Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard will be back with his version tomorrow.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. The next shock to the global economy

Gary Shilling, "ranked Wall Street's top economist", doesn't like what he is seeing.

He is worried about prospects in China, the US fiscal cliff, and US corporate earnings.

The growing gulf between the behavior of investors enamored with monetary and fiscal largess and the reality of globally weakening economies - a phenomenon I call the Grand Disconnect - is profoundly unhealthy.

It will end, sooner or later, in any case. One way it could be eliminated is through the rapid expansion of economies globally. The past and current massive monetary and fiscal stimulus or other forces might rekindle growth. Some investors point to the recent stabilization of U.S. house prices as the beginning of a revival.

I have my doubts. The huge deleveraging in the private sector in the U.S. and abroad; the unresolved odd-couple tensions between the Teutonic North and the Club Med South in the euro zone; and the needed shift in China from an export-led economy to one powered by domestic consumption suggest that “risk on” investments will collapse to meet recessionary and chronically slow-growing economies.

2. The time had come for "a bit of strictness."

The eurozone will take at least another five years to recover from the crippling debt crisis that has hampered even Europe's most powerful economy, according to German Chancellor Angela Merkel.

Mrs Merkel said that though Europe was on the right path to overcome the crisis, she added: "Whoever thinks this can be fixed in one or two years is wrong."

“We need a long breath of five years and more,” she told a conference in Sternberg, Germany. “We need rigor to convince the world it’s worth investing in Europe.”

Two years ago some heavily indebted European countries were dragged into the turmoil that first gripped global financial markets in 2007.

Greece in particular has been struggling with the austerity conditions imposed on it by countries such as Germany.

But Mrs Merkel told a regional meeting of her Christian Democratic Party on Saturday that the time had come for "a bit of strictness."

Otherwise, she says, Europe won't be able to attract international investment.

3. Does Britain have a future in Europe?

Does Britain belong in the European Union? There are plenty both in the United Kingdom and on the Continent who have their doubts. Now, with the debate over the EU's next budget raging, a European Commissioner has challenged London to decide. In Germany, Chancellor Angela Merkel is also losing her patience over the squabble.

On Friday, European Commissioner for Financial Programming and Budget Janusz Lewandowski, Poland's representative in the EU's executive, said it was time for Britain to make a fundamental decision regarding its future in the European Union. "Of course there are limits," he said in an interview with the German daily Süddeutsche Zeitung. "We can't finance more Europe with substantially less money."

When asked if he was referring to budgetary criticism coming from London, Lewandowski said: "Of course I am also referring to Great Britain. Either they see their future in the European Union in the long term or they don't."

Chinese police are going up-market, featuring Porsche Cheyennes.

4. Holden 'poised for collapse'

A motoring expert has claimed that Holden is poised to shut down for good because it can no longer compete in the global market. The details are from the ABC.

The Australian car manufacturer announced yesterday that 170 jobs would be cut from its Elizabeth plant in Adelaide. The announcement came just seven months after a $275 million rescue package was promised by the Federal and South Australian Governments.

The editor of car buyers' Dog and Lemon Guide, Clive Matthew-Wilson, says propping up the industry with taxpayer-funded bailouts is useless.

"Let's not be fooled by this they are going to close anyway," he said. "It is 40 per cent cheaper to build cars in Thailand than it is to build cars in Australia.

"If you look at the long-trend track record of car companies in Australia, they take billions and billions of taxpayers' dollars and they close down anyway."

One of Holden's major parts suppliers, Autodom, also stood down 400 workers in South Australia and Victoria this week.

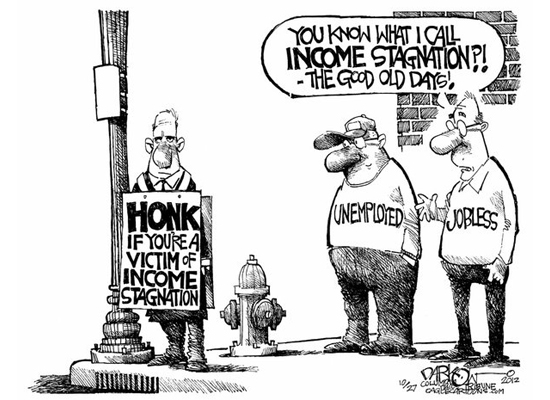

5. The slide in real wages

We get the September 2012 data for New Zealand average hourly pay on Tuesday (tomorrow). It was NZ$27.00/hour in June, so it is likely to be slightly higher, or equivalent to about US$ 21.60/hour and off the bottom of the chart above. I will try and produce a similar series for NZ next week to see if our average hourly wage is declining too - but the big events over the same time frame here are the three tax cuts we have had, and they won't show in the wage levels.

But this data for the US is interesting, and shows an economy adjusting to the new realities. It also shows not all adjustment is necessarily positive, but output is increasing and the number of jobs are growing. But if you don't adjust, you get the European answer, huge unemployment and a declining number of jobs. What would you choose? More from the NY Times:

Job growth has been modest but steady in the last few months. Wages, on the other hand, have been falling since August, after adjusting for both seasonality and price increases.

Assuming this is not just statistical noise, it’s possible that lower wages are enabling or encouraging employers to hire more workers, said John Ryding, the chief economist at RDQ Economics. When the price of something falls, buyers can afford more of it.

Another possible explanation relates to the types of jobs being created. If a sizable share of the jobs being created were low-wage jobs — which was the case from the first quarter of 2010 through the first quarter of 2012, anyway — the average wage could get dragged down.

6. Grocery prices starting to rise

Regular readers with good memories will know that we survey a number of shopping lists in both New Zealand and Australia, tracking the prices for a 'healthy foods' shopping list. That survey broadly confirmed the Statistics NZ food price data, and showed that grocery prices were falling for about a year. However in the past three months they have started to turn higher as international food commodity prices rose. It is not serious here yet - and we get a significantly better deal when we shop than do the Aussies when they shop for the same items. How much of the upturn in our series is seasonal is not yet clear.

Over the past year (if you have been buying 'healthy foods') you have been benefiting from low prices and you have no real reason to complain. Not sure what 2013 will bring though ...

7. Confounding expectations, global hunger is down

Despite sustained drought and population growth, global hunger has decreased over the past two decades. Food aid is smarter and 'host' governments are focusing more on local farmers. The Christian Science Monitor reviews the situation:

With 868 million of the world’s 7 billion people going hungry, “I don’t want to suggest we’ve reached the end of the rainbow, because we haven’t and 868 million is still unacceptable,” Mr. Leach says. “But with the path we’re on we will reach the MDG” on hunger.

So what accounts for the drop in hunger, when a rise was anticipated?

Part of the answer is that the global food-price shocks of 2008-09 did not end up causing the predicted rise in hunger. Countries absorbed the shocks better than anticipated, in some cases by becoming more efficient with domestic food supplies, and international organizations implemented plans with less focus on massive food imports for addressing the new challenge.

The international community is also getting “smarter and more effective," Leach says, at helping countries address emergency food shortfalls resulting from natural disasters or conflict.

But even more important – and perhaps the part with the greatest potential for keeping hunger on the decline – are the innovative ways that international organizations are working with “host” governments to put a new emphasis on local food producers and farm families.

8. Measuring national success

Many people don't like GDP/capita as a measure of our economy. (Many people don't like economists.) All sorts of alternatives have been suggested, but few get past the airy-fairy stage. Well, the Legatum Institute has come up with one, and guess what, New Zealand scores in the top five countries in the world.

Our scores for our economy, and our health dragged us down. But overall, we rank very well indeed (sorry gloomsters).

So does such a result pass the sniff test? If not, are you sure GDP isn't better? Or will it only pass your sniff test if it confirms your bias? One to ponder. The full Report (14.7 MB .pdf) is here »

Recently, there has been a global shift in the understanding of how to measure national success. From former French President Nicolas Sarkozy’s 2009 Commission, to the King of Bhutan’s Index of Gross National Happiness, to David Cameron’s initiative to measure wellbeing in the UK: the world is beginning to take a broader view of success. We welcome this shift in our understanding of why countries prosper.

We believe that the Legatum Institute is contributing to this debate. For the past six years the Legatum Prosperity Index™ has been exploring the foundations of national success by combining traditional measures of material wealth with subjective wellbeing. This holistic view of prosperity, that moves beyond GDP, allows us to paint a more complete picture of the world.

9. In Europe, a repeat of the loan crisis

The credit crisis, which made it difficult if not impossible for companies and individuals to borrow during the worldwide recession, appears to have returned to Europe. More from the NYTimes.com

In the euro area as a whole, the amount of credit outstanding has fallen to levels lower than they were a year ago, according to figures released last week by the European Central Bank. In some countries within the euro zone, including Italy and Spain, credit is falling at a faster rate now than it did during the first crisis.

The difficulty in obtaining credit seems likely to make it even harder for the countries that have been hurt the most to recover and begin to grow again. The figures show that while the E.C.B. has relieved the immediate financial pressures on both governments and banks by making it easy for them to borrow, it has not managed to extend that easy credit to those who need money the most.

10. Final decision

Mr Burns (and Fran O'Sullivan) endorses Mitt Romney. Game over.

21 Comments

I would be interested to know what the NZ MEDIAN wage was.....

Maybe someone more schooled in statistics can chime in but I thought average wage was really skewing what most people actually make. $27hr seems awfully high to me.

Cheers

I thought the average wage was about $45k~50K NZ...."median" would I think be higher......$27 an hour suggests a PAYE is on about $71k.

regards

Yeah $71k seems high for the "norm"....(would thousands be going to OZ if "average" money was $71k?) I guess i'm just not very confident when I see stats and charts as to the veracity of them. Too many years of seeing cow pats shovelled out as fact.

Cheers

You will find that the average wage is considerably higher than the median. The average is worked out the old time honoured way we learned at school whereas the median is worked out by what most people are actually earning. The "average" is skewed by the hideous amounts of money the top few are being paid and the bottom many are not. The median is what it suggests, the middle and should be the figure that calculations are made on, not the skewed average, which suggests that this is the sort of money that most people are earning but in fact are not, nowhere near

You've got "average" and" median" round the wrong way, but otherwise I think you may be about right with th figures. Thing is there are still plenty of people well below even the median wage

Half the people are below the median wage, er, and half above it. The median income (all sources) is $560/week about $29,000 - before tax. This includes retirees but a huge chunk of working Kiwis earn less than that.

There is a growing disparity between the median and the average showing we are becoming much less eglatarian - the Gini coefficient -

Question, what percentage of Kiwis earn the average wage or more? 20%? If that was the case you would need to be in the top quintile to equal the average. Anyone know.

http://www.stats.govt.nz/browse_for_stats/income-and-work/Income/NZIncomeSurvey_HOTPJun12qtr.aspx

It would be good to see a chart showing both average and median wage. This would then make it clearly visible the ever expanding gap between the overpaid and the rest.

Can you do one David?

2. "Rigor" consists of 5 or more years of wage deflattion the the PIIGS then...while Germany sits there and does diddly. The other way is infaltion in germany to correct and "rigor" doesnt sound like they are choosing that way. The former of course will lead to a defaltioanry spiral. huge unrest and I suspect default en-mass.

pigs might fly....she cant see it, doesnt want to or wont admit its going to take the EU out...lala land that one.

regards

Long term wage deflation is part and parcel of Globalisation. This fact is well known two or three decades ago when Globalisation is being debated. Except the Politicians and officials in charge choose to leave this part silent. Well it's home and roosting on our roof nicely now.

As long as globalisation is still in vogue, wages in Developed Economies has to deflate to levels of Developing Economies (YIKES !!! ).....Western lifestyles has been boosted by debt the past three decades to compensate for the deflation in wages and incomes.....of course now this chook has come home to roost too....

Merkel says another five years of hardship is in store for Europe, wonder how she will thinks when she is no longer in office after next May....or will the Germans still refuse to QE when their own economy sinks again ???.

Finally, how will NZ house prices respond to WORLDWIDE DEFLATION ??? I doubt NAts will still be in power after the next election ....

About the only problem is that the only triumph of those who could see this as a result years ago, is the satisfaction of being able to say "I told you so" I think that is one of the things the expression "cold comfort" was coined for

2. Funny how everyone is so keen on foreign "investment" when the reality is extractive in the sense that the return on investment is negative for the country being "invested" in, see the list of South American economic disasters.

Those debts in the EU won't be paid. How they won't be paid is the question. One persons debt is anothers income. At the moment we seem to be favouring creditors/bondholders but sooner or later we will need to favour debtors.

Cheers

re#6 Our local rural small Supervalue supermarket is up to 90c/2litres of milk cheaper than the big supermarkets in town.

Interesting outsider view on TAF http://www.stuff.co.nz/business/farming/7905663/Fonterra-shares-in-hot-…

Farmers can only sell up to 25% of their shares. This doesn't seem to be understood by Terry Hall. If a farm is doing 100,000kgsms that is approx $112,000 they would raise by selling. What can you do with $112k - not a lot. They are giving up a potential $35840 in dividend income (based on 32c 2011/12). So if you don't need to sell, why would you?

We have been told that after the initial launch the fund will be closed to more shares being sold until after the interim accounts but could be shut for 12mths. So not a lot of happy shareholders who thought they were voting in something that gave them the flexibility (a word frequently used by Fonterra) to sell their shares to manage events like drought etc.

Terry also seems to be ignoring the fact that banks usually have security over the shares therefore they need to agree to the shares being sold. There is a reported 'black list' of shareholders who the banks will not allow to sell. Terry refers to 10% interest, sure some have got caught with swaps, but a lot of farmers are paying sub or close to 6% interest rates. With dividends reported to be close to that there is no incentive to sell.

Wouldn't the Shares be worth at least $500k which is a return of 7% on a dividend of $35840?

Stand corrected Neville. As a farmer can only sell down 25% of his shares to the shareholders fund they are passing up 25,000 x 0.32 = $8000 in dividends.

As Kin notes above, long term wage deflation, added to falling credit, is a recipe for ongoing and severe depression.

The only way governments can address this is to spend new money directly into the economy via investment in infrastructure.

number 4

how can a country of 20 million support holden and falcon car plants.

the taxpayer has been the loser for years and the unions have been shafting the car companies forever.

could this be why the v8 racing next year is going to include other car manufactures

Most probably. The country can have whatever the people in it want to have. If the car companies actually wanted to they could make cars efficiently in oz or anywhere, they can actually make cars efficiently in the UK these days- amazing. The population size does not really matter, The global parts bin matters a lot and the plant efficiency . Wages are a small part. Things are based where people want them to be based and then they make up reasons why. The world has been turned on its head. There is little or no logic to location. Or maybe there is. Who knows. Germans make cars in Germany for lots of places. Where are Ford Focuses made these days? Could be anywhere. Tax implications, government handouts, free land etc. Global cos play one place off against the other- they could keep oz on just to keep somewhere else in line- who knows. Actual logic probably has little to do with it. If Australia wants to have a car industry I say go for it. Why not. Only don't let the car co's turn you into a getto of really outdated platforms, old engines , dated interiors- no wait they did that already

Good points made here....giveaways are biggest factor in plant location (socialism anyone). USA can "print " all the dollars it wants and everyone is kinda obliged to recycle them back into government deficit spending in the USA (don't need taxpayers). Great for them. Fiscal cliff my arse. Money is credit and is political in nature, as are economies, and the USA can go on a long time as is I reckon.

Cheers

#4 Holden will never die because

a) half the antipodean bogan population would suddenly have no reason to live and the resulting socio-economic chaos would send both countries back to the stone age. You can't upset the balance!

b) Gillard will continue to bail them out forever not only because of (a) above but because the bogan vote is usually the swing vote, dependent on which particular party the bogan feels is going to give it the most in handouts. Being the political party who let Holden die on their watch is political suiclde, no amount of handouts could compensate.

c) most bogans are struggling to grasp the concept of V8 supercar racing with three teams. If you suddenly take Holden out of the mix at this highly confusing time you will see bogan brains spontaneously combusting with the compexity of it all, like the martians at the end of Mars Attacks. The cost to the mental health industry would be too great for either nation to bear.

d) the building industry would die, just when it is needed the most because of the demise of the ute. How would all the bulders actually get on site?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.