Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard is back tomorrow with his version.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. The fight against excessive bank leverage

The British regulator who said the maximum size of any bank should not exceed US$100 bln in assets thinks that to control bank behaviours, regulators would be better off to seek simplicity through measures like leverage ratios, rather than allow banks to make calculations that depend on thousands of estimates to determine how much capital they need.

This is a link to a detailed paper by Andrew Haldane and presented at Jackson Hole last year.

It is back in discussion because foreign banks are objecting to new rules being imposed on them by the Fed if they want to operate in the US.

Modern finance is complex, perhaps too complex. Regulation of modern finance is complex, almost certainly too complex. That configuration spells trouble. As you do not fight fire with fire, you do not fight complexity with complexity. Because complexity generates uncertainty, not risk, it requires a regulatory response grounded in simplicity, not complexity.

Delivering that would require an about-turn from the regulatory community from the path followed for the better part of the past 50 years. If a once-in-a-lifetime crisis is not able to deliver that change, it is not clear what will. To ask today’s regulators to save us from tomorrow’s crisis using yesterday’s toolbox is to ask a border collie to catch a frisbee by first applying Newton’s Law of Gravity.

2. 'The public is being misused'

Hans-Werner Sinn is Professor of Economics at the University of Munich, is President of the Ifo Institute for Economic Research and serves on the German economy ministry’s Advisory Council. So he is at the heart of German policy making. He doesn't think Germany should leave the euro, and he is uncompromising about the way forward. He is scathing of the bail-out-Keynesian approach gaining traction in Europe:

Many investors echo Soros. They want to cut and run – to unload their toxic paper onto intergovernmental rescuers, who should pay for it with the proceeds of Eurobond sales, and put their money in safer havens.

The public already is being misused in an effort to mop up junk securities and support feeble banks, with taxpayer-funded institutions such as the ECB and the bailout programs having by now provided €1.2 trillion in international credit.

The only remaining option, as unpleasant as it may be for some countries, is to tighten budget constraints in the eurozone. After years of easy money, a way back to reality must be found.

If a country is bankrupt, it must let its creditors know that it cannot repay its debts.

And speculators must take responsibility for their decisions, and stop clamoring for taxpayer money whenever their investments turn bad.

------------------------------------------------------------------------------------------------------------------------------------------

Keep it safe. Keep it in a New Zealand Mint safety deposit box. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

3. Devaluation lessons

Here's an idea. Let's find a way to force our currency down. That way, exporters would thrive and our stubbornly high current account might vanish. Beside's it's "what every one else is doing".

Well, as Martin Wolf points out in the FT, that is what the UK has been doing. They are part of the "everyone else". So how is it working out for the Brits? It turns out, not very well. They seem in a worse place than we are. They got their 20% devaluation, but neither any growth nor has their current account improved.

The crisis has brought important lessons about the benefits of possessing a freely floating currency. One benefit, UK experience suggests, is monetary and fiscal policy autonomy. But a substantial depreciation has contributed much less to the adjustment of the current account than most would have expected. These lessons have important policy implications.

After a long period when its share in the imports of goods of other members of the Group of Seven countries was in decline, the UK’s share has stabilised since the crisis. This is not enough. Part of the reason performance has disappointed is that its fall in productivity growth has partly offset the devaluation.

The failure to achieve a big adjustment in the current account is deeply troubling. This is true, above all, because such adjustment is the only way to combine a desire to eliminate the fiscal deficit with the likelihood of continued frugality in the UK private sector. If the current account does not adjust, either the fiscal consolidation will not happen or, if it does, it will be at the expense of a prolonged slump in output. The flexible exchange rate has given the UK autonomy. That is good. But it has not given it adjustment. This is bad. Indeed, it is a big disappointment.

4. Today's raw market data ...

A quick new week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8476 | 0.8506 | 0.8363 | 0.8232 |

| NZ$1 = AU$ | 0.8253 | 0.8262 | 0.8039 | 0.7872 |

| TWI | 78.25 | 78.66 | 76.97 | 72.89 |

| Gold, US$/oz | 1,472 | 1,451 | 1,584 | 1,651 |

| Dow | 14,704 | 14,701 | 14,577 | 13,226 |

| Copper, US$/tonne | 7,055 | 7,035 | 7,435 | 8,530 |

| Volatility Index | 13.61 | 13.62 | 13.58 | 17.15 |

------------------------------------------------------------------------------------------------------------------------------------------

New Zealand Mint. Experts in gold & silver bullion, commemorative coins and jewellery. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

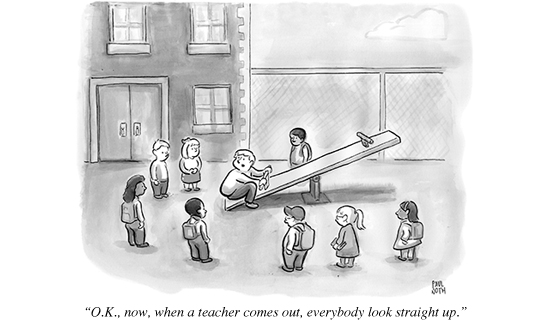

5. Debt, growth and the austerity debate

Anti-austerity advocates have reveled in the spreadsheet errors by Rogoff and Reinhart - conveniently forgetting in my opinion that they used the results of this analysis when it suited them.

The authors however have launched a vigorous defense, admitting the spreadsheet error but claiming it does little to invalidate their work. They point out that their critics overegg their point (see graph below).

Significant debt restructurings and write-downs have always been at the core of our proposal for the periphery European Union countries, where it seems to us unlikely that a mix of structural reform and austerity will work.

Finally, we view ourselves as scholars, though obviously given the prominence of book, and the extraordinary circumstances of the financial crisis, politicians will of course try to use our results to advance their cause. We have never advised Mr. Ryan, nor have we worked for President Obama, whose Council of Economic Advisers drew heavily on our work in a chapter of the 2012 Economic Report of the President, recreating and extending the results.

In the campaign, we received great heat from the right for allowing our work to be used by others as a rationalization for the country’s slow recovery from the financial crisis. Now we are being attacked by the left - primarily by those who have a view that the risks of higher public debt should not be part of the policy conversation. Above all, we resent the attempt to impugn our academic integrity. Doing archival research involves making constant judgments and yes, on occasion, mistakes. Learning from them is how science advances. We hope that we and others can learn from ours.

6. Is becoming Was

California is the biggest, but most dysfunctional state in the US. Ungovernable. Saddled with endless deficits. But that was before Jerry Brown became governor. He is a Democrat, an ex-Jesuit priest and a current Buddhist. He has scared California straight, forcing legislators to make hard but necessary choices, according to Joel Stein:

And, by the way, he virtually governs alone; he has virtually no staff. It's an impressive and surprising story - lesson on how to govern the 12th largest 'country' in the world (about the same size as Spain or Italy).

When Brown took office two years ago, the state had a US$27 billion deficit. Standard & Poor’s rated California’s credit the worst of the 50 states, and 24/7 Wall St. ranked it as the worst-run state in its 2011 and 2012 surveys.

This year, California will have an US$850 million budget surplus in the coming fiscal year. Unemployment, which peaked at 12.4 percent just before Brown took office, is 9.4 percent. S&P has upgraded its outlook on the state. Confidence remains fragile, according to a survey of 1,142 large and small business leaders conducted by the California Business Roundtable: More than six out of 10 say it’s still harder to do business in California than in other states. But 24 percent of businesses say they plan to add jobs this year, compared with 16 percent that intend to cut them.

------------------------------------------------------------------------------------------------------------------------------------------

Available now. Our brand new 1 oz Taku gold bullion coin. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

7. An odd solution

Maybe it is a uniquely Aussie approach, but they are tackling high debt levels and low profitability in their rural sector by offering a new program of ... more debt! It may be 'low interest' but it is hardly an enduring solution.

The New South Wales Farmers' Association says while it will provide some relief, it is concerned low interest loans will exacerbate landowners' debt.

Vice-president Peter Darley says the assistance should be retrospective and apply to existing loans. "It should be looked at as an offset [to] current loans to reduce the burden on farmers because farm debt is the major issue that was impacting on farmers, particularly in the wheat belts of Western Australia, north Queensland area and the cattle industry as well, and that's rolled through to every industry," he said.

8. The risks of poor quality lending

Germany's central bank has gone to its country's Constitutional Court arguing that the ECB is overstepping its role. The UK's Telegraph has the story as a piece of [AEP] sensationalism, but Bloomberg is treating the issue with more professionalism - although the Brits might be right if the Court sides with the Bundesbank:

“Even though monetary policy is having different effects within the euro area, it is questionable whether these differences constitute a malfunctioning to be addressed by monetary policy,” the Bundesbank wrote in an opinion for the court dated Dec. 21 and published by the Handelsblatt newspaper today. The Bundesbank confirmed the authenticity of the document. Rising sovereign bond yields “cannot be used definitively as an explanation for a disturbance of monetary- policy transmission,” the Bundesbank opinion says.

The Bundesbank said ECB bond purchases under OMT would be different from those of other central banks because they target assets of poor credit quality, thereby increasing risks on the ECB’s balance sheet.

It also questioned whether the ECB will be able to ensure that countries applying for bond-market intervention abide by the conditions it sets.

9. Job losses

Calling all union organisers. Surely you know of some meaningful closures? Very few job losses reported again this week. When we started this tally, a number of unions promised us they would keep the list updated. We haven't heard from them since. It's been almost three months. The silence is telling.

We are keeping a tally of reported job losses and we are asking readers for help keeping track of them. Let us know when you hear of some, even small ones.

10. Today's quote

"It’s a kind of spiritual snobbery that makes people think they can be happy without money." Albert Camus

Trade balance, monthly

Select chart tabs

7 Comments

#5 Oh dear god, they are trying to use that graph to prove that they were in the right? look at the way they are misusing the horizontal axis. Above 90% is equally spaced from 60-90 and 30-60 and they have drawn a trend line between them. In reality, people who have actually plotted the R&R data on an actual linear scale have pointed out the effect is no-where near as dramatic, and if there is a neboulus threshold it is somewhere at 120% or above.

This 90%+ problem with the data is that same as if I divided altitude in up to 30cm above sea level, 30-60 cm above sea level, 60-90cm above sea level, and above 90cm above sea level, then assert that as 100% of cases of altitude sickness occur at above 90cm, then this is the dangerous cutoff point.

I think PKrugman sums it up well "The point is not that I have an uncanny ability to be right; it’s that the other guys have an intense desire to be wrong. And they’ve achieved their goal."

So what you see here is the death throws of two wonkies academic careers. Sure they might get a job in politics or something (KFC? Burger King flippers?) but their paper has been reviewed and shown to be an academic disaster. To add to it instead of saying oops we made a boob, they are digging in.....

regards

#6 is nothing to do with the governer. California has a state consitution where citizen initiated referendum can be added to referdum, which then either needed another referedum or votes of 2/3 of the legislature to override it. Many years ago a referendum proposition got added that had they effect of "no adjustments to taxes ever" and it is only in the last electoral cycle that the legislature got a 2/3 Democratic majority so could vote to change the constitution. I strongly recall at the time people saying this was going to crash the Californian economy for good, instead it seems that effective government is encouraging growth.

Number 10...?

Real snobbery is to think one can't be happy without money!

HGW

Ok...time out

and I fully support it too...even better if one is collecting the pension dosh

" Five years after the onset of the global financial crisis, the world economy is in such a chronic condition that the European Central Bank might cut interest rates this week and the Federal Reserve is likely to indicate no let-up in the stimulus it is providing the U.S. economy."

http://uk.reuters.com/article/2013/04/28/uk-economy-global-weekahead-idUKBRE93R0CA20130428

On 3; the UK devaluation and its limited effect on the current account.

As an advocate of not being passive in the "currency wars", I confess that I also have been surprised/ disappointed in the response of the UK current account to their apparent continued devaluation. And yet there is real evidence of say considerably less foreign travel by the Brits; or conversely that British car manufacturing is at its highest level for many years.

So I wonder if there are some counter reasons why the effect has not appeared so high, as follows:

The UK's main trading partner is Europe, which has of course has had major problems. British Unemployment at 7.9% is very low by comparison.

Britain's leading high value industry was/is financial services, which has seen significant margin loss, especially in investment banking.

Its investment returns have worsened as the world economy has struggled. Depreciation has little effect on these

The GBP/ Euro devaluation was a relatively sharp one from ~1.45 in July 2007, down to 1.10 in Jan 2009. http://www.oanda.com/currency/historical-rates/ Since then the pound has actually appreciated to 1.15. The UK's trade balance did improve from -GBP4 billion per month to -2 billion per month over the time of its currency depreciation. It has since been all over the place, but has trended worse to -3.5 billion per month over the period of appreciation back to 1.15 Euros.

http://www.tradingeconomics.com/united-kingdom/balance-of-trade

All of this suggests to me there is still a correlation between currency values and the trade balance as you would expect; but even I acknowledge that for both the UK, and NZ, using the same sites as listed above, the data suggest the effect on trade balance is not as great as I would have expected. China just may be saving us. (and insurance payments?)

I still believe the very lofty heights our currency is currently at, just have to be doing damage; but a radical devaluation may not be necessary or helpful. Some mild pressure down 5-10% would seem about right.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.