Here's my Top 10 links from around the Internet at 10:00 am today.

Bernard is back tomorrow with his version.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

1. The root cause - tax

Like NZ, many countries have let their tax systems grow with twisted incentives.

We give enormous preferences to capital gains, the American give preferences to debt.

The result is that our investment in productive capital is low; for Americans they worry about excessive leverage.

Actually, we give tax preference to debt as well.

Equity investment is severely disadvantaged.

It's time to attack these unhealthy preferences, says Mark Roe.

He reckons distorted tax policies actually caused the behaviour that brought on the GFC.

The taxation issue may go deeper. The tax system first encourages financial firms to use more debt than is safe, but there is a parallel effect on non-financial firms and many homeowners. Tax deductions for interest payments encourage them to borrow, too, an issue that has long been understood. But, less obviously, these borrowers then demand more tax-induced lending from financial institutions, because tax benefits make their own use of debt cheaper. Were their demand for debt lower – and, in the case of corporate debtors, were they to rely more on equity – financial institutions would face less pressure to use so much debt themselves.

Much consideration has already been devoted to how to reform corporate taxation in a way that levels the playing field for equity relative to debt; more than 20 years ago, the US Treasury conducted a major analysis and devised a plan to do so. As the Obama administration moves ahead with its new proposals, it should look back at the financial crisis, which provides strong grounds for implementing such a change.

2. 'An unfolding horror'

From her cubicle in a Beijing office tower, Charlene Chu, who works for bond-rating firm Fitch Ratings, has emerged as one of the most sought-after experts on China's increasingly risky financial system.

She's telling an increasingly worrying story about debt excess. More from the WSJ:

"China is the classic story of corporate credit excess, but to an extreme," says Ms. Chu. By Fitch's measure, higher than the government's, China's private-sector debts rose from 129% of the size of the economy in 2008 to 214% at the end of June.

When China's banking system seized up in June because of a central-bank-driven cash squeeze, her supporters said she had been predicting such an event for more than two years.

"If you read her stuff from one report to the next, the story gets deeper and murkier, an unfolding horror," says Edward Chancellor, a strategist at GMO LLC, an investment firm that manages $108 billion. "As the Chinese banks have sunk, Charlene's profile has risen.…We joke with her that she's become a rock star," he says.

3. Basic banking

Here's something you don't see exposed every day: a 'famous' economist who doesn't understand banking.

At this year's Jackson Hole conference over the past few days, Stanford's Robert Hall presented a paper that has heads shaking. Here's Matthew Klein of Bloomberg explaining why:

[His] startling argument has two parts, both of which are wrong. First, banks don't lend reserves. Reserves aren't needed for lending, and creating additional reserves doesn't make banks more likely to extend credit to households and businesses.

The second problem with Hall's argument is that he ascribes too much importance to the minimal 0.25 percent interest rate that the Fed pays on reserves held by commercial banks. I'll defer to Paul Krugman, who demolished a similar argument a few weeks ago. Krugman notes that the Bank of Japan paid no interest on reserves during its asset-purchase programs yet was as incapable of increasing the quantity of broad money as the Fed. Moreover, the amount of currency in circulation has increased sharply over the past five years, even though the Fed pays no interest on pieces of paper with pictures of old white men on them.

4. Today's raw market data ...

A quick new-week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.7801 | 0.7848 | 0.8093 | 0.8111 |

| NZ$1 = AU$ | 0.8658 | 0.8687 | 0.8725 | 0.7789 |

| TWI | 73.67 | 74.04 | 76.02 | 72.85 |

| Gold, US$/oz | 1,378 | 1,376 | 1,330 | 1,667 |

| Dow | 15,006 | 14,960 | 15,535 | 13,117 |

| Copper, US$/tonne | 7,301 | 7,341 | 6,861 | 7,601 |

| Volatility Index | 13.98 | 14.76 | 13.39 | 16.35 |

5. It needs to be cheaper

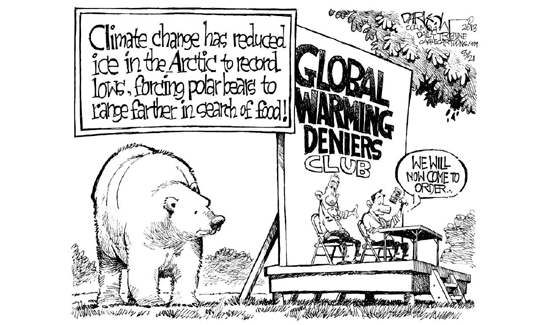

Renewable energy is unsustainable if it needs massive subsidies, either to operate or to buy. Believing in it is like believing in the Tooth Fairy, says someone important. Here's someone else ;) saying invest to make a cost difference if we want it to be sustainable. The full article is on Slate:

Yet we are paying through the nose for these renewables. In the last 12 years, the world has invested $1.6 trillion in clean energy. By 2020, the effort to increase reliance on renewables will cost the European Union alone $250 billion annually.

Spain now pays almost 1 percent of its GDP in subsidies for renewables, which is more than it spends on higher education. At the end of the century, Spain’s massive investment will have postponed global warming by 62 hours.

Current green energy policies are failing for a simple reason: renewables are far too expensive. Sometimes people claim that renewables are actually cheaper. But if renewables were cheaper, they wouldn’t need subsidies, and we wouldn’t need climate policies.

Al Gore’s climate adviser, Jim Hansen, put it bluntly: “Suggesting that renewables will let us phase rapidly off fossil fuels in the United States, China, India, or the world as a whole is almost the equivalent of believing in the Easter Bunny and [the] Tooth Fairy.”

The solution is to innovate the price of renewables downward. We need a dramatic increase in funding for research and development to make the next generations of wind, solar, and biomass energy cheaper and more effective.

6. Austerity: the History of a Dangerous Idea

Mark Blyth is totally sceptical about the EU recovery. Until Europe rejects austerity in favor of a growth-oriented approach, all signs of recovery will prove illusory he says.

When a country gives up its monetary sovereignty, its banks are effectively borrowing in a foreign currency, making them exceptionally vulnerable to liquidity shocks, like that which sparked turmoil in Europe’s banking system in 2010-2011. The government, unable to print money to bail out the banks or increase export competitiveness through currency devaluation, is left with only two options: default or deflation (austerity).

Austerity’s underlying logic is that budget cuts, by reducing the debt burden and restoring confidence, ultimately enhance stability and support growth. But, when countries pursue austerity simultaneously with their main trading partners, overall demand plummets, causing all of their economies to contract and, in turn, increasing their debt/GDP ratios.

But the problem with austerity in the eurozone is more fundamental: policymakers are attempting to address a sovereign-debt crisis, though the real problem is a banking crisis. With Europe’s banking system triple the size and twice as leveraged as its US counterpart, and the ECB lacking genuine lender-of-last-resort authority, the sudden halt in capital flows to peripheral countries in 2009 created a liquidity-starved system that was too big to bail out.

7. Legal highs

We are about to adopt an 'historic experiment' with the supply and demand for drugs. The rest of the world should keep a close eye on it, says The Economist:

A list of all the most prolific drug manufacturers and dealers in the land, complete with their full names and addresses, is something that most police forces would dearly love to get their hands on. In New Zealand, exactly such a list has just been drawn up, without the police having to lift a finger. As we reported a couple of weeks ago, New Zealand recently passed a law to legalise and regulate synthetic recreational drugs, under a system similar to that which is used to license medicines. The licensing regime is due to get under way later this year; until then, companies that are already making and selling “legal highs” (that is, synthetic drugs that the government hasn’t yet got around to banning) have the opportunity to apply for an interim licence to carry on their business.

More intriguing still is the list of people and companies that have applied for interim licences to manufacture and sell drugs, as well as import and export them. Many of the would-be retailers are “adult shops”; others, such as “Pillz & Thrillz”, sound as if they specialise in the business of getting high. Perhaps most interesting are the 13 companies that have applied for licences to manufacture drugs. Some have given addresses that seem to be ordinary houses. Others have registered addresses in smart business parks—have a look on Google’s Street View and it seems that some of them sit alongside well-known companies from more pedestrian walks of life.

8. Personal finance on a napkin

In a continuing series of back-of-the-napkin drawings and posts, Carl Richards, a financial planner, has been explaining the basics of money through simple graphs and diagrams. The NY Times has them all in one place for easy browsing. A great resource; bookmark it and check them out.

9. The third arrow

The purist Keynsian attack on economic stagnation is going on in Japan, and with some success, albiet with considerable risk.

But we all know Japan has a structural demographic problem - the aging of its population. However it also has a huge demographic opportunity too; it's vastly under-utilised female population. Westerners have tended to overlook this opportunity because we look at Japan thinking it is just like us, but older. But it isn't.

Prime Minister Abe knows getting many more women to participate in paid work is his big chance to make his other reforms enduring. Laura Tyson has the story, in the NY Times:

These initiatives are not motivated by softhearted political correctness but by hard-headed economic logic. Japan needs to expand its work force, which is shrinking rapidly as a result of a sagging birth rate and an aging population. The International Monetary Fund estimates that Japan’s working-age population will fall by almost 40 percent by 2050. The share of citizens older than 65 is expected to jump from 24 percent in 2012 to 38 percent in 2050, when the ratio of the working population to the elderly population will be 1 to 1.

“Japan is growing older faster than anywhere else in the world,” the I.M.F. reports. Unless the nation can shore up its work force, it faces a long-term drag on economic growth at a time of soaring obligations for old-age entitlements.

Japan has one of the largest gender gaps in the world. Even though Japanese women are highly educated - indeed, the university enrollment rate for 18-year-old females now exceeds that for 18-year-old males - the female employment rate is about 25 percentage points lower than the rate for men, and ranks among the lowest in the developed countries.

10. What is money?

A shared belief system? Faith? Well that is what Derek Thompson says. Watch his explanation here:

17 Comments

Juat heard Sean Plunkett on Radio LIVE GIVE our Bernard a telling off for always blaming the Govt when things go wrong.ie the manuka honey problem.

He called him anti national .

Sean asked if Bernard had ever heard of a free market.

Very Interesting. It is amazing that people like Sean do not really understand what people in other countries are buying when the buy New Zealand food products. To my mind they are thinking they are buying high quality food backed by New Zealand. If we get our heads around that and deliver on that promise then all good. However we don't. So we end up flooding the UK with rubbish Manuka Honey which is starting to swamp our exports of the good stuff. I guess a Free Market in Seans world would have all of us doing due diligence on each and every supermarket purchase we make- this would need to include a full lab analysis. However in the real world people like regulation- backed by people in government checking stuff, like do the lifts work, are our cars safe, is our food safe- that sort of stuff. The countries we export food to actually pay a premium for food because it is from New Zealand not for some clean green stuff but becasue it is safe quality food.

Ask a Chinese food importer about MAF- MAF is a brand, a quality mark that New Zealand threw away. Not very clever.

Tossing around phrases like 'FREE MARKET" without understanding what Adam Smith was actually refering to- ie freedom from Rent Seekers / monopolists

Plan B - Isn't it in the consumers best interest to be educated rather than relying on some Government regulator?

I'm astounded at the amount of manuka honey on supermarket shelves that doesn't have the UMF stamped on the label and certainly wouldn't purchase manuka honey without it.

The same applies to organics if you're into that. You look for certified products and the logo.

Buyer beware is actually more important today than ever before as too many Government Agencies are unable to do an appropriate job.

... do you know what time that was , so we can listen to it off RadioLive's website ...

Not that I wanna criticize Bernie .... no no no no .... it's just , it's alotta fun when one of his contemporaries verbally bitch-slaps him into submission ....

... if you're gonna cosy up to the Labour Party big guy , you gotta harden up to the slapping , flapping and the eerie feeling that's it's not your hands now fondling around inside your pockets ..

#5....Sure lets say that renewables are still more expensive....what happens to us and our economy when we see fossil fuels prices climb faster than we can switch to renewables? Or if there are shortages?

The argument needs to get beyond purely efficiency and short term first cost and onto resiliance or a % of it anyway. ie if we have no options we are stuck taking what we'll get, if our economy cant survive that well its our own hurt and our own fault.

regards

yeah .. bernard completely fails to mention anything about the global spend on fossil fuel subsidies

Good point.

regards

Had to smile .. here in terra australis, for many, many years the government has paid out $10 billion a year on fossil fuel subsidies, oil and oil exports, gas, coal and coal exports, coal-fired power, and now csg. At the height of the GFC the then govt set up the clean.energy.council to incentivise and encourage renewable energy with grants and feed-in-tariffs to homeowners. 10% of all households have adopted it. Total consumption of power generated by big-power has fallen by 10% Big-Power complained and state governments did their bidding, cutting feed-in-tariffs to a point it is hardly worthwhile. Yet people are still installing solar. The clean-energy program is currently costing $10 billion per year. With an election coming up the Liberal (National) party is proposing to balance the books by dismantling the council because of its cost. However the $10 billion per year of fossil fuel subsidies will continue untouched. All future renewable developments will now be the exclusive domain of big-power. They've lobbied the competition out of existence.

I suppose its no surprise then when ppl in desperation vote for extremist parties as the mainstream ones have deserted them or give them no options they find palitable.

I certainly dont think that a feedin tarrif should exceed the retail price...probably it should be pitched at offering a 7 year payback, longer makes no sense, shorter is in effect yet another subsidy from poor to the better off.

regards

Well I was in contact with ARENA in regards to my technology recently, here is the response I got:

Please note that ARENA’s objectives are focused on the increased competitiveness and supply of renewable energy, as opposed to energy efficiency.

Item 10 amazingly fails to mention thepayment of taxes. The payment of taxes is what gives money its value- we can pay our taxes with it. - Check out Prof Randel Wray if you really want to get an idea of what money is.

He is alos very good at explaining Banks and Reserves

http://www.economonitor.com/lrwray/2013/08/15/banks-dont-lend-reserves-…

No need, money is a proxy or IOU for energy/work, no other description matters.

regards

And in something lighter "Math experts split the check"

http://mathwithbaddrawings.com/2013/08/21/five-math-experts-split-the-c…

No 1 - of course taxes are the culprit.....Governments, Bureaucrats and public servants always want to get their greedy little hands on more of someone elses effort and they tax and tax and tax.

I do hope Bernard that you understand it is not the lack of tax that is the problem it is too much tax and too many types of tax which is the issue. Most people who's only income comes from a wage or salary have a very low level of understandin when it comes to taxes as it is their employers problem to keep the records and pay the PAYE on their behalf.

You only have to read some of the dribble that gets written on interest.co.nz to understand that people simply do not understand GST.

I fear that Bernard will use his little internet find from Mark Roe to write an article on "NZ needs more taxes" to address the issue when it is less taxes that are needed on locals.

When you have the existence of tax treaties that allow foreign investors a tax haven in NZ but penalise the locals you have a large distortion.

DH has made some interesting posts on his findings which can be readily identified by simply following the money. But interest.co.nz has a habit of following the wrong money.

Tax the locals less and tax the off-shore investors and all NZ will be better off as the tax system is a massive distortion to the price of everything. Take away all the other distortions like WFF (which is a subsidy) and watch NZ respond.

There is a complete lack of discipline and it is not in the market place it starts in Wellington and every capital city around the world and until these people are reigned in we will keep getting more of the same issues.

I have to ask BH just what does he think the cost of interest is too business? It is a cost and should be tax deductible. It is a cost involved in the supply of goods and services.

NZ needs local business's creating products and jobs and the Government and bureaucrats role should be that of ensuring that business is free to produce and create jobs. Yes the Government needs to clip the ticket to pay for basics like health, education, police, justice, prisons and superannuation but they go overboard and interfere in every area until you need a handbook telling you what you CAN do as there are two many things you can't do.

Socialism is nothing more than a big failure and those who support it have brought all the problems on society and themselves.

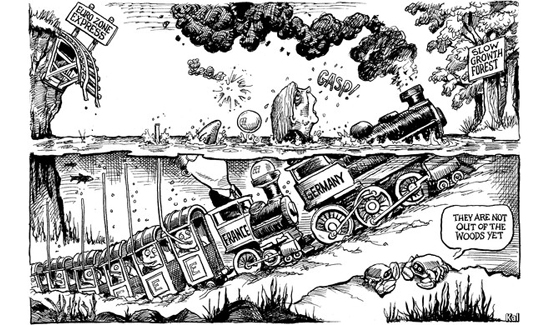

#3 I write as one who when a lad in Invercargill, had a plethora of mothballed NZR steam locomotives to play upon (just down the pike from Liffey St College).

I see quite clearly from the cartoon accompanying the article, the essential reason why the Eurozone is in such deep <insert the Metaphor du Jour here>.

The rod connecting the piston to the driving wheel is diametrically opposed to that connecting that wheel to the trailing driver.

A chuff of the piston will drive one wheel forwards, and the other, back.

Seems a very good description of the EU disaster zome ter me....

Nice spot.

“Suggesting that renewables will let us phase rapidly off fossil fuels in the United States, China, India, or the world as a whole is almost the equivalent of believing in the Easter Bunny and [the] Tooth Fairy.”

These do not seem directly comparable at all. The first is the belief in the cause and effect of an idea. The second is a belief in a fictional character.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.