Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #1 on China's bubble machine.

1. Forever blowing bubbles - China just can't seem to break its bad old habits of quickly going for growth by juicing up bank lending and asset prices.

It did it last year with the stock market, which promptly bust this year.

Now, as Ambrose Evans Pritchard reports, it's trying again with its real estate market.

House sales are rising at an explosive pace in China across most regions of the country as stimulus measures kick in and the Communist authorities launch yet another cycle of credit growth.

Fresh data collected by JL Warren Capital show that sales of existing homes surged by 115pc from a year earlier in the second week of September, rising to 135pc for the so-called 'tier two' group of mid-to-large size cities.

It is the second week of vertiginous growth rates and suggests that buyers may be switching to hard assets after losing confidence in the Shanghai and Shenzhen stock markets. The Chinese media has reported the first signs of a buyers' panic in some cities.

Regulators have lifted curbs on purchases of second homes, cut down-payment requirements from 30pc to 20pc, and are now actively encouraging teachers and civil servants to buy property with special incentives.

The authorities appear to have lurched from a 'tough love' stance last year to a feverish salesmanship, ominously reminiscent of their on-off interventions in the stock market debacle.

2. Could ride-sharing replace car ownership? - That's the theory in this piece on Medium from Sunil Paul, although it has to be said that Paul is the CEO of a ride sharing service called Side Car.

I'm not so sure. I am a big Uber user, but I still own a car.

I'm a little bit sceptical about the predictions that driverless cars and ride-sharing apps will up-end the economics of the car industry or the need for motorways.

But here's the view from San Francisco about the coming brave new world.

The pace of innovation is intense and moving past traditional ridesharing into instant pooling of rides and deliveries. Smartphones allow us to coordinate rides headed in the same direction like with UberPool, LyftLine and Sidecar Shared Rides. At Sidecar, we’re using our Shared Ride technology to combine people and packages on the same trip as well as to facilitate hyper-efficient multi-mode deliveries where a package might be handed off between a driver and a walker or bicyclists in a single trip.Transportation is becoming smarter through technology. Can traditional car companies keep up? That is the big question.

With all these services, it makes sense that auto sales will decline. If you still think Uber and ridesharing is just about replacing a taxicab you’re dead wrong. This is bigger than taxis — ridesharing is on a path to displace cars.The evidence is clear.

Ninety-five percent of rideshare demand in the San Francisco Bay Area is not displacing taxis, which have remained flat over the last few years. We know 57% of rideshare riders own cars and in surveys they report they are taking more rideshare trips and fewer car, taxi, and transit trips.

Industry experts estimate 30% of San Francisco lease owners will not renew when their lease comes up.

3. 'The BIS is just making it up' - Paul Krugman is not happy about the arguments being put around by quite a few bankers about the need for higher interest rates.

He's particularly grumpy about the Bank for International Settlements' (BIS) arguments:

As I’ve written many times, the remarkable thing about policy since 2010 is that outsiders, particularly bearded academics, have based their criticisms of policy on mainstream, textbook economics; whereas serious-sounding bankers in suits have been creating whole new economic doctrines on the fly to justify what they claim are sound policies.

In this case, the BIS not only claims that low interest rates cause financial instability, but goes on to expound a sort of widow’s cruse theory of interest rates, in which low rates today lead to even lower rates tomorrow, because they produce bubbles that weaken the economy further when they burst. That’s pretty wild stuff; you wouldn’t want to take it seriously without a lot of evidence, which the BIS does not provide.

Or put it this way: if, say, Jeremy Corbyn or Bernie Sanders were to invent whole new, dubious economic theories to justify the policies they clearly want for other reasons, everyone would be coming down on them hard for being flaky and irresponsible. Yet when the BIS — which was, once again, dead wrong on inflation — does the same thing, it’s taken very seriously.

4. The rise of Bernie Sanders and Jeremy Corbyn - Martin Wolf at the FT makes some good points about the rise of very left wing politicians (and some would say very right wing and populist politicians such as Donald Trump).

Mr Corbyn’s rise reflects the loss of confidence in political and commercial elites also to be seen in other high-income countries, notably France, Spain and the US. This mistrust has roots in longstanding discontents. But a huge and essentially unexpected financial crisis, followed by the rescue of the institutions held responsible and a lengthy period of depressed real incomes, has turned it into rage.

The anger is to be seen on both extremes. The populist right identifies the enemy as corrupt elites, feckless scroungers and foreigners. The populist left identifies it in greedy plutocrats and their lackeys in politics and media. Mr Corbyn’s ascendancy is the triumph of this second view. It may not be the last such event in western politics.

5. Have the Sydney and Auckland housing markets peaked? - The 'p' word is being bandied around this week on both sides of the Tasman.

The Sydney Morning Herald reports this weekend's 'Super Saturday' of auctions for 1,000 homes is shaping up as a "bloodbath" as auction clearance rates plummet in the wake of new capital requirements that have pushed up interest rates.

“It’s the weakest spring market for three years,” Domain Group senior economist Dr Andrew Wilson said.

“Parts of the city are showing signs of fatigue.”

Auction volumes are up almost 50 per cent this September, with almost 2500 homes going under the hammer so far this month. Auction numbers were also well up over July and August, with 800 auctions most Saturdays – unheard of for winter.

But the high volumes are now taking their toll. The north-west of the city has gone from one of the best-performing regions to one of the weakest. On Saturday, just 54.3 per cent of homes up for auction sold.

And Morgan Stanley have called a peak in Australia's housing market too.

Even the New Zealand Herald used the peak word in this piece by Anne Gibson. A deathly hush descended over the city.

Kiri Barfoot, a director of Auckland's biggest agency, Barfoot & Thompson, confirmed auction clearance rates were down a few percentage points lately.

Auckland landlord Ron Hoy Fong, of coaching business Ronovationz, said he had noticed a sharp downturn in both auction attendance and sales in the last fortnight.

"More properties are being passed in," Fong said.

"There are noticeably less and less people at the auctions. Over half the properties were passed in last week," he said of Barfoot's auction last Wednesday at its Shortland St headquarters.

Mortgage broker Bruce Patten said he had also noticed auction clearance rates falling from unprecedented highs of about 95 per cent.

"There has been a frenzy of activity in the investment space before the banks changed their policies," Patten said.

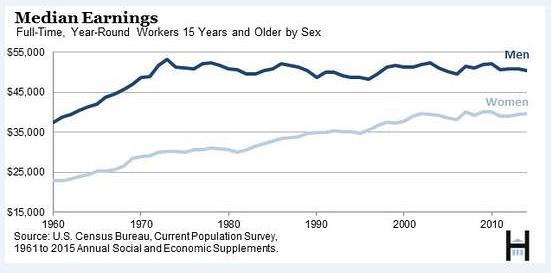

6. The problem with America - There's been a lot of talk of economic recovery in America recently, but the charts below and this Brookings Institute piece on real median wages earned by men show some deep structural drags on growth in the world's largest economy.

The median male worker who was employed year-round and full time earned less in 2014 than a similarly situated worker earned four decades ago. And those are the ones who had jobs.

This one fact, tucked in Table A-4 of the Census Bureau’s annual report on income, is both a symptom of an economy that isn’t delivering for many ordinary Americans and at least one reason for the dissatisfaction, anger, and distrust that voters are displaying in the 2016 presidential campaign.

What about women? Well, they haven’t closed the pay gap with men, but the inflation-adjusted earnings of the median female worker increased more than 30% between 1973 and 2014, to $39,621 from $30,182, according to census data.

But back to men. Why are wages for the typical male worker stagnating? After all, the U.S. economy has grown substantially since 1973. Output per person in the U.S. has nearly doubled since 1973, according to the Bureau of Economic Analysis. And output per hour of work (minus depreciation) has increased nearly 2.5 times, according to a recent analysis by the Economic Policy Institute, a left-leaning think tank that produces reliable statistical analyses.

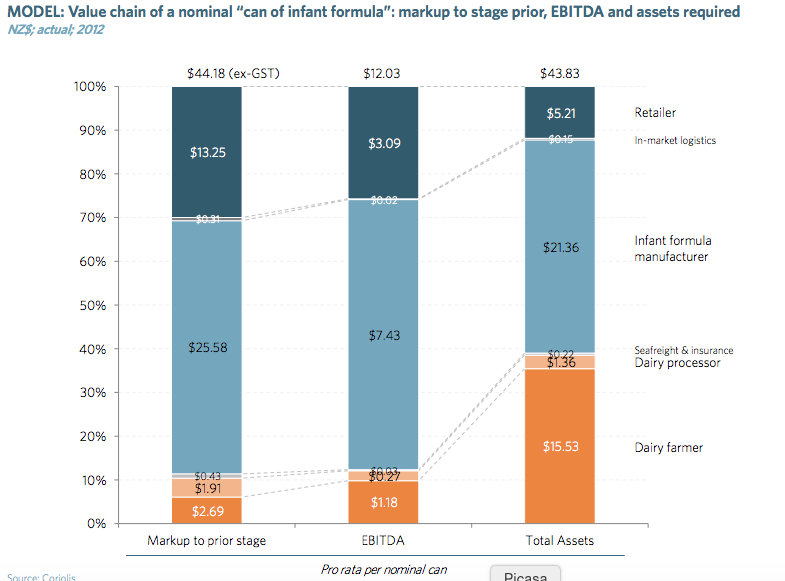

7. Value chains - The debates around the sales of Lochinver and Silver Fern Farms are all about who captures the value of our commodities along the chain from the pasture to the plate.

For decades, New Zealand farms have tried to capture more of the value along the chain by building cooperatives to try to become more than just a price-taker. Fonterra appeared the most successful, although that's debateble given its overwhelming focus in recent years on processing volumes of milk into bags of powder. The meat industry has been less successful.

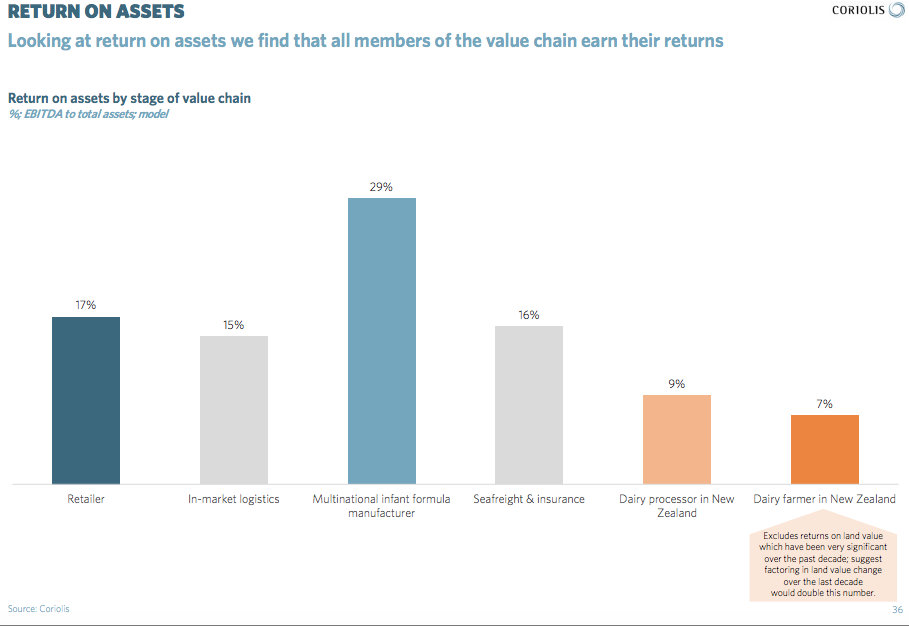

This Coriolis analysis of infant formula value chains from 2014 for the Pacific Economic Cooperation Council (HT Rod Oram) shows that the farmer collects NZ$2.69 of the value of a NZ$44.18 can of formula, yet invests NZ$15.53 of the assets needed to produce that can. The retailer and manufacturer, meanwhile, commits 60% of the assets and collects 88% of the value. The chart below tells the story.

And the end result? The dairy farmer's return on assets is much lower (at least before capital gains on land).

You can't help thinking that the tax free nature of capital gains on land is skewing our national investment decisions towards low returns on investment, and ultimately, lower investment in assets that generate more productivity and higher wages.

8. Totally a great link to a place where you can buy a card game about exploding kittens. This is my penance for putting in this cartoon below. I'm ambivalent about cats. Dogs are less complicated.

9. Totally John Oliver on the issue of food waste.

10. Totally Clarke and Dawe on the changing of the guard in Australia.

7 Comments

#1

Ockham's Razor explanation would be the simplest of all - the people who own or caught up in or trapped in all these empty homes and apartments and ghost towns are closely linked to or are part of the politburo

Yes - similar to when the Shanghai Index hit the fan and a lot of the shares were dropping limit down each day blue chips closely linked to the "Leading" families (communism anyone??) were supported strongly with public money. Bank of China for example went to new highs.

NZ blowing bubbles as well. Talked to a foreign visitor the other day who had been looking around our area. "No one works?" he commented. But who wants to employ people? there's too much red tape. Put your money in real estate....

Looks like China's economy is coming seriously off the rails:

http://www.markiteconomics.com/Survey/PressRelease.mvc/883014a121534f51…

Nothing for us to worry about though chaps. Tourism will apparently save the NZ economy.....

#6 & 7 Happening here too. Talleys forcing workers into IEAs in the meat works at a little over $14.00 an hour and only 16 hour a week guaranteed. The IEA also requires that the meat works job be the primary employment. How does a worker survive on less than $300 a week gross while the business owner profits by millions? Note today also the hedge fund manager (in the US) raising the price of a drug by 5000% because he can! The case for price controls and increased regulation is growing as big business gets greedy and re-invents slavery. Had a friend years ago who invented a personal alarm based on a toilet flushing for elderly. The pharmacies wanted it but wanted to put the price up 150% after they bought the finished product. Ian refused because he couldn't countenance the unbridled and naked greed presented to him.

Our own Panda, John Key, will make some middle/upper class heads spin when the "not gold plated TPP" is signed.

http://www.independent.co.uk/news/people/martin-shkreli-pharmaceuticals…

It sounds unbelievable to us, but this is USA everyday reality. National is actively bringing this to us. A new flag will not protect us.

Only billionaires will be secure. The mere millionaire will be wiped out by a couple of years of illness of themselves or their near and dear. For God's sake, everybody, make yourself as healthy and sane as you can! Turn your backyards into organic gardens.

"Hill used Indian government data on the cost of pharmaceutical ingredients and allowed for a 50-percent profit margin - but no money for investment in research - to work out the costs of producing certain drugs.

On this basis, he found that Novartis' leukaemia drug Glivec actually cost $159 for a year's treatment, against the $106,000 charged in the United States."

http://www.foxnews.com/health/2015/09/22/exclusive-americans-overpaying…

Please do all you can think of to stop our 47% leader from signing the TPP. Letters to editors, donate to Jane Kelsey's freedom of information suit to release the papers (90% cast in stone, why can't we see at least that part - what are they hiding?), petition your local council to declare itself a TPP-free zone. I've done all the above, it's a critical issue.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.