Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard is on his summer break and will be back on January 22, 2013, from Wellington.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

See all previous Top 10s here.

1. If you don't know maths, you're gullible

Swedish researchers have recently done a revealing experiment. Their study finds that even academic scholars perceived research to be of higher quality if there’s some maths involved - even if the maths makes no sense.

The experiment threw an irrelevant mathematical equation into research paper abstracts, and asked scholars of different fields to evaluate the quality of the research. People without maths training were impressed; people with maths skills thought it was bollocks.

Mathematics is a fundamental tool of research. Although potentially applicable in every discipline, the amount of training in mathematics that students typically receive varies greatly between different disciplines. In those disciplines where most researchers do not master mathematics, the use of mathematics may be held in too much awe. To demonstrate this I conducted an online experiment with 200 participants, all of which had experience of reading research reports and a postgraduate degree (in any subject). Participants were presented with the abstracts from two published papers (one in evolutionary anthropology and one in sociology). Based on these abstracts, participants were asked to judge the quality of the research. Either one or the other of the two abstracts was manipulated through the inclusion of an extra sentence taken from a completely unrelated paper and presenting an equation that made no sense in the context. The abstract that included the meaningless mathematics tended to be judged of higher quality. However, this “nonsense math effect” was not found among participants with degrees in mathematics, science, technology or medicine.

2. Not strong enough

The Morrison/Infratil/NZS bid for English airport Stansted has failed, apparently.

Given Stansted is regulated by the Civil Aviation Authority, bidders have been told that the financial structure of their offers must be investment grade – pointing to a hefty equity cheque of at least £500m and no more than 50pc of the financing coming from debt.

However, banking sources said even that conservative structure was too much for the potential lenders to the Morrison consortium, given the risk that the final price could spiral several hundred million north of £1bn and there was no certainty over Ryanair’s long-term plans at Stansted. Any decision by the Irish airline to shift planes away from its UK hub would have a dramatic impact on Stansted’s value.

3. A bank run by children

Jamie Dimon (who has just left his gig at the NY Fed after his term expired) was not happy with how his trrops handled the London Whale scandal.

JPMorgan Chase Chief Executive Officer Jamie Dimon said some top executives at the largest U.S. bank "acted like children" in handling an errant derivatives bet that cost the company more than $6.2 billion last year.

"Instead of helping, they were running around with their head chopped off, ‘what does this mean for me personally, how’s my reputation?’" Dimon, 56, said yesterday at a conference in San Francisco hosted by the New York-based bank. Some people "felt they could take advantage of it personally, they were willing to hurt the company by maneuvering."

4. Today's raw market data ...

A quick holiday update:

| as at 11:10am | Today 9:00 am |

Wednesday | Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8340 | 0.8372 | 0.8392 | 0.7800 |

| NZ$1 = AU$ | 0.7959 | 0.7971 | 0.7972 | 0.7637 |

| TWI | 75.08 | 74.56 | 74.91 | 69.95 |

| Gold, US$/oz | 1,645 | 1,645 | 1,701 | 1,615 |

| Dow | 13,332 | 13,378 | 13,122 | 12,385 |

| Copper, US$/tonne | 8,006 | 7,996 | 7,966 | 7,503 |

| Volatility Index | 13.84 |

13.79 |

15.90 | 21.07 |

5. Market shift

After going through a [very] tough austerity process, Ireland looks like it is coming out the other side rejuvenated, if bond yields are any indication. More from the Irish Times. HT Brendan W.

The National Treasury Management Agency has sold €2.5 billion of 2017 bonds in its first syndicated sovereign deal since 2010, having received orders worth more than €7 billion.

The last time Ireland raised funds through a syndicated deal – which differs from an auction in that the price is pre-agreed – was before the EU-IMF bailout programme was announced in December 2010.

Ireland looks likely to become the first sovereign to successfully exit a euro zone bailout programme and is expected to issue approximately €10 billion of debt this year.

Irish five-year yields initially rose ahead of books opening on the deal but the strong demand saw the bonds recover early losses to trade flat at a yield of 3.36 per cent.

Given that Ireland's average cost of bond funding was circa 4.7 per cent prior to entering the bailout, to fund at such a level is a remarkable turnaround. It also represents a level lower than that which Ireland is borrowing from the troika, about 3.5 per cent.

6. The Auckland housing crisis

Yesterday's building consent data showed that only 432 consents were issued for new homes in Auckland in November, 4,442 in the year. Just how inadequate that is can be seen by comparing it on a population basis. 4,442 is 26.6% of all consents issued in the past year, but 34% of the population live in Auckland. Admitedly, this is a crude comparison, but that difference of -7.4% sticks out like a weeping wound for first home buyers and anyone else who is looking for affordable housing in Auckland. Auckland Council's 'smart growth' strategies is just code for 'no growth', bolstered by voters who want the wealth effect of sharply rising house values.

It is great to see what can happen when Councils get cracking - its just a pity it took a deadly earthquake to motivate Christchurch into new building. They are starting to make a difference now. Auckland needs at least 1,000 new dwellings built per month - for ten years.

7. Crazier and crazier

It is truly amazing how much press the "trillion dollar platinum coin" solution is getting. But Felix Salmon thinks it is all hot air. Dangerous hot air, but hot air all the same.

Let’s be clear about this: no one’s going to mint a trillion-dollar platinum coin. Nor is anybody going to mint a million million-dollar platinum coins.

In this case, the absurdity to be pointed out is the debt ceiling. Everybody who’s ever been in charge of any country’s finances knows that the concept of a debt ceiling is profoundly stupid, self-defeating, and generally idiotic. And we discovered in 2011 that it can do very real harm. Back then, I hated the idea of the platinum coin:

Tools like the 14th Amendment or even crazier loopholes like coin seignorage would be signs of the utter failure of the US political system and civil society. And that alone could mean the loss of America’s status as a safe haven and a reserve currency. The present value of such a loss? Much bigger than $2 trillion.

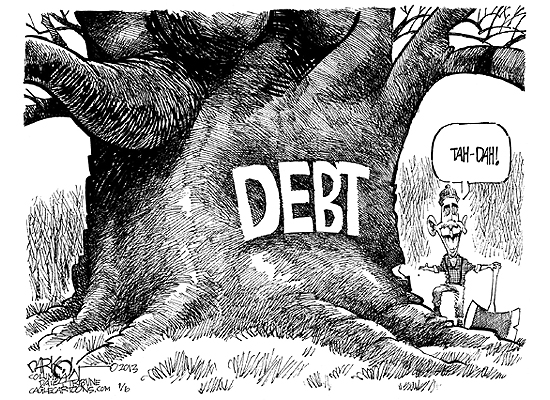

8. Counting down quickly

The US debt ceiling crunch is closer than most people realise. They have already hit the legal limit (debt ceiling) and are using "extraordinary measures" (accounting trickery) right now to stave off default. But people just switch off with endless political brinkmanship. You willing to bet real money they will get through this latest issue?

The US government may default on its debt as soon as Feb. 15, half a month earlier than widely expected, according to a new analysis adding urgency to the debate over how to raise the federal debt ceiling.

The analysis, by the Bipartisan Policy Center, says that the government will be unable to pay all its bills starting sometime between Feb. 15 and March 1.

The government hit the $16.4 trillion statutory debt limit on Dec. 31 , but the Treasury Department is able to undertake a number of accounting schemes to delay when the government runs into funding problems.

9. Up, then down

The Aussies think a new dawn is arriving with iron ore prices. But the the expert analysts think it might be a false dawn. More from Bloomberg:

Iron ore, which posted the biggest quarterly gain on record in the final three months of 2012, may extend gains from a 14-month high as Chinese mills restock, then tumble into a bear market, according to Deutsche Bank AG.

Prices may gain to $170 a ton in the first half on demand in the biggest buyer, before falling to less than $120 as supply expands, Deutsche Bank said in a report. Ore with 62 percent content delivered to Tianjin rose to $158.50 a dry ton yesterday, the highest since October 2011, according to data from The Steel Index Ltd.

A drop from $170 to $120 implies a 29 percent fall, more than the 20 percent that typically defines a bear market.

10. Today's quote

"If you lend someone $20, and never see that person again; it was probably worth it." Anon

Oil and Petrol

Select chart tabs

9 Comments

BDI, take a look at the 5 year graph, in May 2008, 11000, today 700 some drop....and that trend...

http://www.bloomberg.com/quote/BDIY:IND/chart

regards

We can see a classic example of (1) in the - presumably Chaston - comment in (6).

The biggest problem isn't following complicated equations, it is failing to understand exponential numbers.

We are told that the numbers of already-housed are somehow causally-linked to future demand. Why? If that's the case, where does it stop - conveniently after the ten years?

And note that it's a linear-demand perception; a steady rate over a fixed period. Hopeless - it's like the Brownlee clanger about X years of lignite available, which we can use to fuel economic growth. Must be a cognitive link missing in the DNA of these folk? That would explain the plethora of 'more is always good' assertions issuing from a species in overshoot on a finite planet.....

(2) - who'd invest in an airport? Let me guess, thorium-driven aircraft. Of course. Brings us back to (1), methinks....

(8) - The US will have a double-whammy at some inevitable point - since Bretton Woods they have been the base currency, at some debt-point they will be dropped. That will exascerbate the debt - they'll be recognised as junk - , and they'll default (even without that, there was no way back).

The best reason to get out ....fast

"Britain risks damaging its relationship with America and being sidelined in the international community if it leaves the European Union, the Obama administration publicly warned today"

http://news.google.co.nz/news/section?cf=all&ned=uk&topic=n&ict=ln

Talking about maths (#1) can someone help me out here?

I am trying to get the gdp figures for NZ, USA and UK for the period 2005 to 2011 and it is hard to find (maybe i am looking in the wrong places).

The data i have collected so far does not add up, to me at least. Here is what i have gathered.

NZ GDP

2005 - $100,806

2006 - $109,098 - 8.23% increase

2007 - $110,562 - 1.34% increase

2008 - $138,317 - 25.1% increase

2009 - $117,816 - (4.82)% decrease

2010 - $126,679 - 7.52% increase

2011 - $142,477 - 12.47% increase (GDP now higher than before the crash)

USA GDP (trillion)

2005 - $12.74

2006 - $13.04 - 2.35% increase

2007 - $13.33 - 2.22% increase

2008 - $12.88 - (3.38)% decrease

2009 - $12.87 - (0.07)% decrease

2010 - $13.18 - 2.41% increase

2011 - $13.44 - 1.97% increase (GDP now higher than before the crash)

I havent got UK GDP as yet

Assuming these figures to be correct then:

The great big global crash only made a small dent in GDP yet unemployment shot up and we have all these crisis talks about stimulus. Austerity being separate in that this is government debt due to bank bail outs.

If unemployment shoots up then those unemployed spend less. We are also told that those still in jobs are paying off debt instead of spending but these figures don't support that claim. I would have expected economies GDP to fall by about 25%.

Of course the high GDP figures could have to do with all this multiplyer talk. That is, the high GDP is due to increased government expenditure, however it did not help unemployment so the multiplyer effect failed. That is just another assumption untill good figures can be obtained.

Your help would be appreciated.

There is nominal or 'real' data, there is either 'production' or 'expendture' bases, and yes it gets pretty confusing, especially as each country does things a bit differently. I find the best comparatives (other than OECD or World Bank, which can be a bit dated) are this indexes from the RBA, here »

http://www.rba.gov.au/statistics/tables/xls/i01hist.xls?accessed=2013-0…

Thank you David, much appreciated.

If each country does things a bit differently then that implies, to me, that there is no clear definition of what it should be and therefore no standard for countries to work by. That being the case the whole thing is just a guesstimate really.

The supprising thing to me, is that on the basis of the data as it is, GDP is back, and higher than before the crash. If that is the case then why are the other figures so out of sync? such as the unemployment figures. Most confusing.

Added

And the other supprise was how small the fall in GDP is reported as being. If that is true then, "what the heck if you have 9% unemployed as it makes little difference to the economy" so to speak

No 6 - Aucklands housing crisis 432 building consents issued.......equates to poor governance and surely makes a mockery of the Oath that all sworn members must take. There is absolutely no benefit to the whole community in issuing such limited numbers of building consents when a housing supply shortage is present.

There is no community benefit in restrictions on land supply so again all those Councillors who took their Oath are making a mockery of the system.

#10, Why Peak Oil Threatens the International Monetary System

http://aspousa.org/2013/01/commentary-why-peak-oil-threatens-the-intern…

meanwhile we note the price of petrol is uh, stable.

;]

regards

Re Item 5 above

It's all Irish to me or is it media spin

From another European Newspaper

"Unfortunately, this gleaming façade obscures a rather dismal reality. Although Ireland's economy has stabilized, its debts continue to mount -- despite the fact that the country has been diligently fulfilling all of the demands made by the troika of lenders, which consists of the European Commission, the International Monetary Fund (IMF) and the European Central Bank (ECB). This year, Ireland's public debt is expected to increase to 122 percent of its annual gross domestic product (GDP) -- in other words, beyond the limit at which the IMF believes long-term debt sustainability can be achieved.

The €68 billion ($90 billion) in bailout funds are only expected to meet the country's financial needs until the end of 2013."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.