interest.co.nz estimates that homeowners could be leaving as much as $1 bln per year on the table because of the 'loyalty' they grant the major banks.

Interest rates are rising and it is expected that mortgage interest rates will rise as much as +2% more before this 'normalisation' cycle is over.

Home loan borrowers have been the main beneficiaries of the low interest rate policies that have swept the world in the past ten+ years, since the GFC. But they could be the main sufferers as central banks try and return to policies that do not require such low rates or such huge money printing (QE). Part of their motivation is to recharge their policy resources for the next (inevitable) financial crisis (whether it be financial or pandemic-induced).

However, that involves benchmark rates rising, and the direct flow-through to real home loan rates.

As at the end of July there was $316 bln owed to banks for home loans. The August level will be revealed later this week at will almost certainly rise to close to $320 bln. More than 95% of that is owed to just the five largest banks - $300 bln plus.

In the past year, borrowers paid almost $10 bln in interest on these loans. That is about to rise sharply. (And recall it was just under $12 bln in 2018, +17% higher.)

In a rising rate market what can borrowers do to protect themselves?

First you can "go long", locking in lower rates for longer periods. But you may need a professional to advise whether this is the right strategy for you. In many cases it may not be. The math is important, and it will depend in part by what the difference is between the terms you want to choose from.

Second, you can switch your repayment style to focus on paying down the amount you owe, rather than worrying about the interest rate. This however is only a strategy for those who can muster the long term discipline required to make revolving credit arrangements pay off. This is certainly not a strategy for those who use their house as an ATM to support impulse spending.

Thirdly, you can choose the lower interest cost option. Most borrowers aren't.

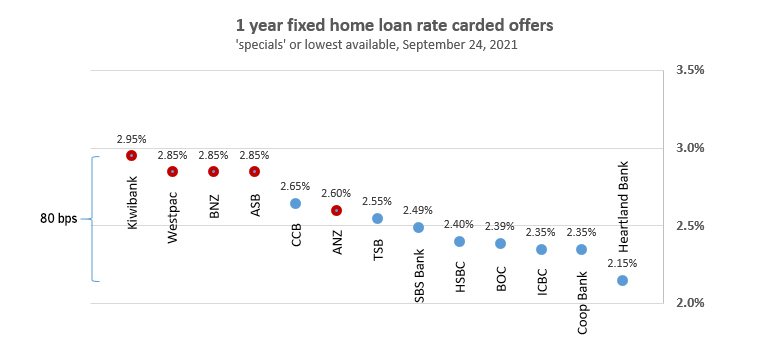

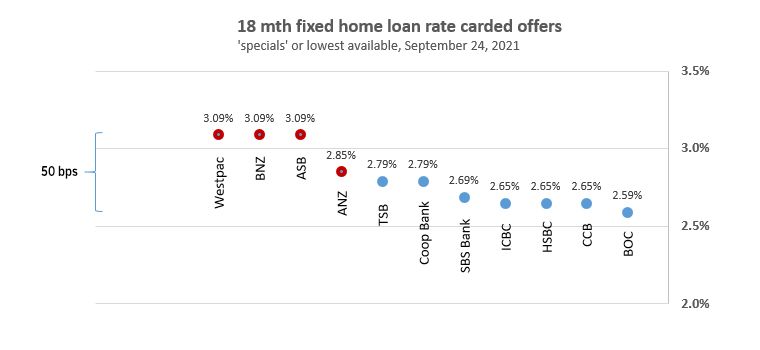

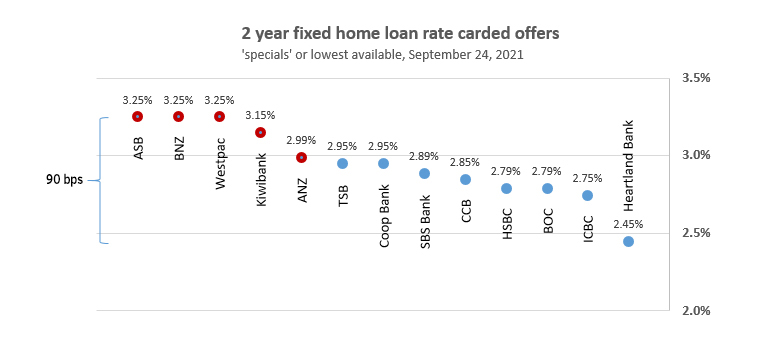

As you can see from the rate spread tables below, at least 50 bps in being conceded to the largest banks at present. (The red markers are the main banks, the blue markers are the challenger banks.)

The math is straightforward. If $300 bln is at a cost of +50 bps higher than the lowest cost option, then that means $1.5 bln could theoretically be saved just by shifting to the cheapest cost option.

However, there will be practical limits to achieving these savings. The smaller banks do not have the capacity to absorb such a switch if everyone did it. And many borrowers, maybe as many as one fifth, do not have the financial strength to justify getting the lowest 'special' rates.

Still, that will leave most who are not getting the best lower rate. And in a rising market, they could prioritise such a shift. Remember, there will be little penalty in breaking a fixed rate loan in a rising interest rate market.

That still leaves us with the conclusion that at least $1 bln per year could be saved just by negotiating the rate harder, down to the lowest cost offers. To do that successfully, you need to be prepared to actually make the shift if a main bank calls your bluff (and most do).

It is only your money.

The latest rates are here. Our break fee calculator is here.

Use our unique double mortgage calculator below to directly compare two options.

Comprehensive Mortgage Calculator

Daily swap rates

Select chart tabs

8 Comments

Home loan borrowers have been the main beneficiaries of the low interest rate policies that have swept the world in the past ten+ years, since the GFC. But they could be the main sufferers as central banks try and return to policies that do not require such low rates or such huge money printing (QE).

Banks don't take deposits and they never lend money. They are in the business of purchasing securities. When one gets a bank loan, the loan contract is a promissory note. The bank purchases that contract from the borrower. Now the bank owes the borrower money and it creates a record of the money it owes, which we call deposits - source. Central banks do exactly the same - they buy bonds and record what they owe banks on their liability ledgers. Money takes no part in these transactions.

Do you feel a need to always paste in this comment on every article about borrowing and lending? Banks "create money", yes, we all know that. It is facetious to say they dont take deposits or lend money. Of course they take deposits (i.e. my salary is deposited in my account) and do lend money.

I get that what you're trying to highlight is they don't need to first take a deposit to then lend out via a loan (mortgage or personal loan) .. but NZ retail banks still need to balance their balance sheets and have liquidity ratios, deposit to lending ratios etc to concern themselves about, so still need to attract deposits (the other side of the transaction being to the vendor).

Good piece.

I am not convinced on the strategy of going long however. This is of course only my opinion.

I will need to re-mortgage come November, I am thinking one year fixed or potentially 2 years.

My basis for this is I am not that bullish on the economy and therefore on the argument for significant increases in the OCR.

I think the OCR might peak at 1.25 in this cycle, and potentially that peak could be mid to late next year.

I am expecting economic problems at the international and/or domestic level to bite again at some point in 2022/ 2023 (sooner if worst case Evergrande scenario plays out).

At which point the OCR will start to be pulled closer to zero again.

Worst case if I fix at one or two years? The economy turns out to be stronger than I expect, and I will need to re-mortgage in one or two years at say 4%. Oh well I would have had 1-2 years at a much lower rate to compensate.

I would have a different view if I thought the OCR might peak at between 2-3%. But I don't think it will.

I needed to remortgage in November so I broke in April and fixed for a few years. All signals are for increases so if you are fixing in for longer than your mortgage has to run, which is almost always the case, then I'd get in there this afternoon.

You "win" in this market by having a long and cheap mortgage churning away so that by the time you come off fixed the amount of debt has dropped by a lot.

If Evergrande exposes the amount of property gambling that's been occurring during the last fifteen years, especially in China (NZ is small) and this leads to another lack of trust between the money printer/lender the debt jenga tower more than wobble. Loans will be called in.

Best place to be will be no mortgages, spare reserves in a crypto model untouchable by banking or govt. Vulture fund anyone...?

One of those are not like the others.

Charts are updated with correct date of rates. H/T BO

Perhaps a little disingenuous to compare with the minors - Heartland for example has a severely limited lending criteria and online process only. EG Very strict on where (main centres) and what (standalone houses only) as well as all the usual lending criteria.

Any commenters had any experience with CCB, BOC or ICBC?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.