Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard will be back with his version tomorrow.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. Change is good

Bernard's role at interest.co.nz will be changing later in the year. From November 1 he will change from being our managing editor, to being a Contributing Editor. He has big plans to build a public interest journalism website working on broad issues.

However, he will still have an important presence on this website, including presenting our 90 at Nine overnight financial news summary, and this Top Ten, among other projects and stories.

Readers may not notice much, but we will. I am sure both of us will benefit from the change, and readers will get even more 'Bernard Hickey', even if some of it is at another web address. (The good stuff will continue to be here, of course!)

The audio at Radio NZ's Media Watch podcast has more details.

2. Who knew what, and when did they know it?

Maybe its a badge of honour for the foreign media, but the Wall Street Journal is doing its best to be banned (again?) by the Chinese authorities. It is carrying more explosive details in its coverage of Gu Kailai, wife of the ousted Communist Party leader Bo Xilai. Hu Shuli is one brave reporter.

Hu Shuli, editor in chief of Caixin Media, which publishes the influential business magazine Caixin Century, wrote an editorial in Chinese and English in its online edition this week in which she listed a string of questions she said had been raised by the official account of Mr. Heywood's death.

Ms. Hu, who has more than 1.9 million followers on her qq.com microblog - which works like Twitter - said she didn't believe Ms. Gu's reported confession that Ms. Gu killed Mr. Heywood because he had threatened the safety of her son after they became involved in a dispute over a failed property deal.

"The story spun about a mother sacrificing herself for her own can hardly deceive anyone," she wrote. "Who are the others involved? Is Bo [Xilai] among them?"

3. Culture thrives on conflict

Yeah!, we are great shape! Warfare, terror, and bloodshed nurtured the Renaissance in Italy. Peace and democracy in Switzerland gave rise to... what, exactly? Here's something you might not expect from the often sanitised and politically correct BBC - maybe their pc police were away enjoying the Olympics when this one slipped through.

Culture may not need democracy or peace, but it can't develop without some measure of freedom - and that requires a diversity of centres of influence, working openly and at times in opposition to one another. Rightly, we've learnt to mistrust any directing cultural role for the state. When artists and writers rely solely on government, the result is at best nepotism and mediocrity.

But the processes through which culture is created and renewed are complex and variegated, and it's just as silly to think that a thriving cultural scene can be produced entirely by market forces. A vital culture comes from competition and rivalry between institutions - state-funded arts councils and libraries, churches and campaigning groups as well as private and corporate sponsors.

Culture thrives on contestation and antagonism, not some dreary fantasy of social harmony.

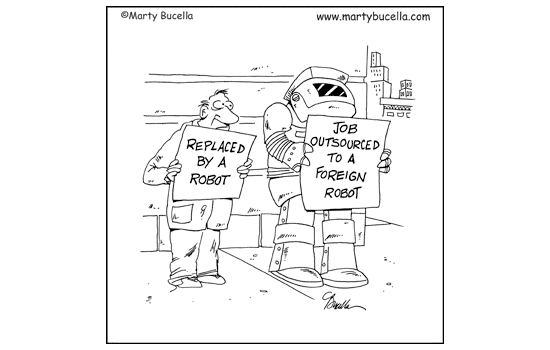

4. Robots are getting smarter

Robots far more adept than those now commonly used by carmakers and other industries are replacing workers in both manufacturing and distribution. Productivity that wins will be almost all capital productivity. The falling costs and growing sophistication of robots have touched off a renewed debate among economists and technologists over how quickly jobs will be lost. John Markoff at the NY Times reports:

At the Philips Electronics factory on the coast of China, hundreds of workers use their hands and specialized tools to assemble electric shavers. That is the old way.

At a sister factory here in the Dutch countryside, 128 robot arms do the same work with yoga-like flexibility. Video cameras guide them through feats well beyond the capability of the most dexterous human.

One robot arm endlessly forms three perfect bends in two connector wires and slips them into holes almost too small for the eye to see. The arms work so fast that they must be enclosed in glass cages to prevent the people supervising them from being injured. And they do it all without a coffee break - three shifts a day, 365 days a year.

All told, the factory here has several dozen workers per shift, about a tenth as many as the plant in the Chinese city of Zhuhai.

This is the future.

5. 'The safest banks'

The latest update has our banks slipping down the rankings a little. But this list does seem odd with the highest ranked banks being both European and public insitutions. Being northern European helps, but they are very close and integrated to the whole euro project so this list could change fast. Also, Kiwibank safer than HSBC ?

For banking safely, global citizens had better go to the local government. And pretty much avoid the US. At least that seems to be the take away from Global Finance Magazine’s ranking of the world’s safest banks. The top 9 banks in the magazine’s World’s 50 Safest Banks list are all state-backed institutions.

| #1 | KfW (Germany) |

| #2 | Bank Nederlandse Gemeenten (BNG) (Netherlands) |

| #3 | Zürcher Kantonalbank (Switzerland) |

| #4 | Landwirtschaftliche Rentenbank (Germany) |

| #5 | Landeskreditbank Baden-Württemberg - Förderbank (L-Bank) (Germany) |

| #10 | Rabobank Group (Netherlands) |

| #11 | TD Bank Group (Canada) |

| #18 | National Australia Bank (Australia) |

| #19 | Commonwealth Bank of Australia (Australia) |

| #20 | Westpac Banking Corporation (Australia) |

| #21 | Australia and New Zealand Banking Group (Australia) |

| #22 | Kiwibank (New Zealand) |

| #23 | HSBC Holdings (United Kingdom) |

6. Trouble at mill? BHP’s untimely dilemma: shrinking cash flows

What a cash flow problem to have, according to the FT.

As low cost producers, with arguably the best resources in the world, it’s little wonder that BHP Billiton and Rio Tinto are shipping as much iron ore as they possible can from their mines in the desolate Pilbara region of Western Australia. Assuming a $7/tonne freight rate, Lex estimates, the landed iron ore price in China would have to fall to $37/t before Rio lost out.

So even with the iron price at a near three-year low of $112 , Rio and to a lesser extent BHP are making a killing and will continue to do so as higher cost producers (mainly Chinese) fall by the way side.

No wonder Rio’s CEO Tom Albanese describes Rio’s iron ore business in Australia as “robust under any probable macroeconomic scenario”

To that end Rio recently sanctioned a massive investment in its Pilbara mines, with the aim of increasing annual production to 353m tonnes a year by the first half of 2015 . But what about BHP? Surely it’s chief executive Marius Kloppers must be poised to do the same?

Er, no.

BHP manages its capital spending on a five-year cycle. Each year, it forecasts the next five years’ incoming cash flow, and after allowing for a modest increase in dividend, exploration and sustaining capital, it allocates the rest to its capital growth projects.

In early 2011, BHP’s forecast for the next five years’ cash inflow (less dividends, exploration and sustaining capital) was USD80b. That figure today is about USD60b. BHP has USD20b less capital to allocate to growth projects than it previously expected.

7. The end of affluence?

Although Americans see upward mobility as their birthright, that assumption faces growing challenges, with consequences not just for the size of their wallets but for the focus of their politics. Economic growth, a secular religion, is stuck in a long-term fizzle. The future promises to be crimped and contentious, according to Robert J Samuelson. He is always worth reading, even if you are a sceptic.

The Affluent Society was more a state of mind than an explicit economic target or threshold level of income. It announced the arrival of an era when traditional economic concerns were being overwhelmed by a seemingly unstoppable flood of abundance. Prosperity was a panacea. We could afford a decent society as well as a wealthy society. Many traditional social, political, and economic choices could, with a little patience, be evaded. There was enough for almost everything. We have been, in historian David Potter’s apt phrase, a “people of plenty.” What happens when there is less plenty than we expected? We are about to find out.

8. Why the gold price is languishing

Central bankers in a [very] few countries have been the big buyers of gold in the last year or so. But the price of gold seems to have hit a brick wall at about US$1,600/oz - it has been at that level for all of 2012 trading in a very narrow range. And its not as though we haven't had financial instability and excessive money printing during this year. You would think that would underpin demand for the precious metal. However, despite that big buying, most real people (investors, consumers, industrial users) seem to have quietly withdrawn their demand. That rising central bank demand only offset other falls. The World Gold Council has issued its Q2 2012 data and we have reviewed it here »

9. The politics of fear

Does fear make people believe weird stuff? Fear induces widespread group-think too. Whole communities seem to start with their fears and then go looking for 'facts' to fit them. It's a human frailty. Because it's not logical, clever people can profit from widespread community 'fears' - in fact British newspapers are famous for inducing food scares in the August-September holiday season when there is a lack of real news. I suspect this has been proved this year - the Olympics filled the void and we have had no food-scare from Britain. Richard Muller is on to something similar perhaps, except you won't find this story playing in New Zealand where we have a full-blown community fear thing going in relation to radiation. The WSJ has his essay:

Denver has particularly high natural radioactivity. It comes primarily from radioactive radon gas, emitted from tiny concentrations of uranium found in local granite. If you live there, you get, on average, an extra dose of .3 rem of radiation per year (on top of the .62 rem that the average American absorbs annually from various sources). A rem is the unit of measure used to gauge radiation damage to human tissue.

The International Commission on Radiological Protection recommends evacuation of a locality whenever the excess radiation dose exceeds .1 rem per year. But that's one-third of what I call the "Denver dose." Applied strictly, the ICRP standard would seem to require the immediate evacuation of Denver.

It is worth noting that, despite its high radiation levels, Denver generally has a lower cancer rate than the rest of the United States. Some scientists interpret this as evidence that low levels of radiation induce cancer resistance; I think it is more likely that lifestyle differences account for the disparity.

Now consider the most famous victim of the March 2011 tsunami in Japan: the Fukushima Daiichi nuclear power plant. Two workers at the reactor were killed by the tsunami, which is believed to have been 50 feet high at the site.

But over the following weeks and months, the fear grew that the ultimate victims of this damaged nuke would number in the thousands or tens of thousands. The "hot spots" in Japan that frightened many people showed radiation at the level of .1 rem, a number quite small compared with the average excess dose that people happily live with in Denver.

10. Joshua Iosefa's inspiring speech

The prefects all make speeches to assembly at Mt Roskill High, and Joshua's speech, Brown Brother, ended up on YouTube. Many of you may have seen it about a month ago on TV3 but for those who missed it, here it is again.

17 Comments

Good luck with your new venture Bernard.

Are you to be part of the Occupied NZ Herald? http://paper.li/OccupyNZ/1336702243

Many thanks. Ha. Not quite

cheers

Bernard

Just because many ppl cant see a longer term view doesnt mean someone who has is wrong.

Bit pointless having (lots of) housing if there are few jobs because business has re-located.......

regards

I've followed the Hollywood Christchurch plan (finger in the throat dry-retching). It will appeal to the affluent west and north-west people who got their houses repainted because of minor damage. They will still have the money to watch the rugby at an expensive stadium, largely financed by people still struggling for a home.

They will be able to buy into CHC's assetts once the woodwork teacher sells them down.

But Hugh, I don't see much in reports about what Waimak is doing. Are they also on the grandiose infrastructure rebuilding, better than it was, kick?

Are they being sucked in to paying for the CHC plan?

How about some what if scenarios and resulting strategies?

a) If we get hyper-inflation (> 20%) this is a possible strategy

b) If we get inflation (> 5%) this is a possible strategy

c) If we get stagflation (+/- 2%) this is a possible strategy

d) If we get a recession > - 5% this is a possible strategy

e) If we get a depression > -10% this is a possible strategy

f) If we get hyper-deflation > -20% this is a possible strategy

etc

regards

Just signed up for email updates re the new venture, Bernard - best wishes for the set up. There were many programmes on TVNZ7 that we used to follow - many ex-watchers of that channel could be very interested in an online version of some of those formats.

This is an interesting not-for-profit community website/blog - linking to good regional/local investigative journalism could also be a great feature of your new site;

http://www.baybuzz.co.nz/who-we-are/

All the best.

I'll follow Bernard's new venture with interest. Interest.co has been one of my must reads each day, both for its world views and a reminder of what is happening in NZ.

Re #7

Now you'll find all interest groups scrambling to keep their standard of living. The only group that will succeed are the CEOs; those further down the food chain will fight each other for the scraps.

I see in the future armed security at Mcdonalds (in the Philippines guards patrol at Jollibee), more working girls everywhere and the bloated class (JK's mates) swanning off to Hawaii or whatever luxurious boltholes they have.

Productivity gains have all been siphoned off to capital interests.

But there's fault elsewhere. The NZ system encourages people to expect rights without responsibilities. Migrants love the place. Why wouldn't they? Housing, benefits, free health,. education for the kids without paying, even money for a car... my spouse can't believe that in NZ it's possible to take a sick father to hospital without borrowing money from the 5/6 (loan sharks) first.

Well done Dave for finally driving "Bernard the Beneficiary" out. He's dead to me, as I assume he is to you.

Finally Interest.co.nz can do the right thing and become a mindlessly pro-Bank mouthpiece for the financial industry in all it's glory. Carpe diem!

Re9 - no emotion, be it fear or optimism, should skew journalism.

What anazes me is the number of journo's who can't investigate in even the most basic fashion, and who swallow what they want to hear. Maybe it's their mortgage-payment driving the dissonance, who knows?

Joanne Black (who opined that there are too many people on the planet - and what is 'too many people' if not 'too few resources'?) off to spin for Bill English.

Bet we don't get 'too many people' from her anymore.

http://www.golemxiv.co.uk/2012/08/a-word-about-banks-and-the-laundering…

This would be much the same argument put to me many years ago when I visited the City Police anti-money laundering division in the City of London who told me with absolutely straight faces that despite London being the centre of international banking, not a single penny of laundered or drug money entered the City banks. I kid you not that is what they said to me. I asked them if they thought I was on day release from a special needs school. They did not laugh.

Andrewj - another great link - I knew the industry was enormous and corrupt but I'm frankly quite lost for words. Never trust a suit.

German eurosceptics quietly hope that Finland will become the first creditor state to storm out of monetary union in disgust, opening the way for others to break free.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/94859…

Number 10

Dear Mr Cashton (or anybody for that matter)

For the enlightenment all past pupils of Mt Roskill GRAMMAR could you please elucidate what you consider inspirational about that video. Personally I find it an embarrassment.

#9 Well... this made me think of 'fat fear', so I blogged about it, snippit below.

"When I read this I immediately thought of fat fear... Obviously people do believe weird stuff, obviously fear is a great motivator and obviously ‘clever’ people use this and generate profit from it. In psychoanalytically inspired neo-Marxian terms the consumers’ angst = surplus profit for the capitalist. The weight-loss industry is a classic example, a $60 billion system built by generating and exacerbating weight-anxiety, a fear of fat: There are currently 34,584 books under the category ‘diet and weight loss’ on amazon.com."

http://othersideofweightloss.org/2012/08/20/the-politics-of-fat-fear/

Also powerdownkiwi - the idea that good journalism should be free of emotion is fantasy, no human can remove emotion from their thought or their writings - more important is to plug for a balance of emotions in journalism, i.e. a balance between fear and optimism in your example.

"the idea that good journalism should be free of emotion is fantasy, no human can remove emotion from their thought or their writing"

You've obviously never seen a German television car show. :-) Kind of the opposite of Top Gear... "Here the cargo space in the Alfa Romeo was measured and found to be 46 Litres less than in the Mercedes. "

I think therin lies the problem. Lack of emotion, tends to be, well, boring. That's not good for sales.

Check out peer reviewed scientific journals. For example, try writing an article where you're told not to use words ending in "ly" (no joke).

Truth be told - I have never seen a German TV car show! ;-) Though one might imagine the perspective of the viewer may determine the emotional value in your example? Here I think of a quiet middle aged German public servant sitting watching said show with a chest swollen with pride, toes curled in ectasy and a fat tear edging down his cheek as he thinks of the efficiency, the pure efficiency of the designers at Mercedes managing to squeak that extra 46 Litres from the design.

This on the doruoght in the US:

Ranchers on both sides of the 49th parallel are telling similar stories. In 2011 Fred Verch of Eganville, Ontario, spent $4,000 on hay because his fields were lush. He told CBC he has already had to spend $80,000 this year. His fields are so dry he knows there will be no second cut.

Read more: http://www.care2.com/causes/no-feedranchers-face-drought-disaster.html#ixzz247bz5ILL

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.