ahead of those of NZ taxpayers and exporters came so naturally to the NZ policy elite that the guarantee barely caused a ripple on the political pond," Bertram said, adding that New Zealand's banks had been consistent supporters of a strong currency when lobbying the government.

He criticised the government's decision to leave this exposure to wholesale guaranteed bank debt off balance sheet, much of which has yet to roll off.

"That amounts to keeping its fingers crossed that no new financial crisis breaks out that might push the banks into triggering the guarantee," he said.

"But more basically, over and above the NZ$8 billion of bank foreign currency funding (red, yellow and blue bars in chart above) underwritten by taxpayers, there is still another NZ$68 billion (as at May 2011) of foreign currency funded NZ$ bank assets outstanding," he said.

"A high priority for the robustness of the NZ economy is to get at least part of these bank liabilities repatriated into NZ dollars. That would put downward pressure on the New Zealand dollar, probably implying some capital losses for the banks' shareholders."

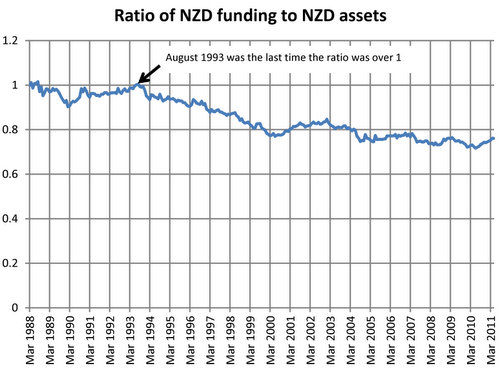

Bertram said the Reserve Bank should take the extra step of regulating this currency mismatch, rather than just its maturity mismatch via the Core Funding Ratio.

"Rather than just imitating overseas central banks by regulating maturity mismatch in bank balance sheets via the Core Funding Ratio, the RBNZ could require the banks to progressively to eliminate this currency mismatch from their books," he said.

"If the banks want to raise new funds offshore they should do so by issuing NZ dollar denominated securities or they could raise funds locally, including from the RBNZ, and pay off overseas loans as they mature," he said.

"Just as the past 15 years of growing currency mismatch propped up the nominal exchange rate, so should an unwinding bring it down."

I spoke with Geoff Bertram in the interview above.

23 Comments

The flow of insurance funds into NZ over the next 1-2 years is surely going to push the dollar even higher, manufacturers need to plan for parity.

The only relief is that much of the insurance monies will be used to pay off debt rather than being spent on anything productive like an actual rebuild, so it might not be as bad as it could have been had the Government got their act together and actually had a real plan for Christchurch recovery!

Oh, but won't that deleveraging be bad for growth! Don't worry Stats NZ have a cure for ugly numbers, they cake on the lipstick - then they are all pretty again!!

But surely if debt is to be wiped with insurance pay outs, then there will be people with reduced debt (great), AND no roof over their head or no business (not so great)?

What then?

Funding from offshore is cheaper, and with an increasing currency - since early 2000s - and a property bubble it's not wonder that foreign currency borrowings by banks is high.

Is this likely to self-correct? US interest can't get much cheaper and their printing presses will have to turn off at some point. They don't have a Germany big-daddy like Greece. Likely their interest rates will go up.

"Likely their interest rates will go up." Well the Fed seems to think raising the OCR is 2 or 3 years off and there is talk of QE3 after the US economy continues to falter....so it could be 5 years off. If we enter a Global depression which IMHO is pretty certain the OCR will stay low for a decade, maybe 3....bit of a long wait for a self-correct? Otherwise, yes at some point it would seem logical that its default or raise taxes, or the collapse of the US economy/dollar is total.....

regards

Agree that interest rates are likely to stay low for an extended period, several years at least. There may be a short period during the next twelve months or so where they rise, due to the large number of people who believe that we are just in a 'cycle', and that local and global growth will pick up real soon now. Hahaha..

Interesting interview.

According to an RBNZ paper banks hedge about 92% of foreign currency denominated borrowings. Granted those are figures from 10 years ago, but would be similar if not higher today, I would've thought.

You can over-do the regulations from a financial markets viewpoint (there probably should be more regulation from a retail, consumer advocacy standpoint). Maybe the problem is that we have an OCR at all? Where would interest rates be today if the front end of the curve wasn't being kept at 2.5% by Dr Bollard in his infinite wisdom? (serious question)

You're right dc. The banks basically hedge 100% of their currency exposures, so there is no risk to them from a sharp currency depreciation. Geoff is out of touch on this one.

It tends to be cheaper for NZ banks to issue in foreign currency and then use swap contracts to hedge the exchange rate risk than to issue directly in NZ dollars. Requiring them to issue in NZD would raise their funding costs and push up borrowing rates, while doing little to lower their overall level of foreign borrowing which is a consequence of New Zealand's low rate of saving.

And why don't Kiwi's save money?? because they would absolutely mad to.

When you have an environment where interest rates are lower than inflation, and then believe it or not is taxed, by a government that claims to want to rebalance the economy, but will do nothing of the sort, what a joke.

If as a county if we can only borrow what we spend, of course interest rates would go up, but they would be going up to a natural level where the balance between savers and borrowers becomes much more even.

Then the country lives and borrows at level that can be sustained long term, and not one that just sets us up for a major dissaster in the future when our debt levels finally crush us, like what has happened in the US, Greeece, Ireland.... the list goes on.....NZ.

If you want an interest rate that gives you a return above inflation after tax you have to accept the risks that go with that. Invest man. Have some balls! There's only what, 100,000 or so publicly listed companies in the world that make stuff, mine stuff, sell stuff, do stuff, invent stuff, build stuff. Sounds like you want to stuff your wallet with a fat risk free rate of return for doing stuff all. Get stuffed.

No wait, lets get da gubmint to jack up interest rates so all the knackerless can get lots of dosh to spend on the cheap imports that the subsequent overvalued currency will deliver them while impoverishing the export sector. Such a good idea. Not.

So what have you invested in?....not property by any chance is it?, so hence all your arguments probably revolve entirely around yourself and trying to help you own interests.

My comment was based around what's good for the country as a whole.

What's probably NZ's biggest economic problem? ok people don't save, so what's the solution?? not make the environment so bad that no one would want to save, make it so it's a good idea to save, it's not happening any time soon though wiht the current policies.

I have already got a reasonable amount invested thanks very much, but's that irrelevant.

You basically have a choice either interest rates will keep going up, or other measures like capital controls, land tax, CGT or whatever will need to come in.

I think you miss one of the main reasons to save....for a rainy day...

Saving is about learning to save / invest. Simply dumping in in a deposit account is not productive savings for you or NZ. Simple I have to get off my butt and work for my money, so should a saver if they want to maximise their return.

CGT, yes its needed, land tax, yes probably.....

regards

While I think you often talk utter cwap(TM),

;]

I totally agree with you on this....want a decent return work at investing and accept the risk, sitting on your fat butt and whine deposits pay too poorly.....gets no sympathy from me.

regards

So you are obviously not the slightest bit worried that this is one of the most in debt countries in the world, debt at similar levels to Greece and Ireland? and we know what happened to them, and the US for that matter.

Most sensible people would say ok how can we stop people taking out so much debt, well one reason is to encourage them to save, and at the moment with interest rates below inflation, and then taxed you'd have to be mad to want to save money.

Most people would I think be able to join the dots and come to that conclusion, but if you want to ignore the obvious and are happy for us to end up like Greece, good on ya.

Philthy... If high interest rates are the answer, well, ya just know it had to be a bloody stupid question.

I always love the one about oooh, all this debt and the young people are going to have to pay it off. What a load of bollocks. We borrowed 200k for a new machine in February. When are they sending us the young people to pay it off. I think the young 'uns are busy paying off their ipods mate. If you genuinely can't comprehend the difference between NZ's debt position and that of Ireland and Greece by now, you probably never will. Those thousands of fund managers queueing to buy NZ bonds didn't come down with the last shower.

Please explain to me the difference between our debt position and Irelands and Greece's? because last time I looked it was very similar.

The main differences between the countries I can see though is we are still getting very good prices for the things we are selling, for now at least, but if something goes wrong for the people buying it, like mainly China and Aussie, then there might not be much difference at all.

Are they the same fund managers that were buying all the mortgage backed securites and credit default swaps from the US a few years ago? those ones didn't come down in the last shower either lol.

If banks were forced to raise more money from NZ, they would also be forced to pay a higher rate of return to investors - This would in turn increse savings. Sounds like a good idea to me.

Why would it increase savings? Interest rates have a bearing on how much it costs to do business if they are to high businesses wont invest and indeed may cut jobs, this is detrimental to NZ.

Also investors come in two flavours, those who are saving for retirement and those in retirement who live off their savings, this is not the same thing. The latter wont be increasing their savings, at best they will decrease them slower...The former are workers, employers or producers they need lowish rates to do well....so they can save, kind of catch22.

regards

Is this not just returning the desposit to lending ratio tool used by the RB upto the early 90s when the then government removed these tools. About a 33% ratio

Not a new idea, even meantioned the Shakespear...but defenately a historically proven idea.

The issue is getting away from the economic balances/equilibrium that we have now as a result of removal of these ratios, back to the orginal equilibuim......And the even bigger issue of do we have politians who are willing to risk political suicide by upsetting the apple cart to get back to a more stable equilibrum?

I dont think so, so for the future for now, and some time, this is just an acedemic moot point.

I like the idea in principle, it might reduce our addiction to foreign $$$, with its propensity to pump up bubbles.

However, all big banks in NZ are Australian. If they have to rein in their lending, they will be sure to maintain it to that which is secured by assets - ie housing, rentals & farms. The productive sector would be starved of funds, reducing a part of the economy that is key for long-term sustainable growth. Not that the govt seems too concerned about that, of course.

Cheers to all.

The productive sector will be much better off, because the dollar would be lower with less hot money coming in, making them more competitive.

I don't think much of this hot money is going to the productive sector currently anyway, it seems to mainly used for pumping up house prices in places like Auckland.

Philthy (nice name)

Sure, I accept what you say.

I'm just aware that the Law of Unintended Consequences tends to bite you on the bum in startling ways. I'm old enough to have learned to look ahead and wonder.

Thanks for your reply

Cheers to all.

"So what have you invested in?...." We've been manufacturing since September 1977. Initially woodware, evolved into knitware. Bloody hard. We survived because we bought the building in'79 and paid it off in '86. Have residential, 7 properties , (4 inherited) and that equity has been a lifeline lots of times. Since '77 have had 263 individual employees. Work too much. Drink too much. Still love finding bargains at the op shop. How 'bout you Philthy?

Well good for you with your 4 inherited houses and very large property holdings, you must be very happy with yourself, it certainly explains your way of thinking.

I've also worked very hard, never been a day out of work or a burdon on the taxpayer in anyway. I don't have investments on anything like your scale, just my super and a few shares, and I'm not sitting on piles of cash if that's what you think.

But at the same time, still think it's fundmentally wrong that we accept a system that inflates away peoples debts, while punishing those that save, especially when those debts are derived from tax free, virtual risk free, property investments.

No wonder the country has massive debts, very low productivity rates, and keeps losing a lot of our young brightest off overseas.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.