Today's Top 10 is a guest post from Nirmal-Kumar Nair, an associate professor at the Department of Electrical and Computer Engineering at the University of Auckland.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 10 yourself, contact gareth.vaughan@interest.co.nz.

See all previous Top 10s here.

For this issue of Top 10, I highlight items on low carbon energy infrastructure; financing; pension and insurance fund growth; ineffective marginal price signals during demand destruction; blackout watch and cyber-security.

1. Engineering New Zealand’s Low Carbon 21st Century Innovation Pathway

Following up on the recent Paris Agreement, countries will kick-start their action points to implement plans for delivering their pledged reduction in emission.

For NZ the following actionable steps are likely to form part of the response.

- Electrification of Transport

- Agricultural GHG (Methane) Mitigation

- Additional electricity capacity through renewables

- Future proofing Tourism through carbon mile quantification

- Building Engineering & Science workforce for Low carbon future

Cross-sector collaboration and innovative thinking around regulation, communicating changes, thought leadership and international engagement will be the key.

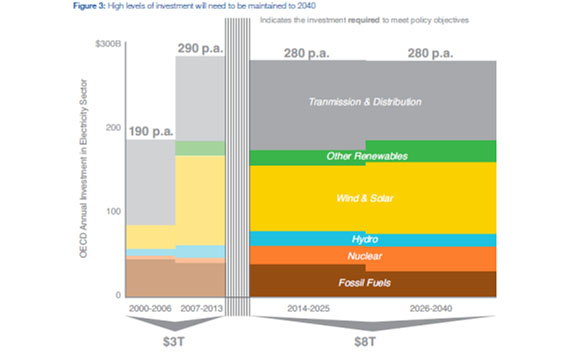

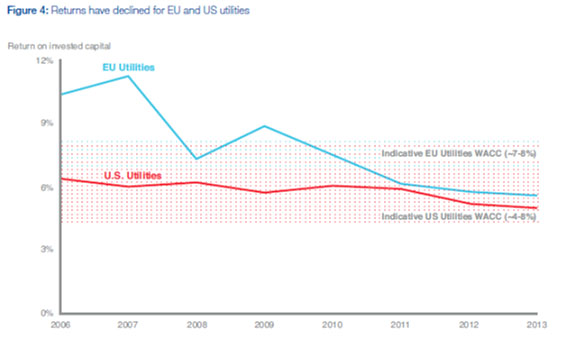

The main challenge will be toward financing electricity infrastructure as the rate of returns in OECD countries has been decreasing for utilities. See this World Economic Forum report.

2. Auckland aspires to be topmost renewable energy cities (a repeat Top 10 item from my October 2015)

I had several items about cities in my Top 10 of May 2015. I discuss renewable energy in Auckland through item #5 of October 2015 in the context of Auckland’s 2040 energy plans.

One of my first interactions with interest.co.nz was a double-shot interview based on a work we did at University of Auckland estimating the solar potential for Auckland.

Auckland should aspire to make the Top 10 renewable energy cities. Currently, it is ranked as one of the most liveable but expensive cities in the world. The extra price to transition to a topmost renewable energy city can be accommodated in the big scheme of things.

3. Are you planning to buy an EV?

In my September 2014 Guest Top 10 contribution, I had flagged through item 8 the news release by Tesla CEO, Elon Musk regarding the Electric Vehicle patents and through item 1 of May 2015 news of battery packs like Tesla home Powerwall and utility scale Powerpack.

In 2016 development in this space continues with future booking for the Tesla Model 3 just having completed successfully. EV rollouts from several global auto companies are also happening following up on this news.

Elon Musk unveiling Tesla Model 3 (2016.3.31)

4. Can kinked-demand theory relevant explain steady prices during sustained decreasing electricity demand?

With reducing electrical consumption in Australia and New Zealand the question is what happens to grid electricity prices now and in the near future with larger uptake of home solar.

NZ price of wholesale energy prices does not appear to fall which is a significant contributor (almost 50-60%) to our retail residential electricity price. The NZX stock prices of NZ’s 5 major generators is pretty steady and our energy derivatives traded through ASX New Zealand Electricity futures and options reflects steady prices of the volumes traded at our North Island and South Island nodes.

Can a case be made that this is because of the kinked-demand hypothesizing price rigidity/stickiness for an oligopolistic market?

If a case can be made that this is happening, then retail competition and demand response gains by consumers will be subdued going forward and not efficient.

5. Commodity Markets: Have they reached their bottom yet?

The deleveraging due to financial quantitative easing in recent years is coinciding with the bearish commodity cycle. Some analysis shows that this is one of the lowest in several decades.

It appears good for consumers globally but commodity exporting economies are rethinking their future portfolios and action plans for investment.

6. Global pension and Insurance funds: Where will they invest?

For this Top 10, I looked into the recent statistics of pension funds and insurance primarily to factor what the future of these instruments look like as a consumer.

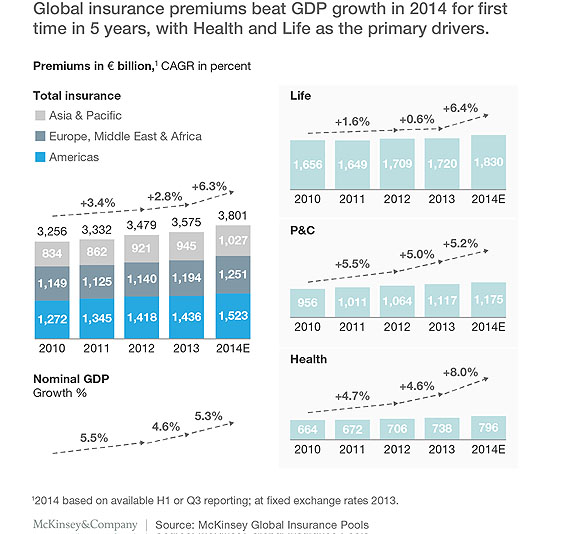

Global pension funds for OECD has reached 25 US trillion and looking for investments other than equities for growth.

Insurance industry is rising. One statistic by McKinsey shows that insurance premiums beat GDP growth in 2014. Hedging against ageing and risk is likely to trend upwards in the future. Where will these funds be invested?

7. International Blackout watch: Ukraine and Sri Lanka

In continuation to my Feb 2015 Top 10 item #9 on blackouts, and May 2015 item #9 on Turkey’s complete country wide shut down, this item is on UK who are on and alert for potential blackout due to increased stress on their supply situation. Cyber incident has been suspected in this year’s major blackout in Ukraine on Jan 18, 2016. In March, Sri Lanka has experienced a nation-wide blackout which follows up on an earlier one that happened there in February.

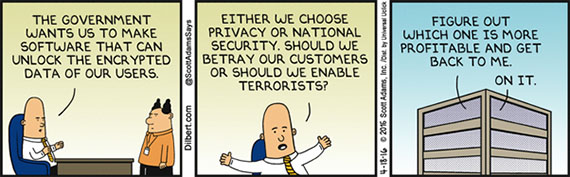

8. New Zealand needs coordination entity for infrastructure Cyber-Physical Systems

The adjective “Smart” appears these days across several infrastructure, services and governance parlance across the globe. The notion of utilising Information and Communication Technologies (ICT) to existing and newer services is the key driver to these adjective add-ons cropping up.

With wide-spread ICT penetration supporting infrastructures, security and privacy forms a key aspect that needs overall system resolution or understanding for handling its complexities. The US has a cyber-physical security framework coordinated by National Institute of Science and Technology (NIST).

New Zealand will need such a coordination framework to enable wide-spread “Smart” infrastructure and services for the 21st Century

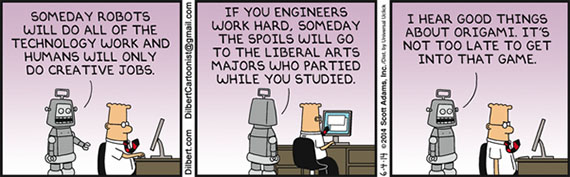

9. Retail Electricity Trials: Peer-to-peer trading platforms

With battery storage solutions in various forms being actively sold, new retail experimentation of trading has started happening.

This particular item caught my attention. It reports on a bitcoin (block chain algorithm technology) transaction for peer-to-peer energy micro-grid trading in the US amongst 10 co-located homes.

These kinds of trials and disruptive financial trends, by third parties, are only likely to increase until commercial regulation and utility led transaction framework catches up to move from its existing contractual mode of engaging residential consumers by introducing new innovative differentiated settlement products.

At University of Auckland we have been researching transactive energy framework that captures a more manageable financial disruption for distribution utilities. For New Zealand we should look at trialing some of these developments particularly in our council owned utilities!

10. Tertiary Education Watch: Global Flow Patterns

I have been having an item on University education in my previous Top 10 columns; February 2015 item #4 on cost of tuition fees; item #8 of May 2015 on Australia/New Zealand international student and Future of Universities through item #10 in October 2015.

I came across an interesting UNESCO application that plots the global flow of international tertiary students. Unsurprisingly United States takes the top-spot for the diverse flow both in terms of numbers and countries.

51 Comments

Oslo moves to ban cars from city centre within four years

http://www.theguardian.com/environment/2015/oct/19/oslo-moves-to-ban-ca…

7 Cities That Are Starting To Go Car-Free

http://www.fastcoexist.com/3040634/7-cities-that-are-starting-to-go-car…

People thought banks were safe Now they believe their pensions are safe

Take your head out of the yellow sand and place it in the black sand and everything will be just fine

Pensions Are Still Making Ludicrous Assumptions About Future Returns

http://www.businessinsider.com/pensions-are-still-making-ludicrous-assu…

The Real Risk of Pension Plans: They Give Retirees False Security

http://www.bloomberg.com/news/articles/2014-12-22/the-real-risk-of-pens…

I wonder if ppl think that, or they are simply yes sticking their head in the sand. When any mention of losses occurs its "I believe it will be OK" followed by "shut the f*** up" , "Im quitting this conversation now", or "you are a nutter, seek medical help". Lets face it if like me you have paid in for 40~50 and you lost 22% in 2008/9 and now are looking at the same or more but have dreamed of a nice retirement that is pretty shattering to contemplate.

Of course, the entire pension industry isnt going to face reality either, they will starve (or pensioners might start lynching them) so its in their best interest to keep you so they can top skim.

I don't think it is heads in the sand. I think it is acceptance that nothing works. i.e. what other option do you have?

Shares/pension/bonds? - if they drop at the wrong time you are stuffed.

Kiwisaver? - Government controlled - so you are definitely stuffed.

Property? - again if it drops at the wrong time you are stuffed.

Banks (TDs/savings)? - when/if they fail, you are stuffed.

Commodities - up and down at the best of times, and really dependent on the things above to ensure value, so really you are stuffed.

Mattress - Good storage, but you lose to inflation - end result, you are stuffed.

No one can predict the future and no one knows what will happen by retirement. So quite frankly there doesn't seem to be any "safe" option anymore.

So what do you do? - Continue on and hope for the best.

#3 "Tesla Discontinues 10-Kilowatt-Hour Powerwall Home Battery

The economics for backup power alone just aren’t that attractive.'

http://www.greentechmedia.com/articles/read/Tesla-Discontinues-10kWh-Po…

Not much of a link there? So Tesla had a 10kwh backup solution that didnt stack up to well against a gene while #3 is about buying an EV.

Did you read #3? Let me help. " I had flagged through item 8 the news release by Tesla CEO, Elon Musk regarding the Electric Vehicle patents and through item 1 of May 2015 news of battery packs like Tesla home Powerwall and utility scale Powerpack." Odd how he didnt mention in his update about it being discontinued.

I think I read somewhere that the new EVs will actually take much of if not all of the annual lithium production, meanwhile the raw material's price seems to be taking off like an Apollo.

How to become wealthy made simple.

While the left is paying ever increasing insurance premiums the right had is is investing more and more into those insurance companies.

I can then retire on the profits i made from the transactions between my left hand and my right hand

#3 - I'd be interested in a plug-in EV when they become economically sensible. ie when they aren't the equivalent of a Ford Focus being sold for BMW 4-series money. The batteries still cost far too much to bring the cars into reasonable pricing without the use of massive subsidies/tax breaks, which we clearly don't have in NZ (yet?).

Economic crossover point is estimated to be 2024, though if Lithium production cant ramp up, maybe not.

I have a Nissan Leaf electric car and I love it. It is a 2014 model which I bought second hand with 4500kms on the clock. Apparently the car dealers do not want to import new ones because they are too expensive but the second hand ones are being Imported and are a reasonable price. I have heard that you have to be careful where the second hand car comes from because they put salt on the roads in Japan which increases the chance of rust but that would apply to all cars not just electric. I charge mine at home around once a week - I don't go out much - and it costs around $3.00. The distance it travels on one charge is around roughly 110kms - the car says 168 but I wouldn't like to test it! And there is next to no servicing. All you have to remember is to pump up the tyres!

#7 venezuela,

http://www.bbc.com/news/world-latin-america-36145184

let alone their hyper-inflation problems,

http://www.bloomberg.com/news/articles/2016-04-27/venezuela-faces-its-s…

yes cheap oil is going really well....

Thank goodness they have a socialist paradise. Lucky buggers.

And if you play your cards right, you could have one too!!

#4 - Can kinked-demand theory relevant explain steady prices during sustained decreasing electricity demand?

Probably not - but an untaxed accounting trick might.

New Zealanders pay substantially more for power than consumers across the Tasman.

In 2010, Australians were paying 14.83c per kwh, while in New Zealand power was retailing for between 22.7c and 24.97c per kwh.

Bertram said that for several years, power companies were revaluing their assets on paper and using that as a basis to increase their prices. Read more

I suggest changing power companies when your locked in period ends. I got $250 when I changed companies recently. So if you do that every year or 2, it tends to keep your costs down. But don't waste the pressy card! Buy basic food items.

This is not accounted for in comparisons like the above link.

The other thing is that all the power companies have generation development sections and the appropriate salary costs. Each of these companies have a "portfolio" of consented projects for which they have paid dearly. At the moment there is no need to proceed with these projects because load growth is low and Huntly has had a stay of execution. So many of these consents will likely need to be rolled over at huge cost again....

Renewable energy is not cheap, but that is another story.

Changing countries would be cheaper in the long haul - my personal envoy is in Europe undertaking due diligence.

We changed from Genesis to Flick and our power bill (so far) is half what it was. This may change in winter and we get hit with spot prices, but so far it's been a case of 'bye Genesis, don't let the door hit you on the way out'!

I've been with them since last year. It's not that bad over winter. The only major impact on spot generation prices will be when the cook straight cable work is carried out. Even then it'll only be an issue around peak times, other times the cost will marginally increase.

I've saved about $500 since leaving my other provider about 11 months ago.

A few years ago there was a cold day and some transmission outages bringing the power to Auckland. I won't mention names but one power company who had market power for those trading periods when the load was high, had put offers into the market which were in the thousands of dollar range. Those power companies who didn't hedge against that got stung.

The media got hold of it.

Heads rolled.

Just a warning that if you are exposed to the wholesale market, there will be times where the power price will be higher than you have ever imagined.

Note: Transmission outages can occur unexpectedly.

Flick didn't pass any of that wholesale rate on at the mercenary price. There's another company that gives you a free hour of power every day so the worst price gets removed.

I see more risk from being gouged by the main power companies which they do unless you switch companies every year.

That would be the point where we frantically run around turning everything off!

With interest rates at historic (i.e. as far back as Babylon) lows one wonders what % return is allowed for from these "revalued" assets. Cute trick, they're worth 50% more and we still want a 20% return, thanks suckers. I see from the graph that US and EU utilities are operating on 5 to 6%.

BTW our power in the Far North is over 40 cents a unit. We now have the green light to proceed with the extended geothermal plant near Kaikohe, owned by us consumers via our local lines company. That will provide 75MW continuous which is more than our peak demand so hopefully we will get some relief and a nice christmas bonus.

#4. "Can a case be made that this is because of the kinked-demand hypothesizing price rigidity/stickiness for an oligopolistic market?"

I wondered what this meant for a while but I then realised it means we are being unwillingly rogered by a electrical industry which carries a whip and wears a black leather hood. eeeeeeweh.

#8 and #9. Yes. The lines industry needs reform to convert it back into a progress promoting utility, instead of being just a profit extractor run by the usual non innovative director hacks.

I see Chinese have purchased Tekapo Station along with Guide Hill Station, on top of that a Chinese People’s Republic company purchased 1191ha Stockerau Station for for $8.5 million. A 124ha Orchard at Upper Moutere, Nelson for $9.8 million sold to some American dude.

This is the "Friday Funny ??" Or the Friday"We're Fridayed" Surely they should be patriotic and support their own nation ?

Patriotic?

Get off the grass

It has taken 7 years of comment here on interest.co.nz and the main crowd and the media have only just woken up

I'm more curious as to exactly what it was that woke them up

Noooooo! God dammit this has to stop. What the hell are we doing! Another 20 years and this country will be unrecognisable. Jesus I don't even have kids and I fear the generational backlash if we do nothing but watch this happen.

A $1 donation plus a $1 contribution should just about do it

The Chinese buyer of the Tekapo Station has told the OIO he will make donations to Lincoln University and contribute to the A2O Cycleway.

Stockerau Station $7000 per hectare

Chinese buyer blocked from snapping up Ausralian farm 2.5% of all Australian agricultural land.

http://www.smh.com.au/federal-politics/political-news/scott-morrison-kn…

Maybe the Aussies are waking up a bit more than the kiwis.

Mortgage Belt, good to see the Aussies did not succumb to all that Chinese Government crap. Morrison last week was going to give Dakang 3 months , so to turn around in a week is impressive. Shanghai Pengxin got the Crafer farms after twisting the OIO arm and because it was a distresed asset . Each of Shanghai Pengxins listed companies are massively down over the past year. Debt has blown out . Dakang is history now, its corrupt to the core . It will be forced to return raised funds which will put Pengxin in trouble because it has pledged shares all over the place.The story of Jiang Zhaobai and Shanghai Pengxin as conveyed to the OIO in regards to their business acumen could not be further from the truth. Alan Crafer had more credibility.

they always have. pity our leadership can not but fall over themselves to try to sell everything not bolted down

Aussies aren't wafting along in a naive dream world thinking there's no corruption. They know all about corruption.

The Australian Government through the FIRB (OIO) has a declared policy of rejecting applications from Foreign State Owned organisations. Preference given to private organisations

and

The country has a far more vigorous aggressive press

The trouble with engineers is that they think everything has an engineered solution.

Another 90,000km2 of ice was lost yesterday, for a new record low ice cover and continuation of the unprecedented Arctic meltdown.

https://ads.nipr.ac.jp/vishop/vishop-extent.html

The time for action on emissions and the restructuring of society was LONG BEFORE tipping points were passed and the accelerating planetary meltdown triggered around 40 years ago would have been good. .

#1 Why are we ignoring the fact that agriculture is responsible for nearly 50% of NZ's carbon emissions? It only comes 2nd on the list, and then only as a vague 'we'll mitigate' solution.

How? What mitigating measures will be put in place? How can you seriously mitigate any other way, than cutting the dairy herd by a good number?

Dairy cattle is not only responsible for an enormous amount of carbon emissions, it's also the main source of nitrate in our rivers and lakes - the main polluter of our fresh water (of which 80% is allocated to agriculture, ,just fyi).

.

We seriously need to start diversifying our industries if we have any hope of

a) reducing our emissions

b) not completely messing up our environment

No one is ignoring agricultures emissions..Do you seriously think the planet would be better of by nz killing half its dairy herd to have it replaced by dairy production in say south America or china?

Modern farming ruminants have been breed for over a hundred years.Ditto grasss species.Reducing methane output takes time.( we could use GM tech to speed it up but that's no good either apparently)

read the following http://www.dairynz.co.nz/media/4113400/Water_Accord_2_years_report_WEB…

Plenty is being done.You just wont find it in the MSM cos it doesn't suit their agenda.

They would rather pander to keyboard warriors like yourself to pretend they have some sort of green conscience..when the opposite is true(green mp,s flew the most of all non ministerial mps last year)

Thanks for the link to the report. It seems to only deal with water management, though, not emissions produced by ruminant animals.

I didn't say that we are ignoring emissions caused by agriculture, I said we are ignoring the fact that agriculture is responsible for nearly 50% of NZ's carbon emissions. I was pointing out the percentage, which a lot of people aren't aware of.

.

The report you've linked, deals with water management on farms. It's a report compiled by DairyNZ. Self reporting and self regulating are not ideal.

They give themselves a pat on the back for excluding livestock from rivers and streams, but are only at the 'gathering information' stage on nitrogen run off and leakage. There does not appear to be a plan in place to reduce the amount of nitrogen used on farms The main focus appears to be mitigating the amount leaked into rivers and streams from surface run off. Other leakage (through highly permeable soils straight into aquifers) was not addressed anywhere.

.

You also assume that a reduction of NZ's dairy herd would automatically mean an increase in dairy somewhere else in the world. That is quite a wild assumption, especially with the price of dairy as it is, now.

An overall reduction of the consumption of dairy and meat in general, worldwide, is what we need to aim for.

I realise that this is going to be slow process, but we're pas the point of trying to mitigate. We need to reduce.

Given protected land area already out numbers dairy land by 4:1 and is the highest ratio to arable in the OECD how much higher does it have to go to absolve middle class urban guilt?

...well for many kiwis non of this stuff means shyyyyt until it intefers with their precious sport..

http://www.stuff.co.nz/national/76563000/battle-to-save-lake-karapiros-…

I'm not sure if your remarks on protected ares in NZ are ignorant, or disingenuous.

.

New Zealand is, in geological terms, quite a young country. Our mountainous areas are still experiencing uplift. Thirty percent of the country is hilly with a slope of more than 25degrees, and as such not much use for farming.

The areas which are 'protected' are also the areas which are not usable for agricultural purposes.

You make it sound as if these protected areas constitute a personal sacrifice on your part.

.

Pasture covers about 39% of New Zealand's land.

Dairy cow numbers have increased from 4million to more than 5.2million between 1996 and 2006 (and probably the same again since then).

Dairy cows excrete almost 7 times the amount of nitrogen and phosphorus in their faeces and urine as breeding ewes.

The 3000 dairy herds in the Waikato river catchment area, generate the equivalent human waste of about 5,000,000 humans, or - about 34 Hamiltons.

.

Those are mind boggling figures, and cannot and should not be ignored. Especially not when the cost of cleaning up the environmental pollution caused by agriculture, are largely not born by farmers but by the wider urban communities.

Dairy farms now mainly operate at a loss, and yet conversions are still happening.

.

your numbers don't help your argument.

If cows excrete 7X More N &P than ewes then on a stock unit basis they are less polluting than sheep.

There is no P in urine.Some in faeces which is not leached through the profile.

The TOTAL waste for 5M humans would far excede 3000 dairy herds.

Just what has your personal contribution to cleaning up the waterways added up to so far?

Don't believe all you read in the "Greens " press releases which are repeated verbatim in the media..

I don't think you realise what my argument is.

My argument is that agriculture as a whole, contributes to nearly 50% of all carbon emissions of New Zealand.

You countered with an article about water management on farms. I then pointed out that livestock are very polluting to our waterways, and that the majority of pollution comes from non-point source, which is run off from farms.

I wasn't comparing the total waste of humans versus animals, I was merely countering your argument about how farming is managing its water (in short, it's not. It's only just starting to rectify the pillaging of our natural resources it's been doing for decades. That's not a cause for a round of applause. It's the absolute bare minimum they need to do).

.

You keep referring to the Greens, and assume I get my information from them, or from the MSM.

All numbers quoted above can be found in Environment New Zealand 2007, a report published by the Ministry of Environment in (you got it) 2007.

As far as I can tell, the Greens had nothing to do with this report.

It's freely available online, and if you email the ministry, they'll send you out a free copy.

In the news today:

.

https://www.tvnz.co.nz/one-news/new-zealand/scientists-warn-nz-aquifers…

a lot has changed since 2007.

Like much of the literature quoted it is all predictions of the doomsday that they THINK will happen.

No other country has included emissions from farm animals in their calculations..so to say that ag is responsible for 50% of our emissions is rubbish.Its based on what some pointy head muppet (s) dreamed up.

They conveniently ignore the rest of the co2/methane cycle.

The oecd recently put out a report on the worlds rivers

"The OECD data is interesting in that it shows the three New Zealand rivers covered (Waikato, Waitaki and Clutha) have very low levels of nitrates and relatively low levels of total phosphorous compared to major rivers in other developed countries."

..but if bashing ag is your thing then who am I to stop you?

How to Win in the Monopoly Economy of the 21st Century

http://www.dailyreckoning.com.au/how-to-win-in-the-monopoly-economy-of-…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.