Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #5 on the Princelings of Sydney.

1. Boomer doom loop? - The amazing fall in bond yields to negative real levels and the equally strong rise in stock prices to record high multiples over earnings in recent years has puzzled many, given the relatively low economic growth seen in most of the Western world since the GFC.

Why are savers so desperate to get their hands on any assets, even if the yield appears punishingly low and prices dangerously high?

This blog post from options trader Two and Twenty posits a theory.

What if the people doing all the buying, who are mostly baby-boomers, are forced to save more and buy even more of these assets because yields keep falling and the stockpile they're having to build up keeps getting bigger.

The circular logic is compelling. Here's a taste:

The more time goes by, the more you need. The more you need, the higher the price of the assets you are buying and hence the lower the expected return. And hence the more you need. If you are unfunded, your “hole” just gets bigger and bigger…You are in a trap you may never get out of. No wonder you don’t feel great about your situation.

Now, imagine if you were going through this same exercise along with millions of other people in your exact same situation in developed markets around the world….All chasing basically the same financial assets. They are all in a massive prisoner’s dilemna with each other. The more they bid, the more they need.

This is what is happening right now. All the DMs are aging. This is a global phenomenon. Insurance companies, pension funds and others trying to store assets for the next 30 years are screaming for returns. And we are thus seeing correlation amongst DM financial assets skyrocket.

2. And the solution? - Two and Twenty doesn't really have an immediate solution or even a prescription as to how it all might end, assuming of course that all this money chasing yield and high stock prices eventually gets to an unsustainable point.

The slightly worrying conclusion is that once yields get to 0% then central banks just crank up the printing presses and hand over cash for investors to put into other hard assets such as land or art or anything with the potential for a capital gain, or even some sought of actual cash return.

In many ways, the boomer’s have given us a free put on financial assets: they basically have to buy them at lower prices. When we see panic sell-offs, we should literally all start front-running the boomers.

What will solve this? Increasing the retirement age. This will have a massive effect on the perceived unfunded liability. Social security in theory could help, but there aren’t enough young workers to pay for the boomer’s retirement.

We as a global society need to wake up to the fact that a life expectancy of 100 is not consistent with a retirement age of 65-70 (or for government/military, 45, but don’t get me started on that…).

The other thing that this opens up which I won’t go into is this: is the Central Bank rate repression effectively increasing the angst among the boomers with regard to their unfunded liability?

3. So much work, yet so much unemployment - Over the last few years it has struck me as perverse that so many people are working longer and longer hours, while so many others are either not in work or are underemployed on part time or temporary conditions. It seems like a market failure of sorts. I understand the incentives that drive it (the high overhead costs of individual full time employees and the ability to earn more by working harder/longer), but it doesn't seem healthy in the long run.

Here's a good New York Times Upshot piece on how the 24/7 workplace is hitting families and women in particular. I don't have a solution, but it's a question that should be asked every now and again.

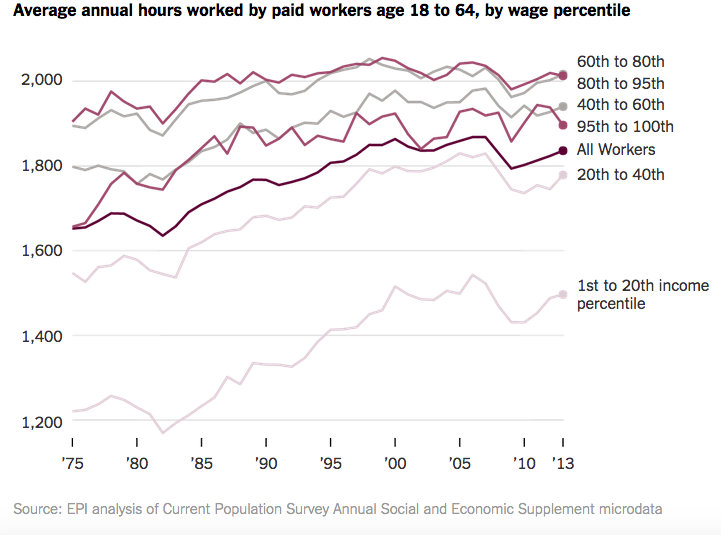

The chart below tells the story, as does this detail:

The time Americans spend at work has sharply increased over the last four decades. We work an average of 1,836 hours a year, up 9 percent from 1,687 in 1979, according to Current Population Survey dataanalyzed by Lawrence Mishel, president of the Economic Policy Institute. Some reasons include a more competitive and global economy as well as technology that enables people to work at any hour and location.

High earners (though not the highest) work the most. Earners in the 60th to 95th percentile worked about 2,015 hours in 2013, up about 5 percent from 1979. Those in the bottom 20th percentile worked far fewer hours (1,497 a year), but their hours increased the most, 20 percent from 1979.

For low-wage earners, the problem is not too many hours but too few. Their schedules are often too unpredictable, and their wages have been rising only modestly. For many workers, a lack of parental leave or child care can create additional strains.

For elite workers, the challenge is the conflict between modern family life and a work culture in which long hours have become a status symbol.

4. Just stop the money laundering - Michael West has a good old rant over the SMH about the A$26 billion that has been pumped into Sydney's property market over the last six years from China and the ... er... uncertain provenance... of some of it. He says tougher money laundering rules under discussion should be introduced pronto. It's very topical in the wake of the 'bright line' changes introduced here.

All the government has to do is to bring in the AML legislation it said it would bring in almost 10 years ago and the heat, or at least some of the heat, would come out of the market.

At present, Chinese investors are only permitted to take $US50,000 ($65,413) out of the country. Yet they are regularly paying cash for $1.5 million-plus homes in Sydney and Melbourne. It is a fair assumption then that most of the money pouring into Australian residential property from China is therefore black money.

The first tranche of the AML legislation was introduced for the financial services and gaming sectors in 2007. It was intended that the second tranche be rolled out the next year – covering real estate and other sectors.

Once this second tranche of the AML regime is introduced, it will require the likes of real estate agents and luxury car dealers to identify for the regulator AUSTRAC a whole slew of details about their customers and where the money is coming from. This will mean anything more than $US50,000 coming out of China may be deemed to be unlawful as it will have breached Chinese foreign investment regulations.

5. The Princelings of Sydney - This Sydney Morning Herald investigation into the web of wealth being pumped into property there by the uber-wealthy connected to China's leadership is a fascinating piece.

When Joe Hockey shocked the real estate world by forcing Chinese billionaire Xu Jiayin to sell his $39 million Point Piper mansion Villa Del Mare in March, the Treasurer wanted to demonstrate that he was serious about stopping foreigners from evading ownership restrictions and inflating the bubbling market.

The Treasurer showed he wouldn't be fooled by an intervening string of shelf companies that stretched via the British Virgin Islands to the headquarters of Xu's property development empire in southern China.

And it was also a way for government political advisers to nod towards the kind of sentiment that turned ugly over the weekend, when a race hate group attempted to provoke a protest rally to "stop the Chinese invasion".

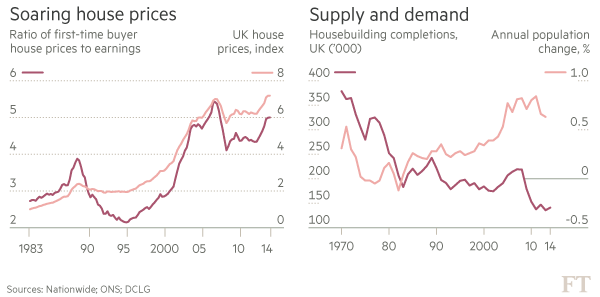

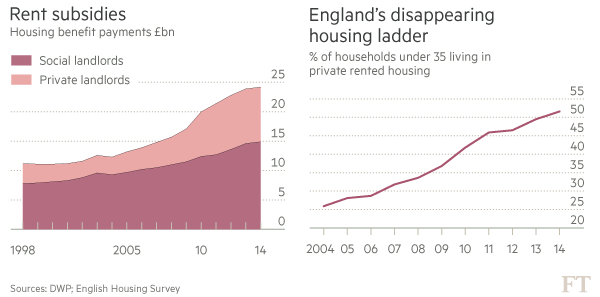

6. The problem with rent subsidies - The FT has done a nice long piece on the 24 billion pounds spent by Britain's Government last year on rent subsidies for beneficiaries.New Zealand has the same problem with the combination of accommodation supplements and income related rents headed for NZ$2.1 billion by 2018/19 from NZ$1.68 billion in 2009/10, despite a big drop in beneficiary numbers.

The two charts below are heart breaking and maddening.

According to the Office for Budget Responsibility, last year the UK spent more than £25bn on rent and home ownership subsidies but ended up with just 141,000 new houses being built — at least 40 per cent below the level some economists argue it needs.

Britain’s housing crisis is widely blamed on too little government intervention. But state involvement is at its highest level since the 1970s — the heyday of mass council housebuilding.

The situation is “as big a crisis as any in the country”, says Sir Stuart Lipton, one of Britain’s most experienced property developers. “We need political leadership,” he adds.

The crisis is weighing on the UK economy. Business leaders cite housing costs — particularly in London and the surrounding commuter belt — as one of the biggest threats to growth. People cannot move to more expensive areas to find work, making it difficult for companies to hire skilled staff. Lower income workers face high housing costs exacerbated by stalled wage growth.

7. The economics of wealth and sadness - Peter Cai writes well at Business Spectator about the work of Adair Turner, who wonders whether GDP growth is a useful thing to aim for and whether the role of finance is now too large.

In his book, Economic after the Crisis: Objectives and Means, Turner rejects two of the most fundamental assumptions underpinning the modern economy: firstly, that continuous improvement in material wealth as measured by GDP is good; and secondly, that the free market, and especially the financial services sector, is the best allocator of resources.

If these ideas came from basket-weaving greenies, no one would be surprised. But they come from a person who has spent his entire career inside the great citadels of capitalism. Turner argues that the shared idea in the West about continuous economic development as measured in better GDP per capita would result in increasing well-being, welfare and happiness, is wrong.

Turner, a trained economist, cites a range of studies showing that the relationship between happiness and income starts to break down at around about $US20,000. In short, people are not getting happier after their income reaches certain thresholds. This is especially evident in rich societies.

8. The nerves in China - Peter Cai looks here at the deepening concerns about the slowdown in China and how the Government seems reasonably determined not to throw 2009-12 style money at it.

Chinese citizens are nervous about the economy. The all-powerful ruling Chinese Communist Party admits the mass psychology is pretty fragile, at according to last Monday’s front page story in the People’s Daily (Reading China's economic tea leaves, June 1) the party’s principal mouthpiece.

The story then went on to address the myriad of problems facing the world’s second largest economy through an interview with an unnamed ‘authority’, an highly unusual move given the sensitivity and symbolic importance of a front page news story on thePeople’s Daily. Its words and messages are well scrutinised and crafted to deliver the message of the party.

The overarching message is that of confidence and determination to ride out the current slump in the economy, which is growing at the slowest pace since the global financial crisis. However, the story also reveals the strategic policy directions of the Chinese government and especially how to handle the problem of high leverage.

9. Totally John Oliver on the FIFA debacle. It was aired before Sepp Blatter resigned, but Oliver should take some of the credit for this as he highlighted it in America in this piece last year.

10. Totally Clarke and Dawe - Joe Hockey reaches out to the young.

16 Comments

Hi Darth

Long time , no talk

i read Shiller's article last week and am inclined to agree with the tenor of your article above..i think i know a reasonable amount about investing and hold quite a few cap. notes which i keep till maturity so zig zag yeilds don't affect me...or do they?...is there something i'm missing if i'm selling the bonds before mat.?

your article was couched in terms that were above me with things like Gamma, CAPE etc which i don't know anything about...consequently, i admired your jargonistic verbal gymnastics but really am none the wiser other than what i knew which is getting bloody hard to make a buck these days

..today i bought some WHS notes at 5.3% and the broker and i laughed about the good old days and how they only got 15% of their WHS allocation as they were so sought after...proving your point...so could you put up another article for the less brill. explaining what you were getting at...even gareth morgan would struggle..uru

CAPE is just analysing dividends over a longer time-frame than just a year - 10 years usually, to figure out what a company might pay-out in the future.

But here's the fly in the ointment with the article as I see it - Boomers are going to run out of the capacity to chase anything, yield or otherwise! Once you are borrowed to the max and invested, then all you can do is watch your investments. Sure, there will be progressive drawdown of pensions etc. but the mainstay of their appetite to buy, is their current wage &/or their capacity to borrow, and once that's gone......game over. But I do like the theory of the piece!

#1 - hardly a new concept - The Nanny explained this circular logic to us so very well many years ago;

https://www.youtube.com/watch?v=TNko2n7-mYY

Oh, Miss Fine, is it that time of the month again? Oh, I'm afraid so, Niles.

Time to make my credit card payments.

Oh, thank God I've got a system.

No, you don't.

I'm tapped.

Not you.

I have to pay my American Express because if I buy a piece of gum, the SWAT team storms the building.

Meanwhile, I pay my Master card with my Discover card, my Discover card with my Optimer, my Optimer card with my City Trust Visa.

But doesn't that leave a very high balance on your Visa? Exactly.

And that's why they give me an expresso machine, which I sell to pay my American Express.

#1 do we have any data on the pensions incomes between capital gain and dividends? changing? ie do they now expect high capital gains to make up the expectations? Sounds like tulip mania.

Just think if the BBs are "panicking" where the hell does that leave the follow generations?

Steven

You've been sucked in by the Hickey-Baby-Boomer-Bashing-Brigade

Think about this

In NZ there are

680,000 people 65+ and over

Not all will receive National Super

Most will, but not the full 100%

Not all will have been born in NZ

Some will have never worked and paid tax in NZ

Safe to assume it's a good sized number

Those in hospices and retirement care-homes have it means tested away

There are 460,000 property owning family trusts in NZ

Most of the settlors will have been either BB's or Gen Jones

Most of the beneficaries will be their GenX children

How many we don't know

Hickey, if he knows, he doesn't tell

If he doesn't know, makes no effort to find out

So the question is

If the bulk of the BB's no longer own all that wealth, then what say you

Hmm, no I wasnt aiming at BBs, but that assets are so massively over-valued compared to yield. So the Q is just who, how many will be able or willing to pay for assets that have such poor returns.

and how much of it is concentrated in the top 10%?

I'll add my number 11

http://peakoil.com/enviroment/kunstler-twenty-three-geniuses

always an entertaining read, especially if you like horror.

Steven have you ever read this publication?

http://oilprice.com/

Sort of, yes, I am not to keen on its methods to advertise inside pieces but I see links to them.

http://peakoil.com/consumption/forget-the-noise-oil-prices-wont-crash-a…

and,

http://oilprice.com/Energy/Oil-Prices/Forget-the-Noise-Oil-Prices-Wont-…

and of course this is related,

http://shipandbunker.com/news/am/690482-osullivan-doubtful-well-ever-ag…

LOL....so many sites linking.....

Lots of speculation and frankly wishful thinking.

#1. I'm not sure the person quoted is aware of the prisoners dilemma. In the prisoners dilemma, any of the main variants (the "two cops", or the "guard and prisoner") the point is that capitulation is rewarded - in the "two cops" it is better to plead guilty/confess because then you're guaranteed a lighter sentence/fine than if you fought (or if you relied on your partner not ratting you out). In the "prisoner / guard" version it is better for the prisoner to stay in the prison than seek his freedom, even though everyone knows he is innocent, and it is in the guards interest to see to this if he wants to keep his job, despite knowing the prisoner is interested.

If anything the article describes the opposite, that their is no way out. It's more like the Gamblers fallacy - the longer one plays the higher one _might_ win eventually, but the more certain a complete wipe out will occur first. The more one plays and the higher the goal the more certain the eventual loss.

Baby Boomers

Try this

Extract from censuses 1996-2013

Baby-Boomers Born 1945-1965

NZ-Total - all groups

1996 1,111,000

2001 1,110,000

2006 1,134,000

2013 1,138,000

Total imported boomers 1996-2013 = 27,000 (at least)

Existing 1996 cohort can't increase beyond 1,111,000 locally

Cant make any more of them organically

Asian-Total

1996 66,000

2001 80,000

2006 97,000

2013 113,000

Between 1996-2013

The National total number of boomers grew 27,000

While the Asian total of boomers grew by 47,000

Which means 20,000 of the original 1996 national cohort never made it

#1 BBs keep investing and investing and investing and the more they invest the lower the return.

Sounds like a BB is a Central bank with no limits.

#2 I have been saying for a very long time that pension funds were a big ponzie scheme. So when it all crashes the BBs are going to get the blame. That is what Bernard is now leading up to

#3 i remember decades ago talk of a 35 hour week. Nothing will change until the system changes.

Re 6: Accommodation supplement liabilities. I just found the solution! Make landlords pay the entirety of the accommodation supplement. Anyone filling out and IR3R must pay into the consolidated fund an accommodation supplement levy. This would remove the unhappy distortion which is inhibiting this supposedly "free" market.

#6 there are huge rent subisidies for investors in NZ. People go to WINZ and get an accomodation supplement that helps pay their rent, goes straight to investors and adds to the yield on property. A possible solution to the JAFFA housing issue would be a legislated cap on rents (Rent Control). The down side is homeless people in a country that prides itself on looking after the less fortunate. However if people can't afford to rent, and houses sit empty, some investors may think twice?

The other side of the ever increasing sums required for retirement i.e. investment have an equal and correspondingly negative impact on consumption. The theory is that if we all do this then a downward spiral ensues. Are we at the point where theory has become reality.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.