Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #8 on the long term fallout from China's one child policy.

1. What will happen to the lump sums? - Significant numbers of KiwiSaver accounts with non-trivial amounts of money are coming up to maturity as many of the Baby Boomers tick over the 65 mark.

Currently there is no restriction on what is done with that money.

It could be used to go on holiday or invest in a business or be geared up to buy rental property.

This is an issue the Australians are grappling with because their Super scheme can be used as a platform for leveraged investments in negatively geared rental property and that's powering the latest surge in Sydney prrices in particular.

It's forcing APRA and the Reserve Bank of Australia to dream up ways to slow the lending growth.

It's another reason why Australia's Treasury has floated the idea that maturing Super Fund money should be forced into a type of annuity. That'll go down like a cup of cold sick (or a loss in the semi tomorrow).

There has been low level chatter on how KiwiSaver lump sums should be dealt with. Annuities are equally unpopular here, but the thought of these lump sums being turbocharged and pumped into two bed brick and tiles in Auckland is a tad frightening. Bankers might say they don't lend to retirees, but there's an awful lot of rental property investors in their 50s and 60s who are still working and earning hard who are likely to keep doing that after the age of 65. Just look at Winston.

A key finding of the wide-ranging inquiry, which chairman David Murray handed to government for their consideration in December, was that people should no longer be given access to their superannuation savings as a lump sum at the end of their working life.

Instead, when people retire their superannuation savings would automatically be transferred to a default fund designed to manage it in the paydown phase and provide a stream of retirement income.

2. Circle the date - Reuters reports Greece will run out of cash on April 20 unless it gets fresh aid. If you're in the market for European holiday or car it might pay to wait and see how that turns out, given a default or ruction could easily weaken the euro further.

3. This might not end well - This stat has been around for a while courtesy of Bill Gates, but the fact that China used more concrete between 2011 to 2013 than was used in all of America through all of the 20th century is still a stunner.

The Washington Post has a good look through what it might mean, particularly for carbon emissions.

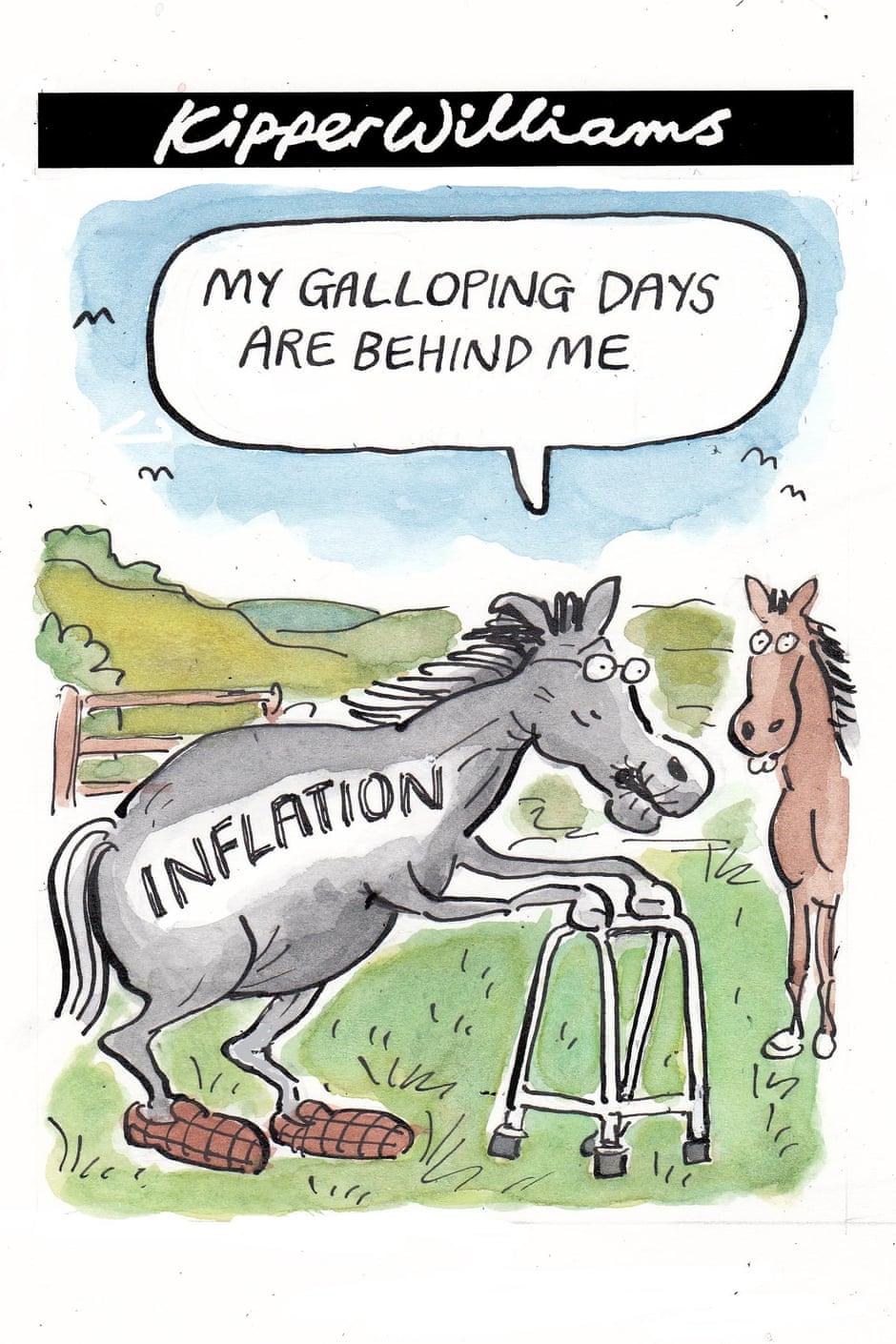

4. Good deflation and bad deflation - The Telegraph has a look here at what Britain's 0.0% CPI inflation figure means. It could be good. Or bad. It's worth thinking about, given the risks of wage deflation and house price deflation, like that seen in Japan.

There's this angle (further to #1 above):

Theoretically, first-time buyers should benefit from falling house prices making expensive areas such as London and the South East more affordable. However, longer term deflation could threaten the income of first and second jobbers, those last through the door in the workplace, preventing young workers, couples and families getting on the property ladder.

The one beneficiary in a longer term, deflationary scenario could be the cash-rich, buy-to-let investor, able to pick up cheap property.

With pension reform coming into effect in April, the over-55s, who will be able to withdraw their pension in one lump sum, may well choose to sink it into property, again reducing the choice for first-time buyers.

5. 'A potentially violent reconciliation' - Ambrose Evans Pritchard is in good form with this piece about the St Louis Fed Governor James Bullard's warning about asset bubbles and the need to hike interest rates.

Mr Bullard said investors are far too complacent about the pace of monetary tightening and could be in for a nasty shock as the policy cycle turns over coming months.

“I think reconciliation between what markets think and what the committee (FOMC) thinks will have to happen at some point. That's a potentially violent reconciliation and I am concerned about that,” he told a City Week forum in London.

Fed officials are deeply irked by accusations that they have been targeting equity prices or that they have allowed the institution to become liquidity prop for Wall Street. Some almost relish the chance to show their teeth again in the fight against moral hazard.

Mr Bullard said the Fed’s decision last week to drop the word “patient” from its plans for raising rates marks a new era in US monetary policy, warning that the central bank is now at liberty to strike at any meeting – though any move in April is effectively ruled out.

He also warned that markets had “badly over-emphasized” the importance of the strong US dollar in shaping in Fed policy, insisting that the headwinds from currency appreciation are overwhelmed by the much greater stimulus from cheap oil and ultra-low bond yields.

Frankly. Blah blah blah. Last week the Fed's actual boss effectively said interest rates would be low for longer and the 10 year Treasury bond yield is well below 2% again. There have been so many cries of the wolves. I'll believe it when I actually see it.

6. Another canary in the mine - Chinese demand for diamonds has been a major factor driving volumes and prices upwards in recent years, but Business Insider reports the latest Antwerp sales show something just went missing. That tallies with what we're seeing out of China's property and factory sectors.

7. A bond bubble - Further to 5 above, here's another warning via the FT that there's a bond bubble that will pop when interest rates start rising, partly because markets are less liquid now that banks can't play around inside them. The problem is we've heard this many, many times, and inflation and bond yields just keep falling. They're now well below 0 and still falling in parts of Europe.

And the Chinese haven't started printing yet.

Brad Crombie, head of fixed income at Aberdeen Asset Management, said: “You only know you’re in a bubble when it pops. But this market could pop. There is more tension and anxiety over valuations than for a long while.”

John Stopford, head of multi-assets at Investec, said: “There could be a bubble as investors have loaded up on high yield and corporate bonds. If we do see a reverse in the market, there could be price dislocation and a messy unwind.”

In the past six years, low interest rates and central bank quantitative easing have spurred a desperate search for yield. This has encouraged investors to buy investment grade, high yield and emerging market bonds to supplement their treasuries and gilts.

But bond trading volumes have not expanded as fast as the funds’ bond holdings — new capital rules have made it more expensive for banks to keep large trading books and the new US Volcker rule has barred American banks from trading out their own accounts, known as proprietary trading.

As a result investment managers fear that bond markets could seize up if falling prices or a financial crisis prompt investors to pull their money out of bond funds. Without the banks to act as backstops, there may not be enough institutions prepared to buy bonds when the funds have to sell.

On the flat delta of the Yangtze River north of Shanghai, Communist cadres embraced the call to stem the nation’s ballooning population a decade before it became national policy in 1979. The result is that Rudong is a window on China’s future, a windswept place of old people, closed schools and growing retirement homes.

“China will see more places like Rudong very soon,” said Wang Feng, a professor of sociology at the University of California at Irvine. “It’s a microcosm of the rapid demographic and economic transformation China has been experiencing the last decades. There will be more ghost villages and deserted or sleepy towns.”

9. Artic sea ice pack smaller than ever - The New York Times reports that the winter maximum covering of ice in the Arctic this year was the smallest on record.

The center said that recent weather patterns partly explain why the maximum this year is smaller than in previous winters. The North Pacific was warm this year because the atmospheric jet stream of cold air looped farther north in that region than is typical. The jet stream also plunged farther south than usual near the United States, bringing cooling temperatures and triggering heavy snows in much of the country.

Summer minimums in the Arctic’s ice cover can have a greater effect on the global climate than winter maximums, according to Walt Meier, a NASA scientist and an expert on sea ice. During the relatively sunny summers, the dark ocean surface of ice-free parts of the Arctic absorbs much more solar energy than highly reflective sea ice. This can create a warming feedback loop when the ocean absorbs sunlight and heats the air above it.

10. Totally Clarke and Dawe - Australia works well on the weekends, it seems.

36 Comments

LOL, using your retirement savings to buy leveraged negativley geared rental properties. Where does the cashflow come from? Surely this will have a happy ending.

Leveraged tax free capital gains. What other investments are there in New Zealand?

And remember that life expectancy will be well over 85 from 2040. That's 20 years after retirement. Plenty of time to build up a portfolio and then sell them along the way for income.

cheers

Bernard

So that is your personal answer for solely investing in New Zealand property.

You should have stayed in Auckland, or did you...with a rental or two?.

What if the Tax Laws change?.

What if the Residency Rules change to preclude non-residents buying up large.?

What if your predictions on a 30% drop eventuate.?

etc..etc.

I can tell you right now, if you have no income other then super, you won't be buying leveraged negatively geared property. Sooner or later someone in the upper echelons is going to realise that building houses is good for the economy, jobs, and standard of living and they will get the votes.

As far as investment goes, if you can get a freecashflow renter, I don't see much safer investment then that. Once you get into negative gearing, well you can speculate on anything, long or short. Everyone is an expert on property at the moment, but those kind of returns can't last for the simple reason that the interest payments are increasing faster then the RBNZ can lower rates. 40-50pa in interest is an average income, good luck keeping up that kind of cash-burn for any length of time.

Everyone seems gripped by a madness that house prices can keep going up forever, exponentially. Simple maths can't even cure that madness.

That's Ok we have bigger ships now to carry it, so fewer equals more, so we are really growing, honest.

Andrewj....They were all watching the NZ cricket World Cup, so no time for shopping.to keep the containers afloat.

Or alternatively the Middle Classes have pulled up stumps and just decided to not purchase anymore items...but they do donate to a good cause, unlike the other 1%. And we have had a fair share of that.

The 1% cannot eat enough, nor drink enough, nor consume enough to keep the up the game of charades.

So they just keep buying shares...,of just about any old thing. Do not have to buy anything, just pumps up the DOW. and keeps the Fed happy, but not the unfed masses.

I'll buy any rental property in a good state of repair in a major centre urban/suburban location at a yield of 5% over the average floating mortgage rate of the last 20 years, using the current department of building and housing average rents as reference. Anything else would be a crap shoot, good luck retirees.

Yield and cash flow are what the 65 age groups focus when it comes to PI.

If they put in 50% equity, loan the rest at 5.3% ish, an average property yielding a net 7% in a semi growth area (say a secondary uni based city where these yields are possible), they get:

250k property, 125k equity in, 125k loan, net p.a return before interest expense of 17,500, less interest expense = $10,875 p.a return on their 125k pension pay out, or 8.7% assuming 0% capital gains. Decent money in their pocket.

If house prices grow at 2% p.a (around inflation, which is very conservative based on NZ and global property price history): return goes to $15,875 or 12.7% p.a, at least 4% of which is tax free (cap gains, expenses that can be claimed)

Less managment fees @ 8%pw, rates, insurance, R&M, vacancy. Takes a lot of the shine out of it, I'd be aiming higher then 7% gross.

Better yet, leverage and buy a Auckland property with 15% yoy tax free capital gains, sell a year later 100k richer and they go on a trip of a lifetime.

Why stop at 100k?

What investment would you recommend?

I'd be looking harder for a rental grossing over 10%. Much less then that and you may as well keep it in KS.

Why not go for yield and capital gain ha ha. I see someone's flipping this little first home buyers dream (http://www.realestate.co.nz/2516366) about a year after it made media headlines. Just down the road from John Keys house.

KS V Property... One word "leverage".

100k in KS today, a year later you might have say (I'll be generous) 115k.

100k in Auckland property today, geared out to 500k, and a year later you'll probably have a net 175k.

"Australia's Treasury has floated the idea that maturing Super Fund money should be forced into a type of annuity."

Well maybe, if it stopped people blowing the lot and then becoming dependent. And only then for an amount that was needed as a minimum income. The excess over that is your own money to blow. Remembering in New Zealand we already have national super as a gift from the taxpayer set at the level which keeps people from absolute poverty.

Nah, they only want people to pump up the housing market...and keep pumping.

Damn contrarians..??

http://www.businessinsider.com.au/heres-what-apra-and-the-rba-are-doing…

First of all let me say - Imagine telling the 1% how they can have their money. But its OK to tell ordinary people if they can get their money as a lump sum or not.

But to more important things - the real reason they do not want BBs cashing in their super is simple.

Look at this graph

http://www.macrotrends.net/chart/1319/dow-jones-100-year-historical-chart

Now the crap artists have been telling you that a lot of this QE money has been flooding into the sharemarket and pushed up share prices.

But this graph showes otherwise.

Look at the steep climb starting in 1982 and going through the 90's - where was the trillion dollar QE then? - Its all a lie. Draw a line from 1982 to the present and show where the QE money apears - It does not, simple as that.

So if it is not QE pushing up share prices then what is?

You will notice on the graph that from 1965 to 1982 shares were in steady decline. So what changed?

Well Ronald Regan introduced super savings and gave tax incentives to sign up. Ever since the rest of the world has been doing the same. Now we have billions of dollars, week after week, pooring into shares. Even when shares are falling, like in the 2000's this money kept flooding in.

That is what is pushing up share prices, not QE, so expect the DOW to keep rising and rising and rising as the global super money keeps pouring in.

I say this graph proves what i say conclusively.

Now though, there is a danger - as the BBs start to retire and draw out their cash lump sums it will effect the price of shares and if this cash withdraw is greater than the younger generations contributions - BOOM the whole pozie collapses.

So you cannot have your lump sum - just too dangerous.

Oh, $30k DOW anyone?

This is something I have been worried about too. When the baby boomers retire en-mass more than one thing will hit. This issue about all these shares being sold at the same time plus the sale of lots or rental properties. All at the same time.

Of course there will be those with vested interests calling out for lump sum payouts to be banned. That is to be expected. And of course, those calls should be resisted loudly by everyone else.

Me; I'm going to retire early. Consequently by the time I reach 65 I will have very little in the way of savings and my kiwisaver balance will not be huge. (As it would otherwise have been).

These two things will reduce the danger associated with sharemarket falls, a future govt bringing in means testing of national super and of bringing in a requirement to convert the kiwisaver into an annuity.

I for one will be putting a portion of my kiwisaver payout into kiwibonds, that way I will not be affected so much if the banks go bust at a time where I will have no way of avoiding being affected. The above plus the OBR scares the begeevers out of me.....

This is a common misunderstanding about shares. Shares grow exponentially (x% per year) so you need to plot on a logarithmic scale. You also want to look at total return including dividends as capital growth is only part of the return. Have a look at this graph, the green line is the relevant one. Looking to this, we are trending as expected.

Note that periods above the line correspond to overvaluations in the market (see 1929 and 1999) and periods under the line represent undervaluation (great depression, 70s).

Based on this trend, the index grows 10-fold every 30 years in inflation-adjusted total returns. Unless you believe in a fundamental game changer e.g. peak oil or something that will permanently shrink GDP then this trend will continue.

Hi Mike, very good point, do you have any reason to think that BB's will have their funds paid out to them on retirement as opposed to using them to generate an annuity? Does anyone keep that kind of stat?

The rich don't keep their money in KiwiSaver. Most have other assets that they can access at any time before or after 65 (property, shares, bonds, businesses). Most people pay 3% into KiwiSaver plus the employer match and the tax contribution. This is not really that much even compounded over a long time.

Kiwisaver funds under management is $20bn and only a minority of this is invested in NZ shares. The market capitalisation of the top 50 shares is $100bn. The value of property is $700bn

I agree that "the rich" generally opt out of Kiwisaver, I guess the question that is hard to quantify is what percentage of BB's cash up their investments on retirement and what percentage leave them to generate an annuity... and what does that convert to in $ terms. Or do they go the other way... there would be plenty of BB's selling business' who then have cash to invest. Or overseas pensions paid out in lump sum NZD.

Happy. Ihe way I hear it anecdotally, is the other way around. The 'rich' opt into Kiwisaver. Because it's a good investment, the 'rich' are rich for a reason and can work that out. So why not. Acknowledging of course is that Kiwisaver is only very new. Thus even at relatively high input, you might have a only a few hundred thou yet in KS, but have several mill of other assets.

Seems to me many of the opt out types are the 'live for today' thinkers who can't bear to give up a little current consumption. So they don't do Kiwisaver, give up the employer contribution, give up the goverment subsidy. Their avoidance, even of free money, is why they are not 'rich'.

Probably pay interest on their credit cards too.

I don't do Kiwisaver because if I did I can't get my hands on the money until I'm 65; I have other investments that provide an income without that restriction. I've heard that most Kiwisaver funds return sub 15% per annum which is not as good as other investment options.

I don't pay interest on my credit card but that's only thanks to setting up a DD ;o)

I want to add that yes KS is a good investment if you're investing small amounts say only 1k as the $1000 government kickstart in the first year + dividend/interest gives you over 100% return. Not so much if you're investing 100k.

Indeed. Once you pass your employer match amount there is little benefit in locking your money away until you are 65. So you put in 3%. If you hsave more money to invest, then you invest it outside of Kiwisaver in other assets which can be accessed at any time. A quick check on my spreadsheets tells me that only 16% of my wealth is in Kiwisaver, the rest is in more liquid assets.

Kwimm. Only about 10% of my assets are in Kiwisaver, even though I am a big fan and been have been ploughing in lots of contributions. But it's only been around 7 years or so, and if it had been longer the higher that percentage would be greater. There are some advantages as I own the company that pays my large employer contribution.

I don't worry about the lockin factor, especially at only 10%, as when the bad thing happens it will be all asset classes will be affected. And I do have a severe case of sceptism about investing in financial services because of their behaviour.

Might even come the time when a can of baked beans will be more valuable than an ingot of gold. How do we decide now what to do, when that is possible in the future. But you have to be somewhere.

I understand it's quite difficult to buy annuities in NZ. In the absence of compulsion, it's not an attractive proposition for potential providers. That is because annuities only make commercial sense to provide when you have a lot of customers whose probable longevities are well distributed; then you can use the money left over when the short-lived people die before their savings run out, to keep paying the long-lived people whose savings run out before they die.

This is obviously an unattractive deal for people who think they're not going to live very long, so the likelihood is that most of the people wanting an annuity are people who think they're going to live a long time. Of course some of them will be mistaken about that, but it is still likely that you will get a preponderance of long-livers among your customers. This means you will not be able to offer to pay them anything much over and above gradually returning their own savings to them, which they could just as easily do for themselves.. So you won't be able to offer them an attractive deal either.

In addition, the fear of living longer than your own savings do, is mitigated in the NZ case by the presence of NZ Super. Effectively, we all already have a pretty good annuity right there - one that you'd have to save up roughly $400k to be able to provide for yourself.

I didn't mean a specifically tailored annuity product, more just any investment that pays an income as apposed to cashing up and throwing the money in the bank. The next big economic trend in NZ, or indeed the developed world, is what will the BBs do when they retire. Will they spend up big, in which case there will be a boom in the services sector and probably a drop in the NZX and/or house prices. Or will they pile into houses and shares and live off the capital gains and rent/dividends, in which case they'll be further share and house price booms.

What will their migration patterns look like? Will Tauranga explode? Or the Gold Coast?

A survey would make for interesting reading

Well said.

Another factor is that if you slowly withdraw money from kiwisaver, if there are any monies in there when you kark it, it will become part of the inheritance. Its not lost to the annuity provider.

Is Canada's housing bubble starting to burst?

Thermohaline Circulation is declining faster then predicted, as with most climate models this one turned out a tad optimistic.

http://www.realclimate.org/index.php/archives/2015/03/whats-going-on-in-the-north-atlantic/

Thanks Michael Mann (founder of Real Climate) for yet another scarey model and proxy reconstructions. They have worked out so well in the past.

"What is new is that we have used proxy reconstructions of large-scale surface temperature (Mann et al, 2009) previously published by one of us (study co-author and RealClimate co-founder Mike Mann) that extend back to 900 AD..."

As for people who actually study the Gulf Stream.

On the long-term stability of Gulf Stream transport based on 20 years of direct measurements"In contrast to recent claims of a Gulf Stream slowdown, two decades of directly measured velocity across the current show no evidence of a decrease."

http://onlinelibrary.wiley.com/doi/10.1002/2013GL058636/abstract

Sku - "...as with most climate models this one turned out a tad optimistic." What models are you looking at clearly not the laughable IPCC ones.

"Simulations conducted in advance of the 2013–14 assessment from the Intergovernmental Panel on Climate Change (IPCC) suggest that the warming should have continued at an average rate of 0.21 °C per decade from 1998 to 2012. Instead, the observed warming during that period was just 0.04 °C per decade, as measured by the UK Met Office in Exeter and the Climatic Research Unit at the University of East Anglia in Norwich, UK."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.