Here's my Top 10 links from around the Internet at 10:00 am today. We now have a new Monday-Wednesday-Friday schedule for Top 10.

Bernard will be back with his version this Wednesday. We will have a guest posting on Friday.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

See all previous Top 10s here.

1. The land of milk and money

Almost anywhere you go on the internet (including this website) you are seeing advertising customised specifically for you, called behavioural targeting (usually combined with some contextural targeting). It's ubiquitous, and advertisers pitch it as being more relevant for the reader.

But now, there is a push on to extend that to link your viewing and spending and banking habits into even more targeted 'behavioural targeted' marketinmg strategies.

Australian retailer Coles is preparing a move into banking. Woolworths (Countdown) won't be far behind. Foodstuffs has part of the pieces already in place.

Not everyone is happy about this trend. That includes Katina Michael who has penned a thoughtful piece on the ABC's Drum:

The big data movement is slowly heralding consumers into an uberveillance society.

The forms of control with what has been come to be known as data-driven innovation and predictive analytics is based on a business model built on technology. In the context of customer relationship management, it has to do with instituting measures that monetize the consumer - the more you play the shopper game, the more you are rewarded with bonus points. It is akin to behavioural economics and can tell supermarket giants what triggered a particular type of purchase, and correlations between various purchase types across retailers, given one's available savings/credit at a given point in time.

Next, shoppers can expect real-time tailored product offers related to existing purchases. The bank or shopper cards will likely be linked to trolleys anticipating complementary and supplementary purchases. These are blatant intervention strategies that predict not only what you might be considering buying but even who you are buying for, and could lead to greater profits for the supermarket, but erode the privacy of the consumer.

This is not what I call marketing, and it certainly is not the function of business intelligence. It is unscrupulous manipulation of the populace for profit; it is the dehumanisation of individuals down to a frequent shopper card ID number; and it is the erosion of an individual's right to privacy.

2. 'A very real risk'

First world economies may seem a bit more stable these days (see #7 below), but not so emerging economies.

Satyajit Das is worried. He sees cheap money building expensive problems, a likelihood of a re-run of the Asian crisis, and blowback on to us.

Emerging market central banks, excluding China, have seen outflows of reserves of around $US80 billion (around 2 per cent of total reserves). Over the last three months, Indonesia has lost around 14 per cent of central bank reserves, Turkey has lost 13 per cent and India has lost around 6 per cent.

Like an outgoing tide that reveals the treacherous rocks that lie hidden when the water level is high, slowing growth and the withdrawal of capital is now exposing deep seated problems, especially high debt levels, financial system problems, current and trade account deficits and structural deficiencies.

3. An SOE selldown success

Even in the face of trenchant political opposition, and an impending strike by its workers, a British SOE float has been a listing success. More from Reuters:

Britain's Royal Mail privatization garnered orders for all of the shares on offer in the space of a few hours on Friday, sources said, marking a strong start for a selloff that stands to flush up to 2 billion pounds ($3.2 billion) into government coffers.

The sale would be one of Britain's most significant since John Major's Conservative government sold the railways in the 1990s and would give Royal Mail access to the private capital it says it needs to modernize and better compete in a thriving parcels market.

Kicking off the sale of the near 500-year-old company, the government said on Friday it would dispose of a majority stake in Royal Mail, offering shares at between 260 pence and 330p each and valuing the whole company at between 2.6 billion pounds and 3.3 billion.

Hours later it had already received orders for all of the shares on offer, two sources close to the deal said, without giving an indication of where in the range those orders had come.

4. Today's raw market data ...

A quick new-week update:

| as at 11:10am |

Today 9:00 am |

Friday |

Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8275 | 0.8292 | 0.7765 | 0.8286 |

| NZ$1 = AU$ | 0.8895 | 0.8852 | 0.8696 | 0.7995 |

| TWI | 77.14 | 77.32 | 73.69 | 73.80 |

| Gold, US$/oz | 1,341 | 1,333 | 1,392 | 1,787 |

| Dow | 15,264 | 15,356 | 14,919 | 13,478 |

| Copper, US$/tonne | 7,253 | 7,221 | 7,175 | 8,192 |

| Volatility Index | 15.46 | 14.06 | 16.61 | 16.32 |

5. The cost of petrol

Petrol prices are high; that is something we can all agree on. But high prices don't seem to have the same 'crisis' impact they used to. Reasons for this may be that incomes are rising steadily, we have had three tax cuts over the past few years, and vehicles are getting more fuel efficient. In other words, petrol seems less un-affordable these days. We can test for this.

The price of petrol has risen a lot over the past decade. Since the MED started keeping data (April 2004), pump prices have risen 94%. What we pay at the pump is more than the cost of the fuel, it also includes taxes (levies we as a society charge ourselves). Taxes (now 93c/L) have gone up 117% over that same period which has accentuated the price rise and worsened affordability by 1.5% of take-home pay..

Median take-home pay has risen 37% over the period. That means that the weekly fill-up has gone from a bit less than 10% of pay, to a bit over 13% over a decade. And it has been stable at this 13~14% level for getting on for two years. Drivers who have moved to more fuel efficient cars won't have felt the full effect of the declining affordability. (Discount coupons also improve affordability.)

Affordability of petrol was worse in 2008, when the pump price reached $2.17 which is slightly less that what we pay today. It was 'worse' in 2006 as well.

6. Normal accidents

Yale professor Charles Perrow suggested (in 1984) that in giant, complex systems, terrible accidents are inevitable. Our modern global financial markets are indeed complex systems and subject to normal failure as we now all know.

These failures are 'normal' not because they happen often, but because they are almost certain to occur in any tightly connected complex system. Tinkering with the current system and looking for easy ways out, as we are now, is bound to fail, says Bill Davidow.

We’re in danger of letting 'normal accidents' in the financial system become all too normal.

[In] recent years, aggressive traders have repeatedly played the role of the hungry bear, setting off potential disaster after potential disaster through a combination of human blunders and network failures.

We need currency hedges, futures markets, and derivatives to keep our economic systems functioning. But we also have to realize tweaking the current system will not fix the problem. Most of the supposedly strong cures implemented by legislators to date, such as prohibiting bank holding companies from proprietary trading, are inadequate as well.

So how do we make our markets less danger prone? A good place to start would be to reduce the excessive trading volumes that lie at the root of accidents like the Flash Freeze, Flash Cash, and Goldman debacle. There is no valid reason for high frequency trading to make up more than 50 percent of all stock trades, and there is no pressing need for some $4 trillion in daily foreign currency transactions. A Tobin tax on transactions, first suggested by Noble laureate James Tobin in 1972, of as little as 0.1 percent, would significantly reduce these volumes. Smaller transaction volumes would reduce the size of accidents and possibly their frequency.

7. The bright side of life

Skip this one if you are a perma-bear. But if you look at the latest Baltic Dry index, it's now over 2000. That's a long way up from the ~700 or so earlier in the year. I was pleased last month when it got over 1000.

In fact if you look at a whole range of international benchmarks, there are positives. Matt Phillips has 19 charts that make encouraging reading - unless of course you are only trying to find impending doom. (Doomsters only need to wait for tomorrow's IPCC Report.)

We know, we know. It’s been a rough half decade for the global economy. The US financial crisis bled into a global recession, Europe spiraled into a debt crisis that threatened to fracture the common currency, and recently, some once-hot emerging markets have been having real difficulties (We’re looking at you, India).

But the world economy is not doomed. In fact, you don’t have to search too far to find widespread signs that things are going reasonably well.

8. Beating extreme poverty

A way of life is ending, notes Nicholas Kristof in the NY Times. And, thank goodness, he says. We should never overlook the immense global progress we have made.

Assuming recent history has been a failure is shallow. Never underestimate human ingenuity, even to tackle global problems, including those that seem intractable when they are first identified

My Sunday column looks at something that has been happening over time so that we haven’t given it the attention it deserves–even though it may be the most important thing going on in history right now. I’m referring to the decline of extreme poverty.

When I was in college, a majority of the world’s people lived in extreme poverty, and the proportion will have dropped to virtually zero by the time I retire. That’s astounding progress, and it’s also reflected in mortality rates.

When I was in college, around 15 million kids a year were dying annually. Now the figure has dropped to a bit more than 6 million, and in my lifetime the figure will drop below 1 million. Illiteracy is also on its way out.

Look, we will still face immense problems - the US is a good example of how even a rich country can have a severe problem with an impoverished underclass - and some kinds of poverty will be with us for decades or centuries to come. But the kind I’ve reported on in so many places, where illiterate parents have eight children who die young and are always on the edge of famine or disability, that kind of extreme poverty may be on its way out, along with river blindness, malaria, trachoma and other ailments.

Foreign aid is one factor in the improvements, but probably not the major one. Most important has been economic growth, especially in countries like China, India, Pakistan, Bangladesh, Indonesia and others.

Looking forward, one of the crucial needs will be security. One of the reasons Congo and South Sudan and Sierra Leone remain so poor is that they were ravaged by civil war; where there’s conflict, it’s enormously difficult to educate kids or vaccinate them or address other needs.

9. A predictable resolution

Watching the US debt ceiling debate unfold is painful (if you are not a US taxpayer).

Now it turns out, even Senator John McCain admits "We will end up not shutting down the government and not de-funding Obamacare." He could have added that a Treasury default is also out of the question, says Anatole Kaletsky.

He goes on to list four events that have changed the US budget battleground in favour of Obama and the Democrats. Markets know it; it seems only House Repuiblicans don't.

The Republicans’ bargaining position will be even weaker in the debt ceiling vote than in this week’s budget debate. Assuming they back down next week to avert a government shutdown, Republicans will find it impossible to justify an even more damaging and painful shutdown over the debt ceiling, especially if their quarrel with the president is over the same issue, Obamacare. It seems overwhelmingly likely, therefore, that if the budget issue is resolved next week, the debt limit will pass without much trouble a few weeks later, just as it did after January’s fiscal cliff vote.

In sum, the fiscal uncertainty in Washington is almost over - and once the gridlock is broken, the U.S. economy and financial markets could jump back to life like a coiled spring. Remember what happened last January after the fiscal cliff was resolved.

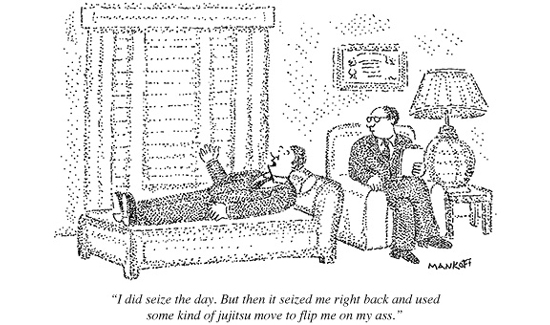

10. Today's quote

"The economy depends about as much on economists as the weather does on weather forecasters." - Jean-Paul Kauffmann

8 Comments

Once again, the world economic news demonstrates to us New Zealander's that we live in a highly favoured part of the world.

We enjoy:

1. Low unemployment - vast majority of work-able/willing adults are employed, & most enjoy "middle-class" incomes (on a global scale)

2. Largely unpolluted environment - look out on the streets - beautiful trees & no garbage

3. Low levels of corruption - relatively 'Good' Government

4. Non-existent levels of sectarian violence between cultural groups

5. Freedom to open/operate a business

6. Political / cultural freedom to meet with any ideological groups

7. Still inheriting the benefits of a Judeo-Christian ethical framework

8. Clean water out of our taps

9. Cheap & plentiful food - & the space to grow our own

10. Good quality schools, universities & techs

11. No huge under belly of people living under the poverty line

No wonder so many people are breaking their necks to come and live in this beautiful highly favoured country. Would-be Immigrants & education immigrants of course appreciate the freedoms and resources that we enjoy.

NZ's problems are almost on a petty scale - maybe some commentators here should travel to Asia / Africa etc to see what real economic/social problems are!

#6 - It is indeed ironic that an industry which has specialised in inventing ever more arcane pieces of paper or process stages, then clipping the ticket on each and every one, could now be brought to heel by the application of a public ticket-clip on HFT and other non-transparent trading arenas. (Or should that be areneaux or arenae? )

They aren't termed 'dark pools' for nothing....

This is not new. This topic has been around for more than 10 years. Nothing gets done. Nothing will get done. It amuses me how the intelligentsia keep coming out with intellectual humbug. Makes for good reading.

I know. Over that time we have been approached by any number of minnows to assist with automated trading systems and we have always declined even though we have the expertise.

High Frequency Trading is a demonstration of how the global major creates its own luck. The one "global major" is flexing enormous financial muscle in a way no one else can. Its got nothing to do with "value" or charting, or intelligent mechanical trading. Sure it's automated. It's where you can push the boulder and how fast.

A great deal of time and effort and money has been spent by the "intermediates" on HFT. Doesn't matter. The intermediates can only take money off their peers and the "retail minnows". Whatever the intermediates make, most of it will be taken off them by the "major". Doesn't matter how much they spend. A Lamborghini is always going to be faster than a souped up jalopy. Doesn't matter how much you soup it up. It's a race that can't be won. The day the souped-up jalopy beats the Cray-Computer the major just gets a faster one. No different to the legal system. The guy with the deepest-pockets always outspends the little-guy. Perfect example : The Americas Cup

#7 and it was 8300 in 2007.....so yippe doo daa, its 25% of what it once was....

or its still 1/2 of 2010....

Also a very fast rise in so short a time period, so why?

"According to reports, the surge in he Baltic Dry Index has been mainly on account of rise in rates for transportation of iron ore-carrying Capesizes due to imports from China."

https://www.puntercalls.com/markets/?tag=baltic-dry-index

So where is the iron demand coming from?

"he Baltic Dry Index, seen by some as a read on demand for commodities likes grains and metals, surged 17% last week after falling more than 40% the prior 2 months, in part on sliding Chinese steel demand."

So drops 40% but back up 17% is good? yes feel the surge.....

http://gcaptain.com/forum/shorebased/9874-steel-import-rebound-sharp-li…

regards

Icould be wrong but i think that Foodstuffs had a link with the St George bank some years ago that didn't turn out to well.

#8. the end of poverty - or what threatens it.

Fully agree. What destroys people and their right to a good life is the lack of good government, lack of democracy, lack of property rights, and lack of redress through good law.

No, wrong. What destroys people and their chance - it's not a 'right', that's arrogance, we're just a species, and 99.999% of all species that have ever existed, currently don't - at a good life is overshooting their resource-base.

Egypt isn't a case of a failure of democracy, it's simply a case of overshoot. No amount of 'good law' can change that.

No, Nature grants none of these....

What we do as a society is try to grant a degree of the above within the energy and resources envelope that is nature...

ppl are deluded if they think any different...

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.