Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard is back tomorrow with his version.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. 'The best way to save banking is to kill it'

Banking may seem stable in our part of the world, but in the northern hemisphere folks think it is broken - even respectable and powerful people.

We track the leverage of the NZ retail banking system here ». While it is falling very slowly, it is still far too high to be safe. I reckon we would all be better off at 7 or 8 times, rather than the 12+ times leverage our banks are now operate with.

Here is Matthew Klein on Bloomberg:

One way to make [banks] more robust is to increase equity capital requirements. This is the remedy advocated by Bloomberg View's editors. The banks call it radical but it's really pretty moderate, because it leaves the basic structure of banking alone. The same is true of calls to make the banks smaller. Smaller banks are still banks.

A genuinely radical approach would be to kill banking as we know it. Rip all banks, large or small, in two - separate deposit-taking from credit-creation. Back the deposits one-for-one with reserves at the central bank. Then fund loans not with deposits or other money-like liabilities but by tapping investors who understand they've put their savings at risk.

The strangeness of the idea shouldn't rule it out, because as Tobin said the current marriage between deposit-taking and credit creation was itself a historical accident - and it's a union that hasn't worked out so well. Radical-seeming alternatives should be part of the conversation.

2. Chasing yield - trouble on a new front

It has an all-too-familiar ring. Investors, in search of better rates, rush to risky, high-yield bonds, raising worries that the market is overheated. But the concerns - which have already been voiced about the $120 billion of European and American junk bonds issued this year - are now being applied to the fledgling Chinese market.

While American and European companies have been selling high-yield debt for decades, Chinese businesses only recently started to tap into the junk bond market in earnest. The NY Times reports:

Chinese high-yield bonds have many of the same characteristics - and risks - as American debt. They tend to be sold by companies looking to finance ventures in new or untested areas or businesses that compete in industries where earnings are subject to volatile swings.

But the Chinese market has its own set of potential problems, and some analysts worry that investors aren’t being properly compensated for the added layer of risks.

For one, the bulk of the high-yield bonds in Asia this year — roughly half — come from Chinese real estate companies. The fear is that the housing market, which has been booming, is a bubble that will eventually burst.

3. Consuming their future

The cost of environmental degradation in China in 2010 was about $230 billion, or 3.5 percent of the nation’s gross domestic product - three times that in 2004, in local currency terms, an official Chinese news report said this week. The NYTimes assesses the size of the handicap China is building:

There is consensus now that China’s decades of double-digit economic growth exacted an enormous environmental cost. But growth remains the priority; the Communist Party’s legitimacy is based largely on rapidly expanding the economy, and China officially estimates that its G.D.P., which was $8.3 trillion in 2012, will grow at a rate of 7.5 percent this year and at an average of 7 percent in the five-year plan that runs to 2015. A Deutsche Bank report released last month said the current growth policies would lead to a continuing steep decline of the environment for the next decade, especially given the expected coal consumption and boom in automobile sales.

Mr. Thornton, the economist, said the recent official estimates of the environmental cost “marries with our on-the-ground feeling that a lot of short-term positives over the past few years are turning into long-term negatives.”

4. Today's raw market data ...

A quick new week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8359 | 0.8365 | 0.8230 | 0.8176 |

| NZ$1 = AU$ | 0.8033 | 0.8038 | 0.8070 | 0.7905 |

| TWI | 76.93 | 76.96 | 75.71 | 72.89 |

| Gold, US$/oz | 1,598 | 1,603 | 1,574 | 1,678 |

| Dow | 14,577 | 14,577 | 14,138 | 13,203 |

| Copper, US$/tonne | 7,583 | 7,570 | 7,751 | 8,480 |

| Volatility Index | 12.70 | 13.15 | 14.01 | 15.64 |

5. Don't worry about future energy

We may soon have an abundance of electricity, more supply than we know what to do with (thank you Rio Tinto?).

The changing nature of the products we buy is changing the amount of energy we need to run our modern economies - and the shift is startling. 'Heavy' manufacturing (or actually any manufacturing) is now much less important to economies than it once was.

Perhaps the most under reported story of the decade may be financial markets having totally missed the point at which oil actually became a growing economic irrelevance rather than a burden.

Basically, output is growing much faster that energy use. And that is not only a good thing, it is a game-changing thing.

In the next few years, oil exports are likely to become a major part of New Zealand's economy when the current investments in Taranaki start delivering. And the same is true worldwide. The problem is that the western world doesn't need all this energy to grow. Maybe the developing world does, but I suspect they too will move away from oil dependency pretty quickly.

I will try and put the data together for New Zealand, but in the meantime, here is a graphic for the US:

6. 'The gold standard, minus the shiny rocks'

Mathew O'Brien at The Atlantic explains why the current malaise in the euro-zone shows why we should avoid returning to a gold standard.

The euro is the gold standard minus the shiny rocks. Both force countries to give up their ability to fight recessions in return for fixed exchange rates and open capital flows. But giving up the ability to fight recessions just makes it easier for recessions to turn into depressions. And that puts all of the pressure on wages to adjust down when a shock hits -- the most painful and destructive way of doing things.

But the gold standard had an even bigger design flaw than creating depressions. That was perpetuating depressions. Under the rules of the game, countries short on gold were supposed to raise interest rates, which would push down wages, and push up exports. More exports would mean more gold, and then lower interest rates. But there was an asymmetry. Countries needed gold to create money, but countries didn't need to create money if they had gold. During the Great Depression, the U.S. and France sucked up most of the world's gold, but didn't turn it into money out of fear of nonexistent inflation. Countries that needed gold needed to push down wages even more to make their exports competitive - not that there were any booming markets for them to export to due to the self-inflicted economics wounds of the U.S. and France. Instead, the depression just fed on itself.

The euro suffers from a similar asymmetry.

7. More carbon, but temperatures have stopped rising

Some of you who noticed we have a drought affecting most of the country will be puzzled why NIWA consistently 'forecast' normal rainfall and temperatures during summer, even when they could look out the window. NIWA scientists were part of the Nobel Prize award for their ability to forecast climate 30 years hence.

But the climate has acted differently to what the IPCC predicted for the past 10 years, and there is a scramble to explain it. This does not mean we don't have a problem, nor does it mean the future is reassuring. It is probably not. Before jumping to any conclusions, it would be wise to read this link. More from The Economist:

Temperatures fluctuate over short periods, but this lack of new warming is a surprise. Ed Hawkins, of the University of Reading, in Britain, points out that surface temperatures since 2005 are already at the low end of the range of projections derived from 20 climate models (see chart 1). If they remain flat, they will fall outside the models’ range within a few years.

The mismatch between rising greenhouse-gas emissions and not-rising temperatures is among the biggest puzzles in climate science just now. It does not mean global warming is a delusion. Flat though they are, temperatures in the first decade of the 21st century remain almost 1°C above their level in the first decade of the 20th. But the puzzle does need explaining.

8. 'The bubbles will burst'

Long-term interest rates are now unsustainably low, implying bubbles in the prices of bonds and other securities. When interest rates rise, as they surely will, the bubbles will burst, the prices of those securities will fall, and anyone holding them – including banks and other financial institutions – will be hurt. You have been warned by none other than Martin Feldstein:

To the extent that banks and other highly leveraged financial institutions hold them, the bursting bubbles could cause bankruptcies and financial-market breakdown.

Investors are buying long-term bonds at the current low interest rates because the interest rate on short-term investments is now close to zero. In other words, buyers are getting an additional 2% current yield in exchange for assuming the risk of holding long-term bonds.

That is likely to be a money-losing strategy unless an investor is sagacious or lucky enough to sell the bond before interest rates rise. If not, the loss in the price of the bond would more than wipe out the extra interest that he earned, even if rates remain unchanged for five years.

9. Job losses

While there was a bit of a flurry of job loss reporting this week, they were mostly a repeat of what has been reported before. We seem to be in a loop of recycling job loss stories; there is very little new. And most of the bigger ones are 'losses' that will be handled by attrition and reassignment, rather than actual layoffs or redundancy. No evidence yet that we have an 'actual' problem - it looks like more of a beat-up at this stage.

We are keeping a tally of reported job losses and we are asking readers for help keeping track of them. Let us know when you see some.

It it doesn't pick up soon, be may have to abandon our monitoring project.

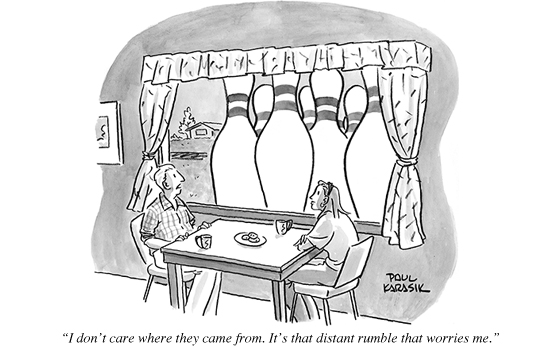

10. Today's quote

"People say that money is not the key to happiness, but I always figured if you have enough money, you can have a key made." Joan Rivers

Oil and Petrol

Select chart tabs

13 Comments

Awful news in the Herald....in 4 million years Cook Strait will be a wee salty ditch a 2 year old could leap across....but hey....the Mainland is going on a diet...haha...

The oil price is manipulated - gosh, who knew.... Iraq was Blood for no oil - to keep the Saudis in charge of the US oil cartel.

BBC and Guardian investigative reporter Greg Palast - a New York Times bestselling author - thinks he knows why. Palast is famous for obtaining original source documents from whistleblowers which tell the real story.

Palast argues today that source documents he obtained through cloak-and-dagger methods prove that the war was actually focused on keeping Saddam's oil off of the market ... so as to keep oil prices high:

http://www.zerohedge.com/contributed/2013-03-30/was-iraq-war-about-grab…

[I obtained] a 323-page, three-volume programme for Iraq's oil crafted by George Bush's State Department and petroleum insiders meeting secretly in Houston, Texas.

I cracked open the pile of paper – and I was blown away.

Like most lefty journalists, I assumed that George Bush and Tony Blair invaded Iraq to buy up its oil fields, cheap and at gun-point, and cart off the oil. We thought we knew the neo-cons true casus belli: Blood for oil.

But the truth in the Options for Iraqi Oil Industry was worse than "Blood for Oil". Much, much worse.

The key was in the flow chart on page 15, Iraq Oil Regime Timeline & Scenario Analysis:

"...A single state-owned company ...enhances a government's relationship with OPEC."

#9

David the problem isn't so much job losses, as lack of job creation. Especially as older people generally work longer today there is a real problem in job creation for young kiwis.

Especially as fewer kiwis start to migrate to Aus and do the OE in the UK, there will be even growing pressure.

Like I said at the start of the year I still expect unemployment to be 7% to 7.5% at year's end. This is going to create real fiscal pressures for the govt.

And underemployment is also a big issue. Plenty of young graduates working 30-35 hours per week in poorly paying retail and hospitality jobs, which is hardly creating a good wealth base for the future

Matt - right. David - wrong, but Right?

(see John Walley's article.)

The cost of everything, the value of .....

An easy mistake to make David.

Les.

" Don't worry about energy future " ....... geez , David , I was awaiting an explosive response from PDK or from steven ....... but the lads must be away , squirrelling winter supplies of tofu and candles into their caves , no doubt ....

.... but it does make me think of the stone-age , when rockdownkiwi and his knapper mates worried endlessly about the shortage of suitable stones for making flint tools ...

.... " peak flint stones " was the primary topic of conversation for those million or two years .... as indeed " peak oil " has been a topic of doom around here for a million years or so ..... well , steven & PDK make it seem that long ...

Apparently the stone-age ended long before the rock supply ran out .... thanks to Hanna-Barbera , we now have an endless supply of Flintstones ...

All I have to say is............doh......or maybe duh....

;]

regards

PS not much to comment on these days, the same regurgitaed everything is alright or will be alright. Now DavidC has clearly come out of the cold and has shown which side he resides on.

PPS Interesting that the right who have long claimed the care of the economy crown over the left are really just wonky in a different way.

GBH

If you can't see the isssue in using "electricity consumption is dropping in the US" as a justification for "we have plenty of Oil" is somewhat flakey then stick your head back in the sand. (plenty of that around)

The only reason the west doesn't need more energy at the present point in time is that they are bankrupt or had you missed that?

Probably had something about exporting all the heavy energy using industries to the east, doya think?

Chaston has had some years to become informed.

Clearly he is either incapable of doing so, or he has chosen not to - along with those who attempt to compare a collection of pebbles with an energy source.

It's a total myth that you can do/supply ANYTHING without energy-expenditure, and Mr Chaston only has to stand on the verge of an arterial highway for a rebuttal of his claim.

There's been enough put up here about infrastructure maintenance (mass and over time) for him to know better too. Enough about efficiencies too, and their diminishing=returns and their academic 100% cap.

Is it Mr Chastons opinion that somehow the biggest collection of infrastructure even seen on the planet - roads, brifges, pipes, sewers, runways, hughways, silos, houses, buildings, dams, wharves, data - won't need increasing maintenance over time, a graph which always crosses that of 'replacement'?

Sure, we are all entitled to our opinions, but reporters should do a bit of investigation first. I sugest that it's not good enough, on this site, at this stage, to be seeing such physics-ignorant comments.

Same goes for 7. I've put up info re the ocean carbon-sink; I think Andyh did too. Anyone attending lectures on CC (or just doing some reasearch) would know this.

http://www.acecrc.org.au/Research/Southern%20Ocean%20Carbon%20Sink

I find history more fascinating every day. I used to think it was boring until you look at it from an economic perspective, then it gels.

For instance take WW2. I'd suggest the NAZI's had the best aircraft, subs, tanks and guns...even the best conventional V weapons, they still lost to economics and a lack of energy, specifically transport fuel. The US was an oil exporter, THE oil exporter, in the 30s and 40s also huge manufacturing most of which had raw materials sourced domestically, ie cheap and safe.

Take that to today, we have the stone-age-quasi voodooists who like Hiltler are deluded that technology (super weapons) will save them. Now I dont mean that as a horrific label which the NAZI's were in any shape r form. Im simply comparing the best reacent example of how the belief in "technology will save us" didnt work. Look at the battle of the Bulge, could have worked if the NAZIs hadnt run dry of fuel....the best tanks, best tactics and greatest commitment couldnt overcome lack of transport energy.

The kicker is of course we dont recognise as yet this is a true problem.

Meanwhile a classic from David,

a) thinks more paper money shuffling improves GDP and we'll all be OK, we dont actually need to produce a thing via manufacturing....

b) looks at electricity prices, yet really it isnt a generation of static energy problem, its generation of transport energy problem.

c) it seems fails to look at the energy use per capita between developed and developing nations....and appreciate that ppl in the develping nations will want to match our developed world consumtion per capita. So 7billion want to live like us 2billion....3.5 times the consumer energy use...lets be generious and say 2.5 times? just where do we get that from? Go back a few years say 2005 and the projected energy use was something like 135mbpd of crude oil. Now its 95mbpd but 30% of that is from as yet unknown sources. So in 8 years the available confirmed energy is half that that was projected should that at least raise an eye brow? (maybe look for Robert Hirsch's 2005 report on youtube).

d) Unemployment isnt significantly worse so lets can monitoring it....1) we have a static stag-flation aka japan...so its not surprsing there is no great change....2) The un-interesting data establishes a baseline, always good for an experiment/observation.

regards

Whew ! ....... that's better , order is re-established . ...... rockdownkiwi's far distant relative & his offsider have had a fair old spray at Mr Chaston .......

..... how dare you , David , how dare you contemplate that the future may not be all dark , stark & absolutely horrid ....... naughty naughty boy !

Chaston...? PDK..Mr Chaston...? s'il vous plait......the tone needs a tweak..!

It's David, Dave, Davey boy, Davo, Davey baby, Chas, Chaso and so forth, but not Chaston, or Mr Chaston as you would expect to hear from a frustrated lecturer.

Come on matey, be a bit real here, apparently Bernard hasn't convinced the readership in the imminent collapse of the property market for five years now.....hasn't dimmed his confidence in writing about it though has it.

Reporting, Mr C, suffers from the same disease that universities do; specialisation.

BH (And HughP) are only looking at a small part of the puzzle. Sure, 'prices' are outpacing 'incomes', but you have to step back and ascertain what 'incomes' are, what underwrites them, and whether land (being a finite-supply resource and contestable) demand is changing also.

As I said, I don't mind folk having opinions - even wrong-uns - but reporters are meant to be pro's, and a notch better. Part of that is the recognition that your investigation not only can, but will, often show your hithertofore-held belief, to be wrong.

So you need a personal mechanism to deal with that.

Others have different agendas. I'm quite sure the 'stones-vs-energy' blitherer above, knows very well what is going on, what the limits are, and is spinning. The question always is: Why? Nobody wins by prolonging this game.

I'm off back to my 100 year old lathe.....turn, turn, turn. Face-plate still accurate to a thou, the knew how to build them.... go well Count. I heard you, but at some point you have to call a spade a spade. It was overdue, and I make no apologies.

Regarding #1, isn't that along the lines of the Glass-Steagall Act? Kind of separate the speculation and gambling banks from the serious, it's my home and livelihood banks.

Regarding #5,

"The changing nature of the products we buy is changing the amount of energy we need to run our modern economies - and the shift is startling. 'Heavy' manufacturing (or actually any manufacturing) is now much less important to economies than it once was."

Yeah, we don't produce much any more 'cos now we buy it from China. Is China's heavy manufacturing also in decline? No, didn't think so.

"Perhaps the most under reported story of the decade may be financial markets having totally missed the point at which oil actually became a growing economic irrelevance rather than a burden."

Western (and increasingly eastern) civilisation today is so reliant on oil that it seems absurd to claim the price of said product is irrelivant.

" oil exports are likely to become a major part of New Zealand's economy when the current investments in Taranaki start delivering."

The link doesn't claim that at all. What is also not mentioned in the article is the cost of developing the field, which is so high that so far nobody has done it already. It's all about EROEI - refer http://en.wikipedia.org/wiki/Energy_returned_on_energy_invested

As fields worldwide continue to go into decline (more than 2/3 are in decline) less and less desirable places (like Taranaki) will increasingly be in demand. It doesn't take genius to see where this is going, particularly with populatiion growth (and resulting food demand) as it is (presently doubling in less than 70 years).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.