Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard is back tomorrow with his version.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. The world's central banker

As of November 2012, the People’s Bank of China had total assets of US$4.8 trillion, more than the European Central Bank or the US Federal Reserve.

The PBOC now supplies more than half the world’s total liquidity and manages foreign reserves worth almost US$3.3 trillion.

Gulp. No wonder European politicians try to persuade the Chinese to buy their bonds. Two University of Queensland professors have taken a close look at its rise.

With its new authority, the PBOC began to flex its muscles in the 2000s, particularly under the governorship of Zhou Xiaochuan, an economist with intimate ties to the political leadership. Although the party still exerts control over the financial sector, the bank has been exploring new, more market- oriented instruments and mechanisms within its discretion to establish a credible monetary policy and maintain price stability.

From 1979 to 1994, economic growth averaged 10.1 percent while inflation averaged 7.7 percent. From 1995 to 2011, economic growth averaged 9.9 percent while core inflation fell to an average of only 3.1 percent. This track record gave the PBOC greater authority and room for maneuver in macroeconomic management.The PBOC also played a central role in liberalizing China’s exchange rate in 2005 and again in 2010, despite mounting internal resistance. Recognizing the importance of a sound banking sector for carrying out monetary policy, the central bank also took the lead in recent banking reforms aimed at improving corporate governance and market discipline. Under Zhou, the bank has also been active in reforming the securities, insurance, and bond markets, internationalizing the renminbi, and establishing state-of-the-art payment and settlement systems.

But the PBOC still faces plenty of challenges. In the short--to-medium-term, it will have to address bad loan risks, especially an increasing prevalence of shadow banking and banks’ exposure to real estate and local-government debt. In the longer term, it will have to ensure stability as China transforms into a more domestically driven economy. What makes these tasks more daunting for the PBOC is that it must constantly bargain and negotiate with other bureaucracies and with the party leadership. It also must implement a more market-oriented monetary policy while constrained by the legacies of the communist past, such as state control of key financial sectors.

2. The US bank stress tests

US banks have enough capital to withstand a severe economic downturn, the Federal Reserve has said, after announcing that 17 out of 18 major banks passed its annual stress tests.

Government-controlled Ally Financial, the rescued former finance arm of General Motors, was the only bank to fail the test of capital strength. Wall Street banks Morgan Stanley, at 5.7%, and Goldman Sachs, at 5.8%, were the next two lowest.

3. 725 happy bankers

In Britain, total of 428 employees of Barclays and 93 at RBS earned more than £1m last year according to data released under their new transparency rules. And 204 HSBC employees were paid more than £1m last year, of which 78 were in the UK, where the group has its headquarters.

4. Today's raw market data ...

A quick new week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8213 | 0.8287 | 0.8366 | 0.8198 |

| NZ$1 = AU$ | 0.8028 | 0.8062 | 0.8111 | 0.7751 |

| TWI | 75.86 | 76.09 | 75.88 | 73.05 |

| Gold, US$/oz | 1,582 | 1,588 | 1,652 | 1,697 |

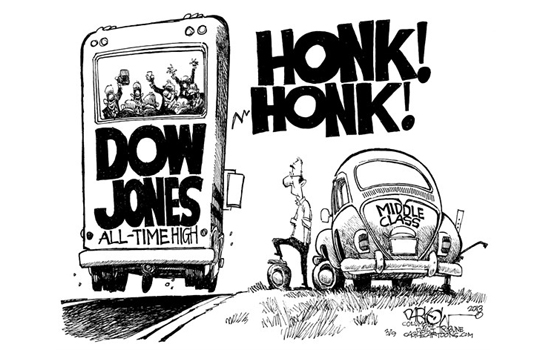

| Dow | 14,386 | 14,336 | 13,975 | 12,951 |

| Copper, US$/tonne | 7,730 | 7,621 | 8,216 | 8,391 |

| Volatility Index | 12.59 | 13.06 | 12.94 | 15.64 |

5. A recipe for division

EU consumers are increasingly asking a simple but discomforting question: Why, in a trading bloc notorious for regulating things like the shape of bananas and the font size on food labels, was something as simple as identifying the difference between a cow and a horse so difficult? The NY Times says the horse meat saga is exposing some fundamental weaknesses.

The horse meat fracas has also put a spotlight on the tenacity of cultural and national stereotypes that were supposed to fade away as a new common sense of European identity took hold. Particularly pronounced has been a tendency in the richer nations of Western Europe to point a finger at what they often see as their poor and unreliable country cousins in the former Communist East.

Growing calls for mandatory “country of origin” labeling on all processed meats sold in Europe have stirred concern in Brussels about a surge in what Mr. Borg, the health and consumer affairs commissioner, has called “veiled protectionism.” Until now, only unprocessed meat had to identify its place of origin.

“The Germans are saying we are only going to eat German products. The French are saying the same for French products. What happened to the common market? This is really serious,” said Françoise Grossetête, a French member of the European Parliament.

6. Yes we're confident, but who knows why

Robert Shiller has spend a career trying to understand what motivates (or demotivates) consumer behaviour. He is still puzzled.

For example, why is a record high in the United States stock market a reason for optimism? Nothing is remarkable about reaching a market record: the S.& P. Composite Index has done it 1,007 times, based on daily closes, since the beginning of 1928. That’s about once every 23 trading days, on average, though the new records tend to come in bunches.

The important fact is that we haven’t set a nominal stock-market record in six years. And we haven’t set one in 13 years if we use the inflation-corrected S.& P. Composite total-return index. That this index may be about to set a record means only that we haven’t made any real money in the stock market in 13 years, which hardly seems a reason for confidence.

But public thinking is inscrutable. We can keep trying to understand it, but we’ll be puzzled again the next time the markets or the economy make major moves.

7. Serious wealth

Norway’s sovereign wealth fund, one of the world’s biggest investors, grew by around NZ$120-billion in 2012 to more than NZ$860 billion, which was one of its best years on record as it benefited from the striking upturn by stock markets. It did it by avoiding EU government stocks, selling out of Apple, and loading up on Aussie bonds.

At the end of last year it sharply cut its holdings of bonds issued by the government of Britain and France, two countries struggling to reduce debt levels while their economies stutter. The fund reduced its holding of British government debt by 13 per cent in the fourth quarter. French government debt holdings fell by a quarter.

The fund also more than quadrupled its holding of Australian government debt.

It earned close to 30 per cent on investments in the financial sector (including HSBC), which also had the biggest weight in its portfolio with 23 per cent. Consumer goods, the second-biggest segment within its share portfolio, also returned a hefty 24.5 per cent.

Meanwhile, in poorly performing sectors, such as utilities and telecommunications, it only had a minimal exposure.

8. 'Don't just do something - stand there'

Anatole Kaletsky has four reasons why he thinks Obama should just do nothing on the budget deficit 'crisis'. You will need to read his piece for those four reasons, but he reckons 'deficit denial' is what the US needs right now.

Ronald Reagan had a catchphrase when faced with a crisis, especially a synthetic “crisis” of the kind Washington loves to concoct. He would call in the officials and media advisers rushing manically around the West Wing and calmly tell them: “Don’t just do something – stand there.” In this respect, as in several others, “No Drama Obama” seems to resemble the man he once admiringly described, despite their ideological animosity, as the last great “transformational” U.S. president.

With Wall Street hitting new records as Washington supposedly plunges into its latest fiscal crisis with the budget sequestration that began this week, Obama could do well to emulate Reagan’s laid-back style. In addition to doing nothing about the latest manufactured fiscal crisis, he could explain why nothing is the right thing to do.

To be more specific, Obama could negotiate a truce in the budget war. Instead of insisting that Republicans must “pay” for Democratic spending cuts by agreeing to higher taxes, the president could offer a much more attractive deal to both sides. If Republicans eased the sequester and demanded no new spending cuts, the Democrats could promise not to raise any taxes. Such a ceasefire would be seen by both parties as an honorable draw. Republicans would have fulfilled their pledge to stop higher taxes; while Democrats would have thwarted efforts to gut government and the welfare state.

There would be only one drawback. My fiscal ceasefire proposal does nothing to reduce deficits or government debts. But doing nothing on deficits is exactly the right policy for the U.S. today.

9. Job losses

Just one report of jobs lost this week. It is very quiet on that front. However 21 positions are being 'disestablished' at the Wairarapa DHB. Still, that is the only one we have for March so far. (It is a grim comparison, but the road toll is higher.)

We are keeping a tally of reported job losses and we are asking readers for help keeping track of them. Let us know when you see some.

10. Today's quote

"This planet has – or rather had – a problem, which was this: most of the people living on it were unhappy for pretty much of the time. Many solutions were suggested for this problem, but most of these were largely concerned with the movements of small green pieces of paper, which is odd because on the whole it wasn’t the small green pieces of paper that were unhappy.” - Douglas Adams

No chart with that title exists.

23 Comments

So the PBOC is now the largest Central Bank in the world.....

Lets not forget the basic idiom in the world :

MONEY TALKS.......

But also let us not forget : THE PBOC IS PART OF THE REPUBLIC OF CHINA GOVERMENT.

It does not enjoy so called "independence" unlike other developed country's Central Bank.

So to analyse the activities and action of the PBOC like any other Central Banks is faulty and dangerous. Their loyalty and action is only and solely for the benefit of China's economy and not necessary the rest of the world.....which give rise to the Deputy Governor's statement last week about "we are prepared for any currency war....."

The world's financial scene will be a very interesting place for the next few years....

We should also note Jim Roger's take on currency wars :

It just depends on which one goes down the most and first, and they take turns. When one says a currency is going down, the question is against what? because they are all trying to debase themselves.

Think the PBOC is going to see their assets debased by other Central Bankers??

#7. Norway proves Micawber was right.

worth reminding ourselves that the NZSF delivered returns of just over 20% in the 12 months to 31 January 2013

Worth examining the longer term return performance (Page 11)- hightened expectations of extraordinary Federal Reserve intervention culminating in QEternity towards the end of 2012 account for a large part of the return you note.

Sorry - I neither see that point on p11, nor understand the point you are making.

Is it that NZSF's performance this year has been better than previous years and much better than their average? That's true, but so has everybody else's; and it doesn't alter the fact that their results this year have been better than Norway's.

There's a more general point here. Why is it that whenever negative news about other countries is reported here, commentators take it as evidence that things are bad in New Zealand; while whenever positive news about other countries is taken as evidence that things in other countries are better than they are here?

Sorry - I neither see that point on p11, nor understand the point you are making.

Hard luck.

Not my problem if you've failed to make your point clear

#10 Google's title page today is dedicated to Douglas Adams as it is the 61st (?) anniversary of his birth.

#1 Check out this rort ...... the Chinese sell their manufafctures for US$ , the Chinese Central Bank collect all the US$ proceeds ( by law Chinese are not allowed to hold US$) and pay their workers with Monoploy money ( Renmimbi), which is worthless outside China

It is the biggest fraud on the planet and not surprising that the Chinses Central Bank is able to hoard so much US currency.

China has a two- tier currency , the Renmimbi is used internally and the Yuan is used externally , its carefully managed and there are severe exchange controls in place for ordinary Chinese.

The Chinese who are buying up Auckland are the " Connected " ones who through friends , and family in high places , and business assocaitions have got access to hard currency .

Boatman... yes ...i would call that a "structural Flaw" in the Global Monetary System.

It is a worry that respected economists like Matt Nolan don't see that,.

On this site matt said this....

'Take for example the China example, which is the only clear one where we have some type of currency intervention. China does this by building up reserves, which come from domestic savings in China - savings which are then used by the government to buy US Treasuries and other assets, and thereby pushes down the nominal value of their exchange rate.'

Why can't economists see this..??? ( It is obvious to u and I ). Why do they presume that this monoply money (boatmans words) is actually peoples savings..???

I don't want to stick it to Matt .... BUT.... There is a profound difference between foriegn reserves coming from "savings" ( deferred consumption)... or... foriegn reserves coming from " monopoly money printing".

The difference is so profound ...one is left scratching ones head... as to how economists see the world so differently.

kind of scary... that as a group...economists are the ones who advise Government about our monetary system... exchange rates.... monetary policy...etc...etc...

Economics is the only "social science" I have come across that has so much influence at a Govt level.....

Cheers Roelof

Boatman, sorry to deflate you.

The Renminbi and Yuan is one and the same thing.....there is no "Two Tier" anything with the Chinese Currency....

Also, you can legally remit money out of China through the Banking system....you only need approval from the Central Bank of China and Foreign Exchange Control Office.....You definitely do not need "Connected" ones to get your money out.....Of course if your source of money is illegal, you would not like too much scrutiny on your wealth and therefore do not like "exchange controls".

Which does not mean that Chinese in Auckland or New Zealand has funds remitted here which is illegal.......

Kin,

The gist of what boatman desribes is correct thou.... Money supply growth in China is principally the PBOC printing renminbi/yuan to exchange with exporters for $US.

Can anyone get approval to remit money out of china..??

I recall having to get reserve bank approval to purchase a book back in the 1970s... ( at least..I think I recall.?? )

The chinese then provided cheap consumer credit for Americans to buy chinese product and it then becomes a vicious cycle which is creating a downward spiral for the US.

How?

I think you have the cart before the horse - it's the US creating the credit for US citizens to buy the Chinese goods - the US bonds are purchased with the Chinese factory USD export proceeds. You may wish to consider this a form of vendor financing after the fact but the US is in effect defaulting on Chinese purchases of US Treasuries as the Dollar collapses under the pressure of excess FED purchases - so the Chinese now have to let US citizens out from under other debt laden, over priced assets - those you keep referring to.

Whatever, it would seem the game is winding down for the moment - read more

re No 7: Norway, UNLIKE New Zealand , is willing to mine its minerals for the benefit of its people . It has exploited is offshore oil reserves for years .

Its therefore not surprising Norway run a budget surplus , have one of the the highest savings levels , and among the highest living standards in the world

Here in Godzone , the Green loons wont even let the oil Companies search for oil ..... they would rather our poorer kids go hungry , people suffer from Third worls diseases, increase the retirment age to 67, slap us with a Capital gains tax , and struggle our arses off with ongoing budget deficits

Boatman...

I don't understand why Norway is swapping "hard assetts" for financail assets... ie.. etracting far more oil than they need to.

Why don't they just extract what they need... ( maybe plus a little bit )...and then leave the rest for future generations to benefit from, and make decisions on..??

I would far rather have a "store of wealth " in hard assets than in financial assets.

Norways oil wealth fund is massive....

So Roelof , I concur with what you are alluding to , we dont need to expolit all the oil reserves , just enough to be comfortable , and go up in the OECD income rankings.

NZ is thought to have about 75 years of oil and gas reserves

The second thing is that contrary to the hype by oil corporates there is no shortage of oil on the planet , in Africa countires such as Madagascar , Angola , Mali , The Congo Brazzaville , CAR , Ghana , and even Uganda have discovered viable oil reserves, .The madagascar rerves , while deep are massive

The middle east has 150 years of proven rerserves , Alaska has about 250 years which the US Govt is keeping in reserve.

There are also alternative sources such as Fracking , shale gas , tar beds , oil from coal , petrol from ethanol , biodiesel.

Modern electric vehicles which are incredibly fuel efficient, are likely to be in increased demand according to Harvard research academics

Finally , an observation , we are in the oil age right ? Do you think the stone age ended because the world ran out of stones ?

There is a real risk that oil could become redundant as an energy sources in the next 50 years with new technology , alternative energy ,

Boatman - references please, including URR, and EROEI.

There has been enough posted hereabouts, for you to know better than that.

The comment stands for every one of your points. Get it together, eh? Time we were past that kind of lightweight nonsense.

#2 - I would suggest if the same "stress tests" had been done in late 2007 all the U.S. banks would have passed with flying colours. It's just a confidence trick to fool the public and make it seem that the Fed has not fallen asleep at the wheel again.

Norways sov wealth fund...not keen on utilities...what's Mighty Creek listed as!

Are you keeping a tally of job gains? Oh wait they don't garner huge headlines.

That table is pure comedy. We have a govt dept for employment stats, and yes you can drive a bus through the revisions, but still miles better than that table.

Mish mashing the US employment BS report ....http://globaleconomicanalysis.blogspot.co.nz/

Soiled Energy is soiled govt...and that's a solid fact

"State-owned Enterprises Minister Tony Ryall said the Government had called on all state businesses to improve their performance and returns"press

I am calling on Tony Ryall and all the Ministers of the Crown ...to improve their performance!

Must be time for another fat salary and bonus boost for all SOE bosses, lesser bosses and govt dept flunky heads.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.